Interview with Sean Samson, President and CEO of Rogue Resources Inc. (TSX-V: RRS): High Quality Silica Asset, on Path to Production in Mining Friendly Québec

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/14/2016

Sean Samson, President and CEO of Rogue Resources Inc. (TSX-V: RRS) shares with Dr. Allen Alper details about their high quality silica asset in mining friendly Québec. With a strong cash position, and very strong financing record, they have a clear plan to move forward rapidly. With a very capable team experienced in building businesses and generating positive cash flow, they are qualified to execute their plan to accomplish their objectives and become a profitable silica producer.

Sean Samson, President and CEO of Rogue Resources Inc.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Sean Samson, who is President and CEO of Rogue Resources. I could see you're getting some excellent results on your Silicon Ridge silicon, and that you engaged Dorfner-ANZAPLAN GmBH (“Anzaplan”). Anzaplan is analyzing your material in their lab and reporting very high quality silica. Could you elaborate on what you're finding and a little bit about your deposit and your plans?

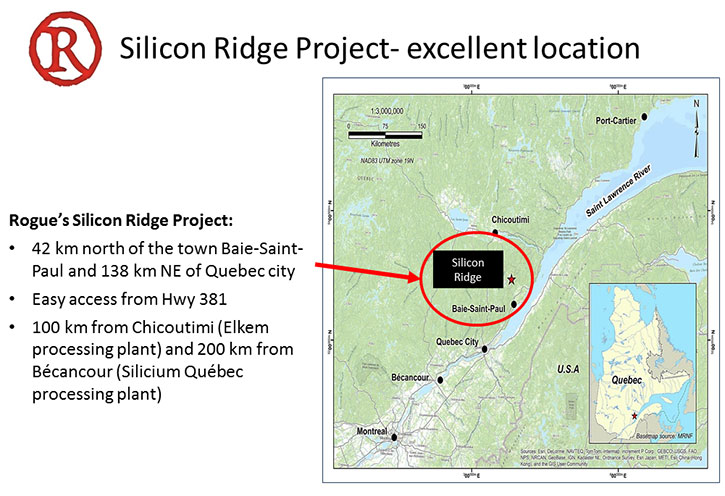

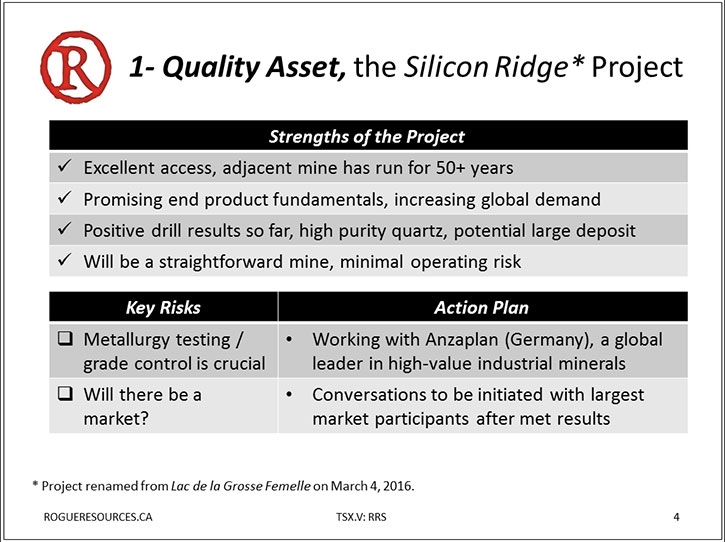

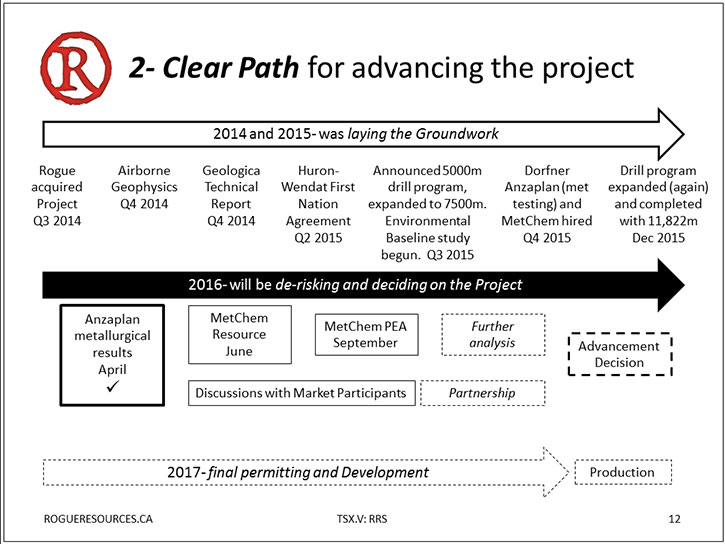

Sean Samson: Sure, thanks Allen. We recently released the results from metallurgical analysis that has been underway for the past couple of months, with Dorfner-Anzaplan, which is a metallurgical lab based in southern Germany who are probably the most qualified in this specialization to be able to assess industrial minerals, specifically silica. They were going through 7,000 kilograms of material that we sent to them after they visited the site during our drill program last year and indicated exactly how much and from where they wanted to review material. It gave them a good understanding and exposure to the full deposit that we have, and allowed them to be able to assess whether we were going to have commercial applications from this material. We expected that they’d have a positive result, because we are within 4 kilometres of a quarry that has operated for over 50 years, so a mine next door has had commercially viable silica that they have successfully sold into the market. We wanted to verify for ourselves though that the metallurgy would show we had comparable material that could be used to make different products.

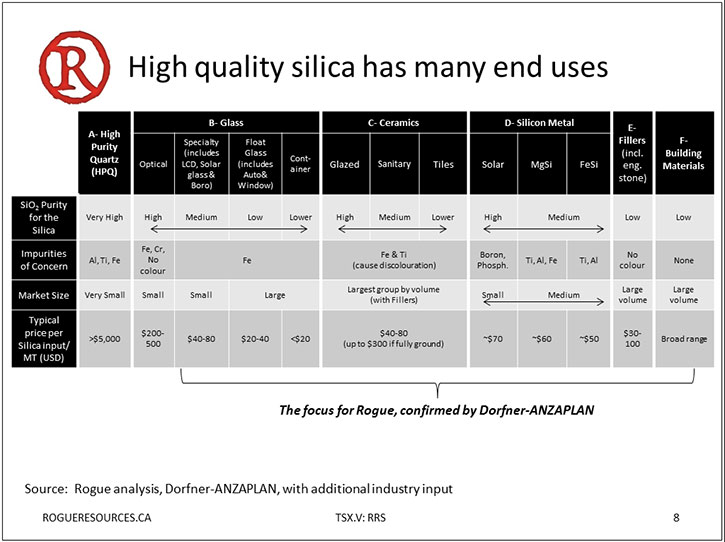

The outcome from that analysis was that our material could make a broad spectrum of potential products, including silicon-based metals, ferrosilicon, a number of high-value applications including glass and ceramics, and right down into fillers and construction materials. We're pretty excited about the results that came out around the Anzaplan analysis, it confirms that basically yes, we can sell our material, and that the market will likely be looking for it, and it launches us into the next very important stage, which has two main parts to it. The first is that we continue with our studies- we now have an engineering firm out of Montreal called Met-Chem, working on a 43-101 resource.

They're underway with that work now, so they're going through the 12,000 meters of drilling that we did at Silicon Ridge last year. We're on pace to come out with a 43-101 resource with Met Chem in June, and then in parallel to that, is the second main part, looking for buyers. Now with the metallurgical results in hand, we are prepared to go out and talk to market participants. These are the people who will buy our material, and we really need to get into the important discussions around what the commercial arrangements could be. Of course, we have a good idea, of who potential buyers could be, especially based on knowing who the neighbour sells to. A big focus for us is going to be the high-value applications, so across the glass and the ceramics. For that, we're working with a company called Roskill out of the UK who are probably the smartest people around market mapping and market sizing in industrial minerals.

They're helping us better understand glass and ceramics, in Québec and the north-eastern US to understand who our potential markets could be. That's going to help bolster our efforts of identifying and sitting across from the potential offtakers and purchasers of our material. In addition, we're working with Anzaplan to process 1500 kgs of material that we sent as a bulk sample, blasted in April from the site, and it's at Anzaplan now in Germany. What that will do is give us samples that we'll be able to bring with us to meetings with potential off-takers and buyers of our material. We'll know who to go to, both from what we know already of the markets, and also the work with Roskill, that is underway right now.

By going to those meetings with representative material in hand, they will become very serious very quickly because we have the metallurgical results from Anzaplan. Anybody who buys our material will want to test it themselves, and we'll be able to bring to them samples that have been prepared by Anzaplan, met tested, and stamped. We'll be able to provide those to potential off-takers and we expect that will lead to pretty constructive discussions.

That's really what our focus is over the next few months, we have a resource coming out in June, and then we're underway with the very important commercial discussions with potential market participants. I have an eye towards the next stage with Met-Chem , they’re completing a PEA (Preliminary Economic Assessment) in September, and of course, when you put economics together, they're only as good as your assumptions. With industrial minerals being an opaque market to price, I want to be very clear on what the price assumptions are, and what we think we'll get paid for our product. That;s another reason that the commercial discussions over the next few months are important.

As for marketing strategy, we'll likely sell it into various different channels. Our neighbour has publicized that they sell into at least 3 applications, so we expect we're going to have multiple applications for our product, but I want to have a pretty clear line of sight on how much we should expect to get paid for these products. The clearest way is to have formal offtake agreements in place. I would like to be able to line up offtakes and/or equity investments of some sort with potential buyers, so that it makes it very real, and firms up our model. I want to make sure that I feel good about each of the prices we use in the PEA, from actual discussions with potential buyers.

Dr. Allen Alper: That sounds excellent like you have a great property right next to a proven operation. You're working with the right people, to test your material and now the right people for your market analysis Roskill are very well-known in the industry. That sounds great.

Sean Samson: It is great Allen. The main thing we're after, and we understand well, is how to mine and how much it costs to mine. Acquiring, planning, permitting, building and running mines is our business. I have experience, as do members of my team, at commercial negotiations for offtake agreements. Industrial minerals are their own beast though, and that is was why I'm very glad that we are working with the smartest metallurgists in the world, these guys from Anzaplan. We were in Germany a few weeks ago, spent time with them, spent time as well watching our material go through the optical sorters at TOMRA , which makes the best optical sorters in the world, and is located just outside of Hamburg, in northern Germany. It reinforced for me that dealing with the best people in the space is very important. It's also why we don't want to go in with blinders on to the market without better understanding all the potential participants. That's why we are going with Roskill, who are the best-informed . None of these consultants are the cheapest though but if we spend the dollars we want to spend them the right way.

I want to make sure that we've got the best information and advice going in, because we are making an investment decision as to where we want to take the company from here. We want to be fully up to speed.

Dr. Allen Alper: That sounds excellent. By the way, I was a senior research associate and a research manager at Corning Glassworks, where we were using a high quality silica and making glasses and ceramics, et cetera. From there, I went on to Sylvania, which became Osram Sylvania, owned by Siemens. We made quartz tubing, and glass for lighting.

Sean Samson: Allen, I remember when we spent the time at PDAC, you had mentioned that. I'm now realizing that that is going to be a large part of our business. It'll be a big focus for us.

Dr. Allen Alper: By the way, if ever I could help, I would be glad to. I help people with offtakes, and investments, etc. We also had experience with silicon nitride, manufacturing that for ceramics and cutting tools, and other applications.

Sean Samson: Yes, as you'll remember from your silica days, the percentage purity is just one of a number of variables. What's in the impurities, what's in the remaining, is very important. Also other performance characteristics become key. Beyond the Anzaplan report, that we press released into 3 pages, was actually a 150 page report about our rock. There are a lot of variables at play there. You'll also notice that we are not targeting the high purity quartz, the “HPQ”. That's the material that trades for $5,000 US a tonne, and it's very well serviced presently out of a mine in North Carolina through Unimin and Quartz Corp. We are not planning to play in that game for a couple of reasons: 1, I think it's a very small volume business, currently dominated by much larger and better financed, entrenched companies; and 2, it's a huge focus for many other silica startups.

I don't think, as we attempt to actually build a proper business, that that's the right market to go after. Our silica is very high quality, but I don't think it's worth the extra costs of going after the HPQ, which all needs to be beneficiated and processed, even the material out of the North Carolina mine. We're going after silicon metal, ferrosilicon, but also these high-value applications. To be clear, we're not focusing on the high-end, HPQ business, which pays you in the many thousands per tonne.

Dr. Allen Alper: I think you're taking the right approach, and going after the right market. Could you tell me a little bit about your background and the team?

Sean Samson: Sure, I came into this company in February of this year. I met Rogue 3 years ago, when I was helping run another junior miner called First Nickel. First Nickel was a nickel, copper producer, that had a mine outside Sudbury. The Company was controlled by 2 private equity funds, with whom we were working very closely and analyzing assets to try to buy additional mines and/or companies to grow the portfolio larger. I was there for 4 years, I initially was the interim COO, so I ran the underground mine outside Sudbury. After I able to bring in another colleague, a proper miner, I transitioned into the job running the M&A. I did corporate development at FNI for 4 years, and bid on many, many projects and companies to buy, all with the support and collaboration of our main shareholder resource capital fund out of Denver. I came to FNI from Kinross Gold, where I was for about 5 years.

At Kinross Gold, I did all things business within the company. That was my first participation in the mining business, and I did things from being chief risk officer through to running all of the supply chain, which had me buying a couple billion dollars of operational supplies across the company, as well as all logistics and warehousing. I was running mines around the world and I had a few hundred people who reported to me in that part of my work. In addition, I ran continuous improvement across each of the mines, and capital approvals. We had no process to allocate about a billion and a half dollars a year, and we had no way of prioritizing across opportunities. Over the 5 years at Kinross, we did a lot of things as the company grew up from being a collection of disassociated juniors through to a real, major resource Company. I left Kinross very soon after the Red Back transaction, partially because I disagreed with the transaction.

A couple of us left at that point because we were looking for other opportunities. Leaving that was the right decision, I think, because Kinross' value plummeted from there. The wrong decision was frankly going after a nickel and copper junior because the nickel price wasn't very strong for the subsequent few years when I was at FNI. I've been 10 years a miner, prior to that I worked in management consulting and private equity with Bain, and I've started up my career working in financial markets. I worked on Wall Street with Lehman Brothers, doing equity, and then I was overseas doing frontier financing in Istanbul, Turkey, and the former Soviet Union. Education-wise, I have a master's from Cambridge in the UK, and I did my undergraduate at Harvard in Cambridge, Massachusetts, with a year at the London School of Economics.

Dr. Allen Alper: You have a very impressive background, Sean.

Sean Samson: It's somewhat unique in the mining world. I'm a Canadian kid who worked and lived outside of Canada for many years. When I eventually came back, I was initially working in financial markets and consulting, but doing a lot of work outside of Canada. I found a great way to actually work for Canadian companies was to get into this business where there's Canadian expertise in human resources that are going around the world and getting rock out of the ground, to bring it to market. I've caught the mining bug, and I think it's just a tremendous opportunity. I got elected last year to the board of the Prospectors and Developers Association of Canada, which has been a great experience because the combination of helping juniors run and now running a junior, has me exposed to the most interesting part of the market, which is where these mines all come from, where projects come from.

I initially worked inside a major, as we were stitching together the new parts of Kinross, figuring out how things should be done. It's really neat to be trying to build up a company based around an asset with potentially strong economic return. What really appeals to me about the Silicon Ridge project is we will actually be building something which I think has pretty compelling economics, which we'll see with more surety when the PEA comes out. Really, it's an opportunity to run a properly sized project, set it up right, and hopefully run a profitable business, which would differentiate from, much of the mining industry and get me back to when I used to work in profitable industries in private equity and consulting.

Dr. Allen Alper: That's very good! I'm very impressed with how rapidly you're getting data and information and moving forward with your high-grade silica project. You're doing very well.

Sean Samson: I stepped into some pretty big shoes to fill, left by John de Jong, the prior CEO, who has retired up to our board. The company did a lot of the right things. I am very pleased with the work we've done with Anzaplan, which was chosen last year. The very large drill program we did last year, I think, was exactly what the company needed to do at this stage.

Dr. Allen Alper: That's great. It looks like your team is getting Rogue well-situated. Could you tell me a little bit about the capital structure of your company?

Sean Samson: Sure. We have done equity financings to this point and we have about 80 million shares outstanding. In terms of the shares and the holdings, we have a few large shareholders, but no anchor institutions. We have Marquest, out of Montreal, and a few investors associated with Marquest that own between 10 and 20% of the stock. They were part of the group that optioned the silica project to Rogue in 2014. Marquest is our largest shareholder, in addition to some high net worth money that's come out of the Vancouver area. There has been a lot of overlap between the shareholders of Rogue and Integra Gold, which now has a larger valuation than Rogue, but John De Jong, the former CEO of Rogue, ran Integra before, and now his son is the CEO. We have a collection of BC high net worth investors who are also in Integra and who have been very supportive of Rogue.

Below that, it's pretty broadly held. Management and the board don't hold enough shares, but in terms of equity that I have purchased I bought $30,000 in the last financing. I hold that equity, plus I have a number of options. I can say that in terms of the management and board, we're trying to get share ownership up. The board is very supportive. On the last financing, we went out for a million dollars, we closed 80% on announcement of the placement which all came from existing shareholders. The second tranche for $400,000, which brought us up to an oversubscribed $1.2 million, much of that second tranche was, I could say, friends and family, money I brought in. I am pretty invested with my network in Toronto, coming in to begin supporting the stock.

We need to drive up ownership across management and the board. We also need to, and this is where a lot of my time has been focused, try to bring into the stock some larger institutions, as we get closer to producing, and then subsequently cash-flowing. It's the kind of thing that I think in the natural transition of a junior miner, you ordinarily bring in larger institutional investors when you transition to operations, because you need to build something. When you need to build something, you need bigger financing, and with bigger financing, you need to attract people who can write bigger checks.

One of the things with our opportunity is the relatively low capital intensity. We will of course know much better about the economics when we bring out the PEA but we expect that the startup CAPEX for this would be something less than $10 million, closer to $5 million. Since we don't have a very large CAPEX to go out and try to finance, we're not going to have that natural transition when institutional money comes into the stock. A big focus now is to tell the story as broadly as we can and try to attract investors into Rogue. I think once people get in, it's pretty compelling to hear how we're de-risking the asset, and how promising the asset could be. Again, we'll know much better when the PEA comes out in September. Even now, with what we're seeing in the market, it seems like it has a lot of appeal at this stage. We're continuing to de-risk it and we're trying to attract more institutional investors, so as I think about our capital structure, we currently only have a couple investors that are greater than 10%.

We're working on the insiders to own a higher percentage, but I also want to attract in more stable institutional money, which I think will come as we continue to de-risk the project, and eventually move closer into becoming an operator. I have this dilemma without the large CAPEX though, a very nice dilemma to have.

Dr. Allen Alper: It's good to have a low CAPEX. It's easier to raise money and get into production.

Sean Samson: In addition to the low CAPEX, we also many, many positives to working in Québec. Everything from the great workforce, to the supportive regulatory jurisdiction, through to the cheaper power price. The government is very supportive of construction projects that could lead to long-term employment opportunities. I know that the Province of Québec has been very supportive of Rogue to this point, investing through their exploration fund in the earlier stages of our company. Also, I anticipate that there may be sources of capital from within the Québec financial community which hopefully will be non-dilutive to help with that CAPEX.

Dr. Allen Alper: That's excellent, Québec is excellent, one of the best places in the world to mine. That's really great. Could you tell me the primary reasons why our readers should invest in your company?

Sean Samson: Sure. I spend a lot of time talking about the quality of the silica rich asset that we have. Silica is a pretty prevalent material around the earth, but not in the purity and not in the concentration that our material is. I think that we have a very good asset with excellent rock characteristics, as described in the metallurgy report. It's also in a great location, being just 4 kilometers away from a quarry which has operated for a long time. You've got benefits on that front for permitting, where the regulators understand the business well, plus from a commercial perspective, these guys have shown that they've been profitable and making money for a long time. It makes us feel better trying to build a business right next door. I think we have a very strong, quality asset, that's the first thing that I think people should be attracted to.

Second thing is, we have a clear path to what we need to do to this year, to de-risk the project, and we're going to get ourselves to a go-forward decision by the end of this year. If we are able to build and operate this project, we'll have a very clear path to cash flow, where I'm talking about potentially in the next year. I haven't talked about permitting during this discussion Allen, but we are very soon going to announce our permitting consultants, and we will then be explaining to the market the very clear road map we have for being able to get Silicon Ridge permitted. That will not be a long lead item, so we expect a straightforward process to permit the quarry that we plan to build. That is another reason that I think we have an appealing investment, is because we have a very clear path to cash flow.

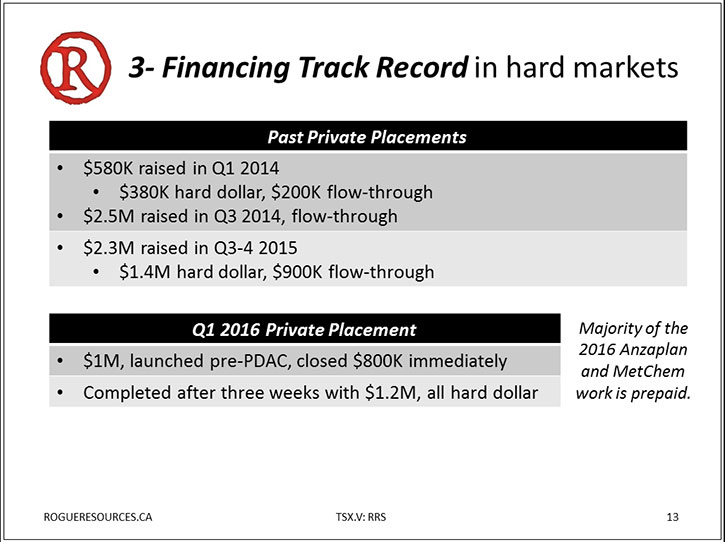

I think that the third reason that Rogue is of interest, and it's also something that attracted me to the company, is that they we have a very strong financing record. We just did a private placement, it was oversubscribed. That was similar to financings that we did last year on good terms. In some very, very poor financing markets, Rogue has been able to continue to raise money by going back to supportive existing investors for continued support, in addition, as I was describing before, expanding our net out to attract more and more people to the stock.

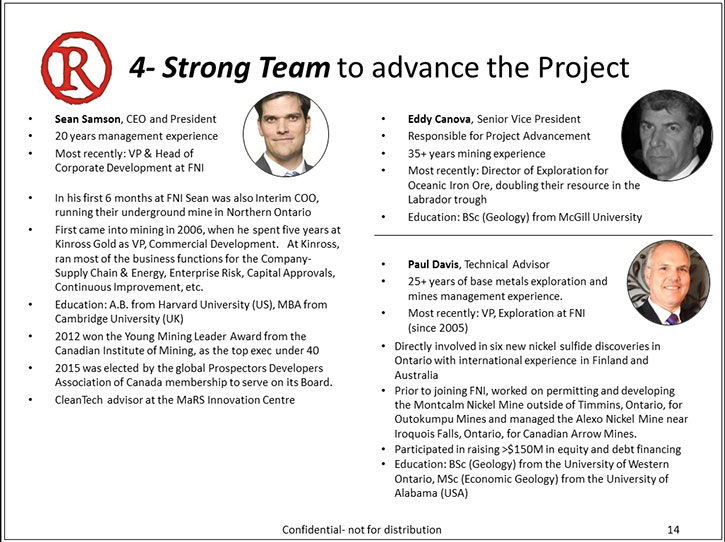

The fourth reason would be because of the team. I mentioned earlier a bit about my background, it's a generalist background. I have ten years in mining, but combined with my career before this, I have a lot of experience building and managing teams, building and running assets, raising financing, and advancing things along. I have a strong, supportive board with deep experience themselves. I also have 2 very strong technical guys, I've brought in with me Paul Davis, who's a very capable geologist who has found, permitted, built and run mines in different metals in Ontario, and he's a really capable, experienced guy who has done a lot of things. In addition, we have Eddy Canova in Montreal, is a very seasoned mining professional. Eddy has advanced and built projects in Québec, and he's done work in Latin America. He has done an excellent job running our drill program, and just generally starting this project. He has very strong relationships in the community and he has been able to get a lot of stuff done. For example, over the last few weeks, we tasked him to go out there and take a 1500kg bulk sample, and he pulled that off, safely and effectively, in less than 10 days- everything from our first blast at site to getting it out on skidoo, all before the coming thaw. Eddy can execute.

We have a small, very capable team, and between Management and the Board, we have all done the pieces of our Plan before, none of this is new. I think that's a major reason why Rogue is a pretty appealing investment.

In summary, we have a very strong asset, with a clear path to cash flow, we have a good history of raising funds, and our strong team differentiates us from the perspective of, we've actually built businesses before and had cash flow, and we've done this, we've done all the things that I plan to do. Members of my team have done it, so that's going to set us up better to be successful.

Dr. Allen Alper: They sound like excellent reasons our readers should consider Rogue Resources.

http://www.rogueresources.ca/

2270 - 1055 West Georgia Street

PO Box 11144, Vancouver, BC

Canada, V6E 3P3

Tel: +1.604.629.1808

Toll Free Direct: +1.888.764.1981

Fax: +1.604.229.0481

Email: info@rogueresources.ca

|

|