Avrupa Minerals Ltd. (TSXV: AVU): A Prospect Generator, Aggressively Exploring in World Class European Districts, Interview with Paul Kuhn, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 3/27/2018

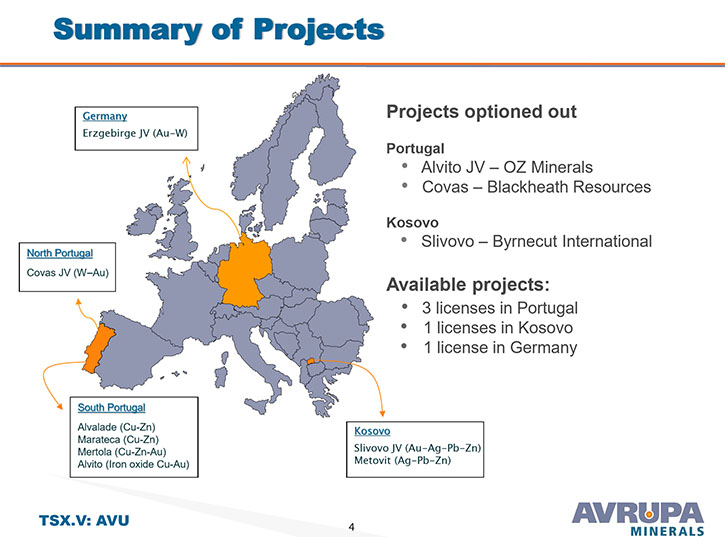

Avrupa Minerals Ltd. (TSXV: AVU) is a growth-oriented junior exploration and development company focused on aggressive exploration, using a modified prospect generator model, for valuable mineral deposits in politically stable and prospective regions of Europe, including Portugal, Kosovo, and Germany. According to Paul Kuhn, President and CEO, of Avrupa Minerals, their plans for 2018 include a 1,500-2,500 meter drilling program at their Alvito iron oxide copper-gold joint venture project in Portugal, as well as getting their Kosovo projects going.

On March 5th Avrupa Minerals announced that it signed a non-binding Letter of Intent (“LOI”) with a subsidiary of an international mining company to option out three exploration projects located in the Pyrite Belt of south Portugal. The funding partner will provide a first stage earn-in amount of 13 million euros (approximately C$20.3 million) for exploration programs over the next three years to acquire a 51% interest in the projects. The parties are currently finalizing a definitive agreement for each of the licenses.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Paul Kuhn, President and CEO, of Avrupa Minerals Ltd. Could you give our readers/investors an overview of your company?

Paul Kuhn: Hey, Al. Nice to see you. Yeah. Avrupa is a prospect generator. We like to call it an opportunity generator these days. We're working in Europe. Our main areas are Portugal, Kosovo, and Germany. Portugal has been our emphasis this past year. We have a joint venture with OZ Minerals on our iron oxide copper-gold project. We're planning a drilling program for that, which should start in the next month or so.

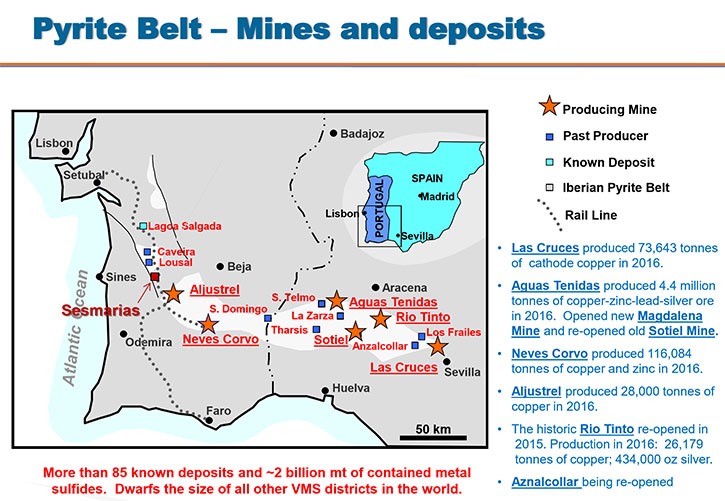

We have three licenses in the Portuguese part of the Pyrite Belt, which is a long, long standing mining area since pre-Roman times. So, we have three licenses in some of the better parts of the Pyrite Belt, and we just put out an announcement that we're doing a joint venture. We're working on a joint venture with an unnamed but large mining company for all three of the licenses.

Dr. Allen Alper: That sounds exciting. Could you tell us a bit more about those properties?

Paul Kuhn: The three properties are Alvalade, Marateca, and Mertola. They're all in the Portuguese Pyrite Belt, which is a copper-zinc district. We've worked on Alvalade for quite a while now, and we made a discovery there in 2014, called Sesmarias. It's a copper-zinc massive sulfide discovery. We have another one nearby, called Monte da Bela Vista, which is a stockwork zone. The property itself has 35 or 40 other places to look for deposits. We've identified targets in all these places.

It has two former operating mines, the Lousal Mine, a 50-million-ton deposit, and the Caveira Mine, a four or five-million-ton deposit. We believe that Lousal still has 30 million tons of material left in the deposit, and our Sesmarias discovery is possibly the other side of the deposit across a major fault. Marateca is a greenfields property. We've done a little bit of drilling up there. We've found mineralization in a number of places. It has 13 known areas of targeting, but a lot of land in between that has never been looked at, which is buried under cover.

Mertola is on the Spanish border, and there are two past producers over there, the São Domingo mine, and the Chança mine, and we have targets at both those places. São Domingo was a 25-million-ton producer. Nobody has found the other lenses. Typically, there are three, or four, or five, or six other lenses in these Pyrite Belt deposits, and we're now in the position, with this new joint venture, to go look for them.

Dr. Allen Alper: That sounds exciting.

Paul Kuhn: Yeah.

Dr. Allen Alper: Sounds like 2018 will be an important year.

Paul Kuhn: What's the term here? Knock on wood? Some might say, "Inshallah." But yeah, we should have a pretty good year. Our joint venture with OZ Minerals has been working nicely. We're meeting with them at PDAC, to talk about our drill program. We anticipate 2,000 meters of drilling on this one and 15 holes.

Dr. Allen Alper: Sounds exciting! That's really great.

Paul Kuhn: We're doing virtually nothing in Kosovo right now. We have one license that we've done a bit of work on, and our Slivovo gold deposit is still being operated by our partner. We're not diluted to 10% yet but it's getting there. We'll be pretty close and then we'll have a 2% NSR. However, I was in the Kosovo session yesterday.

I was the only industry speaker in the show with all the government people. The government is finally, finally, finally, after 10 years, promoting their areas of national interest, which are seven or eight licenses that they've held back for whatever reason, political reasons mostly. Now they're putting half of them out, and it brings a little bit of excitement for me into Kosovo. If we can get ourselves going with Portugal, then I can turn some attention over to Kosovo, where there are a number of licenses that we like, that are going to be available. So Kosovo's going well, as can be, for the moment.

Germany, we're not doing anything there. I'm looking for somebody to take over my portion of a property that has gold, tin, and some cobalt possibilities. I'm talking with two or three potential partners, as far as that goes. So we're working to really promote Portugal this year. Secondarily, get back into Kosovo in a meaningful way. This could be a really good year for us.

Dr. Allen Alper: Oh, that sounds fantastic.

Paul Kuhn: Yeah. It is. It is good. We're really excited about this whole thing.

Dr. Allen Alper: Could you tell remind our readers/investors about your background, and your team, and your board?

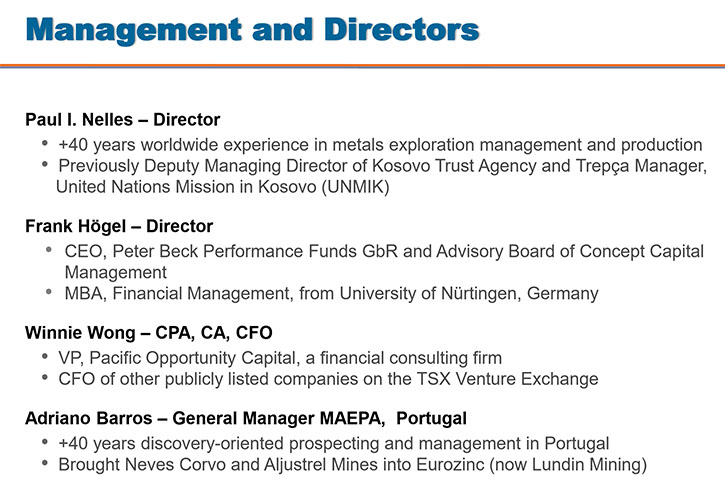

Paul Kuhn: I've been an exploration geologist for 40 years. I've worked all over the world. Well, not Africa or South America, but I've worked in Central Asia, I've worked in Europe, I've worked in North America. I've been part of a number of discoveries in Turkey and now Portugal and Kosovo. Mark Brown is our Chief Financial person. He's Chairman of the Board. He runs a boutique financing and financials company called Pacific Opportunity, based in Vancouver. His group is sort of the umbrella company over our company and several others.

Winnie Wong is the Chief Financial Officer, and she works at Pacific Opportunity, as well. She's part of the team that runs that company. On our Board we have a mining engineer, Paul Nelles and a financial person, Frank Högel, both from Germany. We have a financial person in Vancouver, Ross Stringer, a geologist based in Coeur d'Alene, Idaho, Paul Dircksen, and Mark Brown, and myself. So great board, we work together well. We cover lots of opportunities.

Between the technical and the financials, the Company's in good hands. This new joint venture, when we sign it, should provide us an opportunity to raise money at a much higher price than we are seeing right now. Today stocks have gone from 8.5 to 9.5, as of an hour ago on pretty heavy trading, so we'll see. I don't know what it's at right now. I haven't looked.

Dr. Allen Alper: That's exciting.

Paul Kuhn: Yeah, a little bit. We've been holding back on our properties in Portugal for a couple of years right now because of the lack of money. One partner disappeared on us, left us holding the bag. We paid off all the debts that they should've paid off. We did all that. We did all the right things. Everybody in the area is happy with us. The other two properties are a little bit on the old side, but we're ready to go on them. We have some time with them, and the Alvito project is just going great right now, so good news for Avrupa lately.

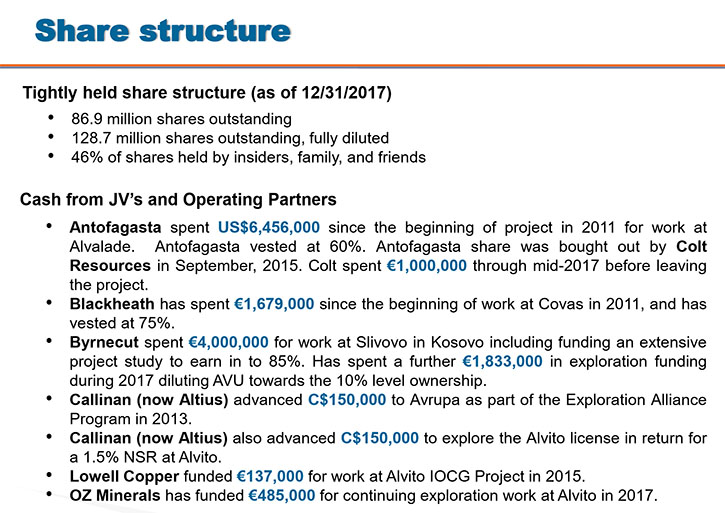

Dr. Allen Alper: That sounds excellent. Could you talk a bit about your share structure and capital structure?

Paul Kuhn: The stock is at about 9.5 cents this morning. There are 85 million shares out. I don't know how many options are out. It's another 30 million or 40 million, or something like that. We're going to lose some of those options pretty soon. 45% of the company is held by board members or groups very close to the board, and another 25% is held by strong, maybe 30% strong hands, people we've known for a long time that have got lots of shares, that have been with us since 2010, that sort of thing. So the market float is 25%, 30% of the shares. We're traded on Toronto Venture under AVU. We have a listing in Frankfurt (8AM) and a listing on the US DEC (AVPMF)

Dr. Allen Alper: That sounds very good.

Paul Kuhn: Yeah, things are going well.

Dr. Allen Alper: What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Paul Kuhn: We're underpriced, in my opinion, so anything new that we do right now should be pretty positive for the shareholders. We're a good group. Financial people and technical people work really well together. We're in a great jurisdiction in Portugal, it's really elephant country. Kosovo is also elephant country. I'd like to get back to that one. It's another good reason to be following us. We have some other ideas in Europe. I'm looking a little bit in Morocco, although right now Portugal is really going to take my time for the near future, followed by Kosovo.

Dr. Allen Alper: Excellent! Very exciting!

Paul Kuhn: Yeah. It's pretty exciting.

Dr. Allen Alper: But, a lot of hard work, a lot of patience.

Paul Kuhn: You know, Al, hard work is the understatement. The team has really been helpful, both in Vancouver and my crew in Portugal, in particular. I have a couple part-time people in Kosovo that have stuck with me, even though they're not getting paid very much, and they're only working part-time. So just getting this joint venture going will allow me some flexibility to work in some of my other places, too.

Dr. Allen Alper: Oh, that sounds excellent. Is there anything you'd like to add, Paul?

Paul Kuhn: Nope. You heard it all. You're the first guy on the scoop here.

Dr. Allen Alper: Thanks for sharing that with our readers/investors.

Paul Kuhn: Well, my pleasure. Thanks for keeping up with us, and giving us a break, and all those other goodies that you help us with.

Dr. Allen Alper: It’s always great talking with you.

http://www.avrupaminerals.com/

Paul W. Kuhn, President and Director

1-604-687-3520

|

|