Interview with Tracy A. Moore, CEO of Canada Rare Earth Corporation (TSX.V: LL): Developing a Global Supply Chain within the Rare-Earth Industry

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/17/2017

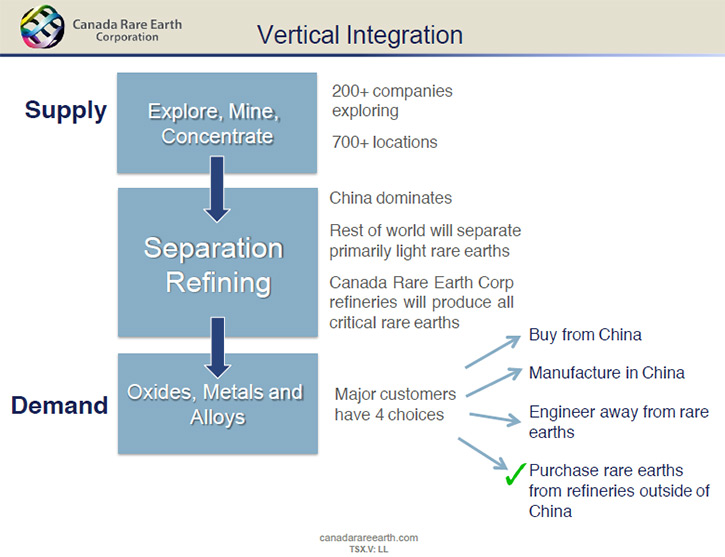

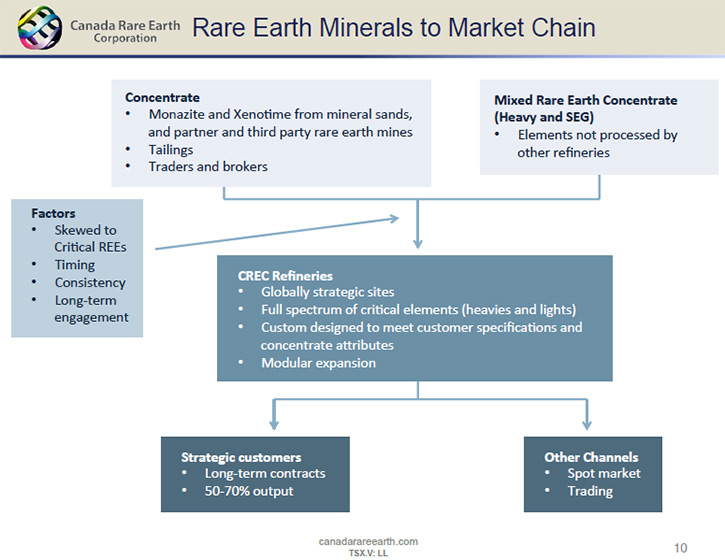

Canada Rare Earth Corporation (TSX.V: LL) (“Canada Rare Earth” or the

“Company”) is developing a global, vertically and horizontally integrated,

supply chain within the rare-earth industry, which is separate from and

alternative to the dominant China supply. This involves:

- working with proven and advanced-staged mining ventures;

- securing supply arrangements with the mining operations for immediate

delivery to customers and to proprietary refineries;

- designing, building and operating rare earth processing refineries in

multiple geographic locations; and

- entering into long-term sales contracts with leading international

manufacturers for a majority of the output from the refineries.

According to Tracy A. Moore, CEO of Canada Rare Earth, the rare earths prices

are at the bottom, but even at this level the Company can be profitable with

trading activities and with refinery operations. The near term and on-going

focus is on trading of concentrates and oxides to generate positive cash flow

and earnings for shareholders while developing strong customer relationships

and concurrently developing rare earth separation refineries. The Company is

taking charge of the final permitting of an existing refinery outside of

China and, if successful, the Company may exercise the option to acquire a

majority interest in that refinery for a pre-negotiated price.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals

News, interviewing Tracy A. Moore, CEO of Canada Rare Earth. I can see that

many new initiatives are occurring with Canada Rare Earth. Could you tell me

how you're proceeding to become a totally integrated rare earth company?

Tracy A. Moore: Yes, with pleasure. We've been working for the last 3

years, on investigating the best approaches to provide a secure, transparent

supply of rare earths to the 200+ major international manufacturers and their

supply networks which depend on rare earths for their numerous and wide

ranging products. China, for a number of reasons, has come to dominate the

market for rare earths and this has caused the large manufacturing companies

to become substantially dependent on the flow of rare earths from China.

Prudent business practice dictates that key ingredients should be dual-

sourced wherever possible. Many companies in the rare earth industry have

tried to “push” their exploration properties to become producing mines in

order to create a concentrate which then would either be sold into China or

require processing by facilities yet to be developed. We have taken a

completely different tact – 180 degrees from the norm: we have firstly

focused on what the customers want. Our view is that rare earth concentrates

are not particularly rare but the processing of rare earths is and therefore

the supply chain to customers is particularly tenuous. The 4 main aspects of

the supply chain, from our perspective include: (1st) securing long-term

consistent sources of rare earth concentrates; (2nd) establishing one or more

fully capability rare earth separation refineries outside of China, which we

think is the key to unlocking the industry; (3rd) establishing relationships

with many of the 200 largest companies that depend on rare earth to

manufacture and develop their products; and (4th) securing financing for

capital expenditures and working capital to support these endeavors.

We've identified a good number of rare earth sources and, with existing

refineries, we are analyzing samples for optimization and benchmarking. The

focus is to line up supply for refineries with existing requirements and for

future rare earth separation refineries we are developing. We've also studied

prospective sites for refineries in 9 different countries situated in South

East Asia, the Caribbean, South America and the Middle East. We're narrowing

our focus on two sites with two other strong contenders being considered.

We've also had meaningful discussions with 25 of the 200 major manufacturing

companies. We need 3 to 5 of the 200 to take up about a half or more of the

output from any one of the refineries to make the project viable and

financeable. We've been dealing with a few financiers and depending on which

refinery project proceeds we are confident about the availability of funds

although terms need to be finalized. We will continue to canvass other

potential sources of capital.

These 4 major activities are happening simultaneously, but to get

things moving, we're starting to buy rare earth concentrates and high purity

rare earth oxides and sell them to suitable customers. These trading

activities and the strong relationship with one particular rare earth

refinery customer are the subjects of the most recent news releases in

September, October, November and December 2016. Our purchases have taken

place in India, South America and China and our sales have taken place in

Europe, North America and China.

We're particularly excited about the sales we have completed and the

increasing momentum of selling concentrate sourced from various providers in

South America and selling to an existing refinery that has a definite need.

We're very pleased with these commercial transactions as they, together with

follow-on transactions, generate income and positive cash flow for us and

very significantly prove that we are in business. Having cash flow is quite

unique in the rare earth industry outside of China at this time and our

achievements prove to the customers (who keep pushing and encouraging us)

that we can deliver.

Dr. Allen Alper: That sounds exciting! Really great!

Tracy A. Moore: Yes, the fact that we are generating sales is a very

significant differentiator in the rare earth industry.

Dr. Allen Alper: It's been a tough environment, and I must commend you

for hanging in there, working hard and establishing relationships in this

very difficult market. What does the market look like now? What are people in

the industry saying, and market experts, about the outlook for rare earths in

the years to come?

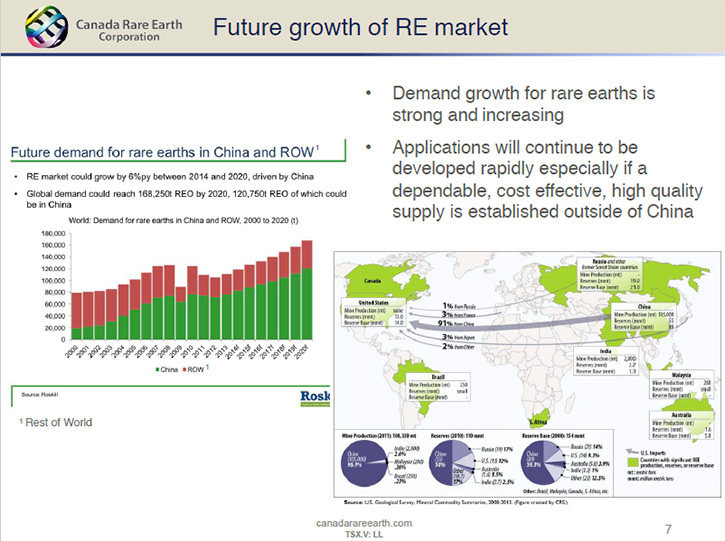

Tracy A. Moore: The market for rare earths, particularly those used

in magnets, have a very good future. Each of the rare earth elements has a

separate market, so it's hard to generalize, but if I were to generalize, I'd

say the prices can't get much lower because even the big organizations in

China had losses of, I believe, in the order of US$300 Million last year.

They're not very happy about that. I think they're going to be encouraging

the prices to go up, which will help float our business as well. I think the

prices are at a bottom, and I'm hoping that they're tending to go up from

this point. Even at this level, with our trading activities, and the

financial models we've created for our solvent extraction refineries, we can

make profits albeit not the profits that we would have enjoyed a few years

ago, when the market was probably too buoyant.

Dr. Allen Alper: Could you tell me a bit about your background Tracy,

your team, and your board?

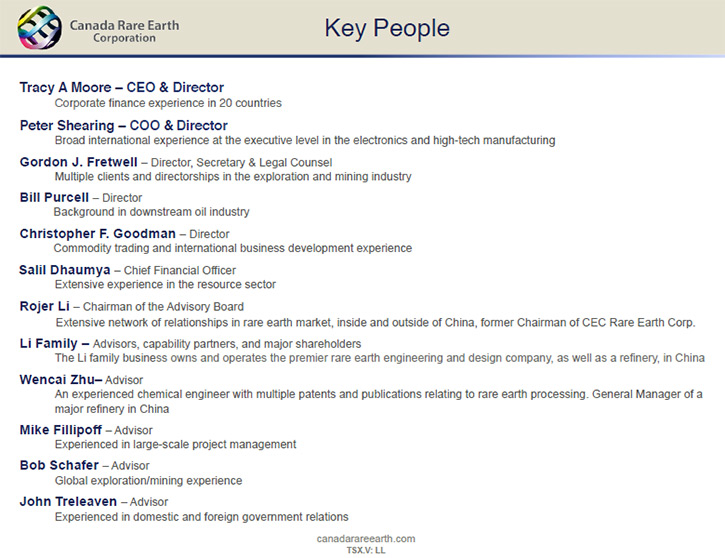

Tracy A. Moore: Of course. My background is strategic planning,

business planning, and corporate finance. I founded a small corporate finance

firm in the '90s. We had small offices in Vancouver, Toronto, London and

Paris. We were even expanding from there when 9/11 happened, and it took the

fun out of international traveling. I've been dealing with 1 or 2 major

clients since 9/11 and this led me into the rare earth industry. Our chief

operating officer, Peter Shearing is an engineer with a Master’s degree. He

worked in the global high tech and contract electronics manufacturing

industry for over a decade and before that with the Canadian Army as an

engineering officer. He's a very accomplished person, well rounded in

operations, engineering and supply chain matters, so he's much more

technically astute in these matters than I am.

We have an excellent, well rounded team of 11 directors, officers and

advisors who are very helpful in moving us forward, including: two people

involved with the rare earth industry for over 40 years at technical and

business levels; a registered professional geologist who has worked in over

50 countries; a professional engineer who has overseen capital projects with

budgets of US$1 billion; a director with extensive background in commodity

trading and natural resources procurement; and a former Canadian ambassador.

Dr. Allen Alper: That sounds very good. Could you tell me a bit about

your stock, where it is listed, etc.?

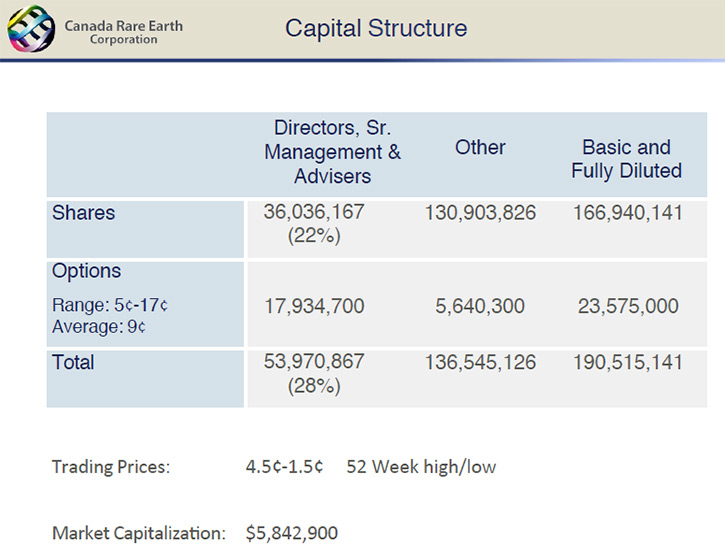

Tracy A. Moore: Our shares are listed in Canada on the TSX Venture

Exchange. The shares also trade in the United States, but we really don't pay

much attention to the US trading at this time. In fact, we have devoted most

of our energies on preparing and developing our business and really haven't

paid very much attention to the public markets other than complying with all

the regulatory filing requirements. We will be increasing our public

awareness efforts early in 2017 as our business is gaining traction. We

believe we have a unique story line in the rare earth sector and exciting,

news worthy events will attract attention. As one of our advisors said,

“until we have a shovel in the ground, we're just a concept.” We are now in

business and hence we have a shovel in the ground. We’re very excited to

start telling people about our focus and our opportunities.

Dr. Allen Alper: That sounds promising. Could you tell me, going out

into the rest of 2017, what might be the important milestones that you're

looking forward to accomplishing?

Tracy A. Moore: Our focus is on trading activities of concentrates

and oxides to generate positive cash flow while we develop equity positions

in at least two rare earth separation refineries. We're helping with the

permitting of an existing, truly unique refinery in part because it is

situated outside of China but also because it is capable of separating the

entire spectrum of commercially traded rare earths. If we're successful with

the permitting, then we will have an opportunity to buy a majority interest

in that refinery for a pre-negotiated price. We're hopeful about that as we

have eliminated the largest objection to the issuance of the final operating

permits and we have support from 2 different federal governments and a

European major business entity, amongst others. We expect to have some

positive news in the next few months in this regard.

We are also involved with 3 other refinery projects that are in the

planning phase. Some work has been done on one of them, studying the

opportunity. For another one, there are permits that have been issued to

start construction. Our roles, responsibilities and equity positions are yet

to be finalized and the doors are open. Involvement with rare earth

refineries is a key aspect to the global supply chain so we are working very

hard to become positioned in multiple refineries. In the meantime, and on an

ongoing basis, the trading of the rare earth concentrates and oxides will

help cement our relationships with customer groups, and also generate

revenues and a fairly decent gross profit, which will help cover our

operating costs and deliver a profit to the shareholders.

Dr. Allen Alper: That sounds very good. Could you tell me a little bit

about the markets and the applications, for which rare earths are used, and

why they're important?

Tracy A. Moore: I often refer to a National Geographic article back

in June, 2011, entitled “The (Chinese) Secret Ingredient of Almost

Everything”. These elements are used strategically and critically in many

products, particularly electronics, and electronic applications. We have some

rough numbers. It's very hard to prove these numbers, but intuitively it

makes sense, that about $2 Billion a year of rare earths are critically

incorporated into $1 Trillion of electronic products. Not a lot is needed for

each one product, but they're critical to those products.

Examples are: guidance systems on missiles, electric cars, hybrid

cars, regular cars, medical equipment, cellphones, laptops, just almost any

electric product you can think of, and others, require, or can definitely

benefit by using rare earths.

Dr. Allen Alper: That sounds very good. Could you summarize the

primary reasons our high-net-worth readers/investors should consider

investing in your company?

Tracy A. Moore: That's a very good question. There are a number of

reasons, but one is that we are about to start actively promoting our company

because our recent accomplishments have got the ball rolling on realizing our

strategy. Our shares have been hovering at a low price for a long time, and I

think that we're just breaking out now. We'll be making the point that we are

one of the few companies in the rare earth sector with revenues and with

profits through the trading activities we recently started. These activities

are important in their own right, but they also help cement and bring

together, what I call, the 4 Legs Of Our Chair: long-term sources of

concentrate; rare earth processing facilities; 3 to 5 customers for each

refinery; and the financing. The first commercial step (trading), is making a

concerted effort to bring together the 4 legs of our chair, and to create a

firm foundation for a business going forward.

Another key reason for investing in our company is our strong foundation of

the processing of rare earths. Most of our peers are either traders with no

processing capabilities in-house or they are explorers hoping to create a

mine but without viable plans for processing the concentrate they hope to

create. We are developing multiple streams of rare earth concentrates that

are byproducts of other mining activities which generates additional revenues

for the existing mining operations and allows us to avoid the typical risks

and costs associated with exploration and mining. We maintain predictable

overheads and therefore have minimal downside risk. For processing refineries

our intention is to work with our proven technical partners and finance each

refinery “off of our balance sheet” so again minimal down side risk other

than for the overhead costs we allocate to initiatives. And, our trading

activities are helping cement relationships with customers and partners that,

in turn, establish even stronger relationships and international profile.

Our low-risk business model is designed to build long-term shareholder value.

Dr. Allen Alper: Thank you – that was well explained. Is there

anything else you'd like to add, Tracy?

Tracy A. Moore: It is very important to emphasize that our global

supply chain integration strategy is based on three factors: satisfying

customer demands; being in business with revenues; and having secured

technical processing capability. In contrast, most peers follow the

traditional geological flow of exploration, hopefully creating a mine,

hopefully creating a saleable concentrate and then finding a processor to

deal with the concentrate. The rare earth industry is different from most

other mineral industries – processing cannot be assumed. By-and-large, China

is the dominant country where many of the processors of the rare earth

concentrate are situated. There are very few exceptions, so most of our

peers, if successful must either sell to China, or develop their own

separation processes. There are a number of efforts including new

technologies but they tend to be unproven and therefore risky propositions.

There are very few full-size processors outside of China.

The customers have 4 ways of dealing with the rare earth issue. One

is to continue exporting from China with the inherent risk of depending on a

sole supplier. The second is to set up operations within China and thereby

transfer technology and value –add to China. The third choice these major

companies have is to engineer away from the use of rare earths, and in some

cases, companies are successfully doing so. In many cases, the best they can

do is reduce the amount of rare earths that they incorporate in products, but

they still require rare earths. The fourth is dealing with a refinery setup

outside of China. That's the solution we are endeavoring to provide. In fact,

with the rapid development of new technologies we see an increasing demand

for rare earths, particularly if a reliable, transparent supply (such as

ours) becomes available.

Each refinery that we are planning to develop will be a profit center unto

itself, and for that, we need 1 or more sources of concentrate, we need 3 to

5 customers, and we need the financing. Each refinery would be something on

the order of 2% of the world market. We'll have a viable business and we can

step up with 1 or more refineries as we bring in the customers and secure the

long-term feedstock for the refinery.

Dr. Allen Alper: Sounds like a very good approach.

Tracy A. Moore: I hope so – our team has devoted a lot of time and

energy developing the strategy and pulling together the key aspects, and we

are now beginning the implementation phase.

Dr. Allen Alper: Well, you've had the courage and the resolve to work

at it. It sounds like you've been able to move forward and keep your dreams

and goals viable.

Tracy A. Moore: Thank you. We have a very strong team and the support

of many, significant customer groups.

Tracy A. Moore, CEO

Email: tmoore@canadarareearth.com

15th floor - 1040 West Georgia St.

Vancouver, BC, Canada V6E 4H1

t: 604.638.8886

e: tmoore@canadarareearth.com

w: www.canadarareearth.com

|

|