Interview with Larry W. Reaugh, President and CEO of American Manganese Inc. (TSX.V: AMY; OTC-US: AMYZF; FSE: 2AM): Recycling Cathode Metals in EV and LIB Batteries

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 6/12/2018

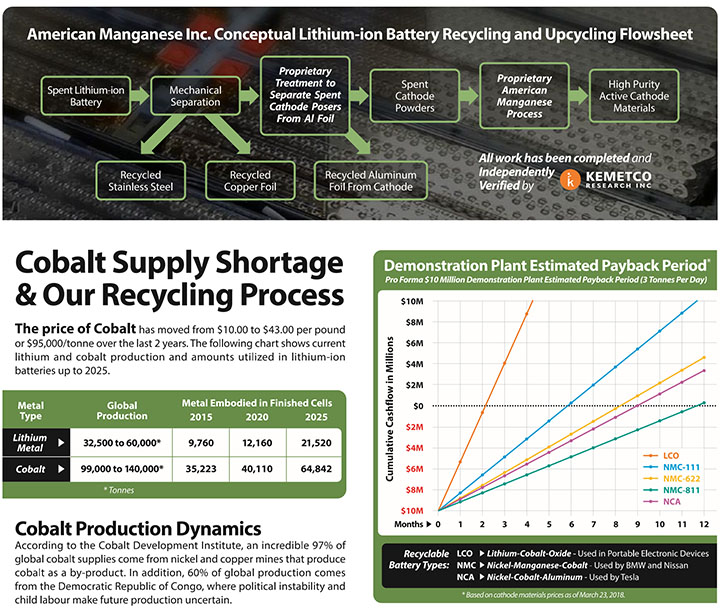

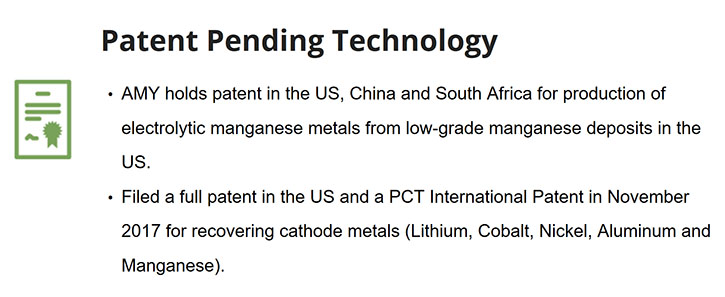

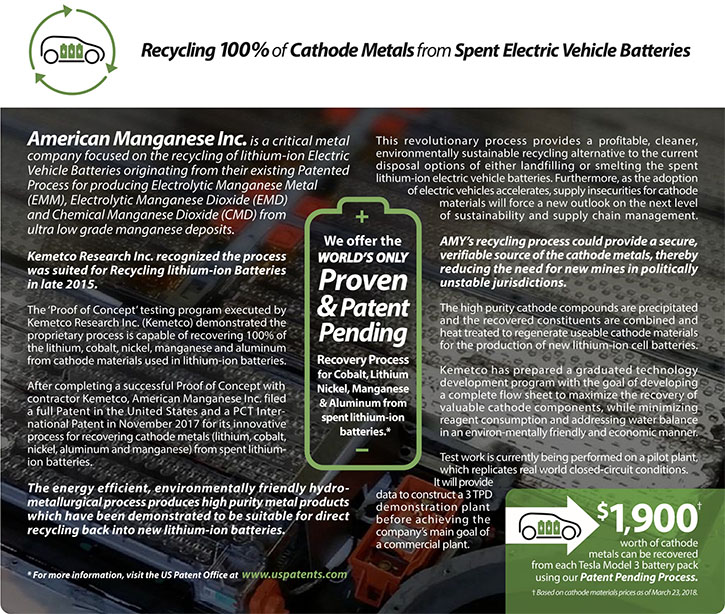

American Manganese Inc. (TSX.V: AMY; OTC-US: AMYZF; FSE: 2AM) is a diversified specialty and critical metals company, focused on capitalizing on its patented intellectual property, through low cost production and recovery of electrolytic manganese products throughout the world, and recycling of spent electric vehicle lithium ion rechargeable batteries. We learned from Larry W. Reaugh, President and CEO of American Manganese, that they are currently focused on recycling cathode metals from LIB batteries. The technology, the company had developed, to produce manganese metal from extremely low-grade material has been adapted to achieve high recoveries of lithium, cobalt, nickel, manganese, and aluminum from spent lithium ion batteries. The patent was recently published by the US Patent Office. Plans for 2018 include working on two other patents, building the pilot plant and using pilot plant data to scale up to a three tonne a day demonstration plant. According to Mr. Reaugh, American Manganese is the most advanced company with a cathode material recycling solution and it is getting attention from China, Japan, South Korea, as well as from North America and Europe.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Larry W. Reaugh, President and CEO of American Manganese Incorporated. Larry, Could you give our readers/investors an overview of American Manganese, your focus and current activities?

Larry Reaugh: Well, Al, American Manganese is a critical Metals company. We are focused, right now, on recycling the cathode metals in an EV LIB battery. This devolves out of our technology breakthrough, made back in our mining days with manganese, which enabled us to recover and produce manganese metal from extremely low-grade material (2% or 3%) from Artillery Peak. The US Bureau of Mines spent millions of dollars and decades trying to achieve what we did. We were able to do that at costs comparable to China’s. We actually went through a pre-feasibility study and we had the process vetted by one of the biggest engineering firms in the world, Tetra Tech. But even with all that, the price of the metal defeated the feasibility; it just kept dropping. It's still down there, it's still down around 90-95 cents a pound, which is just too low. You couldn't raise money and build an operation at that price. So we put that on the shelf.

Kemetco was going through the chemistry, while doing some work on cobalt. They realized that the cathode chemistries were the same and should react to our process, with some changes. They called me and said, "We think your process could recover materials for a lithium ion battery." We did a scoping proof of concept, and sure enough, we got high recoveries of lithium, cobalt, nickel, manganese, and aluminum. To start with, we did the lithium cobalt battery, because that was in the initial Roadster of Elon Musk's Tesla car. We got high recoveries in both of those metals. They're the ones that you want to get.

So we moved onto another big expenditure, between a million and two million dollars over the year to beef that work up and file a patent. That patent was filed November of last year. That patent has been recently published by the US Patent Office. We looked at the investigative research that goes along with a patent, and we can't see any conflicting technologies. So we feel we're good on that front.

We've had a lot of interest in our recycling technology. We've been picked up by Bloomberg on a couple occasions and Reuters on one occasion. We're fairly well known out there. We've been invited to present at conferences all over the world. I'll be presenting in June at another conference in Las Vegas on lithium ion battery recycling. It's been a very exciting ride. You'd think we were working on trying to clean sludge out of a drain, the way the market is treating us. I think that is a direct response to what we're getting from the predator traders out there. It looks like we definitely have a process that will work on the cathode materials. We have a business plan that you can see on our site. You can see the project and the economics of a three tonne a day operation, which is actually quite interesting, because you could be depending on the battery chemistry. But I’ll take the middle road and say it's just between 10 million and 60 million a year on the high end. But I'd say the middle road is somewhere between 20 and 30 million worth of product a year, and that's pretty good for a little three tonne a day operation.

Dr. Allen Alper: Sounds like you have excellent proven technology. What are your plans for the current year?

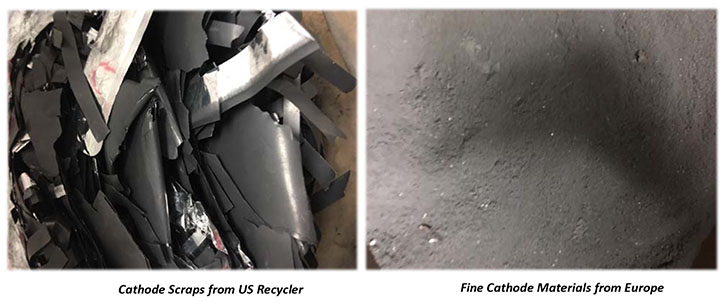

Larry Reaugh: We're currently working on two other patents that we want to file before the granting of the original patent. We're also working on the pilot plant, so we can do testing on a continuous basis. We have what we call scrap material, which is the stuff that's rejected from a battery manufacturer, and this is just the cathode material on an aluminum foil. Or, it could be the anode material on a copper foil. We’ve been told that we can get three tonnes a day from a recycler in the US. Therefore, we're looking at building a three tonne a day demonstration plant, after the pilot plant is done. The demonstration plant has been estimated to cost somewhere around $10 million. These are all ballpark numbers, but you know, it's based on the best knowledge you have from people, who build plants, right? When we get the pilot plant done and do the scale up, we can give you an estimate of what the actual cost is.

But the idea is to build a plant. We have a lot of interest in what we're doing out of Asia, specifically China, Japan, and South Korea. We're getting some interest out of North America and Europe. The Asians are way ahead in their thinking compared to their counterparts here in the US or in Europe. They've cornered all of the markets in lithium, and they've cornered the markets in cobalt. It's a race to the finish line. But, we've gotten good results all the way through.

Kemetco's a research contractor. They don't own any shares in AMY, or anything in the technology. So they're independent. They're not a company with an in-house lab with a couple of employees that are trying to find a metallurgical solution. What Kemetco tells us is what they receive, and what they receive, we report.

Dr. Allen Alper: That sounds great. Now your technology is protected by patents, and you're also applying for new ones.

Larry Reaugh: The original manganese patent is granted in the US, China, Canada, and South Africa, and we've applied for patents in the US and PCT International Patent on the recycling process.

Dr. Allen Alper: That sounds good. Could you tell our readers/investors a bit about your background, and your advisory board?

Larry Reaugh: I've had companies that have actually been involved in discoveries and have gone into production. I've been the CEO of a company that went into production, and I've been the CEO and President of two or three other companies that made discoveries, and eventually went into production. One I sold off and the others I let go during a period in the market when things weren't quite working out with my partnerships. I've been involved in trying to list an internet stock back in '99/2000 just before the bubble burst. Everything was looking good, but that was at Liquidationshop.com.

Then I got involved in tough projects, like molybdenum when nobody knew anything about it, manganese when everybody knew even less about it, and now recycling. We're the only ones out there that are coming up with any kind of results. That's good for competition, but it's not good for market activity. So the more, the merrier, I always say. When more people are talking about it, there is more interest from investors.

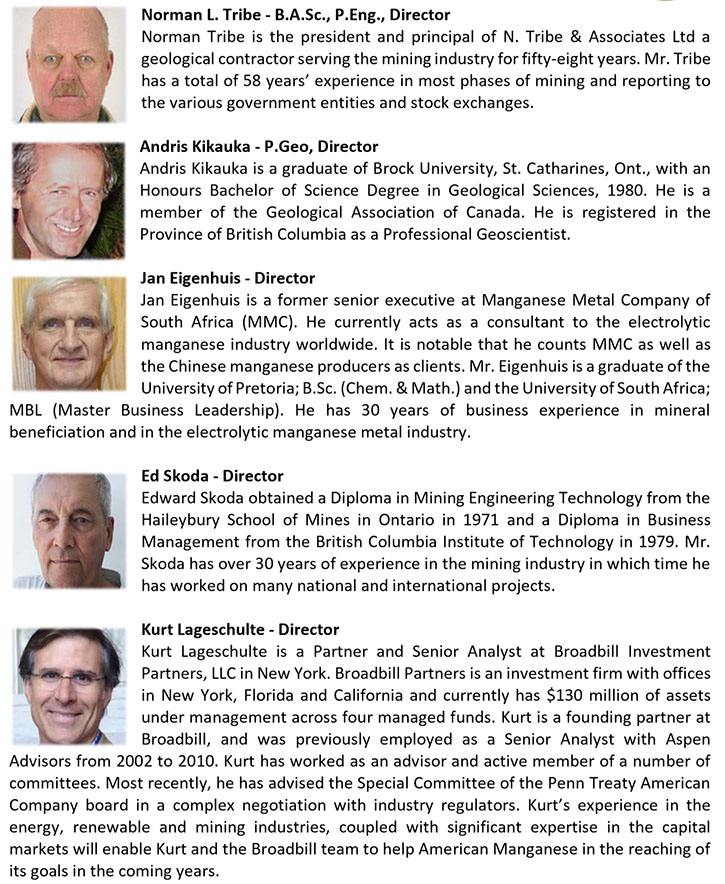

I have a good board of directors, such as, Jan who has experience in operating metallurgical processes at manganese plants in South Africa. My board consists of a few mining people. I have people on the board that have worked on my projects in the past. I have an investment firm representative. We have some stellar people on the advisory board. We have David Langtry, who has half a dozen inventions under his belt. He's an independent business owner, and he's been a big benefactor, financing the company. We have Dan McGroarty, a lobbyist out of Washington D.C. who did all the speech writing for the Bush family. He's tightly connected with Congress and he's one of the main links, when it comes to critical metals, between Congress and the rest of the world. And we have Shailesh Upreti who received a half a million-dollar direct award in New York for his contribution to the lithium ion battery industry. He is now the president of the 15 GWh battery factory being initiated out of New York.

Dr. Allen Alper: Well that's a very impressive group, that's excellent. Could you tell our readers/investors a bit about your share structure?

Larry Reaugh: There're 162 million shares outstanding in the company. Probably 20-30% are controlled by the board and the advisors, and probably another 20% controlled by people that I know personally. The rest is in the float. Right now, we have a million and a half in the treasury, enough to get us through the pilot plant work. The market cooperating, we'll probably get some warrant exercise. I really don't want to have to go back to the market, but if I do, I will. And who knows? I might get a partner in the meantime. But anyway, that's kind of where we're sitting with the share structure. I don't know if you want to know what our symbols are.

Dr. Allen Alper: Yeah, why don't you tell our readers/investors your symbols?

Larry Reaugh: We're traded on the TSX Venture Exchange under the symbol AMY. We're traded in the US under the symbol AMYZF. We're traded in Frankfurt Stock Exchange under the symbol 2AM.

Dr. Allen Alper: Thank you. What are the primary reasons our high-net-worth readers/investors should consider investing in American Manganese Inc.?

Larry Reaugh: Well, if they're following the EV car manufacturing statistics and the battery statistics and the cobalt shortage and everything else out there, it's going to be a huge, multibillion dollar business at some point. So this is just scratching the surface. We're the most advanced company with a recycling focus and a recycling solution. Also look at is the cobalt shortage. In a few years, we could represent 20-30% of all the cobalt coming back into the market from our recycling. That's significant, and it's going to be needed, because the cobalt price is $92,000 a tonne, so that is indicative of where it's going to go. I'm projecting it'll go well over $100,000 here pretty soon. I think it's a space to be in, the price is right on the shares.

Dr. Allen Alper: Sounds like excellent reasons for our high-net-worth readers/investors to consider investing in your company, Larry.

Larry Reaugh: Yeah.

http://www.americanmanganeseinc.com/

Telephone: 778.574.4444

Fax: 604.531.9634

Head Office:

#2, 17942 55th Avenue

Surrey BC

V3S 6C8

Larry W. Reaugh

lreaugh@amymn.com

|

|