Interview with Mark Ireton, CEO Noram Ventures Inc. (TSX-V: NRM, Frankfurt: N7R: GR): Preparing to Become a Lithium and Graphite Supplier to the Battery Market

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/26/2016

Vancouver based Noram Ventures Inc. (TSX-V: NRM, Frankfurt: N7R: GR) is a junior exploration company planning on becoming a force in a green energy

revolution. Mark Ireton is pursuing development of lithium and graphite deposits with the ultimate goal of becoming a low cost supplier for the ever

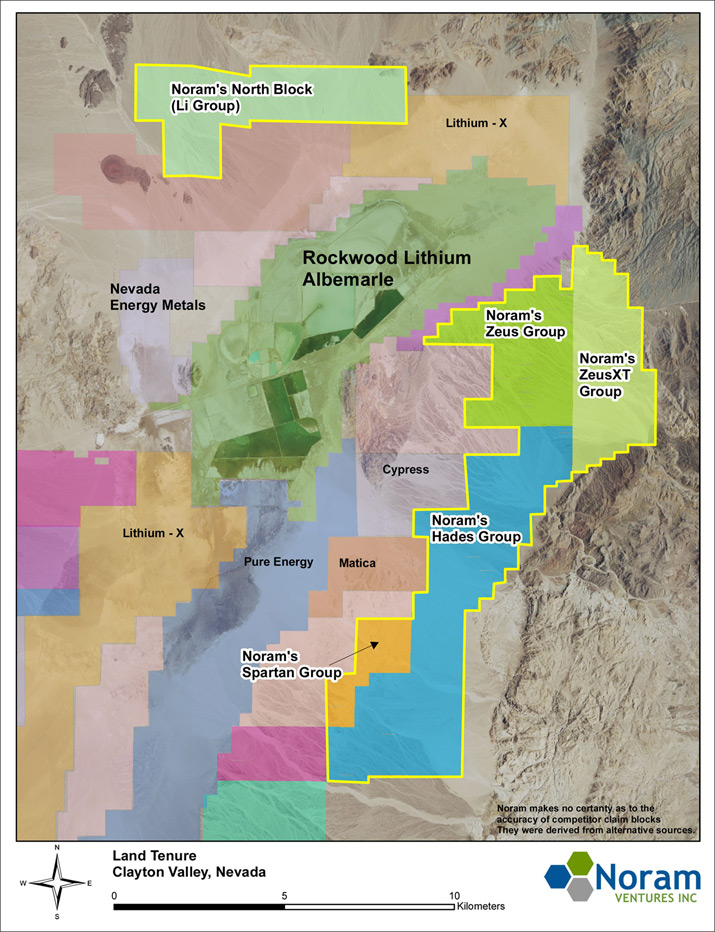

increasing lithium battery market. On the lithium side they have a 17,000 acres’ land package in Clayton Valley, Nevada. This is mostly clay based and

affords tremendous economies of scale in the production and extraction as opposed to brine. On the Graphite side they have over 15,000 hectares with 45%

large flake graphite they can sell at a premium to the battery market. Pleased to be involved in the green revolution, Noram Ventures is positioned to be

an early entrant in the global lithium and graphite markets.

Clayton Valley lithium brines

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Mark Ireton, who is the present CEO of Noram Ventures and

Company consultant, Chris Farnworth.

Dr. Allen Alper: Mark, what is your vision for Noram Ventures?

Mark Ireton: Noram Ventures is a Canadian based junior exploration company headquartered in Vancouver. We trading on the TSX Venture Exchange,

the Frankford Exchange, and waiting for our listing on the OTC board. Noram is committed in becoming a force in the green energy revolution. We intend to

do this through the development of lithium and graphite deposits, with the ultimate goal of becoming a low cost supplier for the ever increasing lithium

battery market.

Our focus has been, since formation, on the acquisition of mining projects, including the lithium project Clayton Valley, Nevada and a graphite

deposit in the Nakusp area, Slocan Mingling District of British Colombia. Our long term strategy is to build a multi-national, lithium graphite dominant

minerals company to produce and sell both resources into the global markets of Europe, North America, and Asia.

Dr. Allen Alper: That sounds very good. Could you tell me a bit more about your property in Nevada? What makes it significant, why it's of

interest?

Mark Ireton: Yes. We've assembled quite an interesting package. One of the largest in the valley, with over 17,000 acres and 888 claims to

date. Most of our property is clay-based as opposed to brine-based, which affords some tremendous economies of scale in the production/ extraction of

lithium from clay vs. to brine. It's far more cost efficient both in terms of dollars and time. Noram has invested in a membrane filtration system that is

secured under a licensing agreement enabling us to be an early producer - first to the market with production. This technology can literally extract

lithium in a day as opposed to a brine based, evaporation process where it sits in a pool for as much as 18-24 months. The brine evaporates until the

lithium can be extracted.

Our process is economical in terms of time and money. It's quite a bit more environmentally friendly. It's a closed loop system recycling all the

chemicals used in the extraction process for re-use and involves little to no water. We've been able to negate a huge environmental and political issue in

Clayton Valley, Nevada, which is water supply. Our process leaves the water aquifer unaffected.

Dr. Allen Alper: That sounds great, looks very promising. Can you elaborate a bit more on your process?

Mark Ireton: I think we're using hydrochloric acid in this process. The membrane that filters the product, with the use of this chemical,

basically extracts the lithium from the clay. The process involves two of these membrane systems. One's basically being cleaned all getting ready for use

while the other line is operating. Buildup clogs membranes arteries and once cleaned we re-engage the second pipeline to continually process and extract

lithium.

Chris: Yeah, Dr. Alper. To extract lithium from the clay, we have to put it in suspension. We use hydrochloric acid or nitric acid to do that. Once

that's in, the lithium is converted to a brine. Then we run it through a two pass membrane system four times. That gives us a 75+% lithium grade battery.

We would pass it through one more process to bring it up to about 99.9% pure lithium.

Very simple system, it's totally self-contained, sits in six containers, and is very cost effective.

Mark Ireton: This process is in the works now. We're waiting for the results, which we expect will be out in a couple of weeks. In this game,

the winner's going to be the one who is first out of the gate with production. We believe with this technology we could be in that line up to achieve this

very goal.

Dr. Allen Alper: That sounds excellent. Tell me a bit about your plans for this year, where the product will go and why lithium is so important?

Mark Ireton: We just completed some early stage sampling. For the next round we have just applied for a permit, dealing with 55 holes that

we've identified on the various properties. We'll go 60-80 feet deep on these just to prove out the existing results we have, which are very encouraging

with an average of 780 ppm, parts per million. The economic viability calls for 100-200 parts per million so we're well ahead of that scale.

Sampling Large Historical Bore Hole on Hades Claim Group

The next round of exploration, to further improve on these results, will take us to the end of October. Lithium is so important today because the electric

vehicle revolution is really driving the market. The price of lithium has remained largely constant over the last few years through 2015 where it finished

off at about $7,000 per metric ton. In the early part of 2016 that price rose as high as $32,000 per metric ton before falling back to $20,000 and today

it's leveling off at around $13-14,000 per metric ton.

It remains a great value because the extraction process (unique to our process) will only cost $2,000 or less per metric ton. The conventional

brine based evaporation can cost as much as $4,000 per ton. With the price of lithium being what it is, our process is very economical. Even if lithium

were to fluctuate downward we believe Noram will have better economics to continue our process even in lower value climates. The electric vehicle is

driving the market. Not only Tesla, but all auto manufacturers are either in the race today or coming into it with their various options.

Tesla is at the forefront and is building a new Gigafactory, 12 million square foot plant, largest building in the world only 200 kilometers from

our property in Clayton Valley and with it they'll start to install “Powerball” battery packs that will go into household common application to store

energy which will be drawn on during prime time when electricity is more expensive rather than using electricity from the grid.

All of these things are driving this market, with demand expected to outstrip supply through to 2020. Conservative estimates on pricing suggest it

will remain the same over the next two years, but if you compare the supply and demand trend which is hockey stick like with the price trend which is

relatively flat, it would appear to be a bit of a disconnect and therefore believe for the price to remain stable for the next two years is very

conservative relative to the demand chart.

Dr. Allen Alper: That sounds very promising. Would you like to say anything about your graphite project?

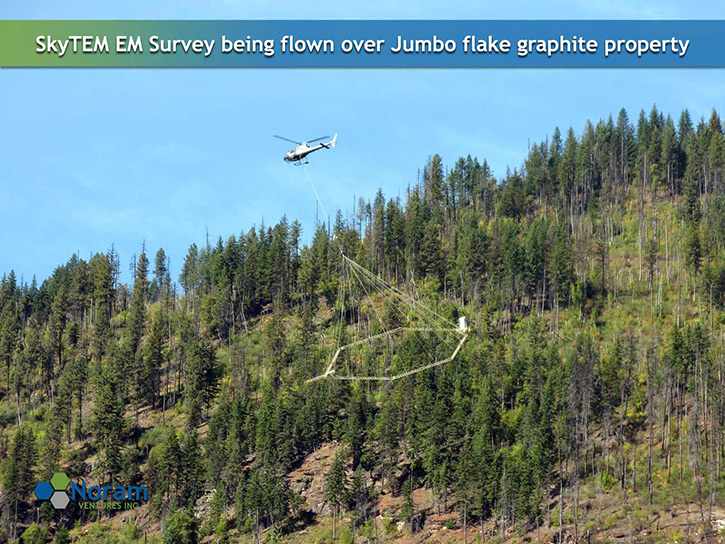

Mark Ireton: Yes, the Jumbo Graphite property is on an area of just over 15,000 hectares which is the size of Manhattan. We had some great

early results there with 26 mineral tenures over the 15,000 hectares, initial testing of a 10kg sample was done by SGS Lakefield and showed 45% of the

content being large flake graphite which is the equivalent of battery grade and that compares very favorably pricewise to smaller flake which commands

about $900 per ton whereas the large flake is 10 times more at $20,000 per ton.

In addition, with the graphite, there's another technology we've engaged in that will produce graphene from graphite. Graphene has wonderful

attributes to it, in that it's the lightest, strongest, most conductive metal in the world, very appropriate for battery use. It will shorten the battery

recharging time and lengthen the life span of a battery from its current use by 10 times.

With this innovative technology, we like to think that we bring some exciting things to the table for the lithium ion battery program through use

of both our clay based lithium and our graphite deposit.

Dr. Allen Alper: That sounds great. Could you tell me a bit about where the graphite deposit is located in the infrastructure of that area?

Mark Ireton: It's about 88 kilometers south of Revelstoke in the Slocan Valley, Nakusp area of BC. All infrastructure, water, roads electricity

is already there. Noram has held this property since 2010. As you know, mining has gone through its lowest ebbs over the last few years and all resources

values have suffered except lithium which has become the hot item. Accordingly, lithium is our immediate focus and from it we intend to raise suitable

funds to expand later on this/next year into further graphite exploration.

Dr. Allen Alper: Very good. Could you tell me a little bit about your background and your team and your board?

Mark Ireton: I'm a commercial lender with 30 years of lending experience to small and mid-size businesses, both public and private. Also on our

board is, Chris Farnworth, our senior consultant. He's been very instrumental in bringing this project together. Our land guy in Clayton Valley is Gavin

Harrison who has assembled the Clayton Valley land position, which being clay based has its real advantages. I believe there are only two others in the

valley that are clay based versus brine based property. Michael Collins is our local geologist, who reviews all our work. We also have a geologist in

Nevada working side by side with Gavin Harrison.

Ken Philippe is our CFO. He's been a CA for 25 years and with Noram since inception. He makes sure our T's are crossed and I's dotted. Dave Rees

has been instrumental in the company since inception and the graphite deposit is his baby. He will continue to oversee Jumbo Flake as we expand in that

area. Arthur Brown is newly on our board. He's been on the boards of at least eight other companies and is very savvy in the public market arena and

certainly understands deal structure.

Dr. Allen Alper: That sounds like a very good, strong board. Could you tell me the primary reasons our high-net-worth readers/investors should

invest in your company?

Mark Ireton: We're very pleased to be involved in the green revolution. We want to make a difference for the planet, for our kids, and their

kids.

Our projects are critical projects, having both the graphite and the lithium based properties. Our drilling results have produced favorable findings to

date. We were one of the later entrants into this market. Our competitive colleagues in the territory are often trading at .60-.80, $1.60, and beyond $2.

The price of our stock is at about seven cents today, seven and a half cents. We think we have great value going forward given the strategic location of

our property and its makeup. The four-month increase of our share has been tremendous. We've literally gone from .01 to a high of .13 before falling back

to the seven and a half cent level here now. That's because of a volume of paper here hitting the market. But we fully expect to see some favorable values

in the share price once we weather the paper volume.

We're looking to retain that share structure so that it will enhance value for shareholders going forward.

Dr. Allen Alper: That sounds very good. Could you, anything else you'd like to add?

Mark Ireton: I think while we're one of the latest entrants into the market, we do believe with the technology we are using, we will be one of

the early producers. That is key to enhance our value in the next few months going forward.

Dr. Allen Alper: Sounds good.

http://www.noramventures.com/

Noram Ventures Inc.

Suite 430 - 580 Hornby Street,

Vancouver, British Columbia

Canada V6C 3B6

Email: admin@noramventures.com

Tel.: (778) 775-1528

Mark Ireton, President & CEO

Email: mark@noramventures.com

Direct Tel.: (604) 761-9994

|

|