Jim Greig, President and CEO of Crystal Exploration (TSX.V: CEI.V): New Canadian Diamond Exploration Company that Recently Acquired Three Exceptionally Good Diamond Assets in Nunavut, Canada

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/19/2016

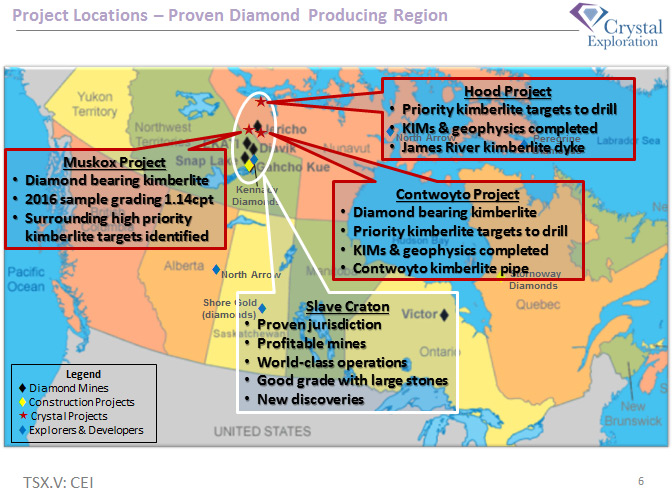

Crystal Exploration, Inc. (TSX.V: CEI.V) is a new Canadian diamond exploration company that recently acquired three exceptionally good diamond assets

in Nunavut, Canada. The most advanced property, called Muskox project, is located approximately 150 kms north of the Ekati Diamond Mine. We learned from

Jim Greig, President and CEO of Crystal Exploration, that the properties came with an extensive historic drill database as well as with many untested bulk

samples. Currently, Crystal Exploration is testing those samples, and by September Mr. Greig expects good news about the actual grade of the diamonds. On

top of that, Crystal defined ten new drill targets on the Muskox project for the next exploration program. According to Mr. Greig rough diamond prices are

closely correlated with gold prices and over the past six months there's been a strong increase in rough diamond prices as well as in demand from China,

India and the USA. In the future, Crystal Exploration wants to consolidate the Muskox’s region via acquisition of the nearby formerly producing Jericho

Diamond mine and surrounding ground.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News interviewing Jim Greig, President & CEO of Crystal Exploration. Could you

tell me a bit about your deposits in Canada, your diamond exploration and your plans for 2016 and 2017?

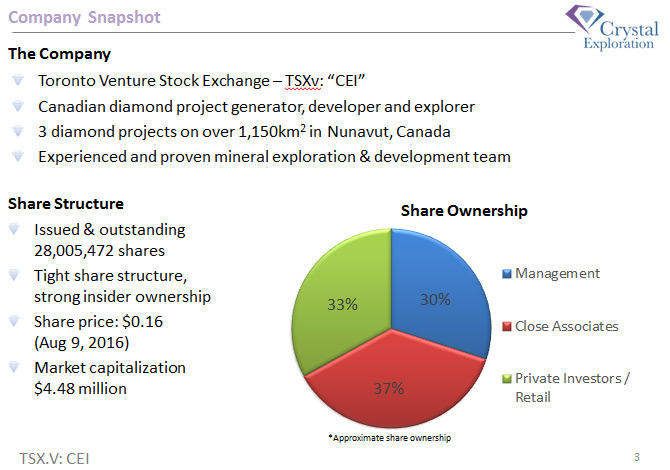

Jim Greig: Yes, absolutely. Crystal Exploration is a relatively new diamond exploration company, presently there is only approximately twenty

eight million shares issued and outstanding. We've just completed a financing. Through the course of the last two years, Crystal had been reviewing and

looking for new distressed assets to acquire, at the bottom of a cycle. We realize there are a lot of very good assets that have been de-valued due to the

state of the mining sector. Approximately eighteen months ago, we acquired these exceptionally good diamond assets through a private vendor. The assets

were formerly owned by De Beers, Tahera Diamonds, Aber Resources and Kennecott Exploration.

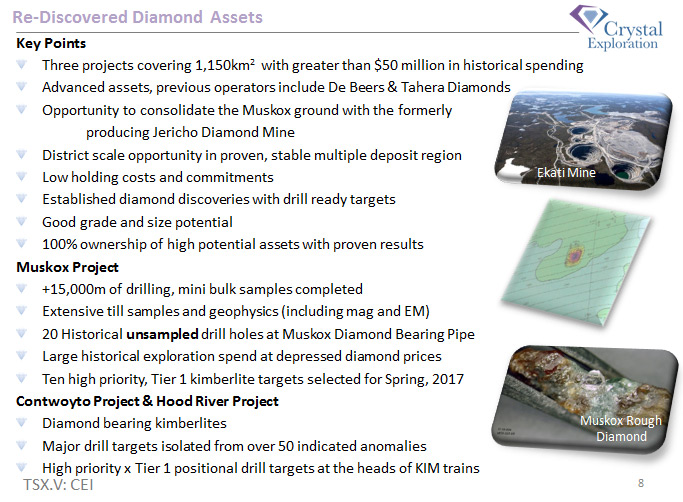

They're located in Nunavut, in the northern part of Canada. There's been in excess of over fifty million dollars spent on our three project areas through

geo-physics, kimberlite indicator minerals and some major drill campaigns. We do have a number of diamond bearing kimberlite pipes and our most advanced

asset is called the Muskox Pipe which is of course in our Muskox project. This project lies approximately 150 kms north of the Ekati Diamond Mine.

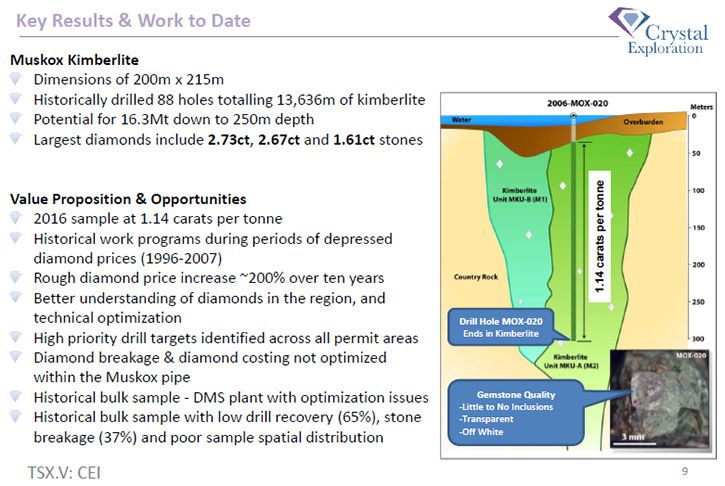

This pipe does contain diamonds. It has had some mini bulk sample work and some bulk sample work done. It has a grade of approximately a half a carat. We

believe there is potential to increase this grade significantly, due to some execution and geological errors that were made ten and twenty years ago when

the pipe was last worked on.

Dr. Allen Alper: Well it sounds very interesting and promising. So going forward what are your thoughts on how to pursue your primary project and

your other two diamond projects.

Jim Greig: Correct. The present plans. As part of a separate acquisition that we did with our projects, we not only acquired the tenements

and the exploration licenses, but we also acquired all of the historical data, and all of the digital data. Within that group of data we acquired twenty

three diamond drill holes that were part of an infill drill program in 2006. Those twenty-three drill holes were never processed for diamond content. They

were drilled and put into boxes. Then the programs were all shut down by the operators, due to low rough diamond prices. Now we have approximately five

million dollars’ worth of drilling that has been completed, but never processed for diamonds.

So we processed three of the holes in March of this year and one of the three holes had a very good result of 1.14 carats per ton. In September we'll

start releasing news of the remaining twenty drill holes, which represents approximately forty tons of material. We do know there are diamonds in this

core, in the mini bulk sample. The billion dollar question is can we show that the grade is much higher and we hope to do so. So there's a good source of

news flow to come in September.

Dr. Allen Alper: Well that's very good, a very inexpensive way of getting drilling data.

Jim Greig: Absolutely! It's been a tremendous save on the treasury, especially with the market improving. But it's still difficult to raise

money and this is a way of not spending money on a drill program. Also as part of all the data that we collected, my geological crew has been

investigating other targets for drilling. There are in excess of fifty anomalies across the Muskox's project area. In that fifty, we've narrowed it down

to ten top tier targets for drill testing and we believe there's great potential to drill a new kimberlite pipe within these ten. The ten targets are all

based at heads of kimberlite indicator mineral trails. There are large underlying geo-physical anomalies and there is also chemistry work indicating

diamond content.

So we're hoping we have multiple hits within these ten drill holes, late winter or early spring of next year.

Dr. Allen Alper: It sounds very good. It sounds like you have your plans well thought out. You could start with a very inexpensive approach and as

the market improves you could get the funding to do the drilling later on.

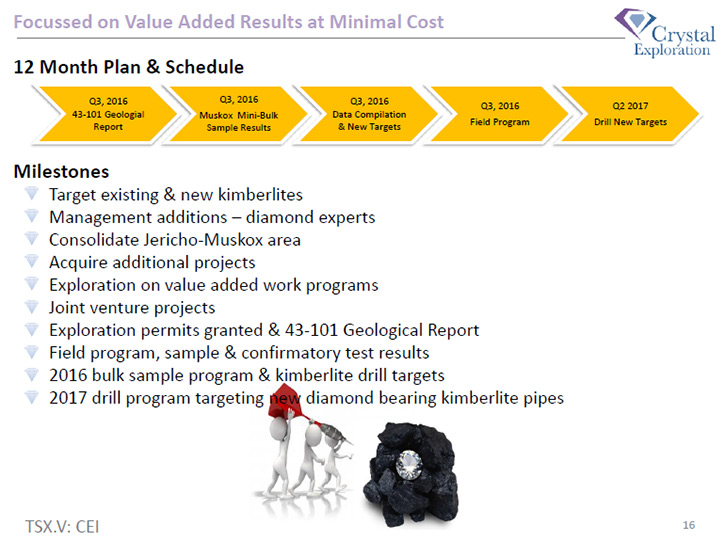

Jim Greig: That's exactly it and nobody is aware of Crystal at the moment because we've done no marketing whatsoever. Over the past twelve

months we spent time reviewing data, putting plans together and adding some significant people to the management and board team. Now as the pendulum is

swinging in favor of mining and resource sector projects, we feel it's a good time to start the marketing and start doing real work. There'll be

significant marketing efforts starting early September going right through to November.

Dr. Allen Alper: That sounds very good. Could you tell me a little bit about your team and your board?

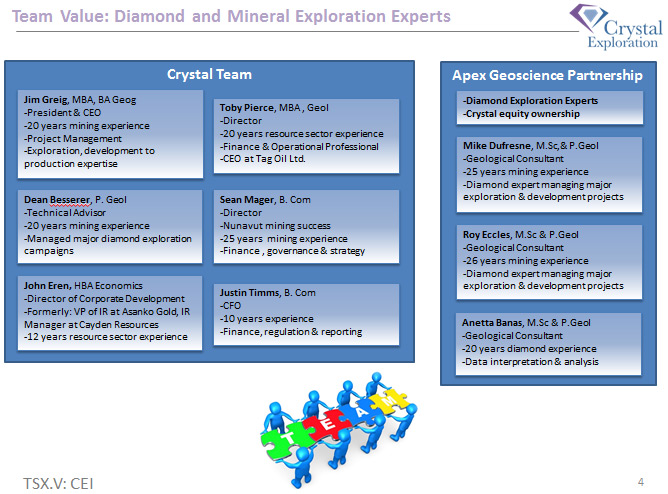

Jim Greig: Yes, absolutely. I guess first I'll introduce myself. I am an over twenty-year veteran within the mining sector, I have worked in

exploration, to development and right through into production. I'm not a geologist and I'm not an engineer, however, I've been slated in those positions

through the years. I hold a BA in geography and much of my geography degree concentrated on earth sciences so my early days in the 1990s I was working for

the Hunter Dickinson Group. Back then I was logging core and eventually moved on to work with some other juniors and managed some drill programs. Then

during the late '90s we hit another down cycle and I decided to re-educate myself and I obtained an MBA, which gave me a very good corporate and financial

focus. The latest companies that I've worked for, in the near past, I'll say, I spent considerable time at Keegan Resources, Keegan is now called Asanko

Gold, but they have a producing mine in Ghana, West Africa. I worked there for close to three years traveling back and forth between Vancouver and Ghana,

helping with the project management, the engineering and developments of the mine site.

Dr. Allen Alper: That's very good. You've had a very good background. What about some of the other members of the team and board?

Jim Greig: So I'll go with the board, it's a small board at the moment, there are three members on the board. However, we do have several

people that we are looking at adding in the near future. That will be a good source of news flow, but the present three, of course, myself, the second

director is Toby Pierce. Toby Pierce is currently CEO at Tag Oil. Tag is a small oil and gas producer with operations in New Zealand. Toby was formerly an

analyst at GMT Resources in London, England and so he brings considerable financial acumen to our team. He is also a geologist, although most of his

experience is based in oil and gas, he does have hard rock mining experience, but his forte within our board team is all about finances and a good clean

share structure.

Our third team member on the board is Sean Mager. Sean also has over approximately twenty-five years of mining sector experience. He brings considerable

regulatory, financial and legal support for the team. His background recently is with Brilliant Resources and he was CEO at Brilliant. Brilliant had some

very good projects in Equatorial Guinea, however Equatorial Guinea of course is a difficult country to operate in with a non-transparent government. The

government did not live up to its expectations and so Brilliant took the EG government to arbitration courts and won nearly forty million dollars in a

settlement. That happened approximately one and a half years ago and a forty million dollar settlement for a junior company at the bottom of the mining

cycle was quite a big win. So he's no longer with Brilliant, Brilliant has taken another course and moved away from the mining sector.

Sean was also part of North Country Gold. North Country merged with another gold firm called Auryn Resources. Auryn had a very good marketing team

with quite a strong treasury, but they lacked a project. North Country held an exceptionally good high-grade gold project in Nunavut and merged it with

North Country. The stock is currently trading at close to four dollars. Market cap is over a two-hundred million. That is quite a good achievement to be

able to close a deal during tough times.

We are in the midst of adding several more executive team members. Currently, we have Dean Besserer, who is our geological technical advisor. Dean

has well over twenty years’ experience. Dean is writing a 43-101 report for us. Dean has excellent experience, mainly within the diamond sector, right

across all of northern Canada, having spent considerable time in the North West Territory, Nunavut, Quebec and Northern Ontario. He worked with some

significant firms such as Stornoway Diamonds. He has a number of kimberlite discoveries under his belt. Dean is leading the charge on all our exploration

efforts.

Dr. Allen Alper: That's very good. Sounds like he has excellent background.

Jim Greig: He does. We have also engaged Apex Geoscience out of Alberta, another formidable team member with considerable diamond experience.

We're quite proud of our diamond geologists and their ability to develop and discover new pipes.

Dr. Allen Alper: That's very good. Could you tell me a bit more about your share structure, capital structure?

Jim Greig: Currently we are at approximately twenty-eight million shares issued and outstanding. The stock is trading at approximately

sixteen cents. That leads us to about a four million market cap, which I believe has considerable opportunity to increase over the coming months as we

bring out news and officially add some new people to our management team and the board.

There's not a lot of liquidity in the stock, it's very strongly held. Insiders and management have participated in every single private placement

that we've done over the past two years and we will continue to do so. Management and insiders all have to get in the game and I believe that is an

important formula for success, to show that we are willing to share the risk. Up until the last three years, since we have controlled this company, there

has not been a single salary doled out to any management or board member. So we have been running very, very lean. Thus, our tight share structure with

only twenty eight million shares outstanding. That is going to change at some point. You have to pay people for good work, but for the time being we are

still running very lean and being aggressive with news to come.

Dr. Allen Alper: What are the main reasons high-net-worth readers/investors should invest in your company.

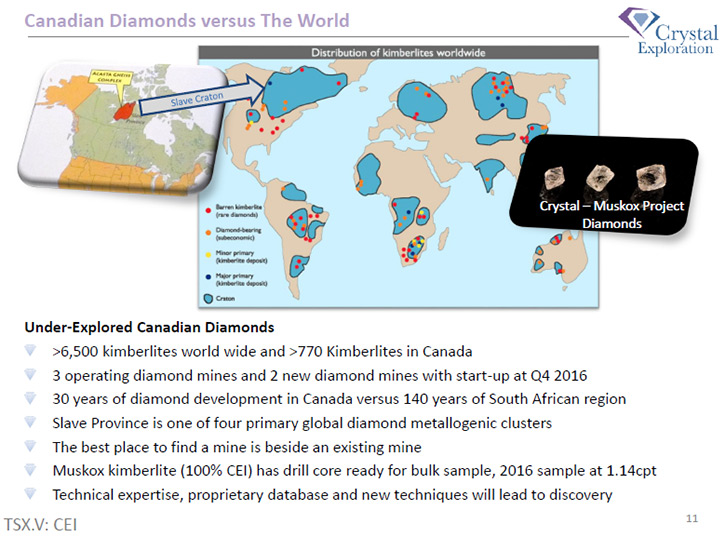

Jim Greig: Diamonds are very good now; rough diamonds actually follow the gold price very closely. In fact, they are almost perfectly

correlated. Over the past six months you've seen a strong increase in the rough diamond price, which does follow gold. The fundamentals for diamonds are

such that there aren't many new world class mines coming into production. In fact, there is a decline in production of rough diamonds over the coming

years and a decline in the life of mines. Compare the decline in diamonds versus demand, which is increasing rapidly. There are some new populations in

the world adopting western world practices of buying diamonds and you're seeing that very well illustrated in China and India. And so both China and India

are part of the large drivers to new demand for diamonds.

So, you have increasing demand for diamonds and decreasing supply over the coming years and I think it's within the next twelve to eighteen months

we will be at peak diamond supply. Canada's an under-explored region, there are three diamond producing mines in Canada and there are two new mines going

into production this year. So there's considerable interest in Canadian diamonds, largely because they're exceptionally good quality diamonds and

ethically produced. In Canada there is only about a thirty-year history of diamond exploration in mining, whereas if you compare it to places like South

Africa and Botswana, there is well over one hundred years. Canada also contains the largest diamond bearing craton in the world. There's potential here

for Canada to become a very large diamond player, moving forward.

So really the value to new investors is that we have not done marketing, we've only just begun to tell the Crystal story. We have considerable news to

come over the next, I'll say weeks to six months’ time. We're looking forward to some encouraging results from these forty tons or twenty holes that we

begin processing for diamond content in September. We're also looking at some new discoveries in the winter of next year.

I think we're just one of those companies that's undervalued, but we've been undervalued because we've not told our story. There are a number of

other people that I didn't mention. We have some significant shareholders and advisors. One of them is Shawn Wallace. Shawn is from Auryn Resources, he

was with Cayden Resources and Cayden was bought out by Agnico Eagle about a year and a half ago. He was also chairman at Keegan Resources, which is now

Asanko. He still remains a director at Asanko Gold. Not only is he a shareholder, he's providing us with exceptional financial expertise, as an advisor.

Dr. Allen Alper: Yes, I know him very well. We're just about to publish an article on Auryn.

Jim Greig: Very good. So you can see there are some former people from the Auryn group that are with Crystal. We have added John Eren,

formerly the marketing and IR director with Auryn and Cayden and Keegan Resources, those groups of companies where Shawn Wallace was a founder, so he is

now leading the charge on our investor relations and marketing efforts and he is also a large shareholder.

So you can see there's a good strong group of friends and colleagues, working together on this new Crystal endeavor.

Dr. Allen Alper: It sounds very good! It sounds like you have an excellent core group of strong, experienced supporters with very successful

histories in the mining industry.

Jim Greig: Yeah, we're very excited, Al.

Dr. Allen Alper: Is there anything else you'd like to add?

Jim Greig: The last thing I'd like to add really is just we are looking at consolidating the Muskox’s region, so that being said, the

formerly producing Jericho diamond mine lies fourteen kilometers away from the Muskox’s Pipe. We're looking at consolidating the region, so making some

new acquisitions, be it on brownfield type ground or others that surround the Jericho and Muskox’s tenements. So there is potential there for Crystal or

perhaps even a senior producing company. It would be a accretive value for Crystal to look towards consolidating or acquiring the Jericho diamond mine,

because it has been on care and maintenance for the last five years.

Arguably, in today's dollars, it probably has a three hundred million dollar replacement value. So there is a mine complex nearby our advance pipe

and we are looking at either acquiring this or building new discoveries surrounding this mine.

Dr. Allen Alper: Well that sounds great. It sounds like great potential.

Jim Greig: Yes and that's what we're hoping for as the market returns and rough diamond prices move forward as they track gold.

https://www.crystalexploration.com/

210, 8429 - 24th Street NW

Edmonton, AB Canada T6P 1L3

Phone: 1.780.437.6624

Fax: 1.780.439.7308

Vancouver Office

Phone: 1.780.437.6624

Email: info@crystalexploration.com

|

|