Dr. Alper Interviews Jean-Sébastien Lavallée, President and CEO of Critical Elements Corporation, Developing a Large Lithium, Tantalum Project with a Take or Pay, Off-Take Agreement

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/20/2016

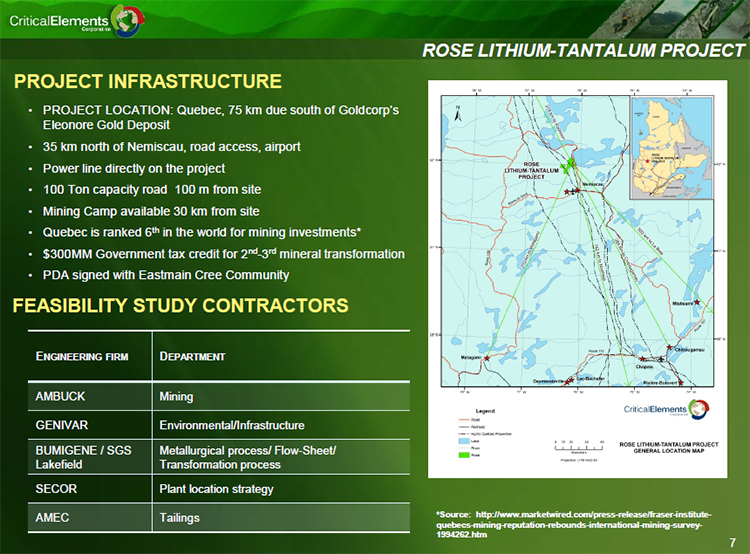

Jean-Sébastien Lavallée, President and CEO of Critical Elements Corporation, is developing a large Lithium, Tantalum project based in James Bay in

Quebec. We learned from Jean-Sébastien Lavallée, President and CEO of Critical Elements that they have a 100% take or pay, off-take with a large chemical

company, HELM AG. Critical Elements announced strategic partner HELM AG is to provide up to $4.5m funding for feasibility study. With a low market cap, a

qualified and experienced staff and a strong business partner, Critical Elements is positioned to become a critical player in the Lithium and Tantalum

market. On June 2, 2016, Critical Elements Corporation announced it closed a private placement for gross proceeds totaling $6,197,500. The private

placement was led by Canaccord Genuity Corp.

This offering was arranged with an elite group of institutions, including lead investor JP Morgan Asset Management UK, which indicates the high regard in

which Critical Elements Corporation is held with sophisticated institutional investors.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Jean-Sébastien Lavallée, President and CEO of

Critical Elements Corporation. You have some great projects in Lithium and Tantalum. Could you tell us a bit about your company and what distinguishes it

from other companies?

Jean-Sébastien Lavallée: First of all, our project is based in James Bay in Quebec, so it's a very good jurisdiction for mining. Our project is at

a Preliminary Economic Assessment (PEA) level. We released a PEA report in December 2011 with very strong numbers; a Net Present Value (NPV) of CA$279

million at an 8% discount rate and an estimated after-tax Internal Rate of Return (IRR) of 25%. At that point, we used a Lithium-Carbonate price of $6,000

and a Tantalum price of US$118 per pound. If you look at the market today, there is not enough supply for the demand. Demand for batteries in electric

cars is growing, and there are not enough producers to support the demand, so the price is going up very quickly.

There is some research that reports prices between US$15-20,000 per ton right now. Our project is getting better and better, if we use this price.

Our goal is always to be conservative, so we are in a definitive study process right now, and we'll use a conservative price. But for sure the price will

be higher than US$6,000 dollar. We'll use the forecast average price for the next 5-10 years.

Dr. Allen Alper: That sounds excellent! Could you tell me a bit about your deposit?

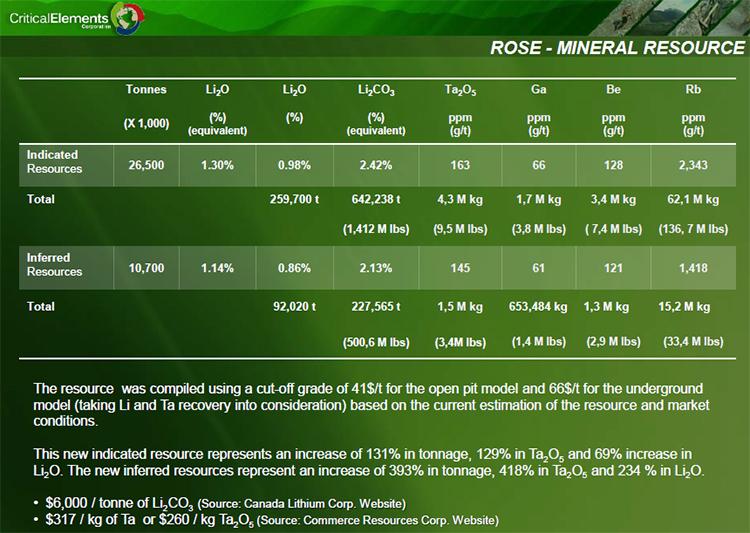

Jean-Sébastien Lavallée: On the deposit we discovered in 2010, we drilled over 200 drill holes on the main zone. We reported 2 resource estimates

on it. The one that was used in the PEA report was, 26.5 million tons of resource at 0.98% lithium-oxide and 168 PPM tantalum oxide.

There are multiple other pegmatites with spodumene and tantalum on the property where we drilled. We have very good results, so there is a good potential

to increase the resource and extend the mine life of the project.

Dr. Allen Alper: That sounds great! You have a strategic agreement in place for Loftek. Is that correct?

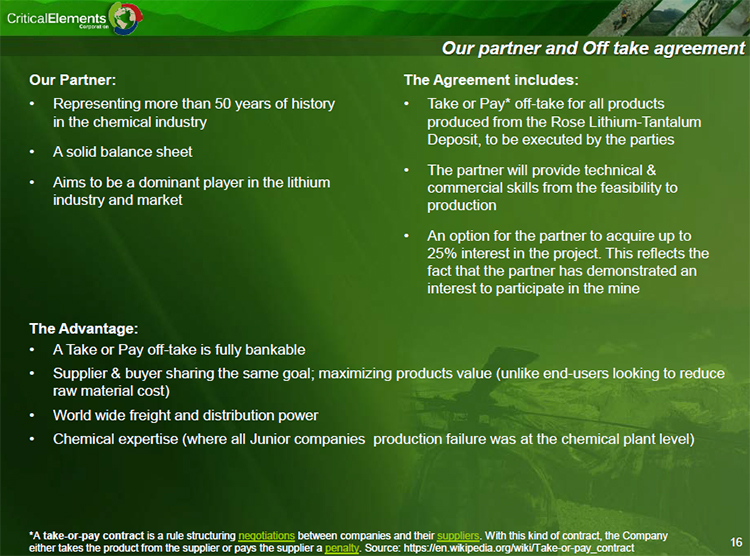

Jean-Sébastien Lavallée: Yes, in September we signed an agreement with a large chemical company for a 100% take or pay, off-take on, all the

material coming out of the project so far. Spodumene concentrate or lithium carbonate, Teflon, any product that we will produce, they will buy it. This is

the main point of the agreement. We did all that in the past, in terms of metallurgy, and with other end-users in the glass and ceramic market. That is

one of the largest markets with the baby market, and there are materials, certain specifications for these markets. This is why we are planning to sell a

portion of our material for this market as a concentrate, and lithium carbonate for the battery market.

This is the main point of the agreement. They will provide technical support for all the engineering and the ramp work with the project, management

expertise, dilution expertise, and chemical expertise. There is also an option with them, based on the results of the study, to provide 25% of the equity

needed to build the project in exchange for 25% of the project.

Dr. Allen Alper: That’s an excellent arrangement. It shows they have great confidence in your project. That's very important.

Jean-Sébastien Lavallée: Yes, it's very important to have an agreement where our off-take partner will own a part of the project and participate in

the project financing. It's very helpful to get the project financing in place with the other institution or bank for the balance of the funding.

Dr. Allen Alper: That's very good. It's an excellent position to be in, particularly at a time when the mining sector is having a lot of problems

raising funds.

Jean-Sébastien Lavallée: The fact that it's a take or pay, off-take, is very good to take to the bank for debt financing on the project, because

there's a payment from this partner for the material. There is 25% equity for the project getting off and we can raise the rest for the construction,

without a doubt.

Dr. Allen Alper: Well, that sounds very good. That would result in minimum dilution.

Jean-Sébastien Lavallée: If you look at our history, our goal has always been to minimize the dilution. There are companies that have been a little

bit faster on development, but our goal is to minimize the dilution until we are producing, to keep good value for the shareholders’ future earnings. We

learned a lot about the supply and demand of lithium and we saw this supply shortage coming. We decided to get this off-take in place and position our

company for when the supply shortage is here. Right now we hope that it will increase the value of the company and allow us to get better valuation for

funding.

Dr. Allen Alper: That's excellent. Could you tell us more about your capital structure?

Jean-Sébastien Lavallée: The Company has 125 million shares out. There are 6.5 million options, mainly to management and some consultants. There

are 2.5 million warrants at 35 cents. For a total, fully diluted of 34.5 million shares out. It's very reasonable at this level of development. Our goal

is to be built with a maximum of 200 million shares. I think a producer with less than 200 million shares is very good.

Dr. Allen Alper: That's excellent. Could you elaborate on the uses of Lithium and Tantalum and why they are so important?

Jean-Sébastien Lavallée: On the Lithium side, there are multiple uses. Most people don't know how much Lithium is used in everything. There are 2

major markets. The largest has always been the glass and ceramic market. It's used in dishes, it's used in screens, it is used everywhere. There is a

large amount used in ceramic stove tops. The fastest growing market is the battery market for all the electric cars, the iPhones and the electronic

devices. One of the markets that is close to exploding is the storage unit battery. With all the new regulations, all around the world to reduce the CO2

emissions, there is a lot of demand for increasing capacity for multiple use on the energy grid.

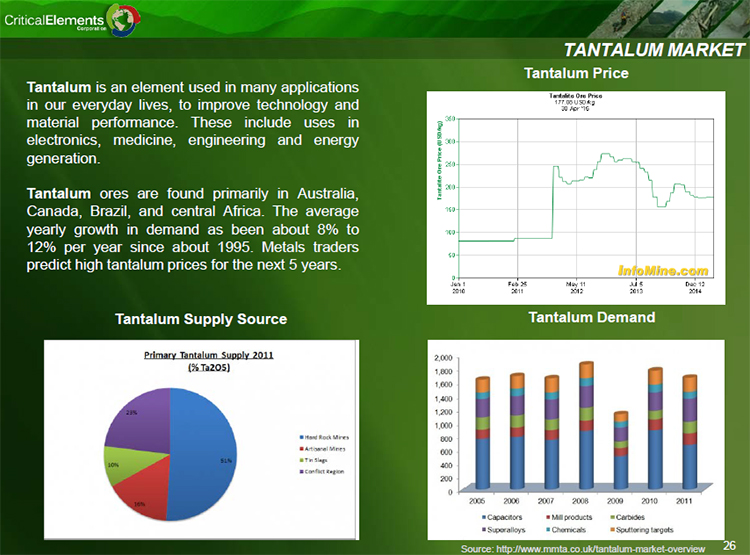

In terms of Tantalum, the main use is in steel and capacitors. Around 4 million pounds of Tantalum is produced a year. About 20% comes from scrap

materials and the rest mainly comes from Brazil, Australia and the DRC. About 60% comes from DRC. One of the largest tantalum mines was in Australia. It

shut down 3 years ago. 80% of the demand is for capacitors, used in all the electronic devices to reduce the size of the device. That’s why cell-phones

and computers are so small today, with so much power.

Dr. Allen Alper: Excellent. Your company is well named, Critical Elements, and you have some very, very important critical elements.

Jean-Sébastien Lavallée: Yes, really critical materials, strategic and critical for our future.

Dr. Allen Alper: Yes. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Jean-Sébastien Lavallée: There are many reasons. Look at the price we use in our feasibility study, we expect to get it out by the end of the

summer. We already have an off-take partner for 100% of our materials. We have very qualified people for processing, experienced people from FMC and

Rockwood Lithium, people, who can build this kind of project. We'll complete the permitting and we'll go right to construction. If we look at our peers in

this sector, we are one of the lowest market cap in the market.

Dr. Allen Alper: That sounds excellent. What is your CapEx projection?

Jean-Sébastien Lavallée: The CapEx projection based on the study in 2011 is 279 million. Some equipment will be higher, but on the other side, the

mining equipment suppliers have tons of trucks, so they are motivated to do a better price.

On the consultation side, people are not working, so we will get better prices from them. We think the CapEx should be in the range of 300 million

or a little bit more. But I think the number we used in 2011 is in the right range. If you apply the dollar exchange, it will give you something around

330 million, 340 million. But the feasibility study will tell us.

Feasibility Study

HELM has agreed to collaborate with, assist and provide technical support to Critical Elements for the preparation and completion of the feasibility

study. HELM has further agreed to provide logistical and sales support to Critical Elements in relation to the distribution and sale of all future mineral

products to be produced on the Project (the “Mine”).

| Project Financing

As consideration for HELM’s covenants and undertakings under the Agreement, Critical Elements has agreed to grant HELM an option to acquire an ownership

interest of up to 25% in the project by committing to pay for a portion of the mine construction costs (the “Financing Option”). HELM may exercise the

Financing Option within a period of 60 days after having received written notice from Critical Elements to the effect that it has arranged financing for

mine construction. The Financing Option is subject to certain conditions, including the execution of the Take or pay, off-take Agreement.

This financing is a significant step forward for Critical, as we are now fully funded to complete our bankable feasibility study. With this funding

committed and the identity of our strategic partner now disclosed, the capacity and the quality of its partner is now confirmed beyond all doubt.

Also Discovery of a pegmatite traced over more than 700 metres on surface returns up to 3.04% Li2O and

248 PPM Ta2O5 from six grab samples1 averaging 1.61% Li2O and 142 PPM Ta2O5 at helico-south, rose lithium-tantalum project |

Dr. Allen Alper: That sounds very good. Is there anything else you would like to add?

Jean-Sébastien Lavallée: For the last 2 years, we have focused on marketing our product and finding an off-take partner. At the same time we put a

lot of effort into the metallurgy to make sure all our test results are accurate and consistent. We used 2 labs to validate all the numbers. We did an

optimization program. We improved the recovery. We improved the region cost, to have a positive effect on the OpEx for processing. I think this is very

important because we want everything to be perfect, when we build a large scale plant. We have very qualified people and we plan to hire the best

additional people with experience in terms of conversion or chemical transformation when needed.

Dr. Allen Alper: That sounds like a very good approach, and it sounds like you are doing all the right things. Could you tell me a bit more about

your background and you team's background?

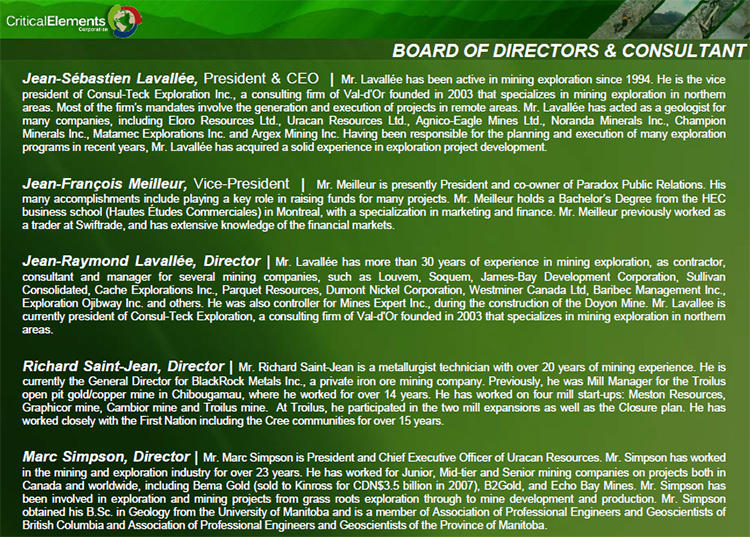

Jean-Sébastien Lavallée: I am a geologist. I graduated in 2003. I'm from a mining family. Both of my grandfathers were metallurgists or miners and

geologists with junior mining companies. My father has been in the mining industry 35 years or more. He acts as a contractor and consultant for

exploration or construction of different projects. I have an uncle, who is also a metallurgist, who is a senior VP, involved in many big silver projects.

My background is mainly in exploration and mining.

We have Jean-François Meilleur who is VP. His background is mainly on the financial and the marketing side. We have Matthew Lauriston, he's a

legal consult for Sumitomo Corp in Japan.

Marc Simpson is more on the mining and exploration side, an old B2 gold employee with experience in exploration, and development.

We have Richard Saint-Jean, who was the mill manager at Troilus mine for 14 years. He was in charge of all the mill for gold. He was there from

the first break to the last break of gold, where they were mining 1 gram per ton, when gold was 270 per ounce. Very good operator. Mr. Berkeley was just

hired as the chief processing engineer. His background is mainly in processing Lithium for SMCM Rockwood.

Dr. Allen Alper: That's an excellent team. It's very nice to hear your family has a background in metallurgy, in geology, that sounds great. You've

put a great team into place. By the way, I worked for Corning Glass Works, where I was a senior research associate.

Jean-Sébastien Lavallée: You know the glass and ceramic market is one of the largest for lithium.

Dr. Allen Alper: Yeah. I have a lot of experience in that area, and I know it well. I understand how critical lithium and those minerals are in

producing glass.

Jean-Sébastien Lavallée: Yes. Lithium is used to control the coefficient of thermal expansion of ceramic materials. I'm impressed that you know

that, because it's pretty rare and it's difficult to understand.

Outside of the Greenbush Deposit, concentrate with low iron content is very rare. There was the Tanco mine in Manitoba that shut down 2 years ago.

There are some artisanal operations and some small projects, but it's difficult for these users right now to get the right price. Based on what I know, I

think they have to use carbonate instead of concentrate because it's too expensive.

Dr. Allen Alper: By the way, I also ran the largest tungsten carbide powder business in the western world. We also made tantalum carbide, cobalt

and molybdenum. I'm very interested in what you and your company are doing, and it sounds like everything is going very well.

Jean-Sébastien Lavallée: Hopefully things will move forward on all aspects of the project. We are trying to do things differently from the others.

We are going beyond being a junior, going into manufacturing. We are trying to act more like a major or very serious company. We have a real project and

we need to be really serious.

Dr. Allen Alper: Yes, that's an excellent approach. You are looking for value added.

Jean-Sébastien Lavallée: Yeah, long term value, solid value, not something temporary. We want to build something permanent for the future.

http://www.cecorp.ca/en/

Critical Elements Corporation

1080, Côte du Beaver Hall

Suite 2101

Montreal, Quebec

H2Z 1S8

Phone: 514 904-1496

Fax: 514 904-1597

Jean-Sébastien Lavallée

Cellphone : 819 354-5146

|

|