Dr. Alper Interviews Richard Williams, President and CEO of Strongbow Exploration Inc (TSXV:SBW) Acquiring 100% Interest in the Historic South Crofty Tin Mine in Cornwall, England

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/24/2016

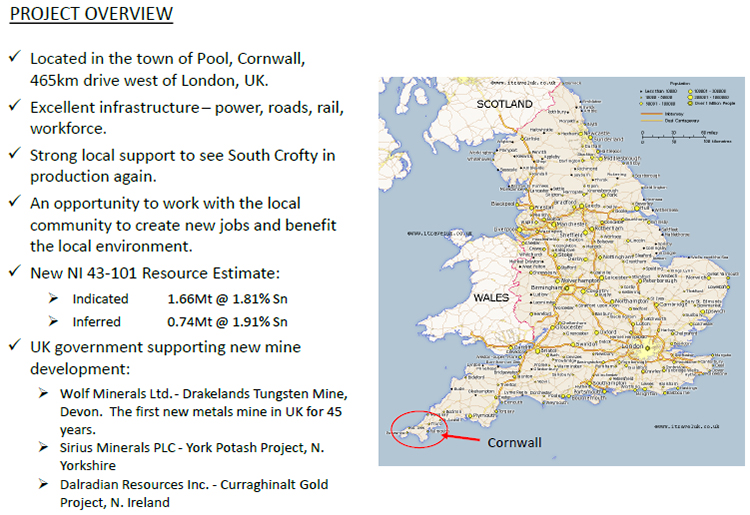

Strongbow Exploration (TSXV:SBW) is a Canadian based company that recently reached an agreement to acquire a 100% interest in the historic South Crofty Tin Mine in Cornwall, England. This is a past producing mine dating back to the 18th century with excellent infrastructure in place, a new mining permit good for 55 years, and a land package secured sufficient for construction of a new process facility. The local Cornwall community supports the mine revival, and the UK government is mining friendly. According to Richard Williams, president and CEO of Strongbow, the company plans to complete the South Crofty acquisition in 2016, and moving into 2017 the plan is to work towards an AIM listing in the U.K.

South Crofty Mine. Image Chris Allen

Dr. Alper: This is Dr. Allen Alper Editor-in-Chief of Metals News, interviewing Richard Williams President and CEO of Strongbow Exploration

Inc. Could you tell me a little bit about your company? I know you're doing quite a few things in tungsten and in tin and you recently did a 43-101 on

your Cornwall, England property, could you update our readers on what your company is doing?

Mr. Williams: Certainly, Strongbow was restructured in 2015 and reached an agreement with Osisko Gold Royalties whereby Osisko vended in two

tin assets in Alaska and at the same time we concluded a $1,000,000 financing to start a new tin tungsten company with Osisko Gold Royalties as our

largest shareholder. Osisko owns around 26%, 27% of the issued capital as of today. John Burzynski, P.Geo. one of the founders of Osisko has joined

Strongbow’s board. In addition, we have Gren Thomas and Ron Netolitzky who are very well known in the resource industry . Gren’s company, Aber

Resources, discovered the Diavik Diamond mine in Northwest Territories.

Ron Netolitzky was involved in the discovery of the Snipo and Eskay Creek deposits and both Gren and Ron are now in the Canadian mining hall of

fame. I joined the company as CEO last September replacing Ken Armstrong who runs North Arrow Minerals, Ken remains on the board of the company as

well.

Dr. Alper: A very strong board! That’s great!

Mr. Williams: Yes, it’s a very strong board with an excellent track record of discovery and generating strong shareholder returns. We aim

to do that with Strongbow this time around.

Dr. Alper: That sounds great! Could you elaborate a little bit about your tin property in Cornwall?

Mr. Williams: Sure - we were introduced to the project last year and after visiting the project and conducting our own due diligence we

recognized there was an opportunity here that had possibly been overlooked, certainly tin wasn’t the flavor of the day, although since the start of 2016

tin prices have risen quite strongly from about $13,000 per tonne up to its current level of around $17,000 per tonne. What really attracted us about

South Crofty was that it had been a mine for about 400 years, with production dating back to the 17th century and mining operations continuing up until

1998, and also had very good grades.

The operation shut down in ’98 and a couple of companies tried to work on the project through the last decade and they achieved a number of

things which were very positive from the project perspective. They managed to secure sufficient land to construct a new process facility if and when

it’s required. They also managed to get a new mining permit issued in 2013 and that permit is valid until 2071, so it still has around 55 years to go.

As we all know, mining permits are time consuming and expensive to get processed.. From our perspective, the historic grades, the long history of

mining operations, the fact that there is land set aside for a process plant, and a mining permit in place are all very positive aspects to this

project.

Dr. Alper: That’s excellent. Could you tell me a little bit about the grade and about tenement and function and the property?

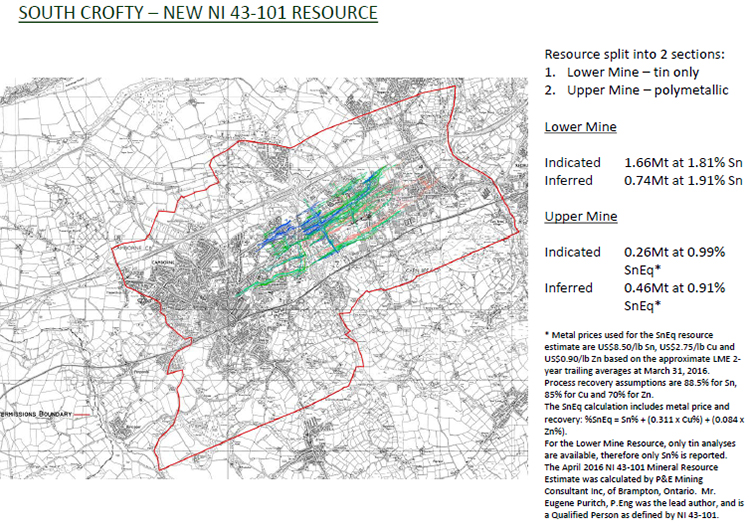

Mr. Williams: On April 19 we published a new 43-101 resource estimate which comprises the polymetallic Upper Mine Resource (tin, copper

and zinc), and the tin-only Lower Mine Resource. The tin-only Lower Mine Resource averages about 1.8% Sn and is the focus for Strongbow. When you

compare the South Crofty grade to other tin projects around the world, Crofty compares very favorably, and in a rising tin price environment those

grades look very attractive.

Dr. Alper: That’s excellent. Could you tell me about the geology?

Mr. Williams: There are two main rock types which host mineralization. There is a metasedimentary rock called “Killas” that typically host

the poly-metallic mineralization. The Killas overlies granite, which typically hosts the tin only mineralization, with Cassiterite being the main ore

mineral. The recovery process for Cassiterite is pretty straight forward - it’s a milling operation with a gravity recovery.

Dr. Alper: Very good! Does that deposit also contain tungsten?

Mr. Williams: No, the mandate for Strongbow is to focus on advanced tin and tungsten projects. We identified two tungsten opportunities in

Northern Canada, and the first milestone in that aspect of the business was to reach agreement with Teck Resources, where we acquired the royalties on

the Cantung and Mactung projects that are located in the Yukon and the Northwest Territories. We announced that deal around PDAC this year. The project

of highest interest is Mactung, which is arguably the world’s largest and highest grade undeveloped tungsten project. Securing those royalties, with

Osisko Gold Royalties’ support, is the first step in the growth of the tungsten side of the company.

The Mactung project is currently owned by the government of the Northwest Territories and indications are that they will be preparing to put

that project out to a tender process, hopefully later this year.

Dr. Alper: By the way I have a background in tungsten, I ran the largest tungsten processing plant that made tungsten powder. It was owned by

GTE and then by Osram Sylvania. We made tungsten powder APT, ammonia paratungstate and tungsten carbide powders. That plant was sold to Plansee, who is

operating it now.

I had a global operation with about seven plants that included the Czech Republic and Mexico. One plant had 2,000 people reporting to me mainly

related to tungsten. If ever you need any kind of advice or consulting on tungsten, I’d be glad to work with you.

Mr. Williams: I’ll remember that thank you.

Dr. Alper: I do remember that you have many other projects beside the one in Cornwall. Could you update our readers on some of those?

Mr. Williams: We have two early stage tin projects in Alaska that we acquired from Osisko, called Coal Creek and Sleitat. They both have

significant historic drill intercepts and form the initial pipeline of tin projects within Strongbow. We also own the Nickel King project in Northwest

Territories, which has very good potential to develop into a significant nickel-sulphide project. There is a 43-101 resource from 2010 that shows

11.1Mt at 0.4% Ni in the Indicated Resource category, and a further 33.1Mt grading 0.36% Ni Inferred. We are looking for a partner to help develop

Nickel King. Finally, we have the Skoonka Gold project in BC, which is a Joint Venture with Almaden Minerals.

Dr. Alper: What are your plans for 2016?

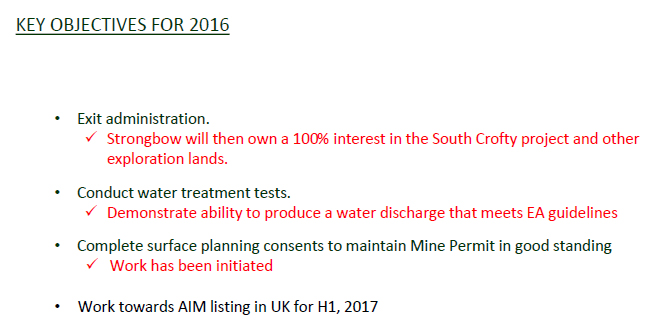

Mr. Williams: Focus on South Crofty. The project was put into administration in 2013. Early this year we reached agreement with Galena (the secured creditor) and a privately funded third party called Tin Shield Production, whereby Strongbow would fund the exit of the assets from administration and thereby take control of 100% of the project.

The next step for us is to get exchange approval for the deal. The main conditions to address are delivery of a 43-101 technical report, the findings of which we published on April 19, and we have to demonstrate that we’ve got sufficient working capital. Once we receive the exchange approval we’ll own 100% of the project.

After that, we need to address surface planning conditions. We’ve started that work, which is required to maintain the mining permit in good standing, and once that is complete, we will start water treatment tests and work with the U.K. environment agency to get permission to de-water the mine. Also, we hope to achieve a listing on the UK’s AIM market in early 2017.

An AIM listing in the U.K. makes sense, given that the project is located there

and there is very good local support to see a revival in mining in Cornwall. Last year Wolf Minerals put the Drakelands Tungsten-Tin Project into production; this was the first new mine in the U.K. for 45 years. There appears to be strong retail and government support for new projects.

Dr. Alper: That sounds like an excellent plan, well thought out. You seem to understand employment, the community and the environment.

Mr. Williams: Yes, and the media response when we initially published the agreement was very positive, with coverage from the BBC, the Financial Times and the Sunday Times and also a lot of interest from the mining community. There’s a large number of people in the mining industry who were trained at the Camborne School of Mines, where South Crofty is located. Camborne School of Mines / South Crofty has produced many mining engineers, many of whom are now working in senior mining jobs around the world. Many of them would love to come back and contribute or see the mine get back into production. I think that’s been very positive.

The other factor to bear in mind is the tin price. ITRI, the Tin Research group presented a compelling argument for dwindling supplies over the coming years, which should see a corresponding rise in tin prices. We are already starting to see that reflected in the tin price which is up between 25% and 30% already this year.

Dr. Alper: It sounds like you have a property that has long life and a long history of being in mining. My memory is that part of England has a certain degree of unemployment and would appreciate a mine being developed in that area, is that correct?

Mr. Williams: Definitely, Cornwall is an area with high unemployment. So again, the response I’ve had from the various Councillors that I’ve spoken with suggests that they would be fully supportive of seeing the mine going again. It’s a shame to see Cornwall, and the long mining history that it has had, in its current state today. But there has been a change within government, and a desire to see mining contribute to the economy, and that is positive from an investment perspective.

Also, look at Dalradian Resources - they are making great progress on the Curraghinalt Gold Project in Northern Ireland.

There is also Sirius Minerals which has a polyhalite deposit in North Yorkshire which they’re hoping to develop. It is a very large scale project that could require in the order of four to five billion dollars in CAPEX, but it has received very good support from the U.K. investment community. The development of these resource projects sends the right signal to outside investors that the U.K. is ready to support new mining projects.

Dr. Alper: That sounds very good, could you tell me a little bit about your CAP structure, your finances?

Mr. Williams: Currently we have twenty-five and a half million shares issued. The largest shareholder is Osisko Gold Royalties, they own between 26% and 27% of the company. The Board and management are all shareholders. The stock is pretty tightly held.

Dr. Alper: It’s been a terrible five years, but things seem to be changing in the last few months, so I’m hoping that continues. What do you think about the mood of the investors?

Mr. Williams: I certainly see a few deals which have had quite incredible runs over the last few weeks. I think people are starting to identify the standout projects. For example, in Uranium space the Nexgen discovery is excellent, and then you look at Lithium X which has just exploded. I’m not sure what assets they’ve got but clearly there is a lot of interest in the lithium space currently. I’m also reading more about interest in gold, and gold being attractive in an economic environment where certain bond issuances provide negative yields. There is still some uncertainty about how strong the recovery is in the U.S., and that has also fueled the relative strength in gold to a large degree.

Investors are starting to look at selective projects in the gold space, such as Dalradian, Kaminak, Midas Gold, Auryn. It is good to see capital being deployed. We’ve also seen a couple of M&A deals recently - True Gold and Amara in West Africa, Claude Resources in Canada. In a rising gold price environment M&A can be great for shareholders where maybe you have two different assets or two different projects, which in isolation don’t carry the same value as they do when they’re combined. We are starting to see that in this market currently.

Dr. Alper: Things are beginning to climb and people are coming back looking at mining as a place to invest and generate wealth. Is there anything else? Could you give me the primary reasons why investors should invest in your company?

Mr. Williams: Companies have to have a strong team, a good project, and good access to capital, especially when times get difficult. We have a very strong board of directors for the size of our company, and we have Osisko as our biggest shareholder.

To have Osisko as a partner building Strongbow is very reassuring, and at the right time and place when we do need larger infusions of capital, obviously having the Osisko backing is going to be very important. Aside from people and financial support, our focus has been quality projects, reflected in the South Crofty and Mactung royalty acquisitions. It all comes down to grades, quality of project, people and money and I think we meet all of those criteria.

Dr. Alper: That sounds excellent! I think you and your board have good plans, great support with Osisko and others. It sounds like you’re doing the right things. I would think that would be a very strong reason for our readers and investors to consider investing in your company. Is there anything else you would like to add?

Mr. Williams: Not right now. I think the news flow to come over the next few months will show that we are accomplishing our objectives. We’ll file a 43-101 resource report and work towards hopefully making a production decision at South Crofty. We’ve got a plan and we’ll work towards it.

Dr. Alper: It sounds excellent.

http://www.strongbowexploration.com/

Strongbow Exploration Inc.

Suite 580 - 625 Howe Street

Vancouver, BC

Canada V6C 2T6

Telephone: +1 (604) 638-8005 +1 (604) 638-8005 +1 (604) 638-8005

Fax: 604-336-4813

Website: http://www.strongbowexploration.com

Email: info@strongbowexploration.com

|

|