Lithium Power International Limited (ASX: LPI): Chile’s Next Lithium Producer: Interview with Martin Holland, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 2/26/2018

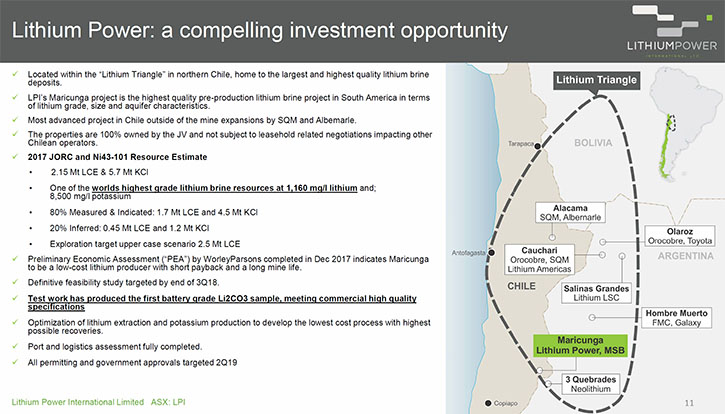

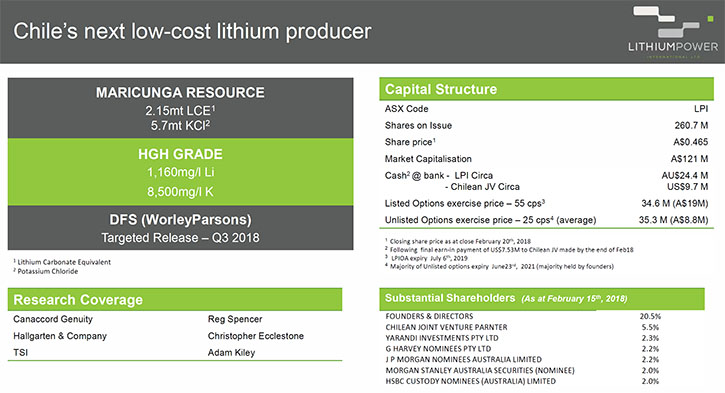

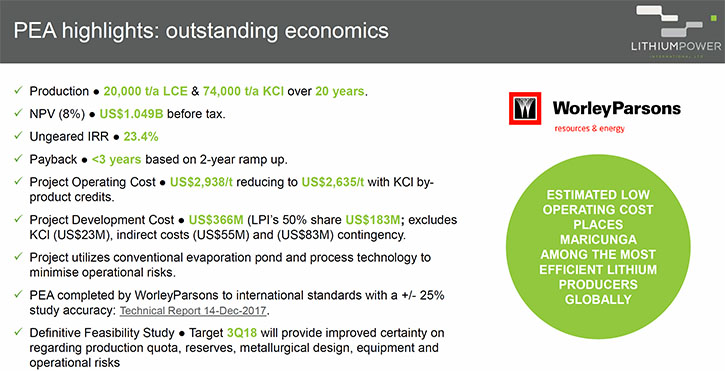

Lithium Power International Limited (ASX: LPI) is fast-tracking to production its high-grade Maricunga Lithium Project in Chile, the highest grade, undeveloped lithium brine salar in the world - second only to the Salar de Atacama project operated by industry heavy weights SQM and Albemarle. We learned from Martin Holland, the CEO of LPI, who is headquartered in Sydney, Australia, that Maricunga has delivered outstanding economic outcomes from a Preliminary Economic Assessment (PEA), which was undertaken by tier 1 consultants WorleyParsons. These included an ungeared IRR of 23.4% and a project NPV of US$1.05 billion before tax, at an 8% discount rate. They were based on a project life of 20 years.

Forecasted project operating costs would place Maricunga among the most efficient global lithium producers, with lithium carbonate production costs of US$2,938 per tonne FOB, reducing to US$2,635/t with credits from a potassium chloride fertilizer (KCl) by-product.

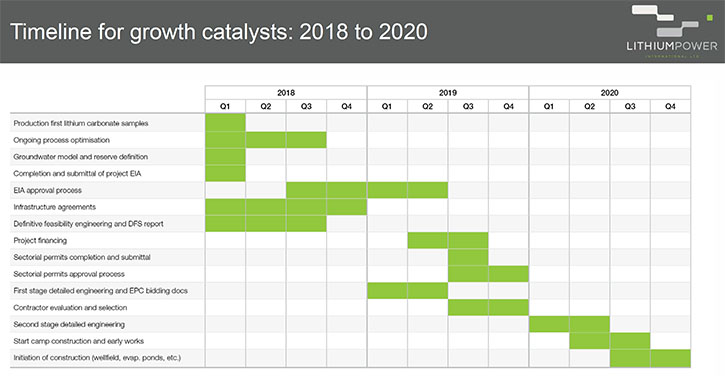

Process test work continues at Maricunga, and the final results of the first LCE production are pending. Expert equipment suppliers Veolia and GEA are working to optimize the lithium extraction process. Several groups of investment analysts have recently made site visits to Maricunga. Canaccord, Sprott Asset Management and other analysts now cover LPI as progress is made towards completing a feasibility study due in Q3 2018.

A non-binding MOU with the Chinese motor vehicle manufacturer, Sichuan Fulin Industrial Group Co Ltd (Fulin), has been executed for potential project equity participation and an off-take agreement. A technical and legal due diligence process was completed by Fulin in January 2018. Further discussions are to be held in February 2018.

LPI owns Maricunga in a 50/50 joint venture with a Chilean partner, and together they have invested over US$50 million in acquisitions, exploration and feasibility studies. The project is close to important infrastructure, including power lines, a highway, and access to nearby port facilities. There is a high probability that the Maricunga lithium brine deposit will become the next new Chilean lithium producer.

Maricunga Lithium Project

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Martin Holland, CEO and managing director and executive director of Lithium Power International. Could you give our readers/investors an overview on your company, Martin?

Martin Holland: Lithium Power is a pure play lithium company and a near-term producer. We are developing the highest quality, pre-production lithium brine project in South America. Once in operation, it will be the second highest grade lithium brine resource in the world. It's also worth noting that our Maricunga project is sited in the same region where 30-40 percent of current global lithium supply is currently being sourced.

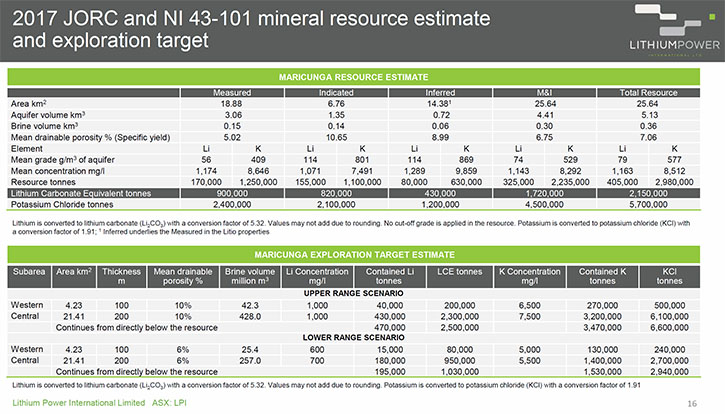

The Maricunga project is a joint venture in which we own 50 percent. The other portion is owned by a Chilean corporation, which gives us a significant advantage because of their on-ground experience in Chile including many years dealing with Chilean politics and permitting processes. Since finalizing the JV in September 2016, we have completed a very successful drilling program, leading to the release last July of a maiden JORC compliant mineral resource estimate. This was followed by a NI-43-101 compliant estimate and technical report in August 2017. Our new resource expanded the existing 2012 estimate by 3.7 times to 2.15Mt of lithium carbonate equivalent at 1,160 mg/l and 5.7 Mt potassium chloride at 8,500 mg/l. Much of this increase was due to the discovery of higher porosity sediments in properties more recently acquired under the JV.

The drilling program also revealed an upside potential to the current resource. We have an exploration target of 1.0-2.5 Mt of lithium carbonate equivalent, and 2.9-6.6 Mt of potassium chloride, defined below the base of the resource extending from 200m depth to 400m.

We are now focused on fast-tracking Maricunga through the development stage. Worley Parsons is targeting completion of our definitive feasibility study by the end of 2018. Submission of our Environmental Impact Assessment is due during the first quarter 2018. On the testing front, we’ve defined a lithium carbonate and potassium chloride process flow sheet, and the pilot plant optimization for Li2CO3 production is ongoing. Test work has successfully achieved a 5% lithium concentration, and the first Li2CO3 and KCl production samples are expected by the end of 2017. Port and logistics assessments have been fully completed.

Our permitting and government approvals are expected by the second quarter of 2019, at which time we will make a production decision. Construction should commence in 2019.

The preliminary results of the PEA are very positive, and confirm Maricunga will be a low-cost lithium producer. The project has the potential for a multi-decade mine life based on its currently defined resource to 200m in depth. But there is now the potential for substantial resource expansion from 200 to 400m depth.

Regarding infrastructure, the Chile-Argentina Highway 31 runs alongside the project, providing direct access to a port with available shipping capacity. We also have a 23kV power line crossing the property that is connected to Chile’s 220kV power grid. We already have water rights, and have secured 6,000 hectares of level land adjacent to the salar where we plan to build out our evaporation ponds and processing plants.

During the past year, we have moved from being an explorer to a developer. We intend to hit every single milestone on the development curve and turn the Maricunga project into Chile's next lithium mine.

Dr. Allen Alper: Well that's an excellent accomplishment in a very short time. It's really quite amazing what you have done and your team has done.

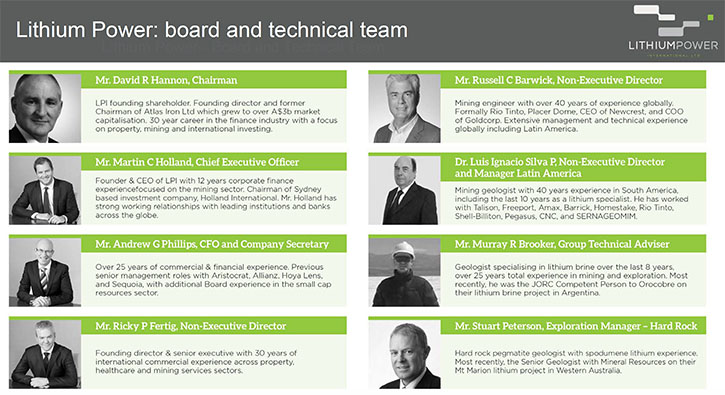

Could you tell our readers/investors a little bit more about your background, your team, and your board?

Martin Holland: I was a founder of the company. I'm the CEO and also the largest shareholder. Very importantly, I ensure that we have the right people with the right expertise in place as we move through the development cycle.

Dr. Allen Alper: Well it sounds like you have a great background, you have an excellent team and group in place. Very impressive! Could you tell us a bit about your share and capital structure?

Martin Holland: We currently have 260 million shares issued. We're trading at around A$0.52 per share. LPI’s major shareholders primarily comprise existing Board and management. The top 20 shareholders own in excess of 50 percent of the company. Our financial position has recently been strengthened through an equity raising A$35.6 million at A$0.55 per share.

Dr. Allen Alper: Excellent, very good. It's nice to have cash to move your company forward. It sounds like you're very good at raising cash. You have an excellent property. Your team should instill confidence in the marketplace. Very impressive!

Martin Holland: Yes, the board provides us with a tremendous amount of global, strategic depth. We have been marketing across Santiago, Hong Kong, Toronto, Connecticut, Boston, New York, Dallas and London during 2017, and also domestically in Australia and in Asia.

Dr. Allen Alper: That's excellent. What are the primary reasons our high-net-worth readers/investors should consider investing in Lithium Power.

Martin Holland: LPI is the only company listed on the ASX with exposure to a lithium brine project in Chile. It is worth noting that Chile is where 30 percent of the world’s copper supply comes from and where 30 percent of the world’s lithium supply comes from. The highest grade lithium deposits in the world are in Chile. The infrastructure already there is outstanding.

A huge global change is underway from petrol to electric vehicles, and also towards electric power storage - both requiring lithium batteries. If investors want to be in lithium, then they should be in high grade assets because grade is king. The country where high grade lithium is found is Chile. They can also gain strong growth from a company like LPI with a pre-production asset, which has already had capital spent and years of development. Our Maricunga project ticks those boxes. Over $US50 million has been spent on our project to date. You want to invest in a project that is nearing the feasibility stage so it has already been de-risked.

Apart from its infrastructure advantages, Maricunga has level land which is ideal for construction of evaporation ponds and a processing plant. It also has a natural evaporation advantage, because it is sited at altitude in the high Andes. Logically, if you want to be in lithium, you need to be in Chile and you need to be in brine. Lithium brine projects sit on the bottom of the lithium cost curve. When supply meets demand, as it will in the future, that is exactly where you want to be. Chilean brine projects are going to be the ones that last a long time, and this is why LPI is a very compelling investment in the lithium thematic.

Dr. Allen Alper: Well that sounds excellent, Martin. Is there anything else you would like to add?

Martin Holland: Yes. There are two very large lithium companies in Chile and they each have market capitalizations of $US10 billion. We are the only pre-production lithium asset in the same region. That puts us in a very interesting position. Our shareholders have the potential for a significant re-rating of our market capitalization following the WorleyParsons PEA, coming out shortly, and the feasibility study during the second quarter of 2018.

Dr. Allen Alper: Well that sounds excellent.

http://www.lithiumpowerinternational.com/

Martin Holland - CEO

info@lithiumpowerinternational.com

+61 2 9276 1245

|

|