Cobalt 27 Capital Corp. (TSXV: KBLT; FSE: 27O): Physical Cobalt Material, Streams and Royalties and Mineral Properties, Interview with Anthony Milewski, Chairman

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 1/12/2018

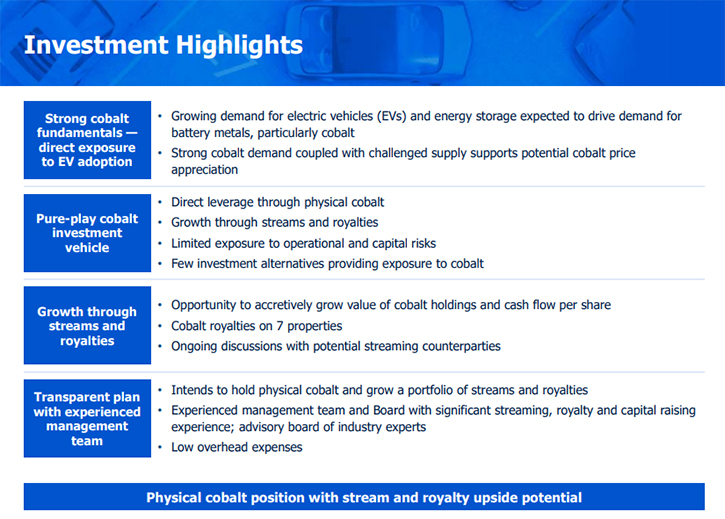

Cobalt 27 Capital Corp. (TSXV: KBLT; FSE: 27O) is a minerals company that offers

pure-play exposure to cobalt, an integral element in key technologies of the

electric vehicle and battery energy storage markets. The company holds physical

cobalt and is also focused on growing a cobalt-focused portfolio of streams,

royalties and direct interests in mineral properties containing cobalt. We learned

from Cobalt 27, that they have just completed a bought deal financing for 97 million

dollars and have used the proceeds to buy another 800 metric tons of physical cobalt

bringing them to almost 3,000 metric tons. According to Mr. Milewski, this

transaction was an opportunity to bring in additional shareholders, bring in more

retail, and strengthen their balance sheet ahead of developing their streaming

business.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News,

interviewing Anthony Milewski, Chairman of Cobalt 27. Anthony, could you give our

readers/investors an overview and update them on what's happening. I know it's been

an exciting time for Cobalt 27. You made the news and have been taking very bold

steps purchasing Cobalt.

Anthony Milewski: Once again, I appreciate you having me back for a

quick catch-up. As always I appreciate your time and your readers/investors’ time.

Yes, we have really exciting news! We've just completed a bought deal financing for

85 million dollars plus the banks exercised the green shoe, bringing the total

offering size to 97 million dollars, which for a company that just went public in

June of 2017, is an impressive show of interest. We will use the proceeds to buy

physical cobalt. As you know, we already have around 2,160 metric tons of cobalt.

We're adding another 800 metric tons, bringing Cobalt27 to almost 3,000 metric tons.

The decision to go ahead and raise the additional funds is to strengthen our

balance sheet. As we tell our shareholders and interested parties, we're focused on

streaming transactions and bringing scale liquidity into the stock.

So this transaction was an opportunity to bring in additional shareholders,

bring in more retail, and to give our balance sheet that added strength, when

entering a cobalt streaming transaction. When you're looking at doing a stream, and

you’re meeting up with a producing mining company, one of the key questions they'll

ask you is where's the money going to come from to do this stream. Of course, you

can make promises around the ability to raise capital, and that works to a certain

extent, but you ultimately need to show the producer that you have capital. So what

this has done, this 3,000 metric tons, is it allows us to use inventory financing.

Inventory financing rates are very inexpensive. It allows us to go into producing

companies and show that we have a strong balance sheet and access to readily

available capital. We're not held hostage to the whim of equity capital markets,

which can open and close on any given day, let alone over protracted negotiation.

Dr. Allen Alper: Well that's excellent. Amazing work you and your team have

been doing in cobalt! Can you tell our readers/investors what that means in terms of

cobalt and what is forecasted for the future?

Anthony Milewski: Cobalt is an interesting commodity. In 98, 99% of

cases, Cobalt is a byproduct of copper and nickel mining globally. The exception

being a primary mine in Morocco. For a decade now, cobalt has been a relatively

stable market. There has been some growth in superalloys, where cobalt is used to

manufacture jet engines, but really a stable market by and large. Then, out of

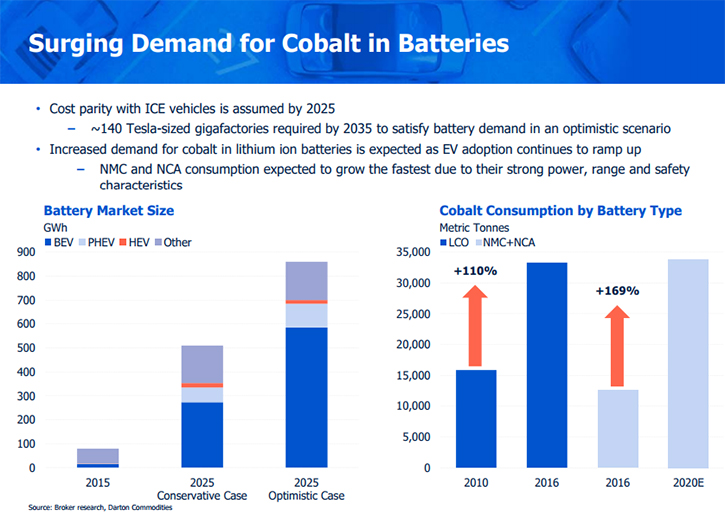

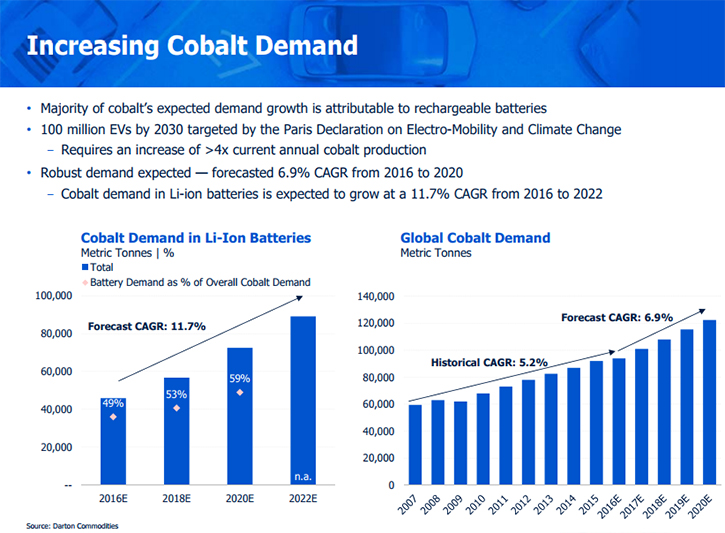

nowhere, you have a new source of demand in the form of the electric vehicle. What

we've seen transpire, even in recent months, is an acceleration of the adoption of

the electric vehicle. Bloomberg published numbers, the last couple weeks, saying

that, quarter on quarter, demand globally was up 63% for electric vehicles.

Volkswagen is in the market, saying the need for cobalt is accelerating. Another

Bloomberg outlet is saying that in 2030 there will be a need for 400 to 500,000

metric tons of cobalt. Today the annual market for cobalt is around 100,000 metric

tons.

We’re seeing a commodity that by and large was in equilibrium, and out of

nowhere, a brand new, unanticipated source of demand entered the market. And with

that, the commodity has come under pressure. People are starting to think about what

it means for today's cobalt price and for the next five or 10 years. It's

fundamental to the battery that powers the EV. Much of the reduction of cobalt

inside a lithium ion battery has already happened. Automakers and battery makers,

are highly focused on where they're going to get their cobalt from in the coming

years.

Dr. Allen Alper: That's excellent! How many pounds of cobalt is in an

average, individual car?

Anthony Milewski: It varies massively. You could have cars in China

with as little as four kilograms, larger batteries that might have 30 kilograms, a

huge range, not including the new Tesla semi-truck for long haul trips. There's also

the electrical vehicle component.

When we speak with automobile makers, around the world, they tell us the electric

vehicle isn't just about being electric. It's a platform for a complete

restructuring of an industry. Some recent reports by the major auto makers are

talking about mobility as a service. They're talking about ride sharing. Your car

may one day go around as an Uber during the day, while you're at work. Some of this

is years away. In order to implement this new paradigm for the automobile industry,

they need a platform that has sufficient technologies, sufficient sensors to

implement it, and so that is the electric vehicle. All the times we've focused on

the environmental aspect of the electric vehicle, which is important, there's the

secondary and probably just as important from a commercial standpoint to the

automobile makers, which is that this is the platform for the future of the

automobile industry.

Dr. Allen Alper: Well that's great! Really exciting! You're right at the

forefront of what is happening with the lithium ion battery market. Could you update

our readers/investors on your background, your team, your board?

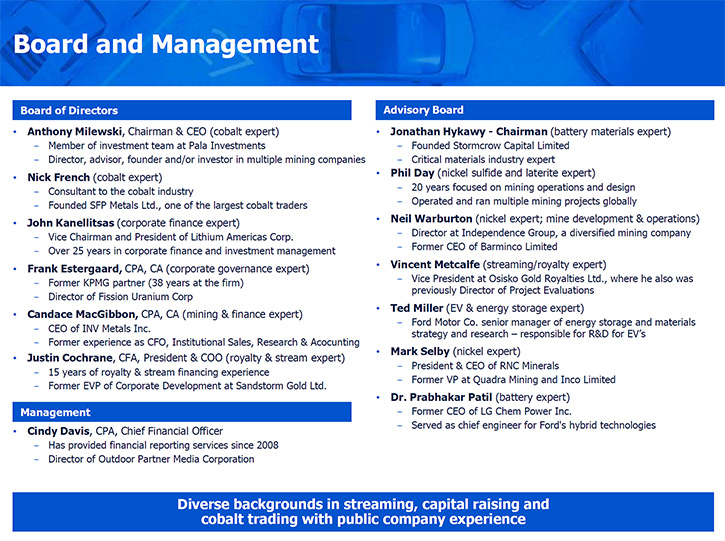

Anthony Milewski: We have a very interesting board, a fully

independent board, except for myself and Justin. We have: Frank Estergaard, who was

a partner at KPMG. Nick French, one of the largest traders of cobalt for 20 years

and John Kanellitsas, who is an executive at Lithium America. So you have a very

sophisticated battery-metals focused board with deep expertise in mine and commodity

financing. In addition to that, we have an advisory board that's comprised of well-

known and renowned experts such as the former CEO of LG Chem. You have Guy, who is

an expert in nickel projects, and that's important because cobalt is often a

byproduct of nickel. We've put together a group of individuals, who know the various

aspects of the business ranging from mining, processing, all the way up to the

automobile industry.

I've spent my career in the mining finance side of the business, and capital

market side of the business. Our President and COO, Justin Cochrane was at Sandstorm

and has negotiated over 50 streams in royalties during his career. He's really the

driver behind the streaming and royalty business. We have a sophisticated group of

individuals, well rounded in the different aspects of the value chain, in the

electric vehicle story.

Dr. Allen Alper: Excellent! I’m impressed with your plans, your

accomplishments, and your vision. Could you review your capital structure for our

readers/investors?

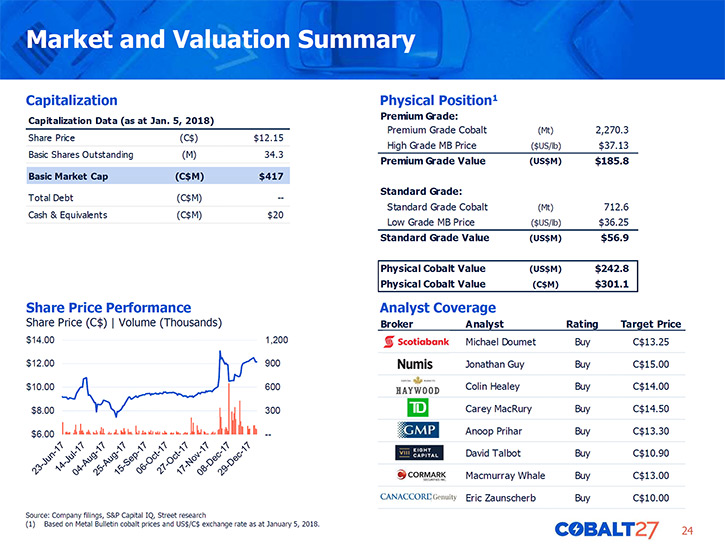

Anthony Milewski: We have common shares. Prior to the recent offering,

we had about 24 million shares. Post offering, we'll have another 8 million shares

outstanding. It's very straightforward. There's no debt on the balance sheet. There

are some options outstanding, and warrants outstanding to the directors and officers

based on merit and performance. It's a very clean capital structure. There's only

one cost of shares. It's publicly traded on the TSX Venture Exchange.

Dr. Allen Alper: Sounds excellent! What are the primary reasons our high-

net-worth readers/investors should consider investing in your company?

Anthony Milewski: This is especially important for the retail

investors because they don't always have the best access to research or the same

access that a big institution might have. We're undergoing a structural change in

the energy business, and the automobile industry. Over 50% of crude is used for the

automobile industry, and up to 75% total for transportation more broadly. The

majority of crude oil is used in transportation. The automobile industry is

undergoing a transition with autonomous vehicles, mobilities of service and the

electric vehicle. Most investors believe the electric vehicle will be adopted, but

do they buy Tesla, Ford, Chevy? Or do they buy the basic materials, the components

that make up the batteries that are going to power the electric vehicle in the

future?"

If you are an investor, thinking about this space, it's very hard to know

which automobile maker is ultimately going to win. However, if you do believe there

is going to be a winner or two, then you know definitively the basic materials that

comprise the battery are all positioned to be winners. In addition to cobalt, which

is my favorite, you should look discerningly at lithium, certain types of nickel,

and copper.

The retail investor really wants to focus on the structural change in these

industries and boil it down to the basic materials and make sure to be exposed to

them through the cycle. I think from my perspective, on a risk adjusted basis,

Cobalt 27 should be in that basket, simply because we're not mining, we're not going

to build a mine. It's a very clean way to play it. I think it's important to be

focused on the transformation that's going on in these industries and the

commodities that back them.

Dr. Allen Alper: Well that sounds like an excellent approach, and I

appreciate you sharing your insights with our readers/investors. Is there anything

else you would like to add, Anthony?

Anthony Milewski: No. I really appreciate your time, Allen, as always.

http://www.co27.com/

Cobalt 27 Capital Corp.

4 King Street West, Suite 401

Toronto, Ontario

Canada

M5H 1B6

TSXv: KBLT | FSE: 27O

Tel: 647.846.7765

Email: info@co27.com

|

|