Dr. Alper Interviews John Versfelt, President and CEO of International Millennium Mining: Owns Promising Silver and Gold Properties in Nevada

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/28/2016

International Millennium Mining Corp (TSX.V:IMI) is a Canadian mineral exploration and development company focused on acquiring known smaller mine

deposits, carrying out exploration and development programs to increase the deposit size and advancing them to production stage. We talked with John

Versfelt, President and CEO of International Millennium Mining, about their promising silver and gold property in Nevada. They now own 100% interest in

the Nivloc Mine and surrounding properties, and have a strong, experienced management team capable of moving the project forward.

Dr. Allen Alper: This is Dr. Allen Alper, editor-in-chief of Metals News, interviewing John Versfelt, President and CEO of International Millennium Mining Corp. Could you tell me what's happening with International Millennium Mining Corp? I know you've just completed a purchase of the Nivloc, Nevada Silver Mine.

John Versfelt: Yes, just to clarify, we had an option agreement to acquire the Nivloc project in 2010. Over the past years, we've been making our option payments, with the final option payment being made in October of 2015, which allowed us to register 85% interest in the properties that we acquired from Silver Reserve Corp, and, of course, we had our 100% interest in the other claims that were within the block that we acquired from SRC, plus the claims that were outside. The option agreement allowed SRC to retain a 15% interest in their project, and if we took the project to a bankable feasibility, they could in effect back into the entire project for 15%. That was how the deal was structured originally.

Then in late March, early April of this year, we acquired that 15% from SRC, subject to a 2% NSR that SRC would retain. We're now in the stages of recording the acquisition of that 15% with the county. We have already done so with the US Bureau of Land Management. The net result of all of it is that we own 100% interest in the Nivloc Mine and surrounding properties, plus, we have the opportunity in December of this year to acquire the 2% net smelter royalty interest from SRC, so that we effectively would own 100% interest in the property without any other interest held by external parties.

Dr. Allen Alper: That sounds like an excellent approach. I'm glad you were able to do that. It took time, but I think it puts the company in a much better position.

John Versfelt: Yes, it does, actually. It allows us to carry out the programs that we wished to carry out in the timing that we would like to do so, without having to be compromised by anybody else's interest.

Dr. Allen Alper: That's excellent. I understand the mine has an interesting history.

John Versfelt: Absolutely. The silver deposit was originally discovered in the early 1900s and was acquired by a person whose last name was Colvin in the late 1920s. He then, through a series of steps, was able to put the project into production in around 1937. For all intents and purposes, a little bit earlier, but the primary was in 1937. Then from 1937 until early 1942, at that project, they mined out approximately 365,000 tons which enabled them to recover a little over 4 million ounces of silver and approximately 18,000 ounces of gold.

In 1942, they had to shut the mine because of the World War II effort. All non-essential mines were shut down in the United States so that, of course, the mining people could go to work in more essential mines. No production happened after that time. Initially, in the very late 1940s and early 1950s, a couple of companies, including Anaconda, took a serious look at the project, but the silver prices were so low that they decided not to do anything with it. What they did do, is they did a fair amount of underground sampling to determine the possibility of mining and came up with some significant exploration type work, but it didn't go anywhere.

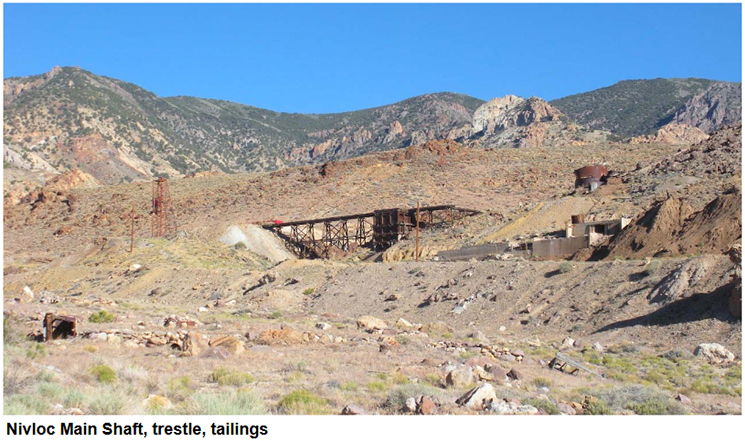

The property sat more or less until the 1970s when another group came in. They thought they had acquired the interest particularly over the Nivloc deposit and went to work on putting a decline in place. That extended from surface down to about 250 feet from the 600-foot level of the mine workings. Somewhere in that timing, they realized that they actually didn't have ownership of the property that included the primary deposit and promptly went bankrupt. Today, there is a decline, a 9-foot-by-9-foot decline, which is very dry. Myself and others have walked the decline to the end, without any air supply, and we did not faint or anything else, which tells me that the air is not too bad down there. It will be the decline that one would use to further the project, and the access it provides will enable us to make the decisions on how to put the property back into production.

The project sat during the late 1970s. In 1986, Sunshine Mines, who was mining the Sixteen-to-One Mine, which is located about a mile and a half, more or less, to the northwest of the Nivloc, and taking the ore to a mill that was approximately a mile and a half to the south of the Nivloc, decided to take a closer look at the Nivloc. They acquired an option, which allowed them to take a closer look at it, and they carried out a small drilling program. They also did some grade confirmation sampling underground and determined at one point that they were going to go forward with acquiring an interest in the property; however, in late 1987, silver prices were not that great, and Sunshine Mines went bankrupt. Again, the work stopped in that area, on both the Nivloc and the Sixteen-to-One properties.

There was another party that acquired the 3 primary claims that were over the outcrop, and over a significant portion of the mine. That person held the property, doing no significant work on it until 2007, when a geologist that I know in Nevada approached me and asked me if International Millennium had an interest in acquiring those 3 claims from the underlying owner, which were in the middle of SRC's claims. I said that would be a good idea and I acquired the claims in International Millennium. Then, we spent 3 years essentially waiting for SRC to approach International Millennium with the idea of them optioning the property to International Millennium, which happened in 2010.

In late 2010, after International Millennium had an agreement in place with SRC, we started organizing to have a drill program on the Nivloc. The program actually started in January, 2011. The final 3 holes were completed in early 2012. The significant downturn in the mining sector happened pretty well at that time, and we couldn't do much work on the property since 2012. There's a small amount of work we did in terms of putting all the data that we had into a database, which we had already set up in 2011. This has allowed us to do a little bit of work to advance the project to the point where our next NI 43-101 resource report would have a higher inferred resource.

In 2012, we produced a NI 43-101 inferred resource report based on the results of the first 34 drill holes, which can be found on the www.immc.ca website. There are various levels of a resource set out in the NI 43-101 report, depending on the minimum level of silver and gold assay values that are included in the resource. We've chosen that level to be 1 ounce of silver. Anything greater than 1 ounce of silver is included into the resource. With that in mind, we have a resource that is 8 million of silver equivalent ounces, which includes the values of the gold as a silver resource. Following the completion and public dissemination of the NI 43-101 report, no further drilling has taken place. As stated earlier, International Millennium has drilled 3 further holes that are not included in the resource. We've been advised by our consulting geologist that we would need about 11 holes to increase that resource to another level, and a significant level at that. These would all be infill holes. This is what we are planning to do on our next program, which hopefully will be later this year.

Dr. Allen Alper: Very good. Could you tell me a little bit more about your team and yourself?

John Versfelt: Okay. My experience in the junior resource and the junior stock non-resource sectors goes back to January of 1982. My background is finance and administration. For 34 years, I have worked with junior companies, in various senior management/director roles. At this time, I am responsible for three other companies, one of which is Cabo Drilling, as its CEO. It is an operating company in five countries and listed on the TSX-V stock exchange. In 2002 it was a junior resource company with no money and a mineral property that was in a very difficult situation. After three tough years, it managed to close four private drill company acquisitions and close to $7.5 million in financings to become an operating company in the mineral drilling business, with positive cash flow. Cabo has operations in North America, Central America and Europe, and it was the company that carried out the drilling on the International Millennium Nivloc mine property. Cabo is a significant shareholder of International Millennium. I'm also responsible for another little junior, which has announced that it is merging with a hydropower technology company.

In addition to my aforementioned experience, International Millennium also employs a Chief Financial Officer who works for Cabo, as well as the other junior. We also have a paralegal corporate secretary person that works for all 3 companies. We have the resources in our office to complete all of the management and administration tasks. We hire consulting geologists to actually plan and carry out the field work on the different projects that are held by, or have been explored by, International Millennium in the past.

As far as the Nivloc is concerned, the primary work has been carried out by Seymour Sears, a consulting geologist who has worked with us and with Cabo since 1999. He is from Sudbury, Ontario. He was one of the authors of the International Millennium NI 43-101 report released in 2012. We would continue to employ Seymour Sears, as our primary geologist, for future work on the Nivloc property. He has over 40 years’ experience as a geologist and has worked on projects in North, Central, and South America, primarily precious metals projects, but he has also worked on base metals projects. Seymour is a very good geologist, a very good field man, and he's excellent at assembling complex data sets, interpreting geological data and writing NI 43-101 reports. I think he is one of the more well-rounded geologists that I have met over the last 34 years. In addition to that, I have other geologists that I can call on who have other talents in addition to the talents of Seymour Sears.

Dr. Allen Alper: It sounds like you have someone with a lot of experience, a lot of know-how. It's good to have him on your team going forward.

John Versfelt: Exactly. The other part to the puzzle is that in 2013, we had initially entered into an agreement to merge with a company called Elephant Copper, the principals of which were from South Africa. The idea was that we would take their significant copper project, which was in Zambia and add that to our primary project, the Nivloc property, with the idea of establishing a very strong base in the silver and copper metals, with gold as a by-product. Our interests were in those 2 primary metals, because we thought that in the next turn up in the global mining markets, silver and copper would be 2 primary metals that would be in significant demand and would receive much attention from the global financial markets.

Elephant Copper was initially supported financially by several individuals, but in early 2015 CMRI, a hedge fund, the principals of which are located in South Africa, provided funds to Elephant Copper for the Zambia property and for International Millenniums Nivloc property. In about July/ August of 2015, it came to light that the managing director of Elephant Copper, who was not a primary party in CMRI, had been reallocating moneys that were meant for the Zambia project and for the Nivloc property, into his pocket. When that situation was discovered, the merger transaction between Elephant Copper and International Millennium was shortly thereafter terminated. The principals of CMRI and management of International Millennium continued to work together, but now directly, without Elephant Copper, and the party who was responsible for the misallocation of funds in Elephant Copper is no longer in the picture.

The CMRI people have provided the funding to enable International Millennium to not only live up to our commitments as far as the SRC option agreement was concerned, but also provided the funding to acquire the 15% that enabled International Millennium to now own 100% of the Nivloc mine property. Going forward, we will continue to work with CMRI, as one of the largest shareholders of International Millennium as well as a couple of our other larger shareholders, including myself, to move forward with the Nivloc project, with a focus of not only carrying out the recommendations that are in the NI 43-101 report, but also with moving forward to improve the decline, to the point that we can break into the mine workings. We will take advantage of some of the infrastructure resources that are already there at the property, such as water, county road and electricity, which are all in place because of the Sixteen-to-One mine and the mill that are located on the road that continues through the Nivloc mine property.

All of the infrastructure related to electricity and roads is in place. It's just a matter of changing some electrical transformers and re-hooking up what needs to be built at the mine. We will need to add the equipment to provide the air underground and carry out a work program to improve the underground workings, which appear to be quite competent, and are known to be completely dry. The road that is in place, which the county maintains, is quite adequate for mining purposes. The water resource is fully permitted pursuant to a historical license, which is grandfathered to the Nivloc mine. In other words, we will have everything that we need, other than air equipment, to start working underground.

Dr. Allen Alper: Well, that's great. It's very good that you developed that relationship with CMRI and that they're supporting you and permitting you to go forward with your project. That sounds very good.

John Versfelt: You are correct, it is very positive.

Dr. Allen Alper: Could you elaborate on your capital structure and your finances?

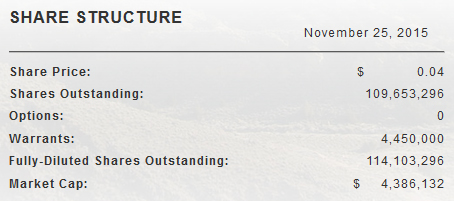

John Versfelt: At this point, not including what we recently announced as far as private placement shares and shares for debt, we have about 110 million shares outstanding. After the shares for debt and private placement transactions happen, we will have around 140 million shares outstanding. Fully-diluted, we will have approximately 155 million shares outstanding, because the private placement will have warrants attached to it. Around 65% or more of those shares and warrants would be held by parties that are friendly to the company. I believe the intention of all of these parties is to be there alongside the company to enable us to get to achieve the goals that we have discussed.

Dr. Allen Alper: Well, that's great - a concentrated group of shareholders, who will have shared the same goals as you do.

John Versfelt: Exactly.

Dr. Allen Alper: Could you give our readers and investors the reasons why they should invest in your company?

John Versfelt: Well, there are several things here. One reason is the commodities that would be produced from the Nivloc mine, which are silver and gold, the primary metal being silver. It appears, from what I can read in the many analyst and mining reports, that we are starting to move towards a stronger global silver market, and that that market is not going to be just a short term strong market, but it will be a longer market, which is similar to what we saw in the 1970s and then in the 1990s, where you have a move up that's sustained for about 3 years or so. Maybe, even 4 years.

I also believe that there are strong pressures coming that will allow/encourage the regulatory authorities to take a closer look at some of the bigger banks who have been, how would I put it, managing the silver and gold resources in a way that's not necessarily in the best interest of many other parties who have a vested interest in silver and gold. I believe that some of that information is now starting to come out. I also believe the cliff from the product side should have a positive impact on the pricing of silver and gold going forward for the next 3 or 4 years. In the past many people were afraid that the demand for silver, in a variety of industrial areas, would decrease. That has proven to be false. There are more uses of silver today than there were in the past, and I see that trend continuing.

A big plus is that our project is in Nevada. Nevada is one of the best places in the world to develop a mine. It has a regulatory regime that is pro-mining. It is a state that has produced a significant amount of gold and silver in the last 50 years and will continue to do so, because it has deposits that are being found that are minable at decent costs. As a result of its mining history and the many mines that are in production today, Nevada also has a very good workforce throughout the state, with reasonable wage rates, and it is not overly impacted by huge increases in wages during peaks of the mining cycles. Nevada is a state that is good to work in and it has significant mining talent at all levels. Further to that, the weather is good in Nevada, especially in our area. It does not experience super cold in the winter, nor is it real hot in the summer. The elevation is right around 5,500 to 6,000 feet. We do not receive a huge amount of snow or rain, so we can work year-round, without any major weather related expenses. We already have the infrastructure in place like roads and electricity and water. We have a mine that is dry. It has no water issues whatsoever. This gives the investor the necessary ingredients to develop a project, where the capital costs are not going to be huge, because we are not in some isolated very difficult Arctic, jungle or desert area. We are very close to resources of any type that are required to support mining. This project is not going to be a huge cost to put into production.

Now if you add to that, that we have people who are experienced in the mining sector, both in management and on our Board. We have an excellent geologist. We have some very good support with the people from CMRI, and, of course, we have the administration support as well. We have a fair amount of experience at this time, plus we can acquire more experience, because it is readily available in Nevada.

Dr. Allen Alper: Those sound like very strong reasons for our investors and readers to consider investing in your company. Is there anything else you would like to add?

John Versfelt: There is. In the mining business, one of the killers on a good project is poor metallurgy, or, in fact, dirty metals. What makes this project so interesting is that the metal is very easy to work with. In 1937 to 1942, the milling people were using just your basic cyanide leaching type processing for the ore, and the recovery was 89% on the silver and 91% on the gold. The ore processing methods have improved quite substantially since that time. We expect that, with the relatively easy ore to work with, the recovery rates, when we start mining and milling, will be better than were experienced in the past, likely at a lower recovery cost per ounce.

In addition, there are minimal sulfides in this ore, so it's not an environmental issue of any sort. It's a very competent, easy rock to work with. The mining is relatively easy as well. This is not a really deep mine. It starts at about the 400-foot level and goes down from there. Some of the workings are already in place, so that will enable us to mine without too much difficulty, as compared to other mining projects. We have several shafts already in place, which will help in constructing proper air flow for the underground workings. As I indicated already, we do have a decline that is 90% completed. We have to improve it, but capital cost will not be huge for that, so it's not like starting something new.

Overall, it's a good area to work in. It's a good mine to work on. It's not difficult to develop. The ore is relatively easy to work with. When I say relatively, you never know for sure, but it's about as good as you're going to get as far as recovery of metals is concerned. We have all the vital ingredients to keep the cost down and to enable a group of people to actually put a mine in production, without having high risks that there will be a disaster, like Rubicon. We literally should, with the right talent, not stumble over ourselves, making big decision mistakes, resulting in large cost overruns.

Dr. Allen Alper: Those sound like good reasons for considering your company. Nevada is one of the primary places for mining and it's one of the safest mining jurisdictions.

John Versfelt: Exactly.

http://www.immc.ca/

20 Sixth Street

New Westminster, BC

Canada

V3L 2Y8

Tel: 604.527.8135

Fax: 604.527.9126

|

|