Interview with Mr. Gary R. Thompson, Chairman and CEO of Brixton Metals Corporation (TSX-V: BBB): Exploring and Developing High Grade Gold and Silver Projects in Canada with Support from Very Strong Shareholders

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/27/2016

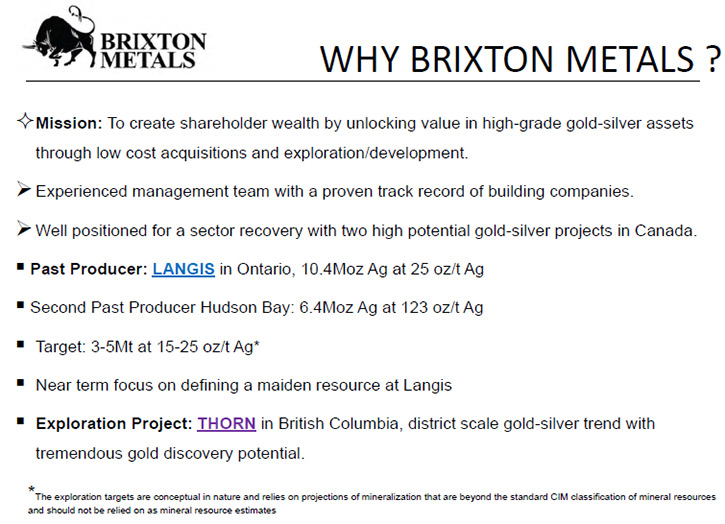

Brixton Metals Corporation (TSX-V: BBB) owns 100% of two very strong high grade gold and silver projects in Canada. The Langis

Silver Mine located in Ontario near Lake Timiskaming is a very high grade silver past producer and represents a potential near term

production opportunity. The Langis project has excellent local infrastructure, year-round road access, close proximity to power, rail,

natural gas, mills, refiner and assay lab. Brixton's second project “Thorn” is located in northwest British Columbia and it represents

a district scale gold/silver system with major discovery potential that could be a real company maker. According to Mr. Thompson,

Chairman and CEO of Brixton Metals, the company's goal is to drill gold targets at Thorn project before winter and to advance Langis

project towards an initial maiden resource. We learned from Mr. Thompson, that Brixton has some strong shareholders like Mr. Rob

McEwen, Hecla Mining, Mr. Eric Sprott and CMP, and that management holds a large amount of the stock.

Gold & Silver Mineralization from Thorn and Langis

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News interviewing Mr. Gary Thompson, chairman and CEO of

Brixton Metals Corporation. Could you tell me what's happening with your company? I know you're going forward with silver.

Mr. Gary Thompson: Brixton Metals Corporation is a Canadian company listed on the TSX venture under the ticker symbol BBB.

We are a gold and silver exploration and development company. We're focused on both gold and silver currently in Canada. We have 2

projects. One is a district scale gold/silver project in northwest British Columbia, called Thorn. Our second project is in Ontario.

It's close to the Quebec-Ontario border near Lake Timiskaming, and it's at the northern extent of the world-famous Cobalt Silver camp.

Our project is called Langis, and it's a past producer of very high grade silver.

Dr. Allen Alper: Could you tell me a little bit more about those projects and the geology of the area, and what differentiates

it from other areas?

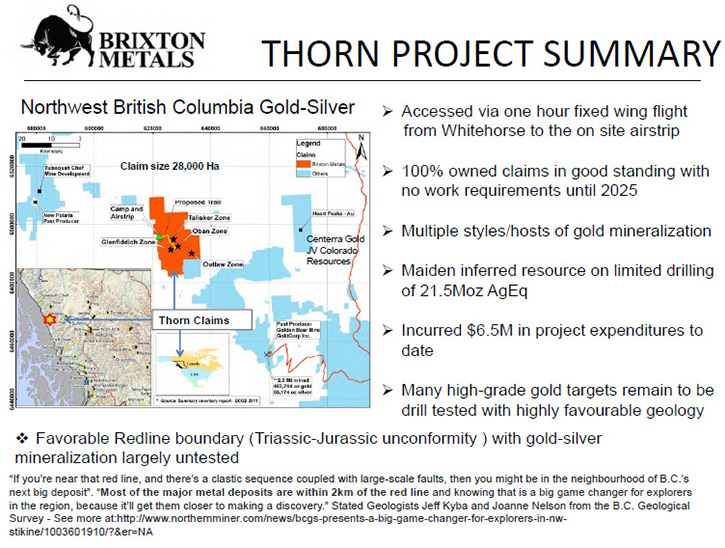

Mr. Gary Thompson: Well, let's start with the B.C. project first. It's located in a northwestern corner of British

Columbia. The closest town would be Juneau, Alaska. It's about a hundred kilometers from Juneau, but within Canada. Geologically, it is

very similar to the geology of the Golden Triangle in the Iskut area, which hosts a lot of gold; very similar geology, just a much

farther northwest trend. What's evolving here appears to be a district scale mineralized system that Brixton has been working on now

since our first drill program in about 2011. We own it 100%.

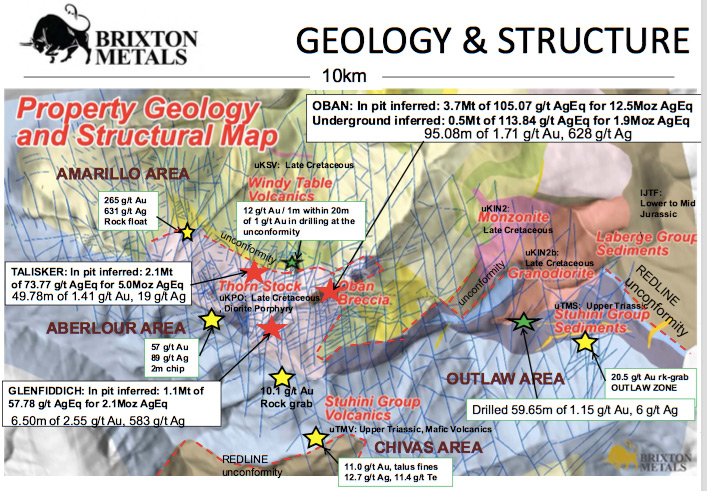

The Thorn property is a porphyry-epithermal related environment. It's quite interesting in that we have many different deposit styles

on the property and gold and silver have been found in most of the rock units. The geology is very interesting, with a very high level

of structural preparation, numerous intrusive phases and a long span of time of mineralizing events from late Cretaceous to Triassic.

The Stuhini Group of volcanics, a favorable host rock in the province, has been our most recent focus on the property, specifically

near the Red-line boundary. The Red-line is an unconformity boundary between the Triassic volcanics and the Jurassic clastic sediments.

British Columbia government geologists’ Nelson and Kyba identified that this Red-line is a significant marker for major mineral

deposits. They have stated that most of the major metal deposits in northwest B.C. lie within 2 kilometers of this Red line boundary.

Why it matters for Brixton is that we have that equivalent boundary running through our Thorn project in several locations. We're just

now recognizing the significance of that and will be giving it more attention.

It is gold and silver with secondary base metals. When we first started looking at this project, we recognized it to be a gold

project. In 2011 we came up with the bonanza silver intercept in hole 60 with 95 meters of 900 grams silver equivalent from surface. We

drilled about 11,000m on the breccia and poly-metallic veins that gave us an inferred resource of 21.5Moz AgEq.

We see the Thorn project still as a gold project. It happened to have a lot of silver associated with the mineralization style. This

year we renewed our focus on the gold targets. We have one zone that's called the Outlaw Zone, which is represented as 3 kilometers

long, gold soil anomaly. It is actually a sediment hosted deposit, which is quite unique for British Columbia. We did some follow-up

work this year on the Aberlour zone, where a 57 gram/tonne gold chip sample was taken historically. We may have a new zone that we're

calling the Chivas zone that looks like quite an interesting new gold target for us.

We've had a renewed interest in gold on the Thorn project. We'll have some geo-chem results coming out hopefully later this month, in

July, and we'd like to follow up the Thorn project with some drilling before the snow flies, which will be sometime in November. It's a

seasonal operation. We do have an airstrip and a camp established on the project, so even though it's in northern B.C., there's no road

access into the site. The nearest road is about 50 kilometers away, so we do have a fixed wing access, which is about an hour flight

out of Whitehorse, Yukon, to the project. It's reasonably easy to get to, considering its location.

Dr. Allen Alper: It sounds like a great project!

Mr. Gary Thompson: Yeah, we think so. We're pretty excited about it. We've always thought this to be a company maker

project. The Thorn was our listing property for Brixton when we got listed in 2010, and we continue to find mineralization at surface.

It's pretty hard to spend a day out on the ground and not come back with some interesting looking mineralization. It's not easy walking

ground, in fact it is pretty rugged. That's probably been part of the challenge historically for previous operators. Nobody's gone in

there with a real budget to make any serious advancement. Brixton Metals, to date, has spent about 7 million dollars. We'd like to get

up there and do some drilling this summer to test some gold targets.

Dr. Allen Alper: That sounds very exciting. I've been close to that area in Whitehorse and the Yukon and I know how mountainous

it can get.

I hear you have other interesting projects.

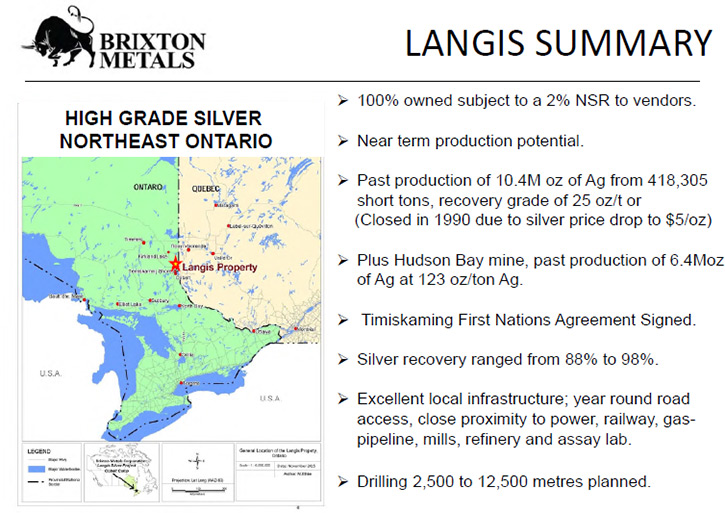

Mr. Gary Thompson: We have this new project for Brixton this year. We struck a deal on the Langis mine. It was a past

producer. They closed down in 1990 due to low silver prices. It's actually quite a historical camp. The Cobalt Silver Camp produced

somewhere in the neighborhood of half a billion ounces of silver at very high grades, and the Langis was one of the operations that was

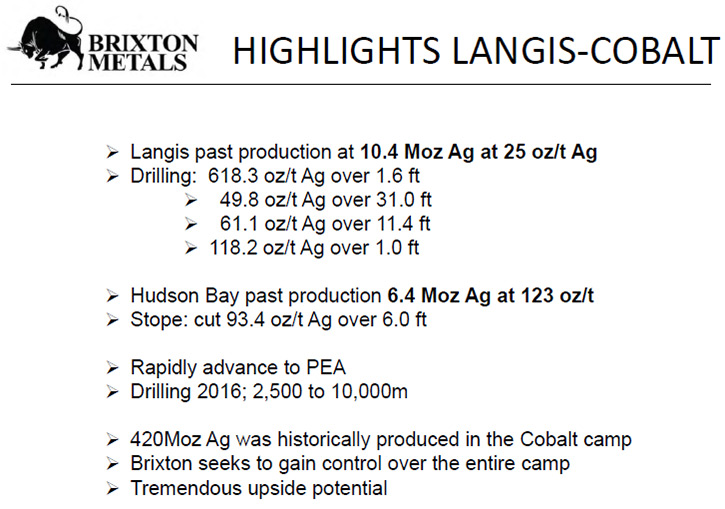

still going until they shut down in 1990. It produced 10.4 million ounces of silver at a recovery grade of about 25 ounces per ton,

with high recovery rates.

A lot of native silver came out of this system, which is quite unique. Currently there is no primary silver mine in Canada. Even though

Canada produces a lot of silver annually, it's usually by-products of base metal or gold mines. We think this project could be a

potential primary silver mine. Our goal is to see if we can advance this project towards an initial maiden resource, and then move it

in towards a PEA, and ultimately see the thing back into production assuming it all comes together.

Some of the historical intercepts were 61 ounces of silver over 11 feet, 50 ounces over 31 feet, 40 ounces over 67 feet and 618 ounces

over 1.6 feet. So it can be quite rich in silver. We are looking at some of these broader zones that we could build some tonnage

around. With those kinds of grades you don't need a lot of material, so we're targeting a few million tons to start. An ideal scenario

would be 3 to 5 million tons in that sort of 15 to 25 ounce range. I think you could start to push this thing towards preliminary

economic assessment.

Dr. Allen Alper: That sounds excellent.

Mr. Gary Thompson: To be clear, those are target numbers. Those are not resource statements. And there are no existing

defined resources on the Langis project. These historical numbers will need to be confirmed through drilling and then go from there.

Dr. Allen Alper: Could you elaborate on where it's located, the deposit, and a bit more about the geology of the area?

Mr. Gary Thompson: Sure. The Langis project is located about 500 kilometers north from the city of Toronto, just north of

the shores of Lake Timiskaming. It's actually very close to the Quebec border. It's in Ontario but it's just west of the Quebec-Ontario

border. Some of the recovery rates were quite high given the native silver factor. The historical records show from the 10.4 million

ounces produced, 88 to 98% recovery rates.

It is part of the Abitibi greenstone belt, so the deeper, older rocks are the Archean volcanics. We believe, based on some of

the work we've done, that there's potential at depth into the Archean rocks as well. We do see some mineralization projecting down at

depth, which hasn't been exploited.

Most of the mineralization that was mined around Langis is associated with the Nipissing diabase sill. Mineralization is

associated with the sill, hosted in these Huronian sediments, which are argillites and conglomerates and greywacke. We're finding

mineralization in all of the 3 rock units: the sill, sediments and volcanics. In other parts of the camp, the mine workings were in the

diabase itself, in some areas in just the volcanics and in some areas in the sediments.

There's certainly significance to the Nipissing diabase sill. We're quite intrigued by the project and with the amount of

high-grade silver intercepts that we have in our database. We have a drill turning now. The plan for us initially is to drill about

2,500 meters of confirmation drilling on some of the historical results. Then with some success on that drilling, we will look to

continue to drill through the balance of the year and move towards an initial maiden resource.

Dr. Allen Alper: That sounds excellent, a very rich resource potential. That sounds very, very good.

Mr. Gary Thompson: It's a pretty amazing amount of history there. I've actually talked with a lot of people that worked

underground, guys that are still around that worked here, and I don't know if you've looked at our presentation, but I have a picture

there from one of the mines underground in the '60s. The silver was so high grade that they used to peel off the native silver out of

the veins or off the walls of these workings, and all the miners would carry around this little sack on their hips and they would pull

some of this native silver, and that was their bonus for the day.

Dr. Allen Alper: That sounds fantastic. That's really amazing. That's rather unusual.

Mr. Gary Thompson: Well, it's very unusual actually. When you think of high grade native silver, you don't think of

Canada, do you? You think of Peru or Mexico when you think of those kinds of grades of silver.

Dr. Allen Alper: Yeah. Well, that sounds like you have a lot of fun in store! With both properties, as you explore and get more

data and information. That's great!

Mr. Gary Thompson: Yeah. We're excited to see some results come in on both of these projects. We've done some initial work

at Thorn and we're just awaiting the geo-chem results on that. Our initial drilling is just starting at Langis, so we're pretty keen to

see those numbers come in.

Dr. Allen Alper: That's excellent! Gary, could you tell me a little bit about your background and your team?

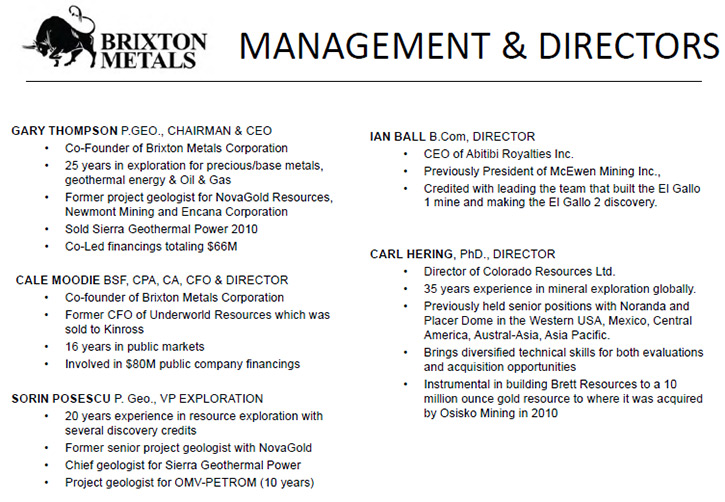

Mr. Gary Thompson: Sure. I'm a geologist by training. I started in the exploration business in the mid-'80s. I went back

to school as a mature student to get my geology degree. Most of my experience is in mineral exploration. I spent about 5 years in oil

and gas. Prior to starting Brixton, I founded a company that was in the geothermal exploration and power development business. I guess

you could say we are serial entrepreneurs, and we like the exploration side of it. To us, exploration is the exciting part and has the

most upside potential.

The art of discovery is what gets us going, gets us moving, keeps us excited. I've worked for numerous companies historically, NovaGold

Resources, Newmont Mining, and on the energy side, Encana Corporation. Mr. Cale Moodie is the co-founder of Brixton. He's our CFO and

a director, and he is a chartered accountant by training. He was formerly with Underworld Resources, which was sold to Kinross back in

2010. He brings some 16 years of public market experience. Mr. Sorin Posescu is our VP Exploration, a seasoned geologist with 20 years’

experience in exploration, with several discovery credits. He was formerly with NovaGold. He worked with me at Sierra Geothermal Power

previously and he also has some oil and gas experience.

We recently appointed a new director, Mr. Carl Hering, who brings some 35 years’ experience in the mineral exploration experience

globally. He was with Placer Dome for a little over a decade and then Noranda for about a decade, so he brings a lot of experience. He

was involved with Brett Resources, which built up a 10 million ounce resource, and that was acquired by Osisko in 2010. The other

director we have is Mr. Ian Ball. Ian is the CEO of Abitibi Royalties. He was previously the president of McEwen Mining. We've got a

strong team. We're a small shop here, a handful of guys, but I can say we've been very efficient in our capital allocations and we're

keen to grow our business.

Dr. Allen Alper: It sounds like you have a very strong board, and very excellent properties. That really sounds very good. Could

you tell me a little bit about your financing and your share structure, capital structure?

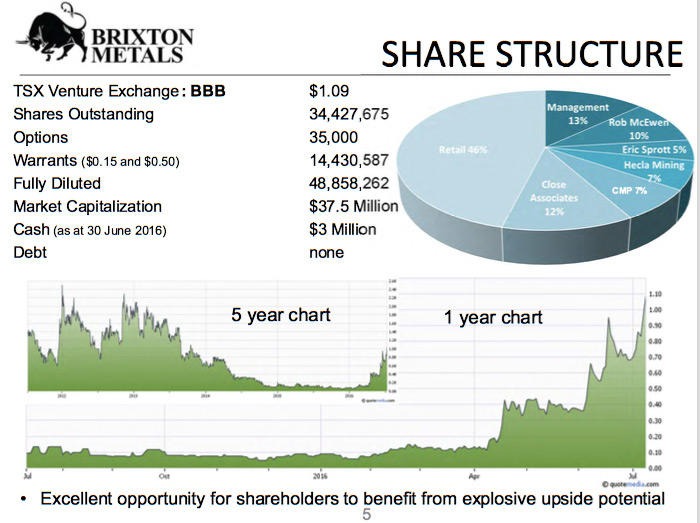

Mr. Gary Thompson: Sure. Currently the company has 34.4 million shares outstanding. We have a market cap of somewhere in

the neighborhood of $35 million, $3 million in cash, and no debt.

Dr. Allen Alper: That's excellent.

Mr. Gary Thompson: We've done a couple of financings this year. We started financing, looking to raise money, early in

January when the market hadn't quite turned yet. I guess through that financing process, the market changed direction on us, and for

the first time in many years, we've had people calling us to see if we needed capital, so that was a pretty rewarding feeling to see

interest coming back in the junior exploration companies.

Yeah, we're obviously looking to put that money to work in the ground and continue to build out our projects, and continue to

look for M & A opportunities. That’s what we've done all last year, we didn't spend any money on the project last year. We've been

focusing on potential M & A opportunities, so we'll continue to look for accretive transactions that will allow Brixton to grow.

Dr. Allen Alper: That sounds excellent, like a great approach! It sounds like you’re very well positioned to go forward with

that.

Mr. Gary Thompson: Yeah, we think so. We’ve got a good structure, 34 million shares out with very strong shareholders,

like Mr. Rob McEwen, our largest shareholder, Mr. Eric Sprott recently took a position in Brixton, Hecla Mining, CMP, which is a

Dundee, or a Ned Goodman fund, and the management, the close associates, we’ve got something like 60% of the company held in strong

hands, so we’re very comfortable with where we’re going, the structure that we have, and the projects that we have, and very happy to

have strong shareholders like we have.

Dr. Allen Alper: That’s very impressive! What are the primary reasons high-net-worth investors should invest in your company?

Mr. Gary Thompson: Well, in addition to our tight structure and strong shareholders we have 100% control over 2 very

strong, high grade gold and silver projects in Canada, The Langis represents a potential near term production opportunity, and the

Thorn project represents a district scale major discovery potential project. We think the combination of those things is a recipe for

success, and we think those are reason that investors should take a look at Brixton.

Dr. Allen Alper: Wow! That sounds fantastic, very strong reasons why our readers/investors should take a very close look at

investing in your company.

Thorn Camp and Airstrip

http://brixtonmetals.com/

Brixton Metals Corporation

409 Granville St., Suite 1010

Vancouver, British Columbia

Canada V6C 1T2

(604) 630-9707 Office

(888) 863 3801 Toll Free

(888) 863 3810 Fax

info@brixtonmetals.com

BBB:TSXV

BXTMF:OTCBB

|

|