Rockex Mining (CSE: RXM) Corp Announces Stellar Results on Lake St. Joseph Iron Ore Project in Canada

|

By By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC: https://www.linkedin.com/in/allen-alper-84432231

on 2/23/2016

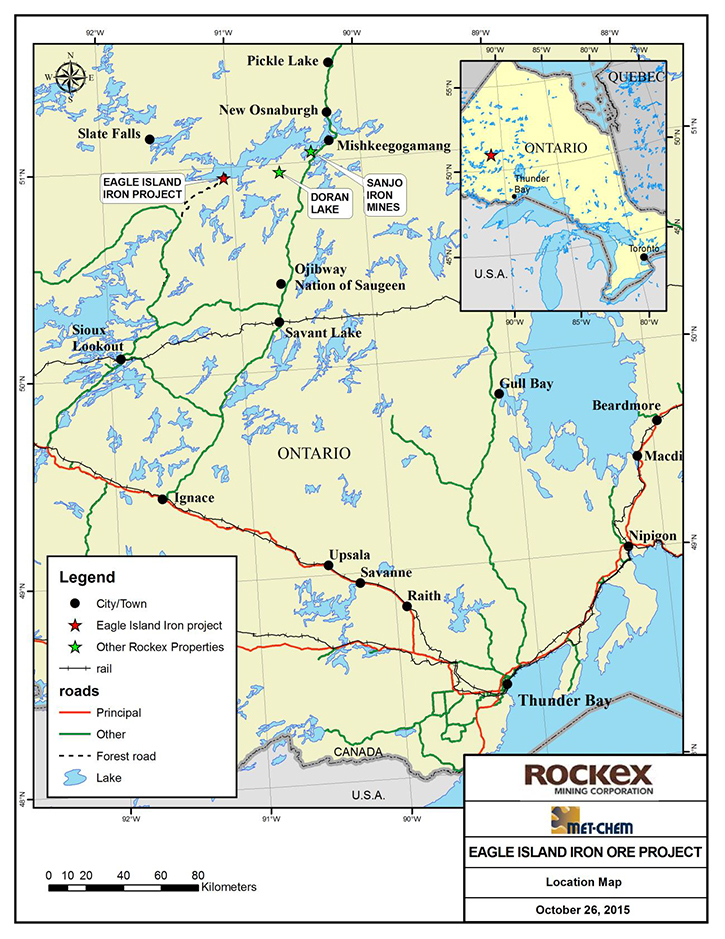

Mr. Armando Plastino, President and CEO of Rockex Mining (CSE: RXM) was happy to discuss the recent results of their updated preliminary economic assessment on the Lake St. Joseph iron ore project located in Canada.

Plastino said, “I joined Rockex in 2011, so I have been with them for about five years, initially as a Director and then about a year ago I started as the CEO. I’m actually retired from the steel business. I live in Sault St. Marie, Ontario, which is centered in the middle of the three Great Lakes, just north of Detroit. There is a large integrated steel mill in Sault St. Marie. I worked there at that steel mill for virtually my entire career. I retired in 2010 and when I retired, I was the Chief Executive Officer of the steel mill in Sault St. Marie called ESSAR Steel Algoma. That is how I came into contact with the Rockex proponents.”

Rockex had contacted Plastino concerning the Lake St. Joseph iron ore deposit. He said, “Originally Algoma Steel, as it was known in the 1960’s, had staked claims on the Lake St. Joseph property, which had lapsed. Algoma had done an extensive amount of core drilling and investigation of the ore property there. They found it to be very, very satisfactory and had actually given serious consideration to developing the site along with a partner. The project didn’t proceed for some reason and Algoma went in a different direction with respect to acquiring a source of iron ore pellets. The lapsed claims were re-staked by Rockex – one of the principals of Rockex re-staked them – and they subsequently approached me as the CEO of the steel mill inquiring whether we were familiar with the property and any work that may have been done on it. As it ended up we had extensive core drilling samples and files containing information and data that would have been useful to Rockex, but was no longer of any use to Algoma Steel., Rockex acquired that information and through that relationship, following my retirement, I subsequently became involved with them.”

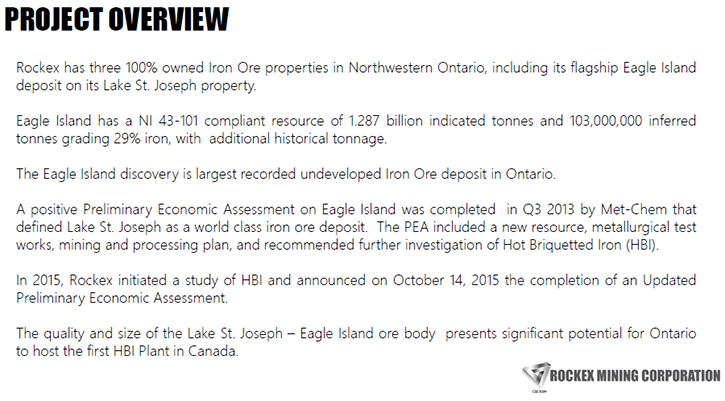

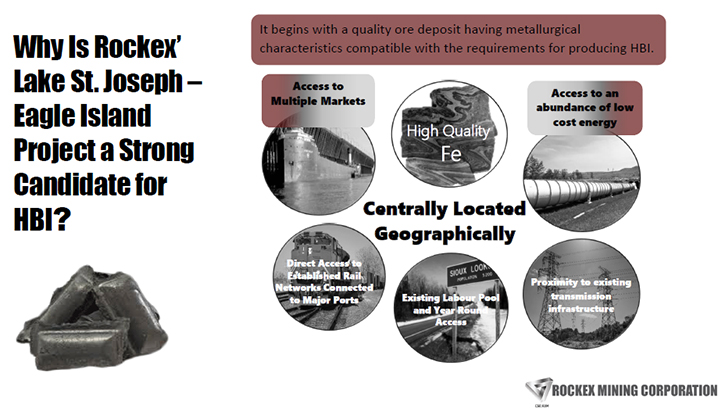

With the new information available in the upgraded PEA, Rockex decided to take the next step in moving the St. Joseph Lake project to the feasibility study stage. Mr. Plastino said, “Rockex basically took that information they had acquired from Algoma Steel and they were able to advance the project through more drilling very quickly into a preliminary economic assessment. The PEA in Canada must be conducted according to a national instrument, referred to as NI43-101, so it is compliant to federal regulations that ensure the PEA is conducted by qualified engineering and metallurgical firms. We were able to get this preliminary economic assessment completed and that was done in 2014 which is when it was finished. It showed that the project was economically quite viable and it contemplated making an ore concentrate but also suggested that HBI could be studied as possible end product.”

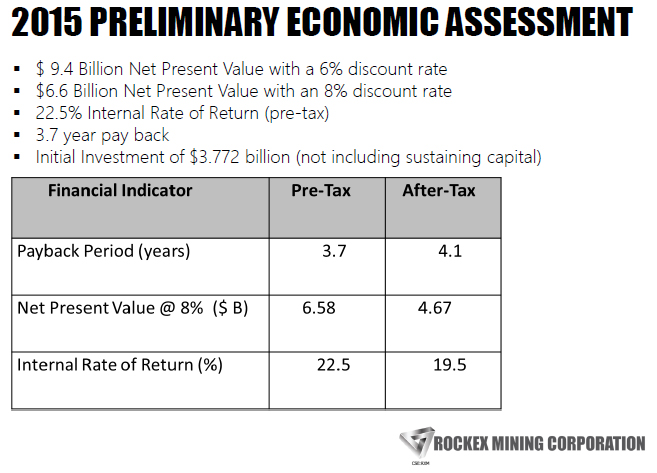

Looking at HBI production changed the entire trajectory of the project. Said Plastino, “When we looked at the economics after the PEA, we decided to add the HBI to the PEA. That PEA was therefore upgraded and completed last November and the results of it were very, very favorable. The PEA came back and said basically it has a $9 billion NPV at a 6% discount rate. It has a 22% IRR pretax return. Fantastic! It was amazing. The total product cost of the HBI was $135 per ton. HBI at the peak of the market can sell for up to $400 per ton. The upgraded PEA contemplates a 30 year life of mine but the size of the deposit at 1.287 billion tones is enough for more than twice the life of mine in the PEA. This was all completely positive for us.”

The next step is to move to a bankable feasibility study. Plastino said, “We then decided that we should forward this project to a bankable feasibly study. We had earlier struck a cooperation agreement with Danieli. headquartered in Udine, Italy. Danieli is an established, leading worldwide manufacturer and supplier of technology and equipment to the metals industry. The agreement establishes Danieli as Rockex’s technological partner for marketing and promoting the Project to possible strategic partners, financiers and final product off-takers. In exchange, Danieli has the opportunity to become the exclusive engineering and procurement supplier for plants to be constructed in the framework of the Project implementation. That agreement we signed last May in 2015, through our combined efforts and through our limited marketing capability. We were approached by Dime Venture Capital out of Atlanta. They expressed some interest and wanted to learn more about Rockex. They said they would be interested in funding our project.”

Rockex was contacted by DIME Venture Capital out of Atlanta expressing some interest in the Project and wanting to learn more about it. Through subsequent discussions, DIME decided they were interested in funding the Project. The financing process with DIME is now underway. Said Plastino, “We are now in the process of ongoing dialog with DIME to establish definitive agreements. We signed a non-binding letter of intent with this firm just about a week ago, on February 11th. That non-binding letter of intent essentially provides for funding the project in two phases. The first phase is $30 million for the bankable feasibility study of which Rockex will have to contribute 10% or $3 million dollars. We are in the process of raising that $3 million in capital. Once we have the $30 million in place, we will start the bankable feasibility study. Presently, a number of r engineering firms that responded to our RFP on the bankable feasibility study are preparing estimates which are due in several weeks’ time. By then, we should have the funding from Dime in place. Phase two will be from Dime as well, which will be $3.77 billion dollars of which Rockex will be required to raise 10%. Our view is that even though market conditions are currently depressed, we think there is great value now, rather than at the peak of the market. We are hoping to get this Project moving and off the ground and are confident that through our arrangements with DIME and Danieli we will soon be doing just that.”

http://www.rockexmining.com/

Rockex Mining Corporation

Armando Plastino

Chief Executive Officer

(416) 594-9449 (416) 594-9449 (416) 594-9449

armando.plastino@rockexmining.com

|

|