Interview with Dr. Iain Todd, President and COO of Stria Lithium Inc. (TSX-V: SRA; OTCQX: SRCAF): A Junior Miner on a Fast-track to Revenues

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/25/2016

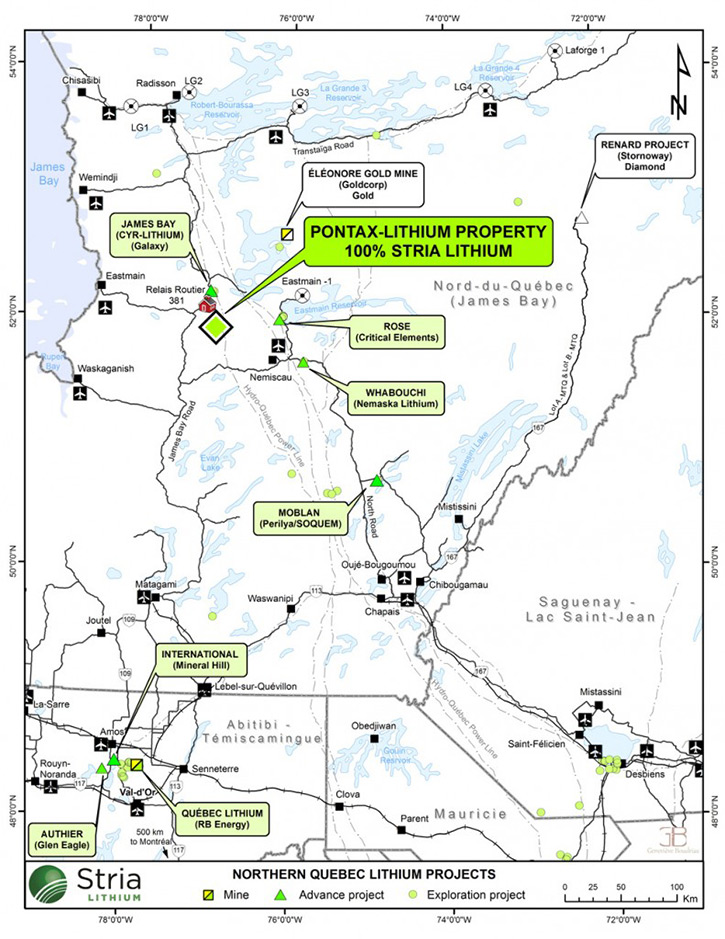

Stria Lithium (TSX-Venture: “SRA”) is a junior mining company, advancing development of its Pontax Lithium exploration property in Quebec and developer of a proprietary lithium extraction technology aiming to be in production of in-demand lithium metal within the next 12 to 24 months. According to metallurgical engineer Dr. Iain Todd, President and COO of Stria, the company has validated its technology in the laboratory, holds the in-house equipment for producing lithium metal and are currently in the process of raising funds through a private placement offering to develop a pilot production plant to obtain the engineering data prior to full-scale production. We learned from Dr. Todd there are three main areas where lithium metal is consumed: battery market, where it is used as a lithium foil; aluminum alloying for the aircraft industry; and also, in pharmaceuticals. Having the in-house technology ready, Stria aims to become a lithium metal producer, and to get its product to the market in one or two years rather than four or more years it might take to bring its mine into production.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Dr. Iain Todd, President and COO of Stria Lithium.

Dr. Allen Alper: Could you tell our readers/investors about Stria, what's happening, your focus and how things are proceeding?

Dr. Todd: Stria Lithium is effectively a junior mining company, but it has a two-pronged approach to entering the lithium market. We have a property under exploration at the moment in northern Quebec, which is our Pontax property. We will be continuing our exploration on that property this year to complete enough data for a drill program for next winter.

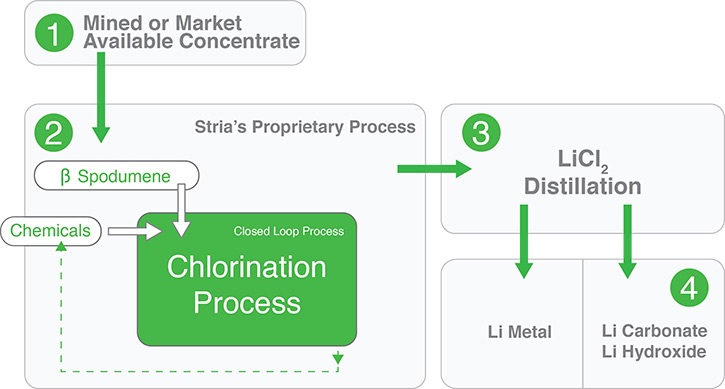

Our second approach is unique among junior lithium miners, and that is our continued development of our proprietary lithium extraction technology, and, perhaps more commercially important, the initiation of our production of lithium metal, using molten salt electrolysis. Conceptually in the short term we will buy feed stock on the open market producing lithium metal at a convenient location.

Dr. Allen Alper: Could you tell us what market your lithium products will serve?

Dr. Todd: There are three main areas where lithium metal is consumed including our core target, the primary lithium ion battery market where lithium foil is applied to battery anodes. Stria’s aim is to produce lithium foil ourselves as part of our added value downstream processing, post metal production. The other areas of use for lithium metal are in aluminum alloying for production of specialty alloys recently developed for the aircraft industry. And third, a significant amount is used in pharmaceutical/chemicals industries where it is used as starter material for making complex, high purity lithium compounds.

Dr. Allen Alper: How are your plans to extract lithium going?

Dr. Todd: Our plan is to continue to develop our proprietary chlorination process. This is a process whereby one takes spodumene ore concentrates, specifically, and then directly converts that into lithium chloride. This considerably simplifies the lithium production flowsheet presently associated with hard rock processing while providing high purity by-products to minimize processing wastes. Lithium chloride is the feed material into molten salt electrolysis to make lithium metal. At the moment we've proven this technology in the laboratory, and we are currently in the market seeking funding to bring our process to the pilot plant stage to obtain engineering data for a full-scale production plant.

Dr. Allen Alper: Very good! That's excellent! What are your plans to go forward, timing-wise?

Dr. Todd: Our present time line is to continue our in-house testing of the metal production electrolysis, and have that initial work completed by the end of this year. We'll follow that with a continuous pilot plant in the first half of next year. That will provide engineering criteria for a full-scale plant, on which we'll expect to start construction towards the end of 2017 or the beginning of 2018. With regards to the Pontax property, we are continuing our exploration there this year with a drill plan for early 2017, to complete the NI 43-101 resource calculation.

Dr. Allen Alper: That sounds very good. Could you tell me a little bit about your background? I know you have an excellent background.

Dr. Todd: My background is as a metallurgical engineer. I worked for many years with SGS Minerals, Lakefield as the manager of their hydrometallurgical group, and have broad experience in process and technology development, along with strong management skills. I've been working on a number of lithium projects over those years, including hard rock, clays and brines, and I have pretty good experience in developing those kinds of projects. I hold a Ph.D in Mineral Processing, an M.Eng in Extractive Metallurgy and a B.Sc in Metallurgy and Material Sciences.

Dr. Allen Alper: Could you tell me a little bit about your technology team?

Dr. Todd: The technology team is centered on myself and our CTO, Chief Technical Officer, David Johnson. He is an ex-Alcan engineer, who has had a lot of experience in developing a number of light metal projects, and significant experience in the use of molten salt electrolysis production of light metals. It's through him that we can obtain some of this technology very quickly.

Dr. Allen Alper: Could you tell us the primary reasons our readers and high-net-worth investors should invest in your company?

Dr. Todd: Of course. First and foremost is our technology advantage. In an industry where most lithium miners sell their product to manufacturers, we hold both the in-house technological expertise to process and manufacture market-ready lithium products. Investor value comes from our business focus on getting our products to market quickly. We believe we can get our product to the market in one or two years rather than four or five years, which is the time it takes to put a mine together. Secondly, we hold a corporate advantage as a partner in the 2GL Platform – a clean energy technology innovation consortium that includes graphene materials developer Grafoid Inc., Focus Graphite Inc. and ALCERECO Inc., a global leader in nanomaterials engineering. In pure business terms, the benefits accrued from our technology and corporate advantages leave us with a competitive advantage in the U.S. and other markets.

Dr. Allen Alper: That sounds very good. Is there anything else you'd like to add?

Dr. Todd: Given the advantages we hold, we see an opportunity for ourselves and our investors to stake an early position in the very lucrative and emerging $600 billion low carbon economy. Lithium is a key, critical component in renewable energy creation and storage and the United States remains an underserved market for technology lithium. We have clear, realistic goals; a world-class technology team, production facilities, and; a very attractive share price. I believe Stria makes a compelling investment case in any market. We recently opened a private placement offering and interested investors can obtain the offering details from our Investor Relations Officer Laura Armiento at: larmiento@strialithium.com

Dr. Allen Alper: Excellent!

http://strialithium.com/

130 Albert St. Ottawa ON. CA

info@strialithium.com

|

|