Discussion with Andrew Dinning, Founder, President and CEO of Sarama Resources Ltd. (TSX-V: SWA): Advancing South Houndé and Karankasso JV Gold Projects in Historically Prolific Gold Belt in Burkina Faso

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/21/2016

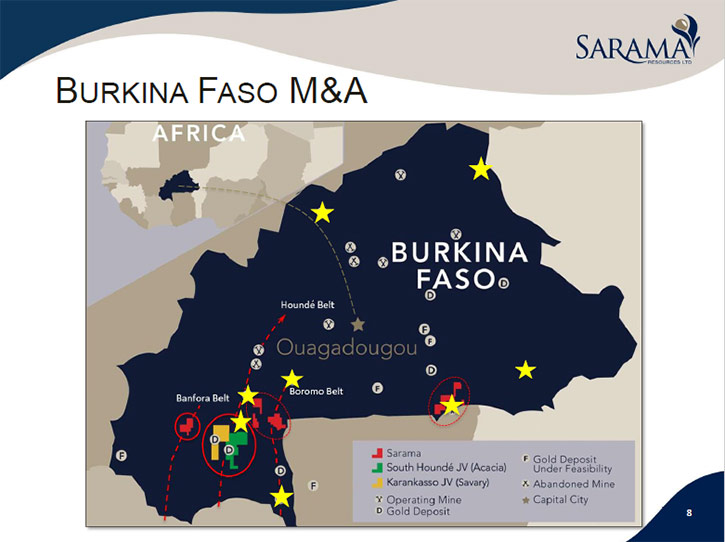

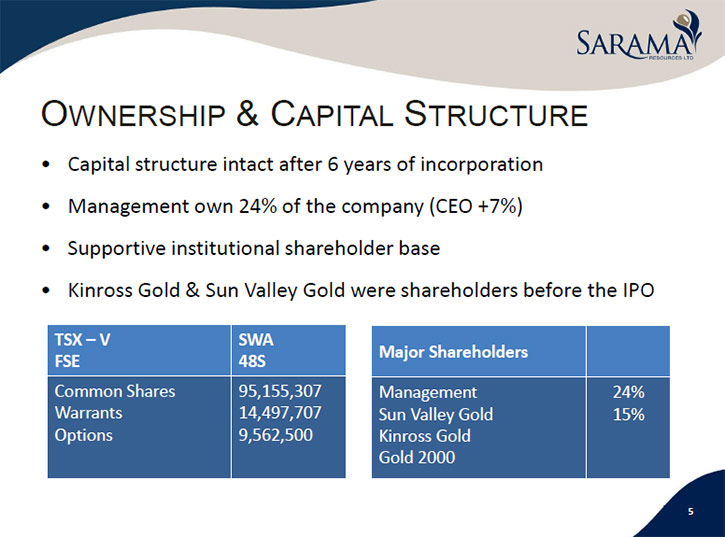

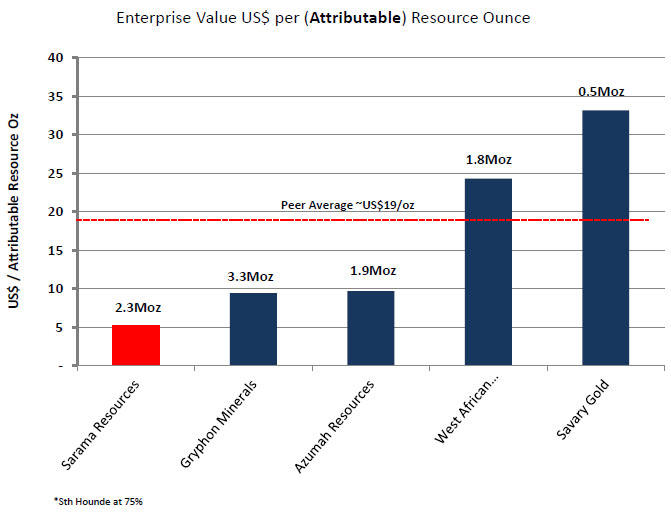

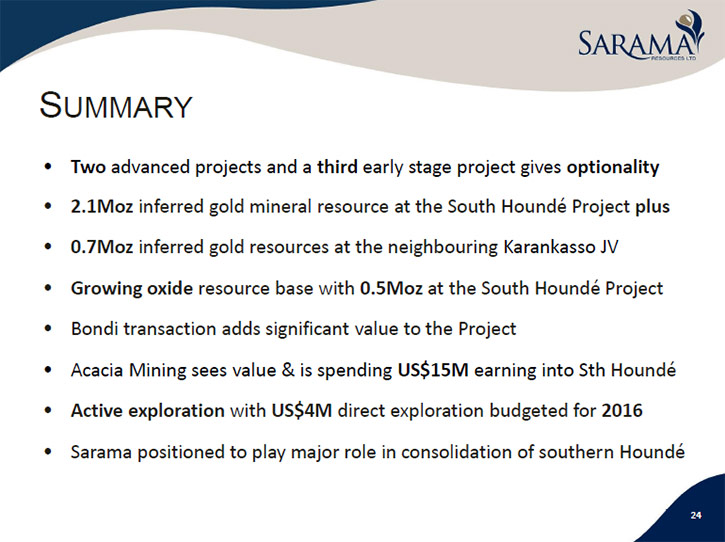

Sarama Resources Ltd. (TSX-V: SWA) is a West African gold explorer and developer whose principal focus is in the historically prolific Houndé gold belt in Burkina Faso. The company’s primary focus is the southern Houndé Belt which has a gold resource endowment >12Moz and growing. Andrew Dinning, a Founder, the President and CEO of Sarama Resources and his team are accomplished ore finders, project developers and operators with a proven track record of success. Management has a strong conviction and commitment to the success of the company, owns 24% (CEO +7%) and has continued to follow its positions through recent equity raises. Sarama has identified 2.1Moz inferred gold mineral resource at the South Houndé Project and owns a third of the adjoining Karankasso JV (Savary Gold Corp) which has a 0.7Moz inferred gold resource. A US$1M on signing and US$14M in the ground, earn-in agreement with Acacia Mining on the company’s South Houndé Project provides funding to advance exploration. Recently Sarama Resources Confirmed High-Grade Oblique Mineralization at the South Houndé Project in Burkina Faso. Sarama has a US$4 million exploration budget for 2016 and will be drilling to improve the size and quality of the resource further.

Dr. Allen Alper, Editor-in-chief of Metals News interviewed Mr. Andrew Dinning, a Founder, President and CEO of Sarama Resources. Mr. Dinning is pleased with the progress the company has made on its two gold projects located in the West African country of Burkina Faso, the South Houndé project and the Karankasso JV. Dr. Allen Alper, Editor-in-chief of Metals News interviewed Mr. Andrew Dinning, a Founder, President and CEO of Sarama Resources. Mr. Dinning is pleased with the progress the company has made on its two gold projects located in the West African country of Burkina Faso, the South Houndé project and the Karankasso JV.

As a leader, Mr. Dinning brings a vast knowledge of the mining sector to the company. Not only is he the President and CEO, but he is also the founder. He said, “I have over 25 years’ experience in the international mining arena. I have worked in the Democratic Republic of Congo, West Africa, UK, Russia and Australia throughout my career with a focus on mine management, operations and capital markets experience specifically in gold.” Mr. Dinning was also a Director, President and Chief Operating Officer of DRC based Moto Goldmines Ltd. from 2005 to 2009. Andrew oversaw the company's flagship, Moto Gold Project (now Kibali Gold), develop from 4 million ounces of gold to +22 million ounces of gold and took the project from exploration to pre-development before Moto Goldmines was purchased by Randgold Resources and AngloGold Ashanti in October 2009.

Mr. Dinning said, “We are a West African gold explorer and developer, whose principal focus is in Burkina Faso. We have had significant exploration success with the definition of 2.1 Moz Au at the South Houndé Project and 0.67 Moz Au at the neighboring Karankasso JV.” The company is enjoying success in a historically prolific gold belt, which includes high level deposits such as Semafo’s Mana Gold Mine, Roxgold’s Yaramoko Gold Mine and Endeavour Mining’s Houndé Gold Project. Dr Alper congratulated Mr. Dinning on his company’s excellent exploration success.

The South Houndé project was discovered by Sarama who generated a maiden resource of 1.5Moz of Gold and in late 2014 Acacia Mining (formally known as African Barrick Gold) entered into an agreement where it will earn an interest through funding the exploration of the project. Overall, the project covers 814km2 and hosts an inferred mineral resource of 43 Mt at 1.5 g/t for 2.1 Moz Au at a 0.3-2.2 g/t cut-off and over 1.1 Moz Au at 2.7 g/t at a 1.6 g/t cut-off as stated in the Mineral Resource estimate effective at February 8, 2016.

In addition to the South Houndé project, a great deal of work has been done on the Karankasso JV project. Sarama did a lot of work on the Serakoro 1 permit that it vended into the JV, Savary has been undertaking the work since we entered in to the agreement so it is a mixture of both.

Mr. Dinning said, “Sarama owns a third of the Karankasso Project which covers approximately 650km2 of highly prospective ground including a 50 km long exploration corridor defined by soil anomalies and artisanal workings. The Karankasso Project hosts a maiden Inferred Mineral Resource of 9.16 Mt at 2.28 g/t for 0.67Moz Au at a 0.5g/t cut-off (Mineral Resource Estimate effective at October 7, 2015), and is situated adjacent to the South Houndé Project.”

Mr. Dinning and his team have a strong belief in the company. Mr. Dinning, himself, owns about 7% of the company, with Directors and management owning a total of 24%. Mr. Dinning said, “Sarama’s Board and management team have a proven track record in Africa and a strong history in the discovery and development of large-scale gold deposits.”

For investors that are interested in gold plays in Africa and particularly ones with very low entry cost per attributable Au ounce and good management teams, Sarama’s details may be worth further investigation. Mr. Dinning said, “We have a quality land package in the southern Houndé gold belt in Burkina Faso with an inferred mineral resource of 2.1 Moz Au at the flagship South Houndé Project in Burkina Faso. There is also 0.5 Moz inferred Au Oxide resource at the flagship South Houndé Project. We have also entered into an agreement with Orezone Gold to acquire their 400Koz Bondi deposit which is contiguous to the South Houndé Project and lifts the total resource for that project to 2.5 Moz Au and importantly lifts the oxide component to 0.7Moz Au and total resource ounces above 2g/t to over 2Moz Au”

The progress that the company is making at the South Houndé is in addition to the results they are seeing at the Karankasso JV project they have with Savary. Mr. Dinning said, “We have a third of the Karankasso JV which hosts a maiden Inferred Mineral Resource of 0.67 Moz and is contiguous to the Company’s South Houndé Project where we have a US$15 million dollar earn-in agreement with Acacia Mining where we do the work and they provide the funding to advance exploration.”

Over the short term, the company has been in active exploration with more than 50,000 meters of drilling completed in 2015 and the same is planned for 2016. Mr. Dinning said, “We have a US$4 million dollar budget for exploration in 2016 and it is our team, with their proven track records in Africa, that facilitated the deal with Acacia and which is why we have continued to operate and advance the project over the last couple of years, when many other companies have stopped exploration.”

The company was operating in several jurisdictions but over recent times has tightened its focus to Burkina Faso. The company has divested most of its non-core properties and will look to continue to build on its presence in Burkina Faso. Mr. Dinning said, “We sold our Liberian assets to Aureus Mining for 6.6m shares, plus a 1% NSR. And we are in discussions to offload the permit adjacent to B2Gold’s (Papillon’s) Fekola deposit in West Mali, which has had some encouraging exploration results.”

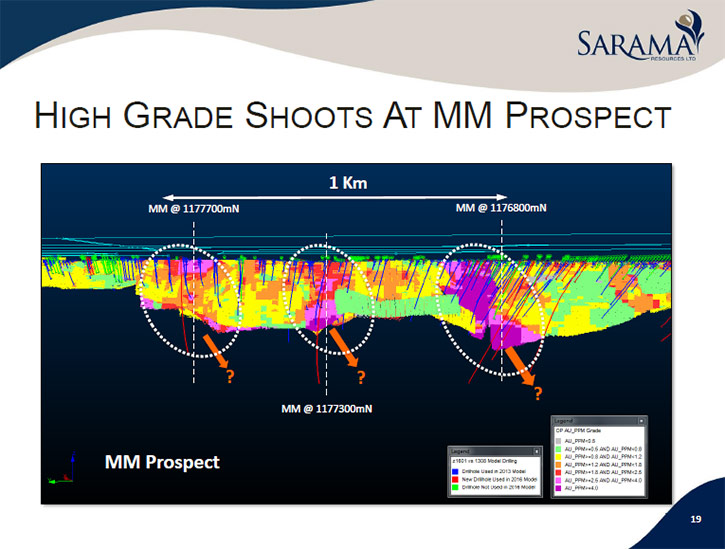

The company’s on-going drill programs continue to yield positive results. Dinning said, “The first quarter, 2016 air-core, reverse-circulation and diamond drilling campaign at the South Houndé Project delivered some very encouraging and important results, identifying high grade cross structures in the main zones of mineralization and also depth extensions to previously identified high grade shoots. The work forms part of an ongoing, multi-faceted exploration program, which includes drilling, geological studies and geophysical surveys at the site.”

The results of the drilling delivered the company the results they were expecting. Said Dinning, “The infill drilling we just completed confirms there is wide, high-grade oxide mineralization with an oblique strike at the MC prospect. In addition, we have identified new high-grade, oblique mineralization at the Phantom East Prospect. Importantly, linking known mineralized horizons provides an insight into the structural architecture of the mineralized system. This supports our mineral resource estimate and provides for extensions along strike of selected lodes at the Kenobi and MC Prospects.”

The company will continue to drill these sites for more information. Mr. Dinning said, “What we have seen during extensional drilling down-dip at the MM, Obi and Kenobi Prospects indicates lithological continuity and provides further targets for testing underground potential.

For more information on Sarama Resources and their holdings, visit http://www.saramaresources.com/

Postal Address: PO Box 575

Subiaco WA 6904

Australia

Telephone: +61 8 9363 7600

Fax: +61 8 9382 4309

Email: info@saramaresources.com

|

|