Interview with Rob McEwen, Chairman & Chief Owner of McEwen Mining (NYSE: MUX, TSX: MUX)

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/12/2016

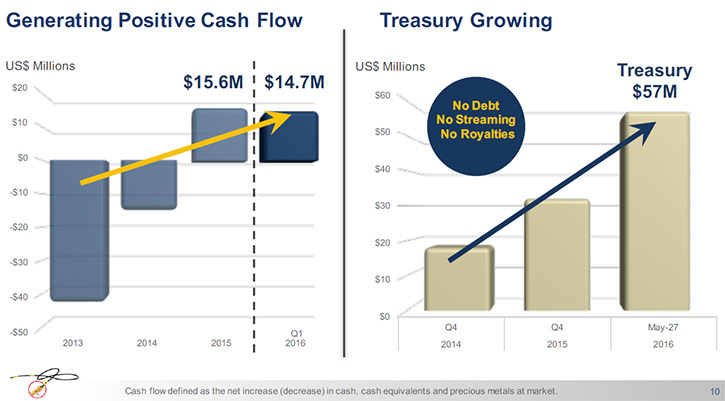

McEwen Mining Inc. (NYSE: MUX, TSX: MUX) is a growing gold and silver producer in the Americas. The Company's goal is to qualify for inclusion in the S&P 500. We learned from Mr. Rob McEwen, Chairman & Chief Owner of McEwen Mining, that during the 2nd quarter, the company produced 27,888 ounces of gold and 875,006 ounces of silver, while their cash and bullion inventories have increased to $57 million. The growth was generated entirely through their operations, without having to do any financing. Mr. McEwen is very pleased with the changes happening in Argentina, where the company's San Jose mine is located. With the export taxes removed and the exchange rate addressed, Mr. McEwen is seeing the increase in the contribution of the San Jose mine to his treasury. According to Mr. McEwen the company has a strong balance sheet, no debt and good growth prospects.

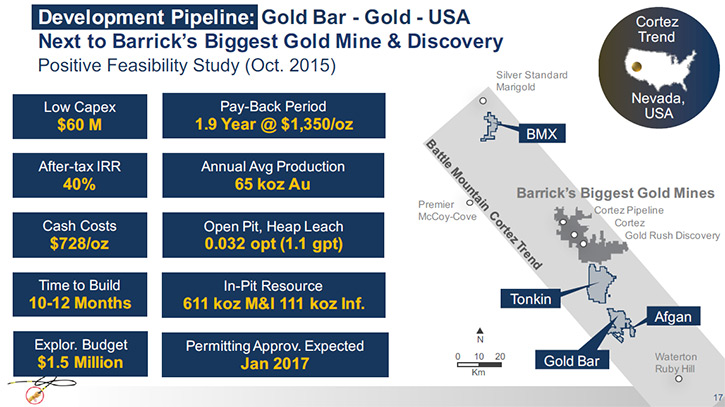

Gold Bar

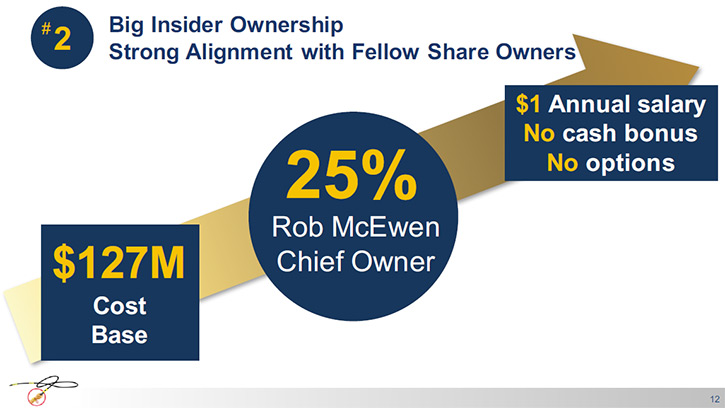

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Mr. Rob McEwen, who is Chairman & Chief Owner, owning 25% of the outstanding shares of McEwen Mining, and who receives a salary of $1 a year. By the way, Mr. McEwen’s $1 per year salary represents a raise he received in June from his previous $0 per year salary. McEwen Mining Inc. is a growing gold and silver producer in the Americas. The Company's goal is to qualify for inclusion in the S&P 500. A lot of great things are happening at McEwen Mining. Could you share your success with our readers, Rob?

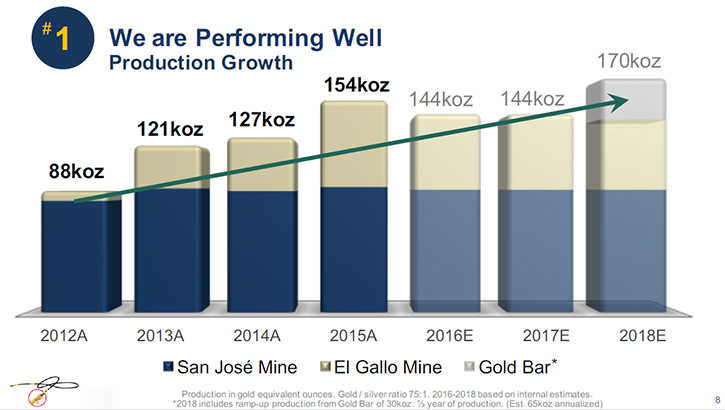

Mr. Rob McEwen: Thank you, Al. We just announced our 2nd quarter results. During the quarter, we produced 39,555 gold equivalent ounces comprising 27,888 ounces of gold and 875,006 ounces of silver. We're on target to achieve our 2016 guidance of 144,000 gold equivalent ounces or 99,500 ounces of gold and 3,337,000 ounces of silver. As you can see, we offer leverage to our share owners to both gold and silver. And we definitely benefit from a shrinking silver to gold exchange ratio.

During the quarter, our cash and bullion inventories have increased to $57 million. That's quite an improvement from a few years earlier. At the end of 2014, we only had 15 million in liquid assets in our treasury. This growth has been generated solely from operations. We have not done any financing since our shareowner friendly rights offering in 2013. In addition, we are debt free. And we have not sold our future revenue growth. We have not sold any metal streams or any royalties and we do not hedge our production.

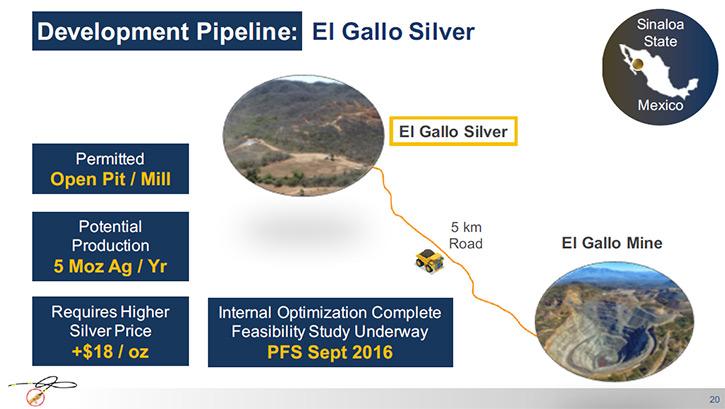

Furthermore, based on our belief that future gold and silver prices will be higher, we bought back a royalty that was on our Mexican property that covered our El Gallo gold mine and our future El Gallo silver mine. Last year, this royalty cost us $44 per ounce of gold produced. Going forward there will be no further royalty payments

At the San Jose mine in Argentina, big things are happening there as a result of the new government in Argentina. They have moved very quickly since taking office in December to create a business/mining friendly environment. The two most significant government initiatives for us was the elimination of export taxes on mineral exports and adjusting the exchange rate of the Argentina peso and the dollar. The financial impact on our San Jose mine, when combined with the higher gold and silver prices, has been dramatic.

To give you some perspective, in 2012, we received a dividend of $20 million from the mine. But last year, as a result of lower metal prices and the higher taxes and adverse government policies, we only received a dividend of $500,000. However, we started the year with a budget forecast dividend of $7.5 million based on a $1,050/oz gold price and a $14 /oz silver price.

Should gold and silver prices remain or climb above current prices we can expect to receive a larger than budgeted dividend from the San Jose mine. Our share of annual production from San Jose is 46,000 ounces of gold and 3.3 million ounces of silver. So when you do the math, multiplying ounces produced by the difference in gold and silver prices since budget (+$270/oz for gold and +$5/oz for silver), you can appreciate the big incremental revenue growth that has occurred. That said, the San Jose is going to be a very large contributor to our treasury, this year. As a result of improved revenue prospects, the 2016 exploration budget at the mine has been increased from $4.5 million to $6.5 million.

In Q2 2016, the El Gallo mine in Mexico produced 15,600 ounces of gold, and in the 1st Half, produced 35,741 gold equivalent ounces. And we are on target to produce 55,000 gold equivalent ounces in 2016. As a result, production for the balance of the year will be lower than in the 1st Half. Another exciting aspect of 2016 is our Mexican exploration budget of $4 million up from $1 million last year. We have some interesting exploration targets that we hope will extend the life of our El Gallo mine.

We have two development projects: First, the El Gallo silver project where we're updating our 2013 feasibility study. We expect to have new numbers out by the end of the summer, which will show that at $21/oz silver price the El Gallo silver project meets our investment criteria to build.

Second, our Gold Bar property, in Nevada, is currently in the final stages of the permitting process. The BLM (Bureau of Land Management) has advised us that it will be issuing a decision on the permit in Q1, 2017. Assuming a positive decision and we are approved to build and operate the mine, it will take $60 million dollars and 12 months to build. Last October, we released a feasibility study that based the economics on a gold price of $1,050/oz, which met our investment criteria. With today’s much improved gold prices the projected economics are significantly improved. Our investment criteria to build for a project are; generates an after tax IRR of 20%; produces a payback of CapEx in 3 years; and requires relatively small CapEx.

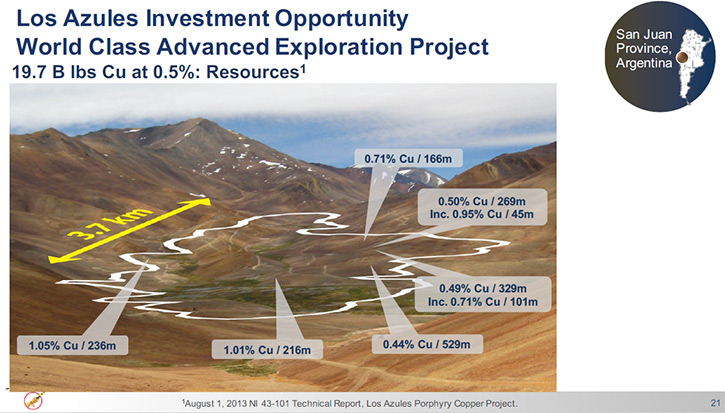

Overall, I'd say if one is looking at the gold and silver market and feeling there might be a correction coming or just a pause in the move high, that MUX is well positioned. We have a strong balance sheet. We don't have any debt and our operating costs are not high. We're in a good position to weather a correction. We have 2 producing mines combined with organic growth that isn’t going to come at a large cost to our share owners. Exploration is the R&D of the mining industry. We are a big believer in the benefits of exploration. Our two development projects, Gold Bar and El Gallo Silver, offer internal production growth of 60% between now and 2019. In addition, we have our large copper deposit, which is a wild card. It's just under 20 billion pounds of copper in an indicated and inferred category. In terms of magnitude relative to gold, if you were to convert the copper into gold, it would be approximately 35 million of gold equivalent in that deposit.

We’re updating the preliminary economic assessment of Los Azules that we did back in 2013. The new Argentinian government recently eliminated the export taxes on mineral production. This action has very significant and positive impact on the economics of Los Azules deposit. It appears that the CapEx and OpEx can be meaningfully reduced. We expect to release preliminary numbers in September.

Corporate Development: We will be making our capital distribution on August 29th, which allows us to have a yield of 0.23%.

Dr. Allen Alper: That's a fantastic story, great accomplishment. I'm very happy to be one of your shareholders. I'm very happy with the performance of McEwen Mining. Everything is happening the way you were forecasting and with gold and silver trending up and your operations, Argentinian laws changing, things are going extremely well for McEwen Mining. Could you give me your thoughts on what's going to happen with gold and silver?

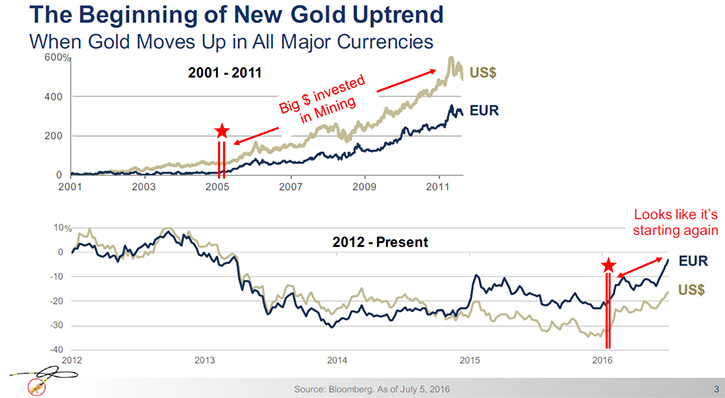

Mr. Rob McEwen: Certainly. The strength of the gold price in Q2 has surprised me somewhat. I was expecting a bit of a pullback, a seasonal correction in late March continuing into May. I think what contributed to that not occurring this year is the increasing number of central banks moving to extremely low and negative interest rates.

Low and negative interest rates pose a real problem for a lot of people because they are not earning any return on their capital. So, the big question is, “Where does one put their money when banks are now charging to store your money?”

It's forced an increasing number of individuals to get outside of their financial comfort zone and take on more risks while reaching for yield. Gold has been a star performer this year because it's holding out what it’s done over the millenniums. It's a traditional storer of value. It's the ultimate currency. I believe that more investors are going to seek the historic protection that gold has provided in uncertain times. While gold and shares of precious metal have been the best performing asset class year to date, I am convinced we are at the beginning of a strong gold market.

Silver outperformed gold over the past 12 months and that's related to the silver/ gold exchange ratio, the number of ounces of silver that is required to equal the value of an ounce of gold. Several months ago, it took 82 ounces of silver to buy one ounce of gold. Today it takes about 67 ounces of silver. As this ratio compresses, silver will move up faster than gold. I think there's more room in both gold and silver. Silver is more an industrial metal. It could have some movements in there that aren't straight lines. But I think ultimately, with gold running, silver will run even further.

Dr. Allen Alper: That sounds very good. Could you summarize the main reasons high-net-worth investors should invest in your company?

Mr. Rob McEwen: Certainly. But, first I want to stress to you and your readers that when you buy gold or gold shares, you have to accept the fact that these are volatile investments. That said, here are the reasons to consider buying MUX: Large +25% insider ownership, approximately $60 million in cash, bullion and liquid assets; no debt; has not sold its future revenue growth – no metal streams, royalties or hedging; listed on NYSE & TSX with good market liquidity; an asset-rich company with a yield: 2 producing mines, 2 development projects that will drive a 60% production growth that is organic and low CapEx; and a large copper deposit that, I believe, has the potential to become a remarkable asset for us.

I own 25% of the company. That's why my title is Chairman and Chief Owner. I'm the largest shareowner of the company. My cost base, on my investment in 75 million shares, is $127 million. I am pleased to say our Board of Directors recently increased my pay. My annual salary increased from $0 per year to $1 per year. In addition, I don't get any bonuses and I don't have any options. It is important to me that my compensation is aligned perfectly with my fellow share owners. The only way I will make money is the same way my fellow share owners will. When the price goes up, we all have a smile on our faces. When the price goes down, I know how everyone else is feeling.

We have not sold our future revenue growth, but a large number of precious metal companies have. If you are looking for a company with lots of upside to the metal price, with revenue growth unencumbered by metal streams, royalties or hedges, I suggest you need to look no further than McEwen Mining. We don't have any debt, so there's no pressure on our balance sheet. Our treasury has cash and gold bullion of $57 million. In addition, we pay our shareowners a capital distribution twice a year. The current yield is approximately 0.23%.

Our development projects, Gold Bar in Nevada and El Gallo Silver in Mexico do not require big capital investments. Our investment criteria for building a mine are three-fold. One, it has to generate an after tax internal rate of return in excess of 20%; Two, a payback of CapEx within three years; and Three, a relatively small CapEx. Gold bar has a projected CapEx of $60 million. Regarding the CapEx for the El Gallo Silver, we are currently updating the feasibility study and we will have preliminary numbers in September. Our economic model projects, that at $21/oz silver, El Gallo Silver project will meet our investment criteria and the CapEx will be in the neighborhood of $110 million.

In terms of timing for these projects, for Gold Bar we hope to receive our permit to build and operate in first quarter of 2017. For El Gallo Silver, it is a unique situation where we already have a permit to build and operate the mine, but we have been waiting for the silver price to recover above $21/oz and the completion of our updated feasibility before starting construction.

We are patient investors. Our investment criteria is designed to minimize risk and it is strongly influenced by my large 25% ownership.

McEwen Mining is listed on the NYSE and the TSX and offers investors good market liquidity. The average trading volume, over the last three months, has been in excess of 4 million shares a day.

Dr. Allen Alper: Well, I would say those are excellent reasons why our high-net-worth readers/investors should consider investing in McEwen Mining. Is there anything else you'd like to add, Rob?

Mr. Rob McEwen: I believe it is the responsibility of every investor to get out and make repeated, forceful demands that our politicians be more fiscally responsible. In addition, to putting a halt on unrestrained government spending, we need to see steps taken by politicians that encourage capital investment and the attendant job creation, rather than their current focus on encouraging consumption.

Dr. Allen Alper: That sounds like a good idea. I enjoyed talking with you as usual, Rob. I'm really, really happy with the performance of McEwen Mining. You are a brilliant decision maker. You are doing really well.

Mr. Rob McEwen: Thank you very much, Al.

Dr. Allen Alper: Thank you.

http://www.mcewenmining.com/

150 King Street West

Suite 2800

Toronto, Ontario. Canada

M5H 1J9

E-mail: info@mcewenmining.com

Tel: 647-258-0395

Fax: 647-258-0408

Toll Free: 1-866-441-0690

Facebook: facebook.com/McEwenRob

Twitter: twitter.com/McEwenMining

|

|