Rob Henderson, CEO Amerigo Resources Ltd. (TSX: ARG) Interview, Processing Fresh and Historic Tailings from Codelco’s El Teniente Mine, the World’s Largest Underground Copper Mine, PDAC Booth # 2123

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 2/28/2018

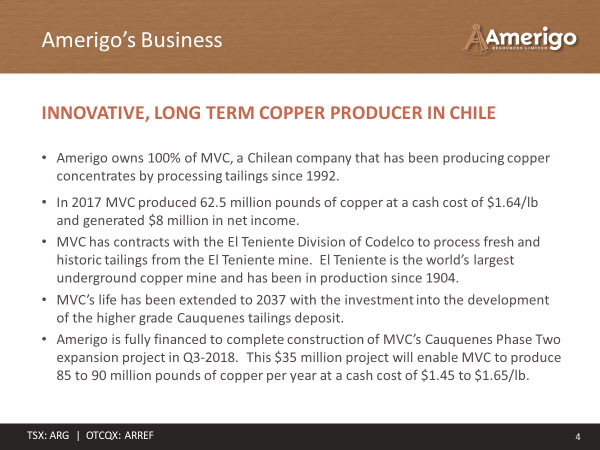

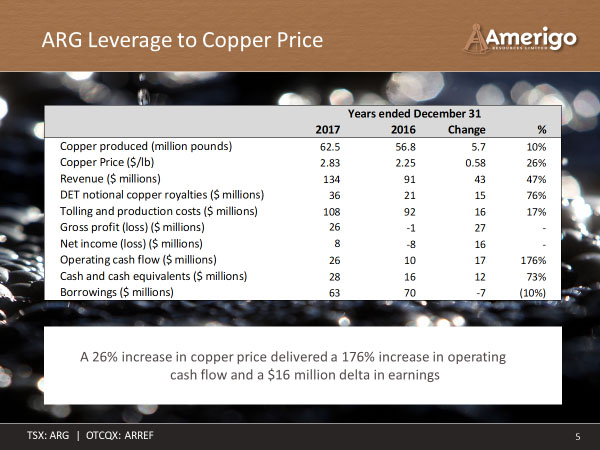

Amerigo Resources Ltd. (TSX: ARG) is an innovative copper producer that produces copper concentrates at its 100% owned MVC operation, in Chile, by processing fresh and historic tailings from Codelco’s El Teniente mine, the world’s largest underground copper mine. MVC has a twenty-five year track record of producing copper safely and profitably and, unlike conventional mines, MVC is not subject to geology or mining risk. Amerigo achieved record annual copper production in 2017, following completion of the first phase of the Cauquenes historic tailings project. We learned from Rob Henderson, CEO of Amerigo Resources, that this year they are planning to increase their production by 40% and reach up to 85 to 90 million pounds after they complete the new plant expansion in Q3. The company is looking forward to the continued increase in copper price, which has returned them to profitability and they hope to be back in a position to pay dividends to their investors in 2019.

Amerigo Resources Ltd.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Rob Henderson, CEO of Amerigo Resources. Rob, could you give our readers/ investors an overview of your company?

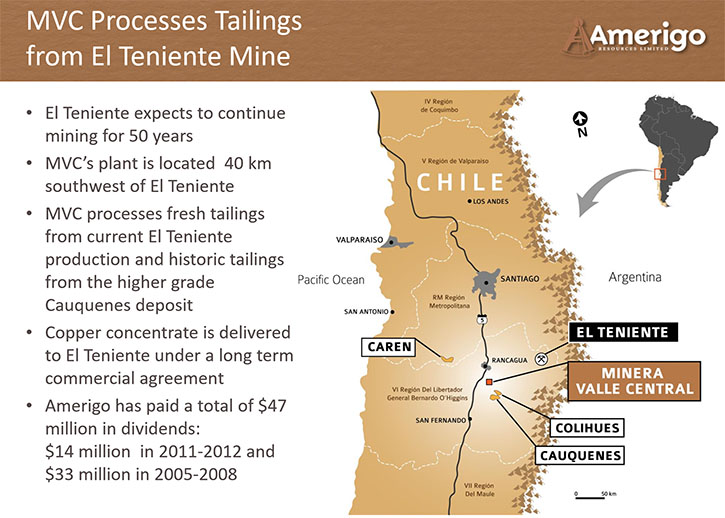

Rob Henderson: Sure. Amerigo is a copper producer. We own a company in Chile, located near Rancagua, Chile. We have 100% of MVC and they have been producing copper concentrates by processing tailings from El Teniente Mine since 1992. Amerigo purchased MVC in 2003, and this year we are going to be producing more copper than we've ever done before. The El Teniente Mine happens to be the world’s largest underground copper mine and has been in production since the turn of the century, so it means they have a lot of historic tailings. In addition, the El Teniente Mine is expected to go on for about another 50 years, so they have a lot of current tailings as well. When MVC started back in 1992, El Teniente knew their plant was inefficient, but they couldn't get capital from their owner Codelco because Codelco, being state owned, is probably one of the most capital constrained mining companies in the world.

Codelco belongs to Chile and most of the profits from their mines like El Teniente go into the state coffers to build roads, schools, and hospitals. El Teniente itself is pretty severely underfunded compared to other comparable mines worldwide. For this reason, El Teniente wasn't able to provide the capital to update the mill in 1992. MVC suggested that they process the tailings and in exchange give El Teniente a royalty. We still have that agreement today. We process the tailings, both the fresh and historic. We have a contract that's good until 2037. It is likely to be extended beyond then because El Teniente has a long life ahead of it. As it stands we produced 63 million pounds of copper last year and we intend to grow that to 85 to 90 million pounds this year.

In a nutshell, we're a tailings processing company that makes money from copper. We've ridden out the previous copper price cycles, and we are looking forward to the continued increase in copper price, which has returned us to profitability. Hopefully we will be back in a position to pay dividends to our investors in 2019.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors a bit about the copper market, its fluctuation and what you think is going to happen with copper?

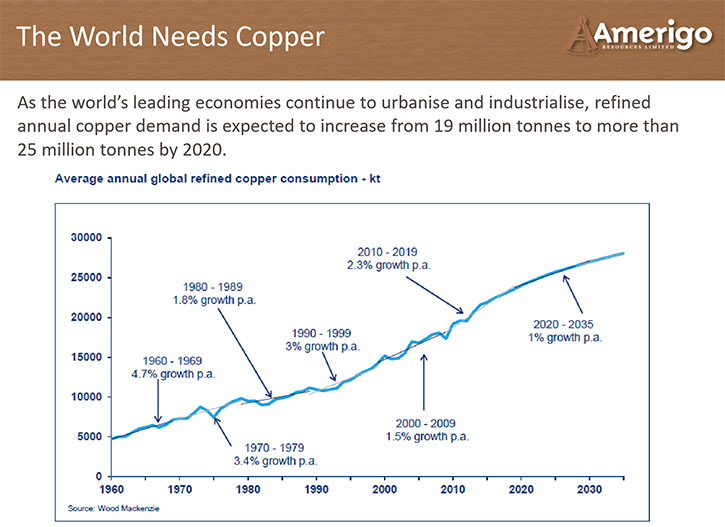

Rob Henderson: As with any other market, there's a lot of short term noise but in the longer term, the picture is pretty clear to me. I'm not an economist, I'm an engineer, so I'm probably not that qualified to comment, but when I look at the demand curves for copper, it is consistent. The world used about five million tons of copper back in 1960. Last year it used 19 million tons. The increase has been pretty much straight line, two percent a year. As the world's population gets bigger so does the use of copper. The world needs copper. It's used extensively in electronics, we're talking about electric cars, we're talking about a thousand and one uses for copper that continue to make it a very, very useful metal because it conducts electricity.

However, on the other hand copper supply is a lot less certain and more variable. Everyone knows that mines are a finite resource. Most mines in the world only last about 20 years, then the ore is depleted and the mining company has to expend large sums of capital to build the next mine. That capitalization has been missing in the last seven years and mining companies haven't been able to put money into the ground due to low metal prices. In the next two or three years the supply of copper is going to reduce and big companies are going to start scrambling to find new projects to fill the supply gap that's coming up. The price of copper, I believe, has to increase. The gurus certainly are of the same opinion.

Wood Mackenzie sees copper price going up to $3.50-$4 a pound over the next five years. The supply gap is going to push up the incentive price of copper. Eventually we're going to see the cycle turn again when investment into new mines begins and copper production starts to grow. I believe that we are at the beginning of a seven to 10 year up cycle and once you look beyond the short-term noise, the long-term fundamentals of copper are extremely solid.

Dr. Allen Alper: Thank you, I think our readers/investors will appreciate a better understanding of what's happening. I know it's been a rather important metal and has gotten a lot of notice this past year again. Could you tell me a bit about your background, your team and your board?

Rob Henderson: I'm an engineer and I've been in the mining business all my life. I started my career working in the gold mines in South Africa. Coincidentally I started with Rand Mines in 1984, who were processing tailings in Johannesburg. So, at the beginning of my career I was processing tailings. I moved to Canada in 1994 and worked with engineering companies and then spent 10 years with Kinross Gold Corporation in Toronto as VP of technical services. Then I moved to Vancouver six years ago to join Klaus Zeitler at Amerigo.

Klaus is the executive chairman of Amerigo. He started the company back in 2002, and Klaus is still very active in the company. I joined as COO in 2012, and consequently rose to be CEO in 2015, my position today. In Chile we have about 300 employees, led by Christian Caceres, who has been there for over 25 years. We have a very experienced, stable and well qualified team.

Dr. Allen Alper: That's very good. Could you tell us a bit about your structure?

Rob Henderson: On the board we have Klaus Zeitler, our chairman. Bob Gayton, Sidney Robinson, Alberto Salas, and George Ireland. George is one of our biggest shareholders, he has about 13% of the company’s shares. Ross Beatty is our biggest shareholder, with about 14% of the shares. Luzich Partners LLC, a fund in Las Vegas has 12% and Rick Rule has 10%. Management has about five percent and so over 50% of our shares are held by insiders.

Dr. Allen Alper: Very impressive group you have there: George Ireland, a knowledgeable Director, who knows the Company inside and out; Ross Beatty, a leader in the mining industry and a prominent investor and Rick Rule, whose knowledge and experience has earned him a worldwide reputation for resource investment management. You can't get any better than that!

Rob Henderson: It is, for sure! Both George and Ross have been with us for a very long time and are supportive of what we do.

Dr. Allen Alper: That's excellent. It's good to have long-term supporters of their stature, who are so well respected in the industry.

Rob Henderson: Exactly. We are a copper producer, but we don't have expensive exploration budgets. We have a contract until 2037, so we have a long run ahead of us. We don't have to look for more material to fill the mill. We know what we have. The geological risks are very low. It's all sitting in tailings above ground so the extraction risk is pretty low. The only things we're subject to are process risk and price risk, so we have much less risk than our peers in the copper producing sector.

Dr. Allen Alper: That's very good. Could you say a little bit about your shares, where they are listed, your market capitalization?

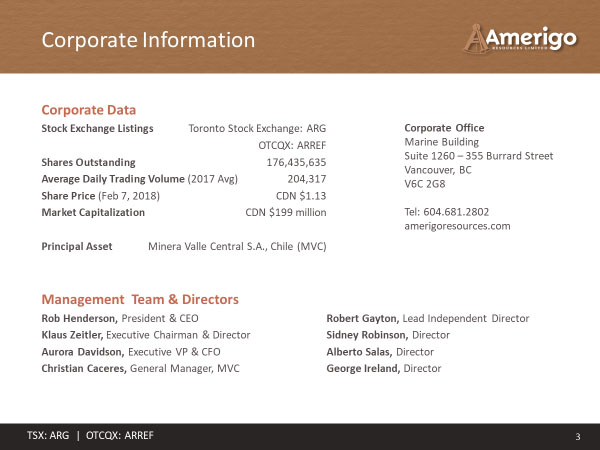

Rob Henderson: Sure, we're listed on the TSX, the main exchange, symbol ARG. The market cap is in the order of 200 million Canadian. We're also listed on the OTCQX in the States and we were number two on their top fifty share list last year. We had a good year in terms of share price appreciation. However, our market cap at about US$150 million is relatively low compared to our peers and very low compared to our projected price to earnings ratio.

Dr. Allen Alper: Well, that sounds great that you had such a good year and it sounds like you have a lot of upside. Could you tell our readers/investors your key objectives for 2018?

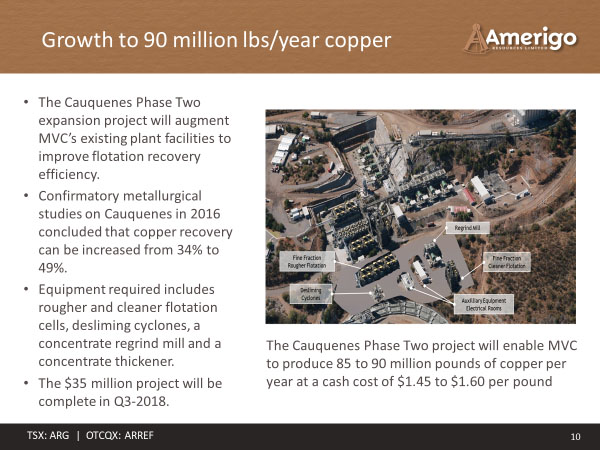

Rob Henderson: It's pretty straightforward. We have to stay focused on completing our Cauquenes phase two expansion, on time and on budget. It will put us at a run rate of 85 to 90 million pounds per year. It's going to drop our cash costs 20 cents, down to $1.45 per pound. The plan is to have construction complete in Q3 this year and in Q4 we should be producing 85 to 90 million pounds of copper per year.

Our main task this year is to make sure we complete the expansion safely and efficiently, however we are also looking at other opportunities. I believe that we have skills in tailings processing that the rest of the world doesn't have. We've built up a huge skills inventory over the last 25 years at MVC and we have an innovative business model. So I am looking at other tailings processing opportunities that may be available to us. We are studying four other options that could well become another MVC within the next five years. Ultimately, I am hoping to identify another tailings operation that would add another arrow to our quiver.

Dr. Allen Alper: That sounds very good. What are the primary reasons our high-net-worth readers/investors should consider investing in Amerigo Resources?

Rob Henderson: We've been around a long time and we are growing. We are producing copper and we're fully exposed to the copper price. We believe the copper price is going to go up. Most of our investors are looking at the copper price cycle and also believe it’s going up. I believe that Amerigo is a very good vehicle for riding increases in the copper price, because we are very, very geared to the copper price. When it was low, we managed to survive. When it was high in the past we paid dividends. Certainly at a copper price of $3 a pound, where it is right now, we would be in a position to start paying dividends in 2019.

We have a dividend policy of paying out a third of our earnings in dividends. Once we've completed our expansion, our production will increase by 40% to 85 to 90 million pounds. So by 2019, we should be in a very healthy financial situation. I believe that Amerigo is the perfect vehicle for market exposure to copper.

Dr. Allen Alper: That sounds excellent. Rob, is there anything else you would like to mention?

Rob Henderson: To sum up, Amerigo had an excellent year in 2107 with record production, record safety and a return to profitability. I believe that the foundations for future growth are now well established. Our strong leverage to copper price combined with our growth profile is the reason I believe that Amerigo is the preferred investment in the copper space.

Dr. Allen Alper: That sounds excellent!

http://www.amerigoresources.com/

Rob Henderson,

President and CEO

(604) 697-6203

|

|