Golden Share Resources Corporation (TSXV: GSH): Focus Vanadium Based Energy Storage, Interview with Nick Zeng, Chairman, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 2/13/2018

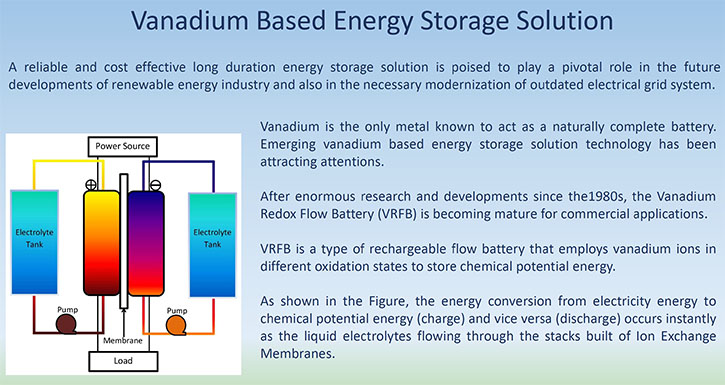

Golden Share Resources Corporation (TSXV: GSH) is a junior natural resource company, focusing on mineral exploration in the Province of Ontario, Canada, a mineral rich and politically stable jurisdiction. We learned from Nick Zeng, Chairman, President and CEO of Golden Share Resources, that their focus is currently on continuing cooperating with the Pacific Northwest National Laboratory (PNNL) to reduce the cost of the vanadium flow battery, through reducing the cost of the vanadium electrolyte. This will make the Vanadium Redox Flow Battery (VRFB) more competitive, compared to the lithium battery in utility-scale electricity storage applications. We also learned from Mr. Zeng, that Golden Share's other focus is on engaging Chinese companies to help build a railroad to the Canadian far-north, to develop the Ring of Fire region and do regional exploration along the railway corridor.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Nick Zeng, Chairman, President and CEO of Golden Share Resources Corporation. Nick, Could you give our readers/investors an overview of your company, your focus and current activities?

Mr. Nick Zeng: Yes, first we are trying to advance the vanadium based energy storage technologies. Secondly, to leverage our relationships in China, our Company is trying to bring the technologies and investments from China into Ontario to build a railroad to the Ring of Fire area, which is the biggest metal discovery since the Voisey Bay in Canada. Thirdly, we're engaging in regional exploration along the proposed railroad corridor. Those are the three things we're trying to do at Golden Share currently.

Due to a recent material development for the energy storage business at Golden Share, we are considering spinning out the energy storage business, probably later this year. Golden Share will continue focusing on the exploration in Ontario.

Dr. Allen Alper: Sounds great! Could you explain to our readers/investors why Canada is so important in the redox-flow battery electrolyte development?

Mr. Nick Zeng: I took over Golden Share, May 1, 2015. We immediately evaluated the Company’s properties portfolio. We concluded that Golden Share would need a better opportunity. We looked into markets that were growing. Minerals needed by the battery industry drew our attention. We checked on almost every mineral used in batteries including lithium, cobalt, magnesium, nickel and copper.

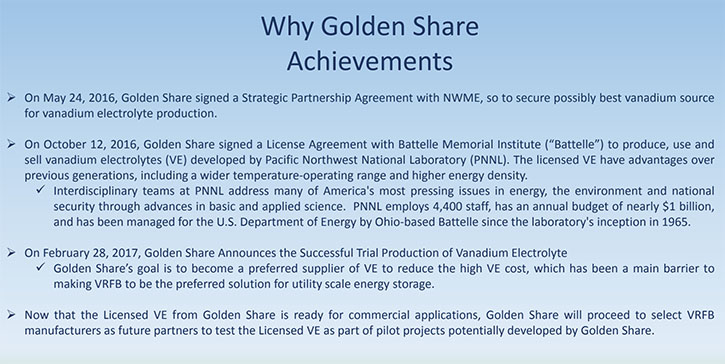

We felt it was too late for us to get into lithium. At one time we seriously considered becoming a cobalt streaming company. We were concerned that most of the cobalt comes from Africa. So, we backed away from it and continued our internal research. Back in 2015, we realized vanadium could become more interesting. That is why we moved forward into vanadium. We leveraged our relationship successfully to secure battery grade vanadium from the largest operating vanadium primary mine in China. We decided to focus on technology development instead of mining to position Golden Share better in vanadium based energy storage.

We initially started with the vanadium redox flow battery (“VRFB”). VRFB has many advantages. We approached PNNL for the most advanced VRFB technologies. The Pacific Northwest National Laboratory in Richland Washington is a U.S. Department of Energy (DOE) government research laboratory. The Laboratory focuses on research and development related to waste management, environmental restoration, global environmental change, energy and national security.

VRFB is matured and the best among the flow battery technologies. There are two generations of vanadium flow batteries. The first generation was developed by Australia. The patent has expired, and the majority of the vanadium flow battery manufacturers are using it to produce vanadium flow batteries. The second generation is developed by PNNL. The second generation has a huge improvement, but somehow the cost was increased.

However, VRFB initial coat is still more expensive than lithium-ion batteries. Vanadium electrolyte is the most expensive part of VRFB. We hope to reduce the cost of the vanadium flow battery through lowering the cost of the vanadium electrolyte. By doing that I think we probably will be able to make the vanadium redox flow battery more competitive compared to the lithium-ion battery in utility scale electricity storage applications.

We all know that Tesla is doing a good job in energy storage, the lithium-ion battery right now dominates the market. I think, with the development of a vanadium flow battery, based on the inherent advantage for the storage, we probably can realize an opportunity to dominate the market in energy storage in the future.

That's just one thing. The second thing we are trying to do. PNNL is going to research and develop a solid-state vanadium battery. This R&D would be a revolutionary development in the battery industry if scientists at PNNL could make it happen. Even it, is still at a very early stage, but all of us are very excited about this opportunity to potentially impact battery industry.

Dr. Allen Alper: That sounds very interesting. Would the main application be energy storage? Is that correct? Could you explain to our readers/investors why that's so important?

Mr. Nick Zeng: The vanadium flow battery can only be used for energy storage, not in cars because it is too bulky. The energy density is too low and it's too heavy. But the solid-state vanadium based new cell, with much higher energy density, has a much longer life span and potentially much lower cost, due to a significantly simplified cell design. It is going to change the energy storage market for sure.

It is still too early to say we are going to be able to challenge the lithium battery. But it will be something we would like to pursue in the future.

Dr. Allen Alper: Sounds good! Could you explain some of the advantages of vanadium batteries, a redox flow battery compared to the lithium battery for storage? Why should this area be investigated and looked at? What might be the advantages?

Mr. Nick Zeng: The main advantage of the redox flow battery is the design is flexible, not like a lithium battery coming with a standard cell. Tesla uses more than 7,000 cells to power just one car. The battery management system should be very challenging. You can imagine managing these thousands of individual cells at one time. I think Tesla has been doing an excellent job in their battery management system to back up the electricity grid and share it, which is much bigger and more complicated than just one car. Tesla probably has millions or even billions of cells in their system to be managed. I don't know how Tesla can make that happen. To manage the millions or even billions of cells at one time must be very, very challenging. It is really an amazing job and I really hope their battery management system will be reliable for a reasonably long term.

But for the design of the vanadium flow battery it's very, very simple. The battery management system will be much easier, much simpler, than the lithium-ion battery system. That's just number one.

Number two, the lithium battery can probably work for three years and charge, discharge. The iPhone people are saying the lithium battery is only going to last for three years. Certain people were saying the lithium battery for energy storage was going to last for ten years. I would put a question mark on that at this moment.

But for the vanadium flow battery, a long life span is actually an advantage. Because VRFB generate electricity through a redox chemical reaction. In theory the life of vanadium electrolyte will last forever and so the life of VRFB. For sure you are going to do maintenance for VRFB, but the vanadium electrolyte, which is the most expensive part of the vanadium flow battery is going to last forever. For utility grid applications, as a giant battery, the vanadium flow battery is probably going to show more advantages than the lithium.

But, if you are going to build a small battery, I think the vanadium flow battery is probably too complicated. The utility industry people normally want to use something for decades. Lithium battery people are only going to talk about three years to ten years maximum. I think, the life and design of the vanadium flow battery are true advantages for the utility large scale electricity applications

Dr. Allen Alper: Well that sounds very good. Could you elaborate on what role Golden Share Resources Cooperation will play? Will you build the battery, will you buy or mine the vanadium ore and refine it and get the chemicals? What would you say your role will be in this project?

Mr. Nick Zeng: Number one, building a battery is very, very expensive. To build a manufacturing facility for batteries will cost millions, probably hundreds of millions of dollars. I know there are not any vanadium flow battery manufacturers making a profit. More than a few were bankrupted within the last few years. The manufacturers are struggling and burning the shareholder's money. I hope the market will reward them in the future. Before we see the market for VRFB taking off, we don't like to take so much risks. We want to make sure we are fully engaged in this industry for now and the future.

At Golden Share, we would like to work with all vanadium flow battery manufacturers to lower the cost of batteries through mast producing electrolyte at Golden Share. We strive to supply vanadium electrolyte with best value/cost ratio. Meanwhile we want to continue working with the PNNL to advance the vanadium electrolyte for VRFB and develop a solid state vanadium based energy storage technology.

We have no interest in becoming a manufacturer for now. We would like to focus on vanadium electrolyte, to lower the cost and advance technologies to make VRFB more competitive. I think right now it's still too early for vanadium flow battery manufacturers to compete with each other for market share. As a group, the vanadium flow battery manufacturers need to work together to compete with the other energy storage technologies, especially lithium ion b batteries for utility clients.

There's no shortage of vanadium on earth. Probably the resources and reserves we have discovered so far will fulfill human beings' applications for thousands of years at the consumption rate of today. Since there's no shortage of vanadium right now, Golden Share wants to maximum our resources by focusing on advanced technology, researching the business model, to develop a profitable and sustainable business. The main application for vanadium is for the steel industry. The main supply of vanadium is also from the steel slag. Vanadium from steel slag goes back into the steel to make steel bars stronger. So high purity is not necessary. But for batteries for energy storage, high purity is a basic requirement, and more importantly, the composition of the impurity. 98.5% purity is the minimum requirement for the vanadium electrolyte. But if you have a high percentage of any unwanted minerals, such as iron or silica, in the 1.5% of impurities, the vanadium electrolyte and batteries will be killed. So, high purity is only a basic requirement and what’s part of the impurity is more critical. A lot of people don't pay attention to that. Not all vanadium mines could provide a battery grade vanadium. In the future, we may pay more attention to the raw material. For now, we are working with the largest operating, primary vanadium mine in China, through a strategic partnership agreement to secure a possible best source for battery grade vanadium.

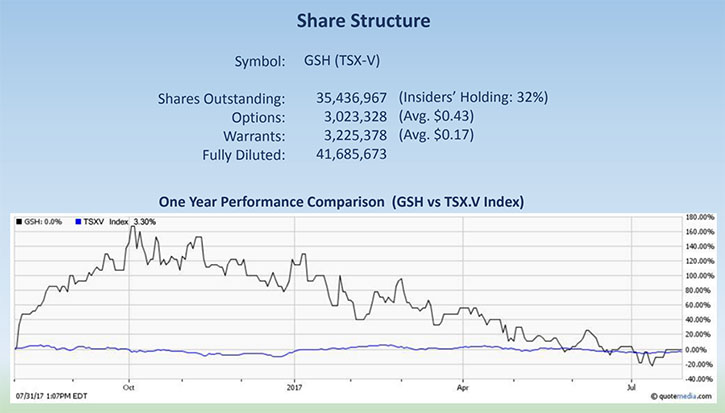

Dr. Allen Alper: That sounds good. Could you tell our readers/investors a bit about your share structure and where your shares are listed?

Mr. Nick Zeng: We have fewer than 40 million shares, and we have a very strong shareholder base. I would say, probably about 60% of the shares of Golden Share are in very strong hands. They're not afraid of the volatile of the market.

Not a lot of people know about our company. We haven’t spent enough in marketing our company because we do not want to get ahead of ourselves. Awareness is one challenge for us. But it could be a good opportunity to start accumulating Golden Share before the market.

Dr. Allen Alper: That sounds good. Could you tell us a bit about your background, your management and directors?

Mr. Nick Zeng: Dr. Huang, a board director is a famous geologist in China, with enough contacts to help us in China. We have a mining engineer, Wes Roberts as a board director. As a seasoned mining engineer, Wes keeps us disciplined. We also have a geologist, David Graham. David played a key role in the ring of fire discovery and helps us a lot, working with indigenous people. Chris Guilbaud is a financier, specializing in junior mining. Golden Share’s Advisory Board is composed of Dr. K. Sethu Raman, Mr. William S. Vaughan and Mr. Yang. Mr. Vaughan is a 2017 inductee into the Canadian Mining Hall of Fame. Both Dr. Raman and Mr. Yang are true mine-finders. We have a very strong, knowledgeable, management team. I'm not the mining guy, I was trained as a chemical engineer, while studying in university back in China. I started my own business when I was 22, started with a tiny manufacturing facility in China, later expanded into US and Canada with design, customer service and distribution facilities. As an entrepreneur, I want to build Golden Share to a real business to shine and last.

Dr. Allen Alper: That's very good. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mr. Nick Zeng: Golden Share is still early stage. A lot of risks there, but if you would like to allocate a small portion of your money that you can afford to lose, hopefully for great future rewards, Golden Share could be a good candidate. I think Golden Share is kind of unique because, right now, we have three businesses going on in Golden Share. It may be risky, but Golden Share has a tremendous upside.

We are considering a spin-off to spin out the energy storage. Energy storage business has a bright future and we are very lucky to have this opportunity to be able to work with PNNL.

Participating in a railroad, to the far north of Canada, for mineral development and conducting regional exploration along the railroad corridor, is an interesting strategy and makes sense.

About 100 years ago, when Canadian Pacific Railway was to build the transcontinental railway from Eastern Canada to British Columbia, with Chinese laborers, CPR was granted mineral rights along the railway to reduce the risks. When CPR drilled for water, they got gas. That is how Encana Corp and Cenovus Energy later started. All three are listed on the S&P/TSX 60 Index, a stock market index of 60 large companies listed on the Toronto Stock Exchange.

We are working to bring investments and technologies from China to build a railroad and do regional exploration along the railroad. Everything is still early stage, but we think it can be a very profitable pursuit.

Dr. Allen Alper: That sounds very interesting!

https://www.goldenshare.ca/

Nick Zeng, President & CEO

Tel: (905) 968-1199

E-mail: info@goldenshare.ca

|

|