Interview with Rudi P. Fronk, Chairman and CEO of Seabridge Gold (TSX: SEA, NYSE: SA): Core Assets are Located in Canada, its Resource Base of Gold, Copper and Silver is One of the World's Largest

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/9/2016

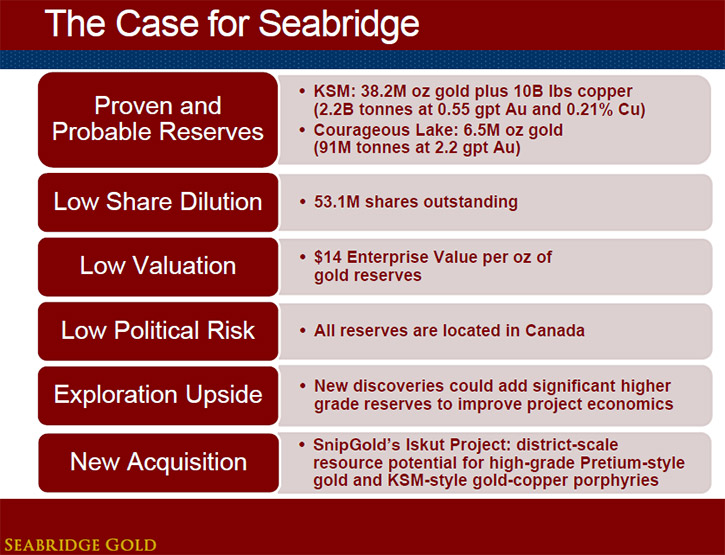

Seabridge Gold (TSX: SEA, NYSE: SA) is a gold exploration company with the principal objective to grow resource and reserve ownership per common share. The company's core assets are located in Canada, its resource base of gold, copper and silver is one of the world's largest. Its KSM project is now the largest undeveloped gold reserve on the planet and also the only big project in the world today held by a junior that's shovel ready. According to Rudi P. Fronk, Chairman and CEO of Seabridge Gold, the recently acquired Iskut property can be another KSM, but only better because it also has that very high grade gold mineralization that's pretty close to the surface. We learned from Mr. Fronk that the company is very lean, has no debt, and has about $30 million of cash in the bank. At 1.8 ounces of gold per common share in the ground, Seabridge Gold provides ten to thirty times more gold ownership per share than any other gold company.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News interviewing Rudi P. Fronk, Chairman and CEO of Seabridge Gold. Could you tell me what differentiates Seabridge Gold from other mining companies and exploration companies?

Rudi Fronk: Yeah. We actually highlighted that in our annual report this year. The industry as a whole is hell bent on turning gold into cash. They go out and find deposits, or buy deposits. They build mines, they dig the gold up out of the ground. Then they sell it at the spot price for cash.

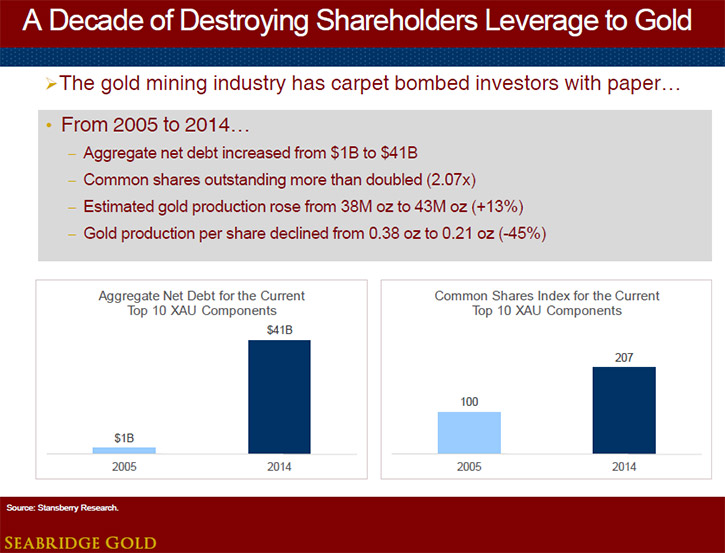

If you look at their performance over the ten year period ending in 2015 when gold has gone from 300 to as high as 1900, and now back to 1300, they've actually underperformed the gold price. It’s our view that the big companies and most of the industry is actually destroying their shareholders leverage and optionality to the gold price.

Over that ten year period, the net debt of the ten largest gold companies has gone up 40 fold, from 1 billion to 41 billion. Their shares outstanding have more than doubled. Their reserves haven't gone up, their production hasn't gone up. Every per share metric, whether you measure it by ounces of gold reserves per share or production per share or cash flow per share, has actually gone down. Turning gold into cash and diluting your shareholders hasn't worked well. That's why the big companies have essentially underperformed the gold price during that time period.

We, on the other hand, have a little different view of the world. We believe that investors buy gold stocks because they want optionality to gold. They expect their investments in gold stocks to actually outperform the price of gold. Our business model is completely the opposite. It's based on the concept of turning cash into gold. We raise money through equity issuances or selling non-core assets. Then we take that cash and reinvest it in either acquisitions that are accretive, or exploration activities.

Our aim is to continue to grow our ounces of gold reserves and gold resources on a per share basis. If you look at the history of Seabridge over the last 17 years since we started the company, we've continued to grow ounces on a per share basis. That provides the optionality and the leverage to the gold price that shareholders want in a rising gold market.

Dr. Allen Alper: That's a great strategy.

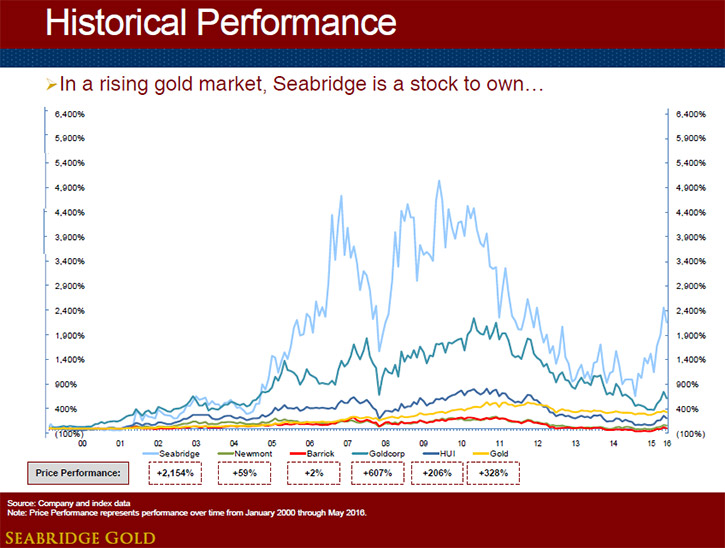

Rudi Fronk: It's worked. If you look at, say for the example the period from 2004 through 2007, to just before the financial crisis, gold went from 400 to 1000, during that time period, so it was up 150%. During that time period, our share price went from $2 to $39. We provide that leverage and that optionality that investors are looking for. Then again, coming out of the financial crisis in 2008, our share prices dropped down to $6 from the previous high of $39. Then as gold then went from 800 to 1900, or a little more than 100%, our share price again went from $6 to the high 30s again, up 500%.

We're now starting to see that disconnect again. We hit a bottom last summer at about $3.30 per share. We're now back at about $14. Again, outperforming the gold sector, and the price of gold, and other gold equities.

What I will tell you is that leverage does work both ways. When the gold market is not doing well, we underperform. That's the whole concept of optionality and leverage. In a rising gold market, we do what we're designed to do, and that's to provide leverage to the gold price.

Dr. Allen Alper: That's great. That's a great strategy and great performance. That's excellent.

Rudi Fronk: The other thing that is unique to us, I think, is, if you look at the industry as a whole, the big companies tend to do their acquisitions at the top of the market. When the shareholders are screaming for growth, growth, growth, we need growth, they tend to overpay. Then, as the gold price settles back down, they are forced to sell, sell, sell. They've taken on too much debt, or they've over paid for assets and need to take write-downs.

We created Seabridge in 1999 when gold was completely out of favor. At that point in time and for the next three years, we had the pick of the litter of gold projects that the majors were willing to sell for pennies on the dollar. Because of the downturn over the last several years, we're now, once again, seeing great acquisition opportunities at low prices. We just recently closed on acquiring a company called Snip Gold that has an asset called Iskut, that's located 30 kilometers from our big KSM asset in British Columbia. We see the opportunity there to drive value for our shareholders through exploration activities.

On top of that, we bought a company at a cost of 700,000 shares that already had 2.2 million ounces of measured and indicated gold resources. We bought that company and got back three ounces of gold in the ground per share on the acquisition, and believe there's a lot more to find there as we move exploration forward.

Dr. Allen Alper: That's great. You and your company are doing an excellent job. Right now you have a massive amount of gold properties. Could you run me through that?

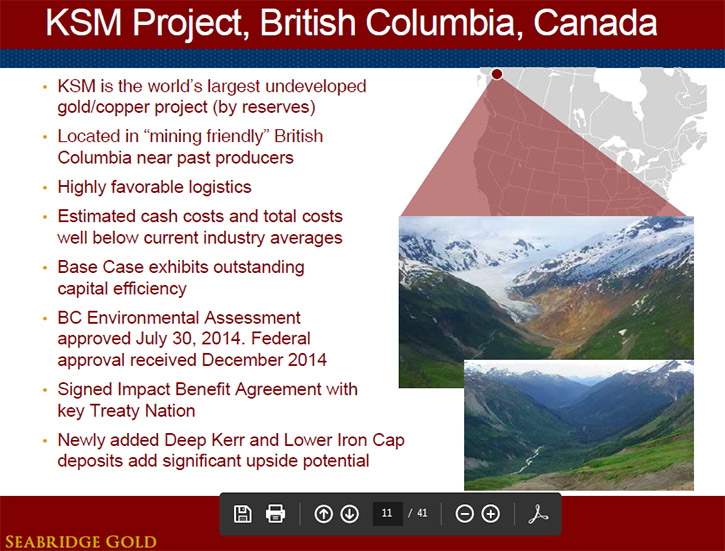

Rudi Fronk: Yeah, so in order of size right now, our biggest one is KSM. We bought KSM from Placer Dome in June of 2000. Matter of fact, it was a right after the Bank of England announced they were selling off all of their gold as a sovereign. We bought the asset for $200,000. Placer Dome had spent $25 million at KSM delineating two deposits that had over about 3 million ounces of gold and 2 billion pounds of copper.

Fast forward to today, we've now spent over $200 million to advance KSM. KSM is now the largest undeveloped gold reserve on the planet. We have 38 million ounces of proven or probable gold reserves and ten billion pounds of copper.

We also have a project that's now gone through the environmental assessment process. It's the only big project in the world today, held by a junior, that's shovel ready. We received all of our environmental approvals in late 2014.

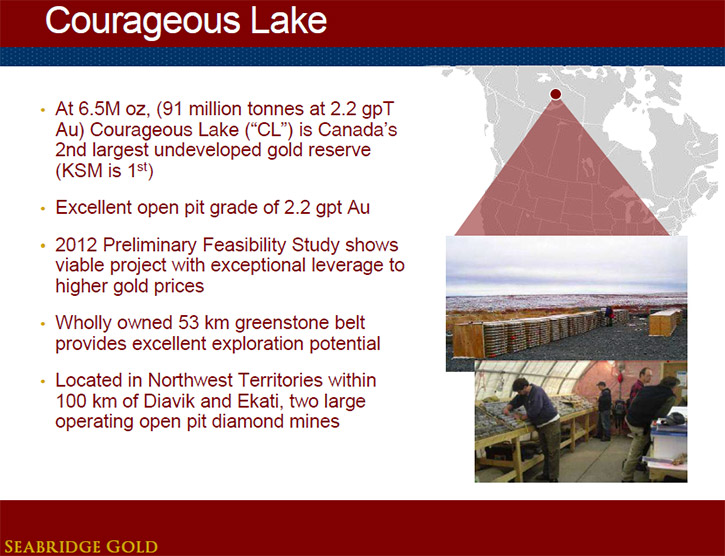

Our second big asset is Courageous Lake, an asset we bought in 2002 from Newmont Mining. We've spent about $50 million at Courageous Lake now. We have a reserve there of over 6 million ounces of proven or probable gold reserves. There’s a lot of exploration upside that we will go and tackle at some point in the future.

The most recent acquisition, which really excites us, is SnipGold. We think that the Iskut property can be another KSM, but only better because it also has high grade gold mineralization that's pretty close to the surface. There have been holes drilled at Iskut that were thousands of grams of gold per ton over mineable widths. There were two former producing mines there. One was called the Snip Mine that Barrick operated, and they produced about a million ounces of gold there at grades of almost 1 ounce of gold per ton. Then, a smaller mine called Johnny Mountain produced about 200,000 ounces of gold at grades of 2/3 of an ounce of gold per ton.

We think there's a lot of opportunity to replicate those high grade former producers on the large land position we just acquired. We'll be going after that this year.

Dr. Allen Alper: That's fantastic. Very, very impressive. Could you tell me a bit about your background and about your team, and your board?

Rudi Fronk: Happy to do so. I'm a mining engineer with graduate degrees in mineral economics and finance. I've been involved with project development and mine construction around the globe. We formed Seabridge in 1999 with a contrarian view on gold. I'd say I'm more of an economist than I am an engineer at this point in time. We saw an opportunity back in 1999 when gold had fallen completely out of favor relative to other financial assets, and thought over time that gold would do well.

We wanted to build a business plan around a model that would reward people that believed in higher gold prices.

On the management side, our team is mostly made up of former senior executives of big mining companies. For example, our head of exploration, Bill Threlkeld, who has driven exploration at KSM and Courageous Lake and now at the SnipGold project, spent a good chunk of his career at Placer Dome running exploration activities in Latin America for almost 20 years. Before he came to Seabridge, he found hundreds of millions of ounces of gold deposits in Latin America.

Jay Layman, the president of Seabridge, spent 15 years of his career at Newmont. He was running technical services. All of the engineering disciplines at Newmont reported into Jay.

Peter Williams, another hire from Newmont, ran their global mining engineering practice. Brent Murphy, who has been looking after our environmental assessment and programs, was running the Canadian Environmental Practice for BHP.

Guys that came from big companies that worked on big projects came to Seabridge because they saw the opportunity of working at the project level again at the beginning of a project, and eventually taking it through to mine construction.

Our board has very similar, very senior, experienced individuals. Guys like Eliseo Gonzales-Urien who ran global exploration for Placer Dome for 20 years. Guys like Scott Barr, who was a senior executive at Newmont on the mine construction side and mine evaluation side, and before that with Freeport. Fred Banfield, a reserve estimation and mine planning expert who developed the software packages called MineSite and MED System. MineSite is used in over 300 mines worldwide. John Sabine, probably the leading mining M&A lawyer in Canada. He's been in the business for 40 years and is very well known on the M&A side. Gary Sugar who recently joined our board, was a mining banker at RBC for the past 30 years. He recently retired and just joined our board a couple of months ago. Finally, Richard Kraus used to be the former CEO of Echo Bay Mines, which years ago was acquired by Kinross.

Dr. Allen Alper: Well, you have a great team and a great board.

Rudi Fronk: What brings a great team and a great board in are great assets. I think that's why we put together the personnel we have.

Dr. Allen Alper: That sounds great.

Rudi Fronk: In the 17 years that I've run Seabridge, I think we've only had one employee leave the company and that's because he retired.

Dr. Allen Alper: That is fantastic. It must be a great place to work and they must have great pride in the company. You must be picking the right people.

Rudi Fronk: For the company of our size, we only have 18 full time people. A bunch of professionals, not a lot of fat.

Dr. Allen Alper: That's great. Excellent. Kind of a lean group.

Rudi Fronk: Lean and mean.

Dr. Allen Alper: That sounds great. Could you tell me a little bit about your capital structure and your finances?

Rudi Fronk: Yeah, we're very stingy with our shares. When we took over the shell company in 1999, there were about 17 million shares outstanding. By the time we finished the acquisitions in 2002, in that down cycle, we increased our share count to about 27 million shares, but we had 15 million ounces of gold resources that we had acquired.

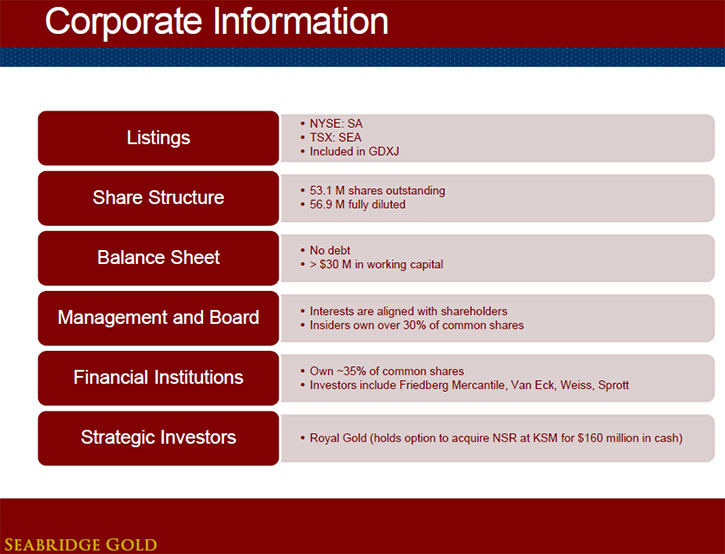

Fast forward to today, we now have 53 million shares outstanding. When you look at our total gold resources and reserves, we have 45 million ounces of proven or probable gold reserves and another 48 million ounces of resources on top of that. Almost 1.8 ounces of gold per common share.

Everything we do is based on the metric of ounces of gold per common share. We're willing to spend money or do acquisitions if it improves our shareholders ounces of gold per common share. We're also fortunate being a Canadian company with Canadian assets that we can fund ourselves through what's known as the flow through market. This is a tax driven structure put in place by the Canadian government that basically incentivizes companies to spend dollars on Canadian projects on exploration.

The last financing we did on a flow through basis was at a 30% premium to market with no warrant attached. We finance ourselves about once a year to raise what we want to spend in the next year. It's all based on our belief that financing and the dilution we're going to suffer is more than offset by the accretion to ounces.

We have no debt, and right now we have about $30 million of cash in the bank.

Dr. Allen Alper: Well that's excellent. Gosh, you really run a tight ship. You haven’t diluted your stock at all.

Rudi Fronk: You look at most companies that have assets like this. They have hundreds of millions of shares outstanding.

Dr. Allen Alper: That's right. That's amazing. That's an amazing job you've done. That's really great.

Rudi Fronk: A lot of the discipline is also in place by listening to our big shareholder. We have the support starting in 2001 from a very bright commodity and currency expert by the name of Albert Friedberg. He's helped instilled discipline as well. Mr. Friedberg now owns almost 20% of the company, and at the last down turn, continued to buy shares.

Dr. Allen Alper: That's great to have that kind of support.

Rudi Fronk: Yep. We call them sticky shareholders. Guys that have been with us pretty much from day one.

Dr. Allen Alper: That's great. They have that faith in your company and it looks like it's well deserved.

Rudi Fronk: We've stayed on message, we've stayed on theme, we haven't changed our business plan just because gold prices may be up or down. Also, if you look at our annual reports each year, we clearly lay out key objectives to be met every year. Then in the next annual report that comes out a year later, we report how we did against those objectives. It's kind of like a self-imposed grading system. Shareholders get to see okay, here's what they say they're going to do, and here's what they did.

Dr. Allen Alper: That's great.

Rudi Fronk: That consistency has been helpful.

Dr. Allen Alper: That's excellent. Could you tell me the primary reasons why high-net-worth readers and investors should invest in your company?

Rudi Fronk: I'll start on the basis that I think in this day and age everybody should have some gold exposure. Think of it as portfolio insurance. If something goes wrong, which we're seeing more and more of, gold will go up. You want that exposure to gold because the other investments you may be holding may go down. Take for example Brexit. Markets got clobbered those two days. Gold stocks soared. It would have offset losses in your portfolio. If you're buying portfolio insurance by buying a gold instrument, you want the insurance to pay the best, the highest it can.

Because of our ounces of gold per common share, we provide that leverage. At 1.8 ounces of gold per common share in the ground, we provide ten to thirty times more gold ownership per share than any other gold company. Which is why when the gold price is going up, we outperform. I think we're probably the most cost effective way to get portfolio insurance.

Dr. Allen Alper: That's great. That's very persuasive.

http://seabridgegold.net/

106 Front Street East

Suite 400

Toronto, Ontario M5A 1E1

Canada

Tel: 416.367.9292

Fax: 416.367.2711

info@seabridgegold.net

|

|