Eurasian Minerals Inc. (TSX-V: EMX, NYSE MKT: EMXX) Is Very Successful in Developing Royalty Streams in Multiple Countries as a Prospect Generator

|

By By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC: https://www.linkedin.com/in/allen-alper-84432231

on 4/7/2016

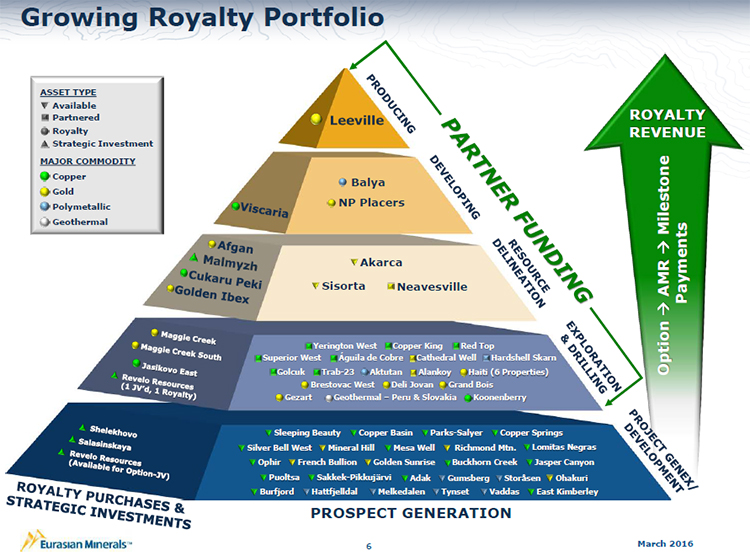

Eurasian Minerals, Inc. (TSX: EMX, NYSE MKT: EMXX) is a company executing the royalty and prospect generator business model in multiple countries to provide value to their shareholders. David Cole, President and CEO of Eurasian Minerals, named six value drivers within Eurasian Minerals’ portfolio: the Carlin Trend royalty in Nevada, the Akarca project and Balya royalty in Turkey, the Cukaru Peki royalty in Serbia, the Malmyzh deposit in Russia, and the super strong Eurasian Minerals team that has built a mineral property portfolio of over 1.5 million acres worldwide. David has an excellent track record for discovering, exploring and developing valuable mineral properties throughout the world. He has built an outstanding team

David Cole, President and CEO of Eurasian Minerals (TSX-V: EMX, NYSE MKT: EMXX), has an MS in Geology from Colorado State University. He studied under the distinguished Dr. Tommy Thompson. He spoke with Dr. Alper at PDAC to share the secret of his success with our readers. Mr. Cole talked about the benefit their business model, royalty and prospect generation, is offering to investors. Cole said, “We are global royalty and prospect generators. We have over 1.5 million acres of mineral real estate around the world executing this business model that I believe in passionately. We are in thirteen different countries on five continents, primarily in copper and gold, but we also have some polymetallic exposure as well. We continue to have good deal flow in getting projects out the door and into the hands of other companies, including Rio Tinto, and other well-funded top tier companies. We execute the business model in a manner to keep our exploration properties available with 100% project equity to our customers. That works nicely and contributes to good deal flow.”

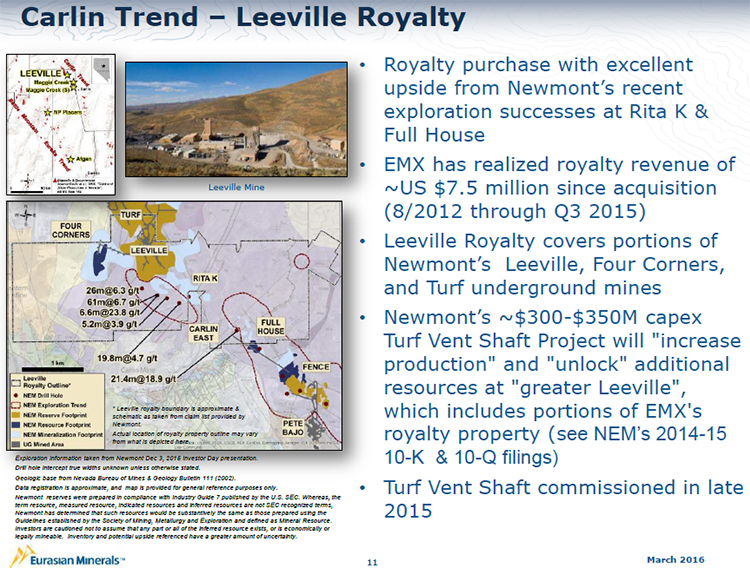

Mr. Cole has his business plan well defined into six areas that move the company forward. He said, “There are six value drivers within the portfolio. One of those is our royalty on the Carlin Trend with Newmont at the Leeville Mine. Newmont has recently announced a substantial new discovery extending southeast from that deposit. They are calling it the Rita K corridor, which substantially occurs on our royalty ground. Also Newmont recently completed the new Turf ventilation shaft increasing the number of shafts at "greater Leeville" to three. The underground construction there continues to advance. Newmont has announced that they would like to see production from the "greater Leeville" complex, which is partially covered by our royalty, to increase by 100,000 to 150,000 ounces of gold annually as we head into 2016. We are delighted about that.”

Mr. Cole believes that Rita K is one of the best opportunities for the company both now and in the future, though there are other properties that show signs of promise. He said, “That is a good kingpin asset for us. It gives us good cash flow.

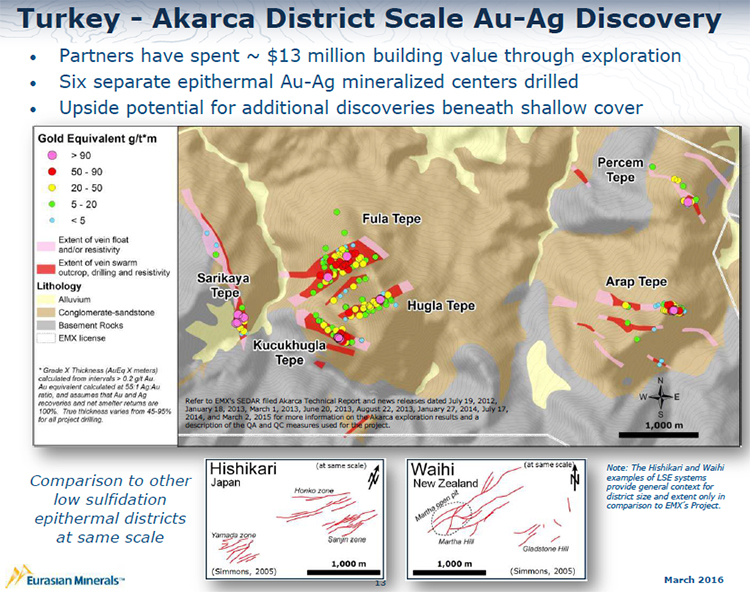

Second on the list of the six key value drivers within our ~1.5 million acres would be our Akarca project in Turkey. Akarca is a gold and silver discovery. We own that 100%. It is an epithermal gold and silver deposit in western Turkey. Turkey is very workable. We are entertaining offers to sell the property at this point, part and parcel as according to our business model. We seek to sell it for a combination of cash and royalties. Akarca is a key asset in the portfolio and it is a good example of the execution of the business model. Partner companies have spent $13 million advancing it. It is very fortuitous because of the downturn in precious metals prices that we had that the property returned to us. We are delighted to have it back. We have been reviewing the data and putting together the story and are quite confident that we will be able to sell that asset.”

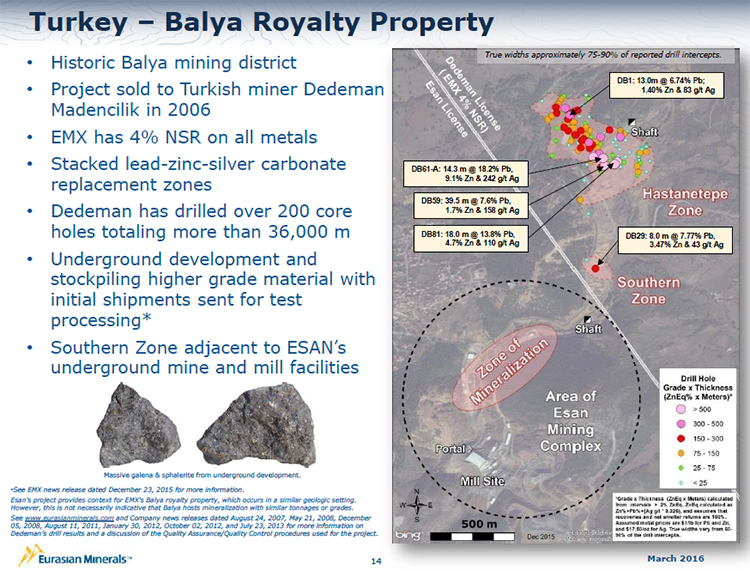

Another one of their projects combines the company’s ability to find assets and then convert them into royalties. Cole said, “Third on the list and very importantly, is our Balya lead, zinc, silver NSR royalty of 4%. We are delighted as that will put us in the position to have cashable bonds in 2017. That is a very important asset for the company."

When the company isn’t working on developing royalties through prospect generation, they are looking to purchase them at other projects, which can help to drive their earnings forward. Said Cole, “Another prong of our business model is to purchase royalties when we can. We have a 0.5% NSR royalty covering Reservoir's share of the Cukaru Peki discovery in Serbia, and this is the fourth value driver for EMX. That was one of our first royalty parcels that we bought. Lundin Mining very recently made an offer to buy out a portion of Cukaru Peki, which signals value is increasing. I’m glad to see it advance towards fruition.

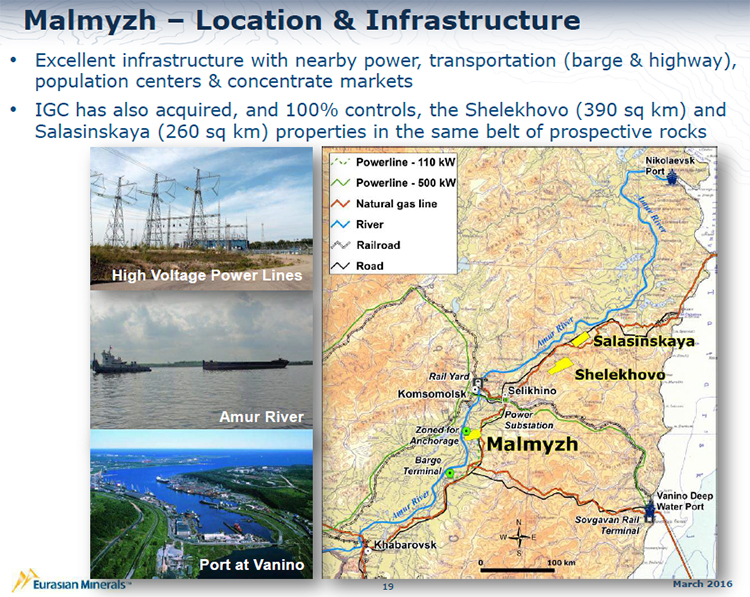

The Malmyzh copper-gold discovery in Russia, we own a part of that. That came from a strategic EMX investment, and is our fifth value driver. We own 42% of the private company (IG Copper) that is in a joint venture with Freeport (51% IG Copper, 49% Freeport). The inferred resources were reported in our SEDAR filed technical report at a 0.30% copper equivalent cutoff as 1.66 billion tonnes averaging 0.34% copper and 0.17 g/t gold, or 0.42% copper-equivalent. That inferred resource represents 12.4 billion pounds of copper and 9.11 million ounces of gold. We are delighted with that resource, and we expect it to grow over time. It is close to a river, paved highway and power. There are markets close by. We think that project is marketable. We believe that our investment in copper is worth more than the market is seeing right now.

Those are some of the key assets in the portfolio driving value and representing the three prongs of our business model: royalty and prospect generation, royalty purchases, and strategic investments. There has been substantial insider buying and we are up to about 35%. Paul Stevens, who is on our advisory board, is up to 18%.”

The team that Cole has assembled, he believes, has contributed greatly to the success of Eurasian, and this is the sixth and most important value driver for the company. Said Cole, “I get to work with some wonderful people. I’m an educated geologist and I also learned from the school of hard knocks. I’ve always believed in the innate value of mineral rights. I built the business model that we work on at Eurasian. I work with super smart guys that have business sense and education. That has built this portfolio of over 1.5 million acres worldwide. The team has built this portfolio. They are firing on all cylinders. I’m really excited about the project in Sweden that we are getting ready to drill. We have a lot of irons in the fire. Our share ownership in Malmyzh has potential value that provides real market cap upside. There are several properties like that. We have substantial insider buying. That tells exactly what we think. The track record, if you look at when insiders are buying, that might be a good reason to consider doing the same.”

http://www.eurasianminerals.com

Corporate Office

Suite 501 - 543 Granville Street

Vancouver, British Columbia

Canada V6C 1X8

Phone: +1 (604) 688-6390

Fax: +1 (604) 688-1157

kcasswell@eurasianminerals.com

|

|