Interview with Mark Smith, President and CEO of NioCorp (TSX.V - NB, OTCQX: NIOBF, FSE: BR3) Advancing the Elk Creek Niobium-Scandium-Titanium Project in Southeast Nebraska, USA

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/16/2016

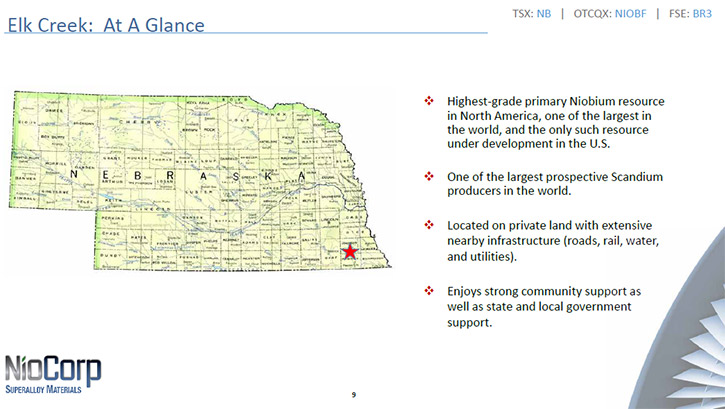

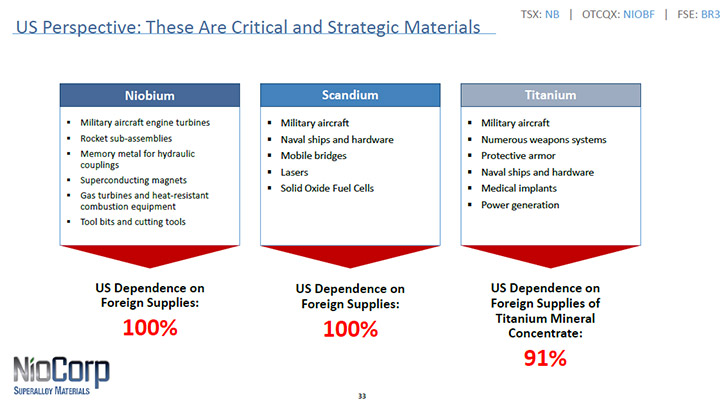

NioCorp Developments Ltd. (TSX.V - NB, OTCQX: NIOBF, FSE: BR3) is advancing the Elk Creek niobium-scandium-titanium project in the Southeast Nebraska, USA.

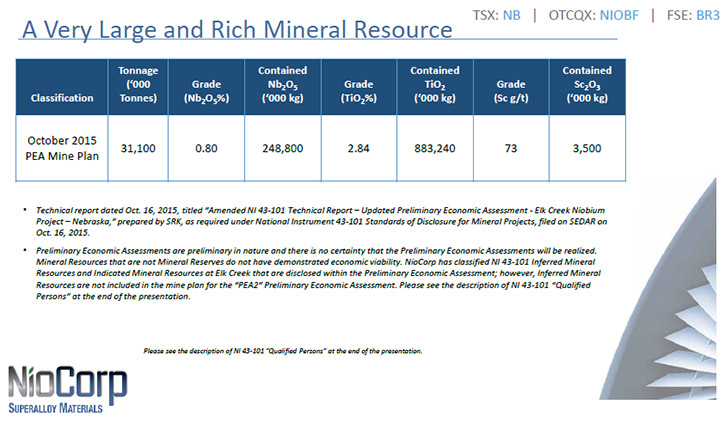

With the prospective production of 240 million kilograms of ferroniobium. This is the third richest niobium resource known in the world today. According to

the Company’s October 2015 Preliminary Economic Assessment (PEA), the mine and processing facility is expected to produce 7,490 metric tonnes (mt) of

ferroniobium per year for 32 years, along with 97 mt a year of scandium trioxide and about 24,000 mt of titanium dioxide annually as a byproduct of the

niobium production. Mark Smith is the President and CEO of NioCorp and the single largest shareholder in the company. He has had a very successful career in

running companies that mine, refine, manufacture and market strategic and critical elements and products. The Elk Creek project has extremely strong state and

local support in Nebraska. The company is closing in on completion of the project’s Feasibility Study, and the next step is full project financing and

building the underground mine and surface processing facility. According to Mr. Smith, demand for niobium is robust (4-6% CAGR); they have already contracted

out 75% of their niobium production; and are in discussions with several other parties concerning the remaining 25%.

Allen: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Mark Smith, who’s President and CEO of NioCorp. Could you tell me what’s

happening with NioCorp and what differentiates it from other companies.

Mark: Thank you. We believe we’ve got something pretty special here, Al. This is a case where we have a very large carbonatite structure located in the

Southeast corner of the State of Nebraska in the United States. It’s a very large, a very unique resource that will have a long life associated with it.

There’s currently zero niobium produced out of the United States. Indeed there are only two countries in the world that produce niobium right now, that being

Brazil where over 91, almost 92% of the world’s production comes from, and then Canada where the remaining 8 to 9% comes from. This mine will be located in

the business friendly State of Nebraska in the United States, and it will provide for the first ever niobium production in the United States that we’re aware

of.

Niobium is a very unique element in that it has a very stable pricing environment associated with it. That stable pricing environment is what we think makes

this project so unique. Again, this is the third richest primary niobium resource known in the world today. It has a very long estimated life. Niobium supply

and demand fundamentals suggest that the market demand is growing at a very healthy 4-6 percent compound annual growth rate. By the time our mine is online

the market will easily be able to absorb this increased niobium production. We believe that financing of a project of this size is also doable largely because

we have a very stable price associated with niobium, which we think banking entities will find very acceptable as compared to some of the higher volatility

materials that are out there.

I think a very strong indication of the potential success of this project is the fact that we’ve already contracted out 75% of our niobium production over our

first 10 years of operation. We are in discussions with several other parties concerning the remaining 25%, so it’s very clear to me that the demand for the

material is there. In particular, customers all discuss the need for more diversity of supply. That’s what NioCorp brings to the table. We’re pretty excited

about where we’re going and we think we are moving along these lines very fast.

In two years we’ve accomplished what most junior exploration companies accomplish in an 8-to-10-year period. We’ve shown a very good, strong track

record of continuing to raise money for this project, which has allowed us to do the technical work necessary to advance to feasibility level. We are probably

within months now of finalizing our feasibility study. The next step is full project financing and then we start to build the project. It is getting very

exciting in our office.

Allen: That really sounds great. That sounds like you’re in a unique position and getting ready to mine and sell niobium which is in demand. There aren’t too

many suppliers and you’re in a very stable area.

Mark: Extremely stable, and it is very business friendly in the State of Nebraska. How I like to describe it, Al, is I’ve been in this business for over 35

years. I’ve permitted various business activities or industrial activities in many of the states in the United States and I can tell you that I’ve never had

to permit anything in Nebraska. I’m utterly amazed at how business-friendly the agencies are in the state, how helpful they are. The local support that we

have with the community is better than I’ve ever seen on any project I’ve been involved in. It just gives me a great deal of confidence about moving this

project forward. Given 35 years of working in the industry this is probably the best permitting situation I’ve ever seen.

Allen: That’s fantastic. It’s excellent to work in a state and in an environment where they know mining and it’s a stable government besides. That’s a great

position. Could you tell me a little bit more about the size of the deposit, the projected timing on the project and possible CapEx et cetera?

Mark: You bet. In terms of the size of the deposit I can do that in a couple of ways. We do have a 43-101 compliant report built around mining a portion of

the indicated resources present at the project site. The contained niobium is based on Nb2O5, which is niobium pentoxide. The mine plan is built around mining

a total of 248.8 million kilograms of niobium pentoxide. We plan to produce 7,500 metric tons per year of ferroniobium, which is the commercial version of

niobium used in steelmaking that is predominant in the world today, and the mine plan allows for that annual production rate of ferroniobium for 32 years.

Allen: That’s fantastic. What will be your source of energy to do that?

Mark: We will have two forms of energy coming into the site. We’ll have a natural gas pipeline and we’ll have the electrical grid connected at the site as

well. It’s very close to the project site. The local infrastructure that we have in existence already is quite phenomenal. Again it gives me a high level of

confidence that this project is very doable.

A state highway runs right next to the project site, so we don’t need to build any roads. There is a twin-line railroad track that is primarily used

to transport Powder River Basin coal from Wyoming to the East Coast. It’s available within 3 miles of the project site. We’ve got electricity, we’ve got gas,

we’ve got water, we’ve got highways, we’ve got railroads. We really, really like the location of this facility.

Allen: That’s excellent. That’s great to have that infrastructure and it’s great to have a source of electricity that’s relatively low cost because I know

the cost of electricity is very important in producing ferroniobium.

Mark: Yes, it is and we do. I will confirm that the price of the electricity that we will get is very, very reasonable, probably in the $.05 to $0.06 per

kilowatt range.

Allen: That’s excellent.

Mark: Yes.

Allen: For our readers/investors could you elaborate on the uses of niobium in the market.

Mark: I would love to. That’s an exciting area for me actually. I think it’s the best way to get potential investors excited about this project because

niobium is relatively unknown. It’s unknown because about 85% of the world’s production comes from a privately held company out of Brazil. They don’t have to

report things like we do on a public basis. What you end up with then is a lack of knowledge in terms of how important niobium is to the world economy.

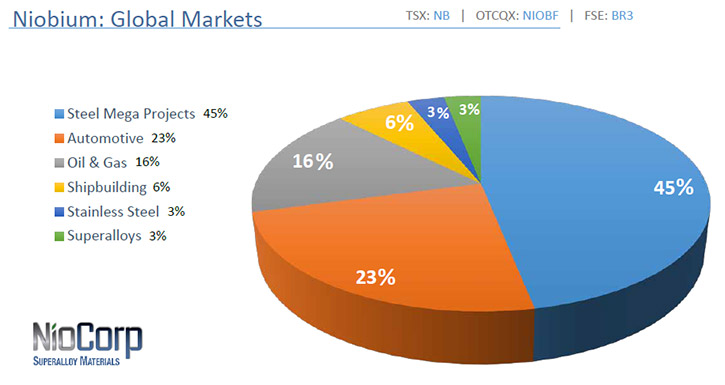

The largest single use of niobium is in what we call steel mega-projects, such as large bridges, roads, architectural buildings in downtown areas that

get into multi-stories. Roughly 45% of the niobium produced today is used in those types of steel mega-projects. The reasons why niobium is used in those

projects are multiple. Primarily when you think of niobium, one needs to think about making steel stronger and lighter. When you make steel stronger it’s

better for you and me as consumers of products. We’re living in a building and we’re in a seismically active area. You want to have that type of extra safety

built into the construction of that building.

The niobium provides the strength to the steel particularly its tensile strength. It does create a much safer building or bridge for us given whatever natural

events could occur. The other nice part is if you need less weight in steel to build that building or bridge think of the greenhouse gas emissions that we can

save in terms of just transporting those construction materials out to the job site. One of the largest suspension bridges in the world, the Millau Viaduct in

France, was built using steel that had .025% niobium in it. By using that niobium-based steel, they were able to reduce the amount of steel and concrete

necessary to build that bridge by 60%.

That’s an enormous reduction, obviously, so I’ve had that confirmed by different independent engineers. That’s when it really dawned on me how much

money you can save transporting construction materials to these job sites. So, niobium’s primary use is in the steel mega-projects.

Its second largest use is automotive. Every single automobile in the world that has a steel body or a steel chassis uses niobium as part of that

steel. It makes the steel stronger, so people in the car are safer surrounded by a stronger material in case of an accident. At the same time the car is

lighter, using less fuel, which in turn helps to reduced emissions.

I get pretty excited about an element like niobium because of the benefits it confers upon us as consumers, who utilize these materials. Just think of

the gasoline we’re saving and the emissions we’re not creating as a result of that lighter car. Almost every automobile company in the world is now utilizing

this high-strength, low alloy steel containing niobium to produce their automobiles because lowering the weight of the vehicle is the primary mechanism that

all of them have used to increase their miles per gallon, which they have to do in accordance with the EPA standards. It’s a win, win, win everywhere you

look, when it’s used in the automotive industry. About 23% of the niobium produced in the world today is used in vehicle production.

The third largest use is oil and gas. It’s in your drill stem and your pipelines, particularly in the fracking industry and the deep water drilling

that the oil companies are doing. You have to have that because, again, the increased strength of the steel that niobium confers is where its properties

really become apparent. Niobium also creates a much higher temperature capacity in that drill stem or that pipeline. It’s also very corrosion-resistant and so

you can use niobium-based pipelines and drill stems in these very harsh environments. Indeed the corrosion and temperature resistance are so prominent in

these niobium steels that there actually is no substitute for the niobium-based steels in this particular use and application. About 16% of the niobium that’s

used in the world today or produced in the world today actually goes to oil and gas drill stem and pipelines conveying the material.

Then you have three other smaller uses, important and growing, but smaller. Shipbuilding, about 6% of the niobium produced today is used in the production of

ships. Again it goes right to the strength of the steel in the hulls of those ships and it makes the ship lighter, so it’s much more efficient to move and

uses less fuel to move from point A to point B. A small amount of niobium is used in stainless steel production as well, again primarily associated with

specialty steels where either temperature resistance or corrosion resistance are required. Then you have the super alloys. Those are your alloys that are used

as part of the metal in the airspace industry or defense industry. Those are your 6 primary uses of the material and that basically covers probably about 99%

of the uses.

Allen: Wow, you did an excellent job of explaining the uses and the market for niobium. Our readers/investors will have more insight into the value of

niobium and the strategic advantages that NioCorp has producing niobium in the USA in mining friendly, Southeast Nebraska. I would guess a lot of people are

going to be reviewing your company and possibly investing in NioCorp. Could you tell me a bit about your background? I know you have an outstanding background

and career.

Mark: I would love to. I’m an engineer by education and a Registered Professional Engineer in the United States, in particular the State of California. I’m

also a lawyer by training and have been accepted into the bar in both the State of California and the State of Colorado. I’ve been associated with the mining

industry since the 80s. I had some companies that are a little more prominent than others.

I was the president and CEO of Molycorp, both what I call the old Molycorp and the new Molycorp. The rare earth assets at Mountain Pass, California

were bought by a group of private equity investors in 2008. They asked me to come in and run the company. I did and we took that company public in 2010.

Ultimately during the 4 plus years that I was there we raised over $2.5 billion and did over a billion and a half dollars of mergers and acquisitions to

create what I call, and many other people call, the largest, most vertically integrated rare earth company outside of China. I’m very proud of what we were

able to put together there.

Prior to that President and CEO position at Molycorp, I was the President and CEO of Chevron Mining, which was a wholly-owned subsidiary of Chevron

Corporation. In that mining entity we had coal, we had molybdenum, we had rare earth, and we had various development projects underway, including palladium

and additional coal projects up in the Powder River Basin. Prior to Chevron Mining I was with what I call the old Molycorp and I was the President and CEO of

the old Molycorp which consisted of rare earth, molybdenum, and then various conversion facilities where we would take the molybdenum oxide, convert it to

ferromolybdenum and sell that on the market. That was a very good learning opportunity in terms of all of these specialty products and high-strength, low

alloy steels in particular.

While I was the President and CEO of the old Molycorp that entity had an equity ownership in CBMM, which is the largest niobium producer in the world

today. That’s the one I just mentioned a few minutes ago with about 85% of the world’s production. As a result of our having an equity ownership position in

CBMM, I became very familiar with CBMM by serving on their board of directors for seven years, from 2000 to 2007.

While at CBMM, I would call myself a very active board member, and they enjoyed having that level of attention from a board member. I went to many

conferences with and on behalf of CBMM, met with many customers. I got to know the markets, got to know the uses of niobium intimately and I do consider that

to be one of the primary reasons why I became very interested in NioCorp, because I really do know and understand the niobium business and markets. I enjoy

them and think that they are one of the most promising areas to be in as a mining company.

Allen: That’s excellent. You have an astounding background. That’s really excellent. I know, besides niobium, NioCorp also has scandium in your Nebraska

resource, and now you’re also working with IBC Advanced Alloys. Could you tell me a bit about that too?

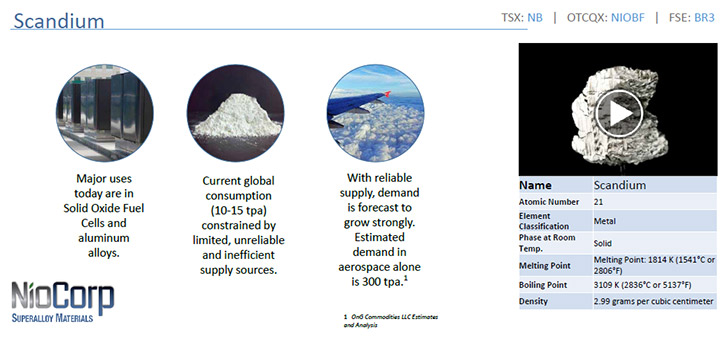

Mark: I would love to. We have scandium. It’s not strictly a high ore grade. It’s about 73 parts per million scandium in the part of the resource we plan to

mine. By virtue of processing our mineral to extract the niobium we then necessarily start producing scandium. We’ll be able to produce about 97 tonnes a

year of scandium trioxide.

This is, we think, very good news for the scandium market because there’s an unbelievable latent demand for scandium and its uses in various alloying and fuel

cell type activities in businesses. However, there isn’t enough scandium being produced in the world today. There are only about 5 to 15 tons of scandium

being produced in the entire world today. That comes out of one or two places: China and/or Russia. Again we have the pleasure of saying that our U.S.-based

Elk Creek project will be producing niobium, which is a critical and strategic metal to the United States, and we will be producing scandium, which is also a

critical and strategic metal for our country. We’ll be producing that right here in Nebraska.

The United States is considered a very stable place to do business, a very predictable place to do business. It adds to the risk mitigation efforts

that banks and investors are always looking at. We’ll be producing about 97 tons of scandium.

Now, in terms of Scandium’s uses, I’ve already discussed what niobium does for steel. Scandium basically does for aluminum what niobium does for steel. It

makes the aluminum much stronger, but it also makes the aluminum much lighter.

If we can incorporate scandium into an aluminum alloy and start producing planes with this scandium aluminum alloy we will have a much stronger

fuselage in the aircraft, but we’ll also have a much lighter plane. You can probably reduce the weight of the planes by as much as 20% with a very small

addition of scandium to the aluminum. Typically aluminum is not considered an easily weldable metal. But when you add just a little bit of scandium to the

aluminum, you make an alloy that is very weldable. That all goes to the production issues that the airline industry are facing.

Currently when you fly on the airplanes and you look out at the wings, you’ll notice there are an awful lot of rivets and other devices, holding all

the parts together on these planes. It would really increase the manufacturing efficiency in the aerospace industry if they were able to weld a lot of these

things together rather than rivet them. The scandium aluminum alloy allows that. For about a million to $1.5 million worth of scandium oxide in a single

airliner, you can achieve sufficient weight savings to deliver 10 to $15 million in fuel savings, over the life of one airplane on a net present value basis.

This is very significant. The airline industry would love to use the scandium aluminum alloys in the construction of their planes. But there hasn’t

been enough scandium available. We plan to start to address that issue by producing 97 tons of that material a year. Again as we produce niobium we

necessarily produce scandium. I think the scandium market will take great pleasure in knowing that we have pledged 75% of our niobium in off-take agreements

because that means scandium is going to be produced from this facility.

Allen: That’s excellent. That’s really great. A strategic and critical metal!

Mark: We’re very proud of that.

Allen: Could you tell me of any other metals or products that you’ll be working with in NioCorp.

Mark: There are three total that we’re focused on for production, niobium, scandium, and then titanium. We’ll be able to produce about 24,000 tons of

titanium dioxide per year. Again by virtue of producing the niobium the titanium flows with it. As we separate the titanium from the niobium, during the

metallurgical process, we can capture the titanium, clean it up, and turn it into an oxide material that we’ll be able to sell. There is a very large market

for titanium dioxide, so we’ll be producing less than 10% of what the United States uses. Again we think we’ll be able to fit our production into the US and

world markets quite easily.

The one thing we don’t know about yet, on the titanium dioxide, is what quality level we can produce from the facility. We’re still doing some metallurgical

work on that. Even the lowest grade titanium dioxide material is fairly simple to move into the markets. There are a lot of different suppliers and a lot of

material that moves every day. It’s fairly liquid, so that’ll be our third product. Again niobium, scandium, and titanium, all very important metals that the

United States and the rest of the world needs for various reasons.

Allen: That sounds excellent. Could you tell me a bit about your finances and your capital structure?

Mark: Yeah, we have been using straight equity deals to raise money for the company and then undertake all the technical work programs that are required to

put the feasibility study together. Currently we have about 172.5 million shares outstanding on an undiluted basis. Our stock price is about $.90 to … It was

as high as $.94 yesterday, but kind of in that $.90 Canadian range which gives us a market cap of C$140 to C$150 million. It puts us in a very good position

to show potential investors that the market does think quite highly and it has a lot of confidence in our ability to move this project into production. We’ve

been very fortunate in our ability to go out to the market and seek funds to keep all of this work going and moving as fast as it is.

We’re currently in a very, very strong financial position as a company. We just finished what we called an early warrant exercise program. It does put

the company in a position now to be able to say that we will have access to sufficient cash to complete the feasibility study. That’s a good feeling to have

because I think the market has been wondering if we have enough money to finish that effort.

Allen: That’s an excellent position to be in. Could you tell our high-net-worth readers/investors the primary reasons why they should consider investing in

NioCorp?

Mark: You bet. It’s a large and unique resource with a long life. The primary product is niobium which enjoys extremely stable pricing. We already have 75%

of our niobium production contracted for sale. There are numerous and diverse end-markets for our products. We feel moving all of these products into the

marketplace is very doable. Niobium, scandium, and titanium are products that are considered critical and strategic to national security, not just in the

United States, but in the European Union, Japan and other places as well. We enjoy extremely strong state and local support in Nebraska.

I have never had the pleasure of working on a project that is supported by almost 100% of the local community. It’s really an honor and a privilege to

say that. We have an experienced team putting this project together. These are people that are not used to being in the junior exploration world. We are all

people, used to building things and having them produced. This team can take this project all the way to production and beyond. We think overall, when you

take a look at the preliminary economic analysis figures in particular, that we offer an outstanding opportunity for exceptional returns to investors.

We think we’ve got something very special here. We have a large group of investors already that continues to support us in every endeavor that we

undertake, lots of confidence in our abilities. The two off-take partners that we have for niobium, CMC Cometals and ThyssenKrupp, I like to mention those

names as well because when you have companies of that size and that history that come in and enter into off-take agreements before feasibility studies are

even done, I think it expresses a large, a huge level of confidence in terms of what we have for a resource, the people we have to put it into production, and

our ability to generate good returns for our investors.

I would just add as one closing remark in that regard. This is one that I take very seriously personally. I am the single largest shareholder in the

company right now. I’ve put my money where my mouth is. I believe in this project and I plan to make a very nice return on my money over the course of time

here.

Allen: That’s great. You’ve mentioned some very compelling reasons why our readers and investors should consider investing in NioCorp. That’s really

excellent, sir. I must say you do an excellent job of discussing your company.

Mark: As you can tell we’re very passionate about what we do here and we are so excited to keep advancing this forward. We love to tell people about this

company.

Allen: Your Company is in a very unusual position. It has critical and strategic elements that you have the ability to take from the mine through

beneficiations, through production of materials to sell, refined materials and products, so that’s really great.

Mark: Yeah, we’re very excited.

Allen: You’re well-suited to do this with your experience doing it at Molycorp.

Mark: Exactly, we’ve got the experience. We’ve got a great team here.

Allen: Is there anything you’d like to add?

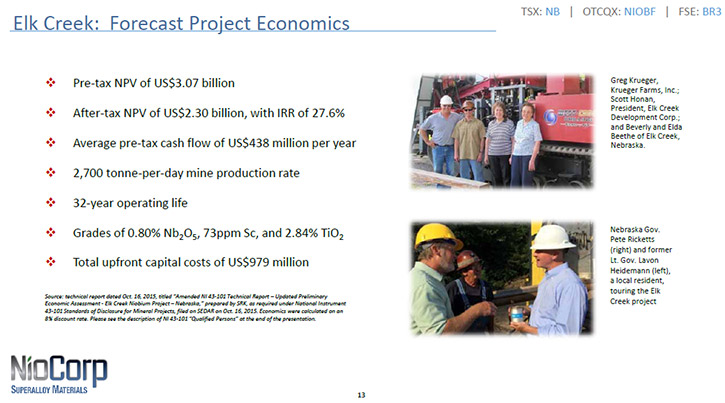

Mark: When we put our preliminary economic analysis out last fall, we were very proud of the results. We used independent third parties and engineers to

put the economic analysis together, so it was totally objective and professional. Just some quick numbers for you on that. The PEA estimated a pretax NPV of

$3.07 billion for this project. It indicated an average pretax cash flow of $438 million per year. Again that’s all based on roughly 7,500 tonnes of

ferroniobium per year, 97 tonnes of scandium trioxide, and roughly 24,000 tonnes of titanium dioxide per year. We think those economics are extremely robust.

Those are before tax IRR of 31.7%. Again numbers that we think investors are looking for. We can sit here and put an economic model in front of them and

demonstrate that we can provide those types of returns.

Allen: That’s excellent. That’s a very high rate of return. That’s great.

Mark: Exactly.

http://niocorp.com/

Head Office:

Suite 115 - 7000 South Yosemite Street

Centennial, CO 80112

Investor Relations:

Jim Sims, VP External Affairs

Phone: +1 720-639-4650

Email: jim.sims@niocorp.com

|

|