Pelangio Exploration Inc. (PX: TSX-V; OTC PINK: PGXPF): Interview with Ingrid Hibbard, President and CEO, Track Record of Discovery & Value PDAC Booth 2237

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 2/19/2018

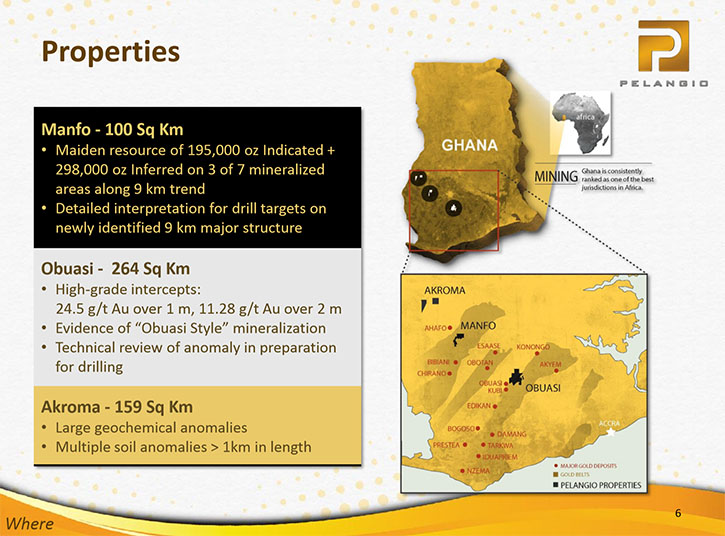

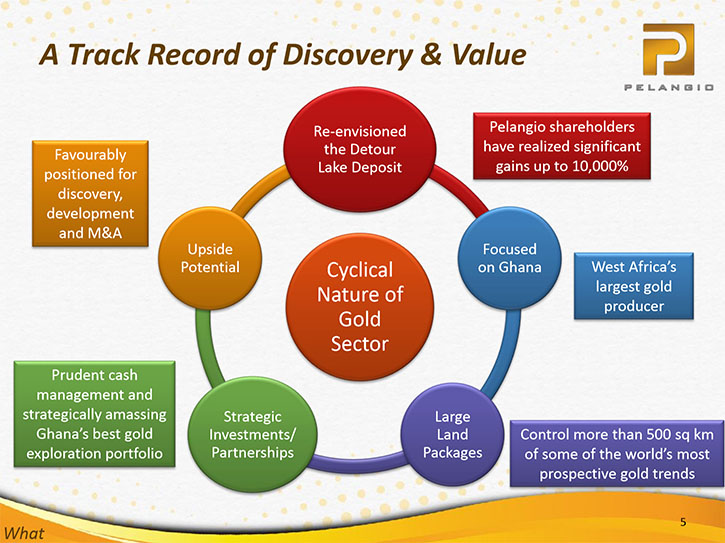

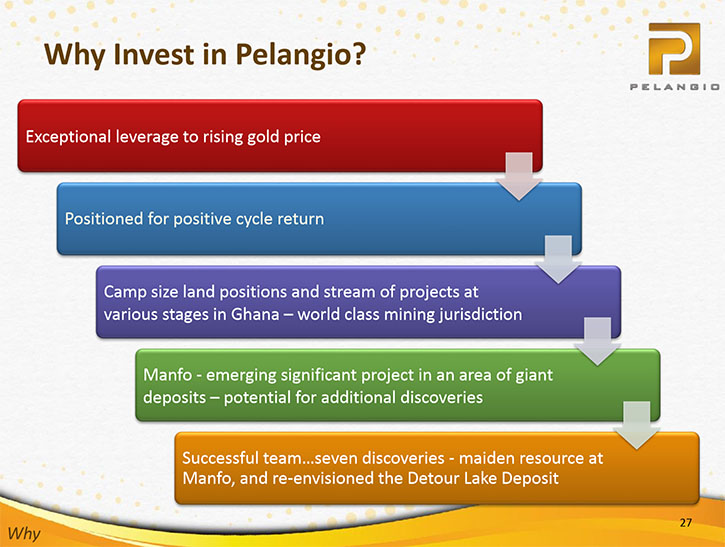

Pelangio Exploration Inc. (PX:TSX-V; OTC PINK:PGXPF) is a junior gold exploration company that successfully acquires and explores camp-sized land packages in world-class gold belts. Pelangio primarily operates in Ghana, West Africa, an English-speaking, common law jurisdiction that is consistently ranked amongst the most favorable mining jurisdictions in Africa. Pelangio is exploring three 100%-owned camp-sized properties: the 100 km2 Manfo Property, the site of seven recent near-surface gold discoveries, the 264 km2 Obuasi Property, located 4 km on strike and adjacent to AngloGold Ashanti’s prolific, high-grade Obuasi Mine and the early-stage 159 km2 Akroma Properties, which includes the Dormaa and Wamfie concessions. We learned from Ingrid Hibbard, who is President and CEO of Pelangio Exploration, that they recognize the real and significant opportunities that exist in the cyclical nature of the gold industry, by acquiring properties at the bottom of the cycle and then capitalizing during the rising markets, as they did with the Detour Gold project, one of the largest gold mines in North America. According to Mrs. Hibbard, if one wants to play the gold game, it is all about having the right people, the right properties, and the right timing.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Ingrid Hibbard, President and CEO of Pelangio Exploration. Could you give our readers/investors an overview of your company, your focus and current activities?

Ingrid Hibbard: Sure. We're a Canadian-based exploration company, focused on developing the best gold portfolio in Ghana, West Africa. We've acquired a portfolio of three extremely large or camp-sized exploration properties in Ghana. It encompasses about 500 square kilometers. Right now, we've identified more than 50 drill-ready target areas on those 500 square kilometers.

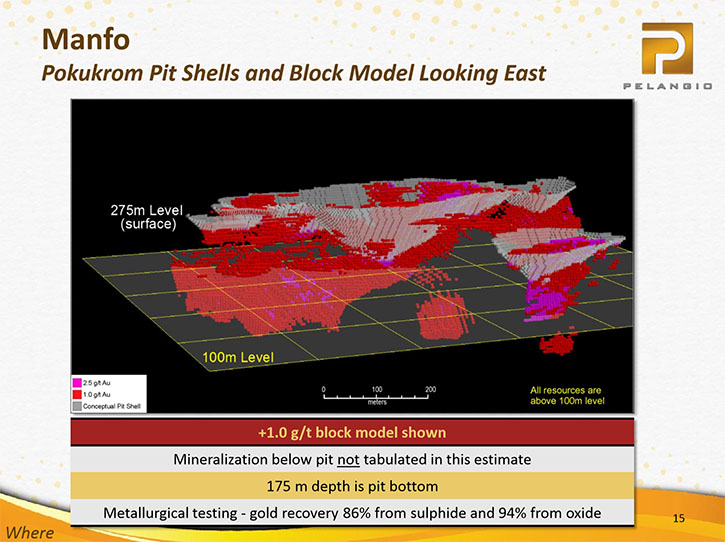

These properties include our 100 square kilometer Manfo property, our flagship property, where we've completed an initial resource estimate, with 195,000 ounces in the indicated category and 298,000 ounces in the inferred category. We have 35 drill-ready target areas identified and a drill program is currently underway. It also includes our 264 square kilometer Obuasi property, which is located directly contiguous to the former producer, the Obuasi mine, which hosts the largest vein-hosted deposit in the world. It's about a 50 million ounce deposit, and we have eight drill-ready target areas identified there. Lastly, we have an early stage property, the Akroma property, which has eight drill-ready target areas identified. At this property, exploration is being funded by RosCan Minerals, which has the right to earn a 50% interest by funding a total of $2 million in exploration.

As you well know, Al, we have a track record of success, having previously acquired the Detour Lake deposit and the very large land package around it, over 250 square kilometers. We acquired that in 1998 at a previous low point in the gold cycle, and we re-envisioned it as a large open pit. Most importantly, though, we identified a team able to develop it, and we were able to retain a major stake in that new company for our shareholders by spinning it out into a new company, Detour Gold, in return for a 50% interest in Detour Gold. This provided our shareholders, with the opportunity for tremendous wealth generation, up to 100 times their original investment. Detour is now one of the largest gold mines in North America and continues to generate wealth, creating over 1,000 jobs in northern Ontario.

Given our experience in the previous cycles in the gold market, and Al, I know you have had this experience too, because we've been through them together.

Dr. Allen Alper: That's right.

Ingrid Hibbard: We recognize the real and significant opportunities that exist in the cyclical nature of the gold industry. That's what allowed us to acquire Detour at the bottom of the cycle in 1998 for just over $1 per ounce in the ground. That's what allowed our shareholders to capitalize during the rising markets of 2007 and 2011. Really, if you want to play the gold game, it's all about the cycles. It's about having the right people, the right property, and the right timing.

This time, during the down portion of the cycle, we've made a number of significant moves and achievements. During this previous downturn, and I do think we're coming out of it now, and are well on our way to better times, but during the downturn, we created the maiden resource estimate at Manfo. Again, that's 195,000 ounces in the indicated category and 298,000 in the inferred category. We completed significant research and analysis on all our properties so that we could come into this improving market with about 50 drill-ready target areas prepared. That's about 35 at Manfo, 8 at Obuasi, and 8 at Akroma.

We also identified a new gold zone on the Manfo property called Nkansu. It's located two and a half kilometers from the Pokukrom East deposit, and it includes results of 49.5 meters of 1.18 gold at near surface. We also identified some additional structures parallel to the structure hosting the resource area, Nkansu and the other zones discovered to date, so we now have multiple structures to follow-up.

We identified and assisted a local Ghanaian company in acquiring and commissioning a cost-effective convertible reverse circulation in their core rig, and now, Al, this is just new, we've identified a man-portable diamond drill rig which is now onsite at our Manfo property. Both rigs are going to be operated by that Ghanaian drilling company. You and I talked about this before, that we have assisted a Ghanaian drilling company in locating and acquiring the rigs. In return for that, we have preferential access and rates. What's really exciting about it is it's providing not just jobs but business opportunities for the local community in Ghana. We anticipate that these two rigs are going to reduce our overall drilling costs significantly.

The Grasshopper rig is fantastic, but it only goes to about 150 meters. In certain areas, if it's wet, it just can't handle it, so the man portable diamond drill rig is going to allow us to go deeper, and it's going to give us much more flexibility having access to two rigs. We're pretty excited about it.

Now, with the market turning and a host of accomplishments during the downturn, we are well positioned. We've just completed two financings, totaling almost $1.75 million. The most recent financing of 1.2 was just completed early in January. We began drilling at Manfo in October, but now, with the completion of this new financing, and having preferential access to the diamond drill rig, we're taking the opportunity to revise our drilling program. The current program is going to focus on diamond drilling and test about 8 target areas with 4,000 meters of diamond drilling. This initial program is going to be focused in and around the Pokukrom East deposit that hosts the bulk of our resources, and as well, around Nkansu, which is that new zone that we discovered during the downturn, with results including 49.5 meters of 1.18 grams.

I think we've taken our experience of cycles and made the best of the downturn, accomplished a lot, set ourselves up well for the improving market, and now here we are. It is improving, and we're drilling.

Dr. Allen Alper: Outstanding! Excellent strategy! Well done! That looks great.

Ingrid Hibbard: Yeah, we're pretty pleased, Al. It's been a tough haul. I always enjoy having the opportunity to put my thoughts together for this, because it makes me feel better when you put it all down. "Okay, this is what we actually accomplished."

Dr. Allen Alper: You and your team are doing a great job. You have the courage to spend money when things are tough and to stick with it. The mining business is a tough business. It's a cyclic business, and it's important to understand that and know when to invest and when to have the courage to move forward. I admire what you and your team are doing. That's absolutely great.

Ingrid Hibbard: Thank you.

Dr. Allen Alper: Could you tell us a bit about your management, your directors, and yourself?

Ingrid Hibbard: We've made two recent director changes. Recently, Dave Paxton has joined the board. He's a mining engineer from London. He's had a lot of experience with various financial houses as an analyst. It's a big addition for us, and having the European connection extends our reach out of just Canada.

Prior to that, Kevin Thomson joined the board. Kevin lived in Ghana for 12 years and worked with Newmont. He was their head of exploration in Ghana. Then he went on and had the same sort of role at Perseus, so he has a lot of experience in Ghana. He's a big addition for us, too. We've made some very positive changes to our board as well.

Dr. Allen Alper: We just posted our article on Perseus Mining. I interviewed Jeff Quartermaine.

Ingrid Hibbard: I see that they're having pretty good success in Cote d'Ivoire now, too.

Dr. Allen Alper: Yes, they are, very good. Could you tell our readers/investors a bit about your share structure?

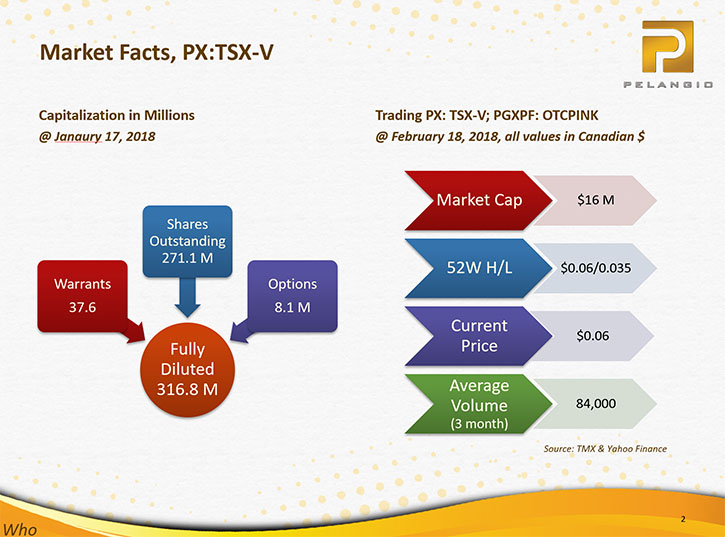

Ingrid Hibbard: There are 271 million shares outstanding.

Dr. Allen Alper: Could you tell our readers/investors a bit more about why Ghana is such an important area for gold mining?

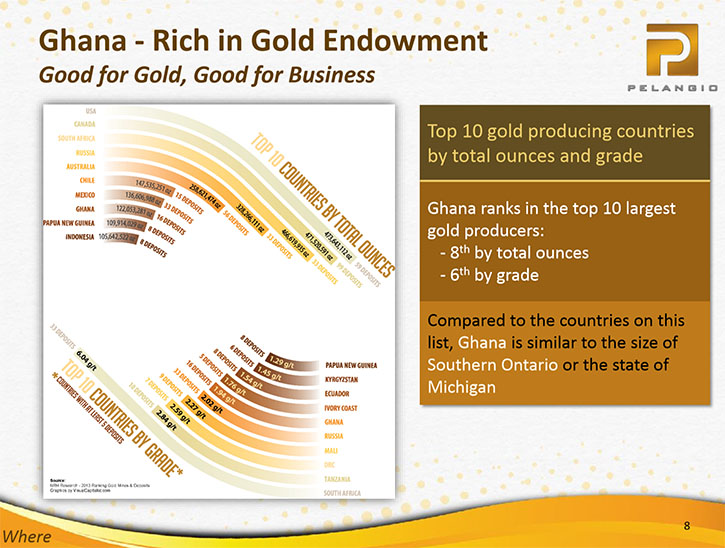

Ingrid Hibbard: In terms of gold endowment, Ghana has had many five million ounce plus deposits found in the last 10 to 15 years. It hosts the Obuasi mine, which is the largest vein-hosted deposit in the world. At Manfo, we're 30 kilometers away from Newmont's Ahafo, which is a 15 million ounce mine. The gold endowment, in terms of big deposits, and when you consider that Ghana is the size of the state of Michigan, is amazing. Compared it to all of China, or all of Russia, or all of Canada, or all of the U.S., and it's the size of the state of Michigan.

Dr. Allen Alper: That's amazing. That's really the place to be.

Ingrid Hibbard: It's funny how it doesn't get the recognition that you'd think it would, given the intensity of gold endowment there.

Dr. Allen Alper: That's a great place to be. How is it operating in Ghana, the people and the government?

Ingrid Hibbard: Remember, it's a former British colony, so for Canadians, we're very comfortable there, because it's a British common law system. Basically, I'm trained as a lawyer, I practiced as a lawyer for a period of time, so I think to myself, "What would the law be in Canada?" It's virtually the same there, because it's based on that same common law system. They do have the rule of law. I feel very comfortable operating there. I feel safe. I find it a great place to work.

The other thing is that they've had mining there for centuries, so there's infrastructure available. We're 30 kilometers away from a 15 million ounce mine, so infrastructure's all there. Assaying companies are located there. Drilling is available. All of the things that you need for exploration in mining are available because it has a mining history that goes back longer than Canada's.

Dr. Allen Alper: That's great. It sounds excellent!

Ingrid Hibbard: That's a big difference, too, Al, in terms of community relations. If people are familiar with mining, then it's easier to work with them, and they recognize it as a wealth-generating industry. You know how I was talking about Detour creating wealth in northern Ontario? They recognize that in Ghana. They recognize that mines create jobs, and jobs are sorely, sorely needed in Ghana. Gold is one of their premier job-creating industries.

Dr. Allen Alper: That's excellent. What are the primary reasons our high-net-worth readers/investors should consider investing in Pelangio Exploration?

Ingrid Hibbard: People, projects, and price. We have a management team that is experienced, that recognizes the cyclical nature. The quality of our projects, we came out with a resource during the downturn. At Manfo, we have a 100 square kilometer land package. We have a resource. We have multiple targets, other target areas, so we can be looking at building on the existing resource and have multiple other target areas. And, the share price is right at five to six cents.

Dr. Allen Alper: It sounds like it's a great opportunity for our high-net-worth readers/investors.

Ingrid Hibbard: It was the cycles that helped our shareholders in the last iteration do so well. By participating at the bottom and watching us be able to buy the mine for less, and then to be spinning it out with the markets improving, it's that kind of playing the cycle that really, really works to your advantage.

Dr. Allen Alper: I think you have shown our high-net-worth readers/investors why they should consider investing in Pelangio; what your focus is, what your strategy is, and what you've done, and what you're about to do. It sounds like 2018 will be a great year for Pelangio, with all the drilling and exploration, and at much lower costs than your competitors, so that's great.

Ingrid Hibbard, President and CEO or

Warren Bates, Senior Vice President Exploration

Tel: 905-336-3828

Toll-free: 1-877-746-1632

Email: info@pelangio.com

Website: www.pelangio.com

|

|