Wheaton Precious Metals (NYSE: WPM, TSX: WPM): The World’s Largest, High-Margin, Pure Silver and Gold Streaming Company, Interview with Randy Smallwood, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 3/19/2018

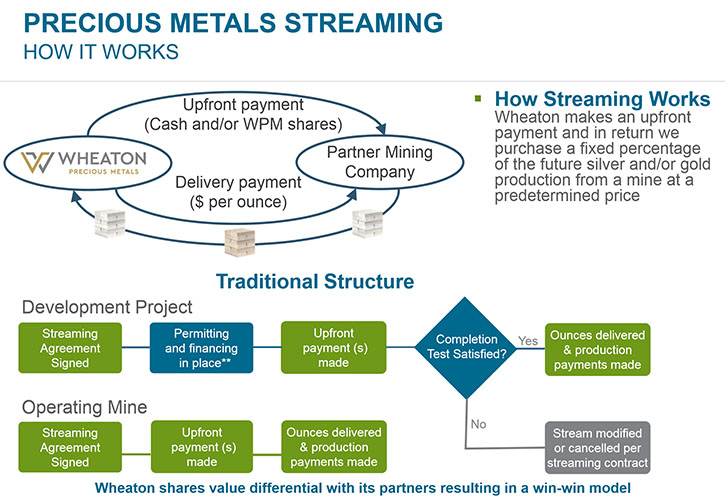

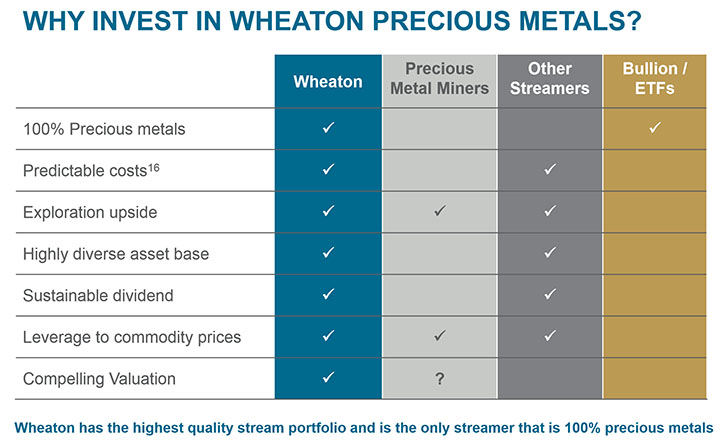

Wheaton Precious Metals (NYSE: WPM, TSX: WPM) is the world’s largest, high-margin, pure silver and gold streaming company, that offers investors cost predictability, direct leverage to increasing silver and gold prices, and a high-quality asset base. We learned from Randy Smallwood, President and CEO of Wheaton Precious Metals, that they produce substantially more metal than any other streaming company, and have substantially more cash flow than any other streaming company. Their business model is to enter into contracts with mining companies to purchase the right to all or a portion of the gold or silver production for an upfront payment and an additional payment upon delivery of the precious metal, which is typically at a low, fixed price. The gold and/or silver is then delivered to them and they turn around and sell that back into the marketplace at the spot price. Their cashflow is the difference between their fixed payment and the current spot price. Because it's a percentage of whatever the mine produces, they also get exposure to any exploration success or expansion potential. Such business models deliver all the benefits of a good sound mining investment, but don't have the cost risk that a traditional mining investment has. So it's much more attractive than your traditional mining company.

Salobo Mine, Brazil, owned and operated by Vale

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Randy Smallwood, President and CEO of Wheaton Precious Metals. Could you give our readers/investors an overview of your company, your focus and current activities?

Randy Smallwood: That's right. Wheaton Precious Metals is a streaming company. We supply capital to mine operators, and for that capital we get a portion of the metal they produce. As the name implies, we focus solely on precious metals.

We created this company in 2004, and we essentially developed the business model. It's a bit different from royalties in the sense that what we do is a contract, so it's a contractual relationship between the operator and ourselves. We focus on getting byproduct precious metals, for example gold from copper mines or nickel mines, or byproduct silver from copper mines or lead-zinc mines, or for that matter gold mines.

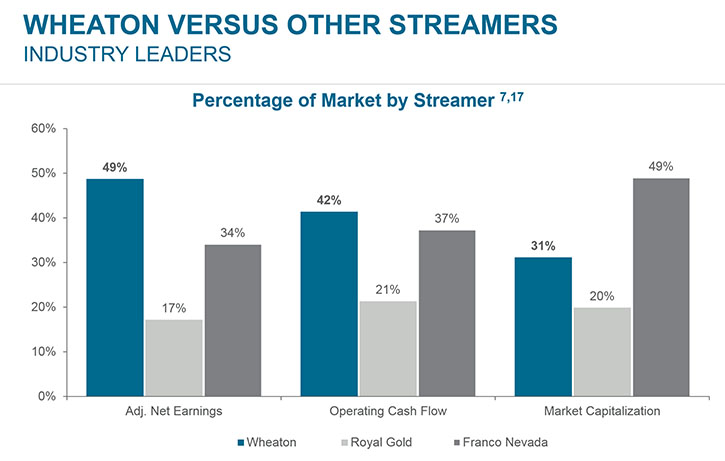

By production, we're the largest streaming company, streaming-slash-royalty Company. That tends to be our peer group. We produce substantially more metal than any other streaming company, and have substantially more cash flow than any other streaming company. We continue to focus on precious metals. 100% of our revenue comes from silver and gold. It's a good, strong company that's had a good track record of making great quality investments.

Dr. Allen Alper: That sounds excellent! Could you describe a bit more about how the streaming process works?

Randy Smallwood: We approach companies that have a capital requirement and establish a contractual relationship with them to purchase the rights to a percentage of their gold or silver production. For example, we have a contract to receive 75% of the gold produced from the Salobo Mine, which is owned and operated by Vale. Through three separate transactions with Vale, we now receive 75% of their gold production for a cumulative total of $3.1 billion in upfront payments that's been paid to Vale. Salobo is currently producing well over 200,000 ounces per year, and they're looking at expansion.

The benefit of a streaming company versus a traditional mining company, from an investor's perspective, is that our costs are fixed as they are determined at the time the streaming agreement is entered into. The investor knows that our gold will always cost us around $400 per ounce. Whereas with a traditional mining company, the costs aren't fixed, and quite often they're a negative surprise to the investor. In our company, the costs are fixed and known, and so that's a real advantage to investors out there.

With the streaming model, we make that upfront payment, and then as the gold is delivered to us we'll make a production payment of $400 per ounce. Then we turn around and sell that back into the marketplace at the spot price, or we try to do a little bit better than the spot price. Of course our cashflow is the difference between $400 and whatever the spot price is. Again, a huge advantage to our investors is when the price of gold goes up $10, $20, $50, that benefit directly impacts us. Again, our cost stays the same even though the commodity price climbs. It gives great exposure to the commodity prices.

Because it's a percentage of whatever the mine produces, we also get exposure to any exploration success or expansion potential. It delivers all the benefits of a good sound mining investment, but a streaming company doesn't have the cost risk that a traditional mining investment has, so it's much more attractive than your traditional mining company.

Randy Smallwood: The way it works, for example, is at a copper mine the gold is contained in the copper concentrate, and it is shipped off to a copper smelter. When the concentrate gets shipped off to the smelter, the smelter charges a fee for processing that. Then, they'll either deliver the metal back to the mining company or they'll sell it into the market and just deliver cash. It's irrelevant to us. What we have is a contract that says once the company receives payment from the smelter for that concentrate, then they must give us an equal amount of gold to what we're entitled. For example, if we are entitled to 75% of the gold production, and the mine operator sends off copper concentrate that contains about 100,000 ounces of gold, once they get paid for that copper concentrate, they then purchase 75,000 ounces of gold and deliver it to us.

We can take it in physical. We can take it in a metals trading account, which means it just stays with some of the metals traders out there. Then we turn around and sell it back to the market, we don't hold it for any length of time, we never hold metal through a quarter end, and we just do some short-term price optimization trading. That's about it. We don't hold metal. Our belief is that our business focus is to deliver consistent metal production that is profitable, and not to get into holding or hedging metal holdings.

Dr. Allen Alper: Excellent! Could you tell us a bit about your background, your management team and your board?

Randy Smallwood: Sure. One of the advantages of this company is that although we're close to $9 billion USD in market cap, we have a total of about 35 employees. It's a very small team. Our focus is mainly on high quality assets, and so most of our work is done during the due diligence process, but then we also have to stay on top of what's happening at these assets.

I'm a geological engineer by training, and spent many years doing exploration geology work up in northern Canada, and all through British Columbia and western Canada. Plenty of experience! I had the benefit of finding and then bringing into production a very successful, small scale but very profitable, gold mine in northern Canada. It was a great learning experience for me over the course of ten years, from discovery through to production. I stayed on as ultimately production manager, or project manager, and then mine manager. It was a great experience for me. I have a lot of respect for how hard it is to operate mines, to build mines successfully, and I'm very, very technically driven.

On our management team, my CFO's been with the firm for ten years now. Our SVP of Corporate Development joined us probably eight years ago, came onboard as a mining engineer with a strong technical background. We are a strong management team that's been working together for a long time, and we still really enjoy working together. We work very well as a team.

When we created this company, it was a spinoff from Goldcorp. So, we had some common directors that used to be part of Goldcorp, and stayed on with us afterwards. They have since stepped off, but Doug Holtby's our Chairman with a strong background in business here in Canada. We have a very well-balanced board. There are a couple of others, Chuck Jeannes and George Brack, they are well known in the mining industry. Chuck was a former CEO of Goldcorp, and George Brack, a former investment banker, with Scotia Capital and Macquarie bank in the past. It's a strong board with diverse and broad skillsets all the way across. Chantal Gosselin joined our board about three years ago. She's a mining engineer by background, and again a name that's pretty well known in the mining industry, especially on the investment side in terms of looking for quality investments. Chantal’s been a real key add-on in terms of technical strength.

So a strong management team and board, stable on all fronts. We haven't had any turnover on the senior management front for quite a few years now, and it's because we love this company. We think we have the best business model out there, and we just continue to focus on growing it, and have fun doing it.

Dr. Allen Alper: That's excellent. Sounds like you have a great background, your team has a great background, and you have an excellent board too.

Randy Smallwood: Yeah. There's a real focus on the technical side. We put in a lot of effort in terms of making sure we make sound technical decisions. I constantly remind our team, including our geologists, engineers and metallurgists that work here, that sometimes the most important decisions are to not invest in certain assets. It's a good, strong team.

Dr. Allen Alper: That's excellent. Could you elaborate a bit on your key streaming properties?

Randy Smallwood: Certainly. The main one of course is the Salobo Mine down in Brazil. It's a relatively new mine, it only started production back in 2011-2012. It's a deposit that has huge exploration potential. Basically, Vale just got to a billion tons of reserves and stopped drilling, and said no more, let's get it up and running and producing, and generating cashflow.

What's really exciting is this year they finally brought the drills back on. It's the first drills on this property since 2003. They're now testing the deeper extent and the strike extent of this ore body and doing some drilling. The one we're interested in is the depth extent, because this is an ore body that looks like it could grow substantially. They're already talking about a third phase of expansion. They're hoping to make a decision on the scale of that expansion by the end of this year, in terms of how big and when they're going to do it. We eagerly await for that to move forward. This is a deposit that still has a lot of optimization and maturing capacity, and exploration success, and therefore expansion potential. It's a great asset, a good cornerstone asset.

A couple of other key assets are:

At Antamina, we get 100% payable on Glencore’s 33.75% of the total silver produced at the Antamina mine in Peru, which is one of the more incredible mines in this world, poly-metallic. It produces copper sometimes, produces zinc other times, but it produces silver all the time, and so we get about five million ounces of silver a year from that mine, varying as high as I think last year we were up over six.

Goldcorp’s Peñasquito mine in Mexico is an excellent asset as well, just going through a pyrite leach installation, a program to try to improve recoveries. We're expecting a bump up in silver production there, somewhere as high as anywhere between five and seven million ounces of silver from that mine per year. We get 25% of silver production from the Peñasquito mine.

The San Dimas mine is another key asset, which is in the process of being taken over by First Majestic. It was the first stream we'd ever done, and it was a pretty hefty burden on the asset, and so quite happy to have a newly renegotiated stream with First Majestic as they take over the San Dimas mine. We think the new stream is first off a lighter load, but second off, it's more evenly balanced across the property and therefore should open up all sorts of opportunities for First Majestic to take the San Dimas mine and return it to its former glory. It's an incredible asset, it has a very long operating history in Mexico, and we're confident that there's still a long future in front of it. We think First Majestic will be a good company to have as an operator, it's the type of mine that First Majestic has a lot of experience with.

Dr. Allen Alper: Sounds like excellent assets that you have, that's great. Could you tell our readers/investors a bit about your capital structure?

Randy Smallwood: We're not believers in cash, we're believers in metal, and putting cash back into the ground to get the rights to metal. We have a $2 billion revolver that's available to us, and we're probably $700 million drawn into that right now, so our net debt is around $700 million. We're very comfortable with that. Our interest rate on that revolver is around 2%, maybe a little bit over 2% right now, so it's very attractively priced debt. It's our preference to use debt versus issuing shares. Some of our peers have a habit of doing a financing at the worst times, diluting their existing shareholders. We're very negative on that. We have issued equity in the past to fund some of the acquisitions, but there always has to be a use of proceeds. We'll never just do it for general corporate purposes.

Our preference of course is putting the money back in the ground, and I hope that we always stay on the negative side of the cash balance. I think that having a bit of debt in our books just makes our balance sheet that much more efficient. In our case, we have strong current capacity of well over a billion dollars as well as a strong balance sheet and capital structure.

We trade both on the Toronto Stock Exchange and the New York Stock Exchange. Probably two-thirds of our trading happens in New York, and the other third happens in Toronto. I think we're about 60% institutional, about 35% to 40% retail. Because we do have a bit of a silver bias, more silver than the average precious metals company, we do get a little bit more retail, but as gold has become a little bit more important to us, we've seen the institutions step in and start taking large positions in the company.

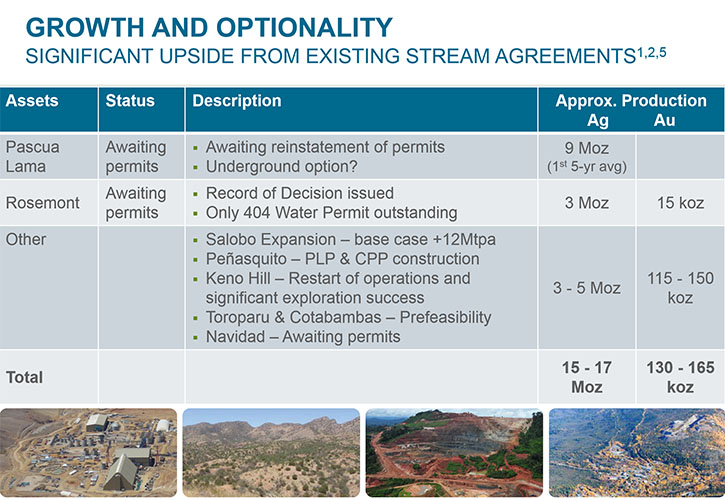

Dr. Allen Alper: That sounds excellent. Could you tell us a bit about the growth opportunities your company has?

Randy Smallwood: Yes. We have a few projects organically within the company itself. The Rosemont copper project in Arizona, which is owned by Hudbay, it's just waiting for its final permits before it can go into construction. We're hoping that happens sometime in the next couple months. For that, we'll get 100% of the silver and 100% of the gold, and so a good quality asset. We'll probably see about four million silver equivalent ounces. Most of that is silver. It's about three to three and a half million silver ounces per year, and then the rest is made up of a bit of gold, about 15 to 20 thousand ounces of gold per year. We still have to fund that one. It's about $230 million to fund that as part of the construction budget.

We also have a stream on the Pascua-Lama project. Barrick is aggressively looking at converting it to an underground mine and is trying to come up with a way to get that mine into production. We get 25% of whatever silver is produced from that mine. It's the best half-built gold mine in the world and to Barrick's credit, it'll produce close to a million gold equivalent ounces per year, but for us we would see somewhere in the order of between seven and nine million silver ounces per year from our portion of the silver, so it's a great asset. Barrick's had challenges in Chile, but they continue to work their way through that process and are pretty focused on advancing Pascua-Lama.

Our biggest area of organic growth is the potential for expansion at the Salobo mine. Right now we're receiving well over 200,000 ounces of gold per year from this mine. Their base case for this expansion study that they're going through is a 50% increase in production, and I say base case because they're trying to decide whether they should just double production. It is a mine that has that capacity. Its current operating capacity is about 60,000 tons a day, so there's no doubt to potentially take it up over 100,000 tons per day. There are many copper mines that operate at those kind of capacities, so Vale is going through those studies over the next while.

Lots of organic growth within the company that could add up to 45% on top of our current production levels, and so some good organic opportunities. We're still very active on the corporate development front in terms of looking at new projects, and new opportunities. We closed a small transaction last year on Kutcho Copper. It's a small copper project here in BC that has some healthy precious metals credits. Then we're actively looking at between five and ten different opportunities to continue growing our company through acquisitions and further investments. Very, very active on that front. The assets in our portfolio have the capacity to increase production by 45%, and on top of that we're very busy on the corporate development front and think we can possibly add some more production there.

Dr. Allen Alper: That sounds excellent. What are the primary reasons our high-net-worth readers/investors should consider investing in Wheaton Precious Metals?

Randy Smallwood: That's a topic I'm passionate about. Our objective in this company is to deliver the best precious metals investment opportunity that we can to our shareholders. I've already talked a bit about the streaming model, but the key benefit investors have in a streaming company is the fact that we have access to all the production benefits, the exploration success, the expansion potential, but we get that without risk on the cost side. Our capital costs are null, and our operating costs are null. Our production payments are our operating cost. There are no cost surprises when you look at any of our investments, you know what's going on. We get the benefits from exploration success and expansion potential.

Amongst the streaming and royalty companies out there, we are by far the most attractively valued company. We are pure precious metals. We have the highest quality asset base in the space, and our average reserve life is 27 years. We have 27 years of reserves in front of us going forward, which is an incredible number when you think about how stable our company is from an operating perspective. You compare our market multiples, our cashflow earnings and PNAV multiples, and we are by far the most attractively priced, which we don't think will last. I think that's why we stand alone as being by far the most attractive investment within the space.

Dr. Allen Alper: That sounds fantastic. That's really great. The mining companies that you have funded, is that payment in cash, bullion, or Dore bars?

Randy Smallwood: We get refined product, and so it's not Dore bars. It's actually refined gold and refined silver. We get it in certificate form, and if we want to take it in physical we can, it just costs us to do that and there's also a security risk if we do that. We have the choice of taking it in physical form, we choose not to. We basically take it in certificate form, and then turn around and sell it. It's in a metals trading account. We sell it back into the marketplace. We get physical metal from our partners. It's a matter of whether we decide to actually take delivery of that physical metal, or sell it back into the marketplace, and that's what we do.

Dr. Allen Alper: Sounds very smart! Is there anything else you'd like to add?

Randy Smallwood: I appreciate the opportunity to inform your readers/investors about our company, we’re very proud of it. It’s good to talk to you again and I appreciate the opportunity. If anyone needs more information, there's all sorts of access information on our website in terms of how you can ask more questions. I'd be happy to answer them.

Dr. Allen Alper: That's great. I appreciate you taking the time and informing our readers/investors about Wheaton Precious Metals Corp. You should be proud of your company. It sounds brilliant!

http://www.wheatonpm.com/

Patrick Drouin,

Senior Vice President, Investor Relations,

Wheaton Precious Metals Corp.,

Tel: 1-844-288-9878,

Email: info@wheatonpm.com

|

|