Lomiko Metals (TSX: LMR) Releases Resource Estimate on La Loutre Flake Graphite Project Located in Quebec with Positive Results

|

By By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC: https://www.linkedin.com/in/allen-alper-84432231

on 2/21/2016

A. Paul Gill, CEO of Lomiko Metals (TSX: LMR) spent some time explaining the progress of the company now that their resource estimate has been completed. He said, “I’ve been in mining for about 11 years, starting with the development of Norsemont Mining’s Constancia Copper Project in 2004. That is now an operating mine owned by HudBay Minerals, so we had a real success with that copper project.”

Now with Lomiko Metals, Gill is looking at how mining can satisfy the changing economy. He said, “We looked at where product demands are developing and what kind of materials will be needed for the new green economy. Through that, we developed the concept for and launched Lomiko Metals, which is looking for copper (a metal always prevalent in any electronics). Lomiko Metals also looks for lithium, graphite and cobalt, all elements required for lithium ion batteries, essential for electric cars like the Tesla S and Nissan Leaf.”

Graphite has become the main focus of Lomiko. So Lomiko chose to “drill down” on the La Loutre project. Said Gill, “What interested me about graphite over lithium was that, while both lithium and graphite are used in Li-ion batteries, graphite is universal because it is also used in nickel metal-hydride batteries and other battery forms, such as vanadium batteries and others. So, we have a really good demand for graphite regardless of what battery platform a vehicle uses.”

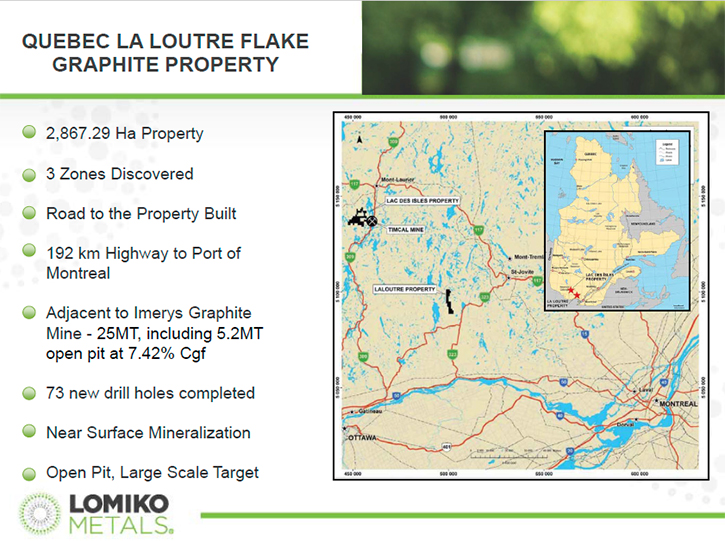

The business plan for the company has been designed around graphite. Gill said, “Taking that into consideration, we took a look around the globe for the best location for mining and we found that Quebec is the best jurisdiction with highways and ports infrastructure close to the manufacturing centers on the East Coast and to auto-makers in Detroit. It also has, luckily enough, some of the best graphite in the world. We didn’t have to go to far flung reaches to find the graphite. It was right were we wanted it to be – we couldn’t have put the property in a better location.”

As a result of that focus, the company has now acquired several properties. Gill said, “We’ve optioned three properties there and we have just released a resource estimate on our La Loutre property, which is located about 170 km. north of Montreal. It is very easy to get the product to the world-class Port of Montreal, but more importantly it is about twenty-five or thirty kilometers away from the Imerys graphite mine, which is the only operating graphite mine in all of North America right now.”

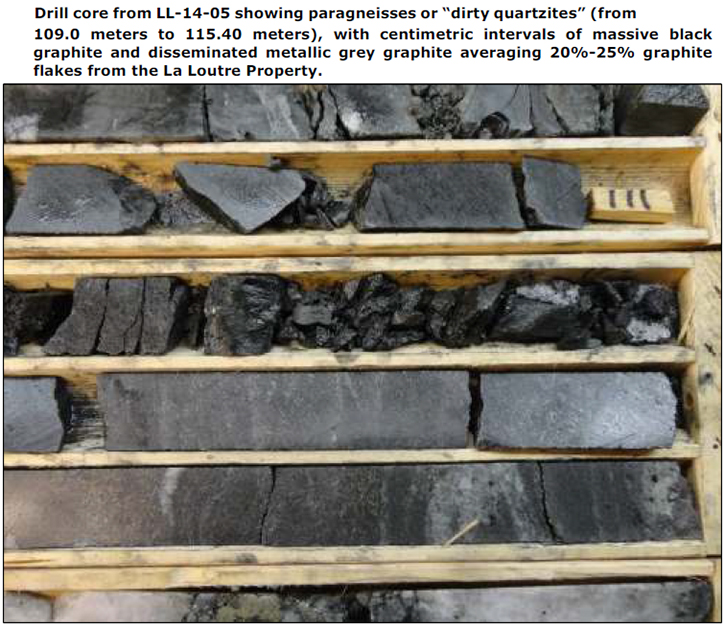

Researching the market is a focus for the company. Said Gill, “Generally speaking, our plans are in concert with the market for graphite. The market for graphite is tied in with refractories right now. The current major use in China is for their refractories. In fact, the zones that we have discovered on the La Loutre property are called Graphene, Battery and Refractory Zones. We are focusing on those as the major area of development for each of those markets. First, we will focus on the deposit in the Battery zone, which is the near surface location and has a steep demand curve to 2020. It has low extraction costs and we hope to be a competitive producer that can meet or beat the prices of graphite coming from China. That is what all of the graphite properties have to do. You have to be a low cost producer to compete with China. We found the graphite in the ground, so now we are discussing the economics of extracting the graphite. That will be in our PEA and will take into account infrastructure and capex to build the property up to a mining start and also the operating costs for continuing to operate the mine. That factors into the profitability. We are excited and the engineers are putting together the background material for the analysts now and hopefully for the banking world.”

The company has already raised funds and has plans for moving the project forward in the near term. Said Gill, “The PEA is underway right now based on the funds that we have already raised. We will want to do more definition drilling to bring inferred resource up to proven. We can extract at over a 3% grade of graphite and there is about 19 million tons available to us that would yield over 200,000 tones. There is also about the same amount that is inferred that will need more drilling and higher grade areas not fully drilled yet. Once we get that work done, all Lomiko will require is road shows to explain the PEA details to prospective buyers or partners. We will go to the market for a bankable feasibility once we find additional partners. In addition to that activity, we hope to continue exploring the refractory zones. We had intercepts of 16%, which is a very high grade zone not included in the current PEA plans, but provides long term “legs” to the project. No one knows about us yet and we are a dark horse coming up the middle of the pack. There are a lot of graphite companies with resources defined, but no one can compete with China yet. I think we can.”

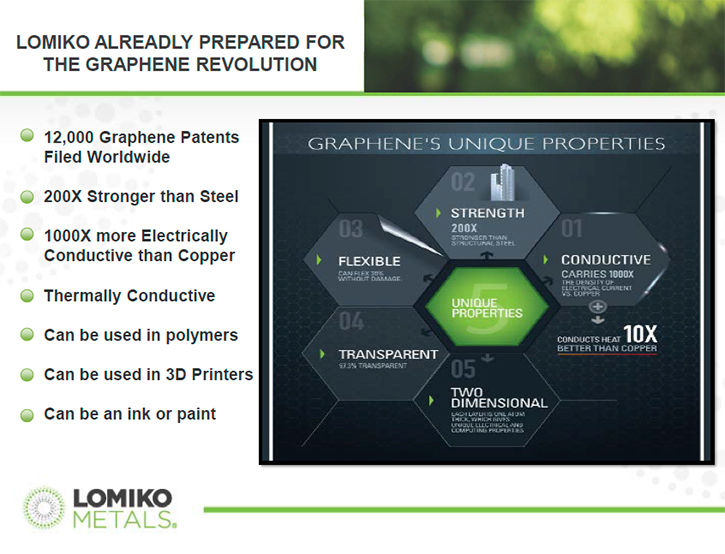

Gill believes that there are many good reasons that investors should take a close look at Lomiko Metals (TSX: LMR) for investment. He said, “Number one, location, it is in close proximity to Detroit and to the East Coast. The Freight on Board (FOB) costs are low and remember, this will establish the actual cost to the customer, not only the extraction costs. We are right beside Imerys, one of the biggest graphite producers in North America. They are a potential buyout or JV partner for us. The material is near surface, which means we are not wasting money moving waste material from the top of the ore before we get to pay-dirt. We want to have a resource at surface so we can make money right away and mitigate project costs. We already have had good results from our tests to create battery material and refractory material for steel making and we are not stopping at graphite. We are investing in graphene by investing in Graphene 3D Lab Inc. which has a very good long term outlook. It is 200 times stronger than steel and 1000 times more conductive than copper. It is an interesting material that is coming to the fore.”

http://www.lomiko.com/

#439-7184 120th Street, Surrey, B.C. V3W0M6

|

|