Photo: Mr. Ian Graham, CEO and Director of Montan and Mr. Luis Zapata,

Executive Chairman at the Mollehuaca Gold Processing Plant (Toll Mill) Site

1.

Montan Mining Corp. (TSXv: MNY) (FSE: S5GM) is a relatively new company

focused on Peru. Can you please explain to our readers why you chose Peru?

Montan was specifically created to be in Peru because our management

team has a track record of success, experience and roots there. Mr. Michel

Robert, Montan Director and spearhead of our technical efforts was previously

Senior Vice President of Pan American Silver Corp. (TSX: PAA) during the

foundation and growth years of 1995 through 2001 where he was responsible for

the management of operations in Latin America and oversaw the expansion of the

company in Peru, Mexico and Bolivia. Mr. Robert knows how to build and operate

mines and mills in Peru as well as build a mining company from the start. Mr.

Luis Zapata, Montan’s Executive Chairman and Co-Founder is based in Peru and

was formerly Head of Latin America Institutional Equity Sales at Canaccord

Genuity. Mr. Zapata brings domestic financial capacity to the company as well

as government, operational and community contacts.

Photo: Mr. Luis Zapata, Executive Chairman of Montan Mining Corp. at the

Eladium Gold Mine

1.

While the qualifying transaction for Montan was the acquisition of the

Alicia Copper Project the primary focus of the company is the Mollehuaca Plant

in the Peruvian region of Arequipa. Can you please give us some details on that

deal? What exactly did you acquire and what will you have to pay?

Montan recently entered into an agreement to acquire two producing assets:

the Mollehuaca Gold Processing Plant (Toll Mill) and the Eladium Gold Mine, as

well as an exploration property Saulito, all located in the Arequipa region of

southern Peru. The

Mollehuaca Plant was recently expanded and has both a carbon-in-pulp (CIP)

circuit as well as a flotation circuit with a total capacity of approximately

150 TPD. This will make us the second largest currently operating plant in Peru

held by a TSX listed company. The assets are being

acquired from a private company Goldsmith Resources SAC whom had spent more

then US$4 million and four plus years advancing the assets to their current

stage. We will acquire the assets for US$3.3 million staged over 15 months in a

combination of equity and cash. The acquisition of an existing

permitted, operating and producing gold ore processing facility saves Montan significant

capital, time and resources by eliminating the construction and permitting

process which building a new gold processing plant would entail.

2.

So, basically you bought / are buying a plant that you will use for

toll-milling. What is the opportunity here and where will the ore to be

processed come from?

Yes. The plant processes ore from various small-scale formalized gold

mines/miners in the region and throughout Peru as well as from the wholly-owned

Eladium Mine. It is a good margin / margin protected business – buying ore at a

discount to the spot gold price, processing through the plant, and selling the

gold or gold-in-carbon at market. The Peruvian government has been taking steps

to formalize the small-scale mining space in country and mills so there is

increasing need for formalized mills.

In terms of our ore purchasing strategy, Montan

recently announced a key addition to our team: Mr. Jose Luis Garcia as VP

Operations Peru. Mr. Garcia was previously the manager of minerals procurement

for one of the largest Peruvian toll mill operators (annual sales of more than US$150M)

and was key to the growth of that company. Without entering into operational details,

it is fair to say that minerals procurement is the most important aspect of

this business, in comparison with running a plant and its infrastructure which

is basically a straightforward technical issue. The key to success is

developing and maintaining relationships based on trust and respect. Like most

businesses, this is a people business. We are focused on having the right

people. Our mill is in a region of high concentration of gold mining activity

and we are confident in our ability to source ore, as well as in our expanding

team.

Photo: Ball Mill at the Mollehuaca Gold Processing Facility

1.

How are you planning to finance those ore purchases?

Montan is about to finance through an equity

private placement – this will be sufficient for initial ore purchases and the

beginning of ramp up. In the longer term, we are looking to build relationships

with strategic partners that will be able to provide us with low cost credit

for ore purchases. This is ongoing – we have been taking parties to site and

receiving expressions of interest.

Photo: Feed shipment to the Mollehuaca Gold Processing Facility

1.

What are your next steps? Are you planning to expand the mills capacity?

If so, in what time frame and to what capacity?

Our immediate goal is to increase production

from its current 30 tpd to its as built capacity of 150 tpd. As we are doing

that we will begin the process to upgrade our permits to 350 tpd. This will

give us optionality moving forward. Operationally, our initial plan is to

achieve steady throughput of 130 – 150 tpd of 0.8/oz Au material and then we

will make the strategic decision to go to 350 tpd.

Photo: Mollehuaca Gold Processing Plant

1.

What kind of earnings / cashflows does management believe it will be

able to achieve at Mollehuaca?

Cash flow and earnings is highly dependent on throughput (tpd) and feed grade.

Based on steady state 140 tpd processing of 0.8oz Au material and assuming a

$1150 gold price we should be able to deliver on US$7M+ of EBIDTA per year to

begin with.

2.

Assuming all goes as planned and the plant is running at maximum

capacity, generating earnings / free cashflow – what are your plans for Montan

Mining longer term?

Initially we plan to ramp up

to 140 tpd in order to show the market that our team is efficiently running the

business. From there on we can expand the existing plant to 350 tpd. As the

company becomes a significant cash flow generator we will be able to reward our

shareholders through share price appreciation, protection from dilution, potential

dividends or share-buy backs. We will also be able to grow the company further

through M&A in a depressed market environment where additional accretive assets

are cheap.

3.

Why would, in your personal opinion, now be a good time for investors to

have a closer look at Montan? Can you give us some examples for how

toll-milling companies in Peru have been performing recently?

Several reasons: our share structure is one of the best in the space –

with no debt, our management team is experienced, capable, driven and focused –

a mix between experience and young energy, our valuation is compelling versus

peers and we have a clear cash flow focused business plan.

Comparables – TSX Listed Toll Mill Producers in Peru

|

Company

|

Shares

/ FD

|

Price

|

Market

Cap.

|

Debt

(~ $M)

|

Plant

Cost (~ $M)

|

Plant

Capacity (tpd)

|

In

Production

|

|

Dynacor

Gold Mines Inc. (TSX: DNG)

|

36 M / 38 M

|

$2.15

|

$77.9 M

|

-

|

8 / 10

|

300 & 300 (1)

|

Yes

|

|

Inca

One Gold Corp. (TSXv: IO)

|

68 M / 86 M

|

$0.21

|

$14.3 M

|

8

|

5

|

100

|

Yes

|

|

|

|

|

|

|

|

|

|

|

Montan Mining Corp. (TSXv: MNY)

|

19

M / 21 M

|

$0.205

|

$4.0

M

|

nil

|

3.3

|

150

|

Yes

|

As at June 11th 2015

(1) Second plant in construction

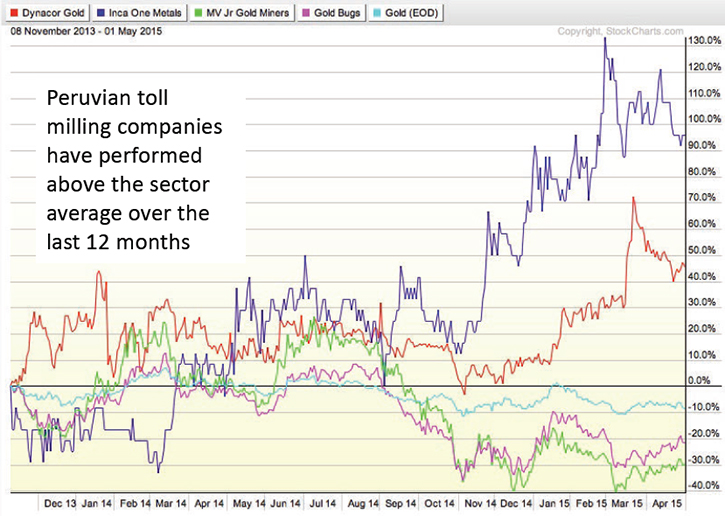

As the chart below shows the Peruvian toll

millers have out-performed all other major gold investment asset classes over

the last 12 months – including Gold (Spot), Gold Seniors (HUI) and Gold Juniors

(GDXJ).

More on Montan Mining Corp.

Montan Mining Corp. (TSXv: MNY) (FSE: S5GM) is positioned for growth in

Peru through the acquisition and development of advanced and/or cash flow mining

opportunities. Montan is backed by an experienced and high-energy management

team with diverse technical, market and finance expertise and strengths and is

supported by committed and sophisticated investors focused on building value

for the long term.

For more

information on Montan Mining Corp. please visit their corporate website at http://www.montanmining.ca or

contact Jason Shepherd, Investor Relations at

Ph: 250.212.2122

or TF: 1.866.913.1910 or Email: jshepherd@montanmining.ca

Forward-Looking Statements: Certain statements in this

article are forward-looking statements within the meaning of applicable

securities laws. Such forward-looking statements and information are subject to

risks, uncertainties and other factors which may cause our actual results,

performance or achievements, or industry results, to be materially different

from any future results, performance or achievements expressed or implied by

such forward-looking statement. Specific risks included that we may not be able

to finance our intended acquisition and we may not obtain regulatory approval.

General risks include the reliance on available data and assumptions and

judgments used in the interpretation of such data, the speculative and

uncertain nature of exploration and development, exploration and development

costs, capital requirements and the ability to obtain financing, volatility of

global and local economic climates, share price volatility, estimate price

volatility, changes in equity markets, increases in costs, exchange rate

fluctuations and other risks involved in the mineral exploration and

development industry. There can be no assurance that a forward-looking

statement or information referenced herein will prove to be accurate, as actual

results and future events could differ materially from those anticipated in

such statements or information. Also, many of the factors are beyond our

control. Accordingly, readers should not place undue reliance on

forward-looking statements or information. We undertake no obligation to

reissue or update any forward-looking statements or information except as

required by law.