Marimaca Copper Corp. (TSX: MARI): Low-Risk Project, Substantial Exploration Potential and the Promise to Become One of the Most Significant Copper‐Oxide Discoveries in Recent Years; Hayden Locke, President CEO and Director, Interviewed

|

By Allen Alper, CEO and Senior Editor

on 5/16/2021

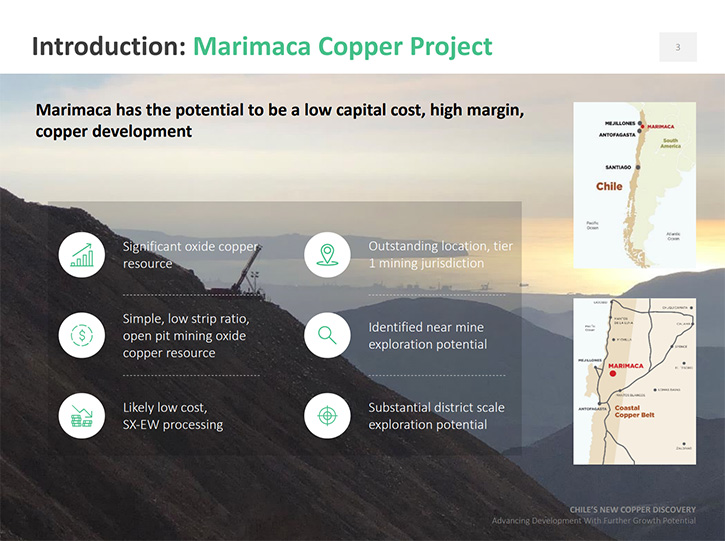

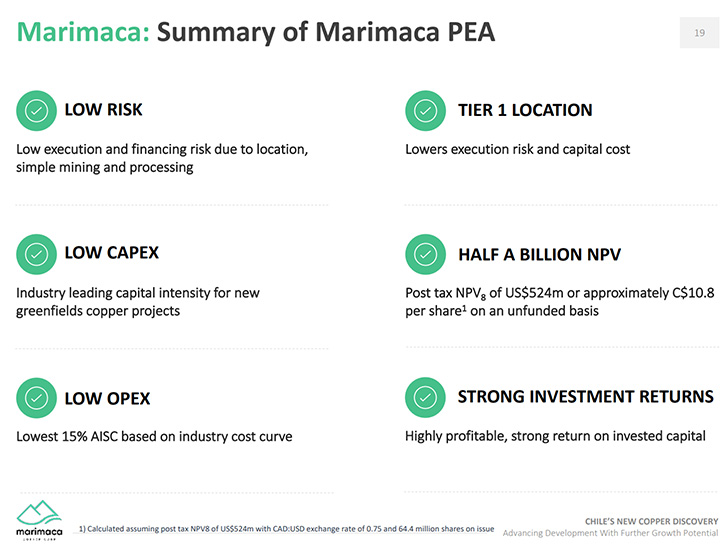

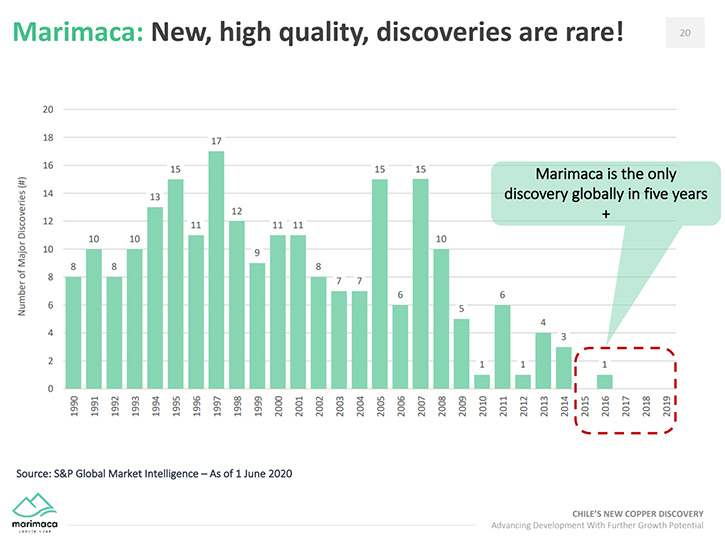

We learned from Hayden Locke, President, CEO and Director of Marimaca Copper Corp. (TSX: MARI) that they are implementing a dual strategy of realizing the full potential of their flagship Marimaca Copper Project, located in Chile, and explore for multiple large scale Marimaca Copper Project style targets, including a possible new IOCG district. The Marimaca Copper Project is the only copper discovery globally, during the last five years, and is a low-risk project, with substantial exploration potential and the promise to become one of the most significant copper‐oxide discoveries, in recent years. According to Mr. Locke, a combination of low upfront capital cost and competitive operating cost means that its economic output is incredibly compelling, and it really is one of the standout development stage copper projects on the basis of economics.

Marimaca Copper Corp.

Allen Alper, Jr.:

This Allen Alper, Jr. from Metals News. I'm talking with Hayden Locke, CEO and Director of Marimaca Copper. Marimaca has a promising copper project, located in Chile. Hayden, could you give us an overview of Marimaca Copper and what makes you unique?

Hayden Locke:Marimaca really is a unique, development-stage, copper asset, up in the Antofagasta Region of Chile. I think the key things that really make it stand out are it's an all-oxide project and it's in an incredible location. As a result, we have really low capital cost of production, so it's a very easily financed project, much lower technical risk in terms of execution. Because it's relatively shallow from surface and has favorable metallurgical results coming from all our testing, and it does have extremely competitive operating costs.

A combination of low upfront capital cost and competitive operating cost means that its economic output is incredibly compelling. It really is one of the standout development-stage copper projects based on economics. It's an exciting place to be for us, going into a strong copper market. I think what's most exciting is the exploration potential for us. We're out drilling at the moment and will be for about the next 6 to 12 months. We're looking to find more copper mineralization, obviously hoping to find more Marimaca style projects, things that will add to our mineral inventory and hopefully increase the scale of the opportunity for us as a Company.

Allen Alper, Jr.:

Could you tell our readers/investors more about Marimaca Copper, your project, your extremely compelling PEA and your exploration potential?

Hayden Locke:

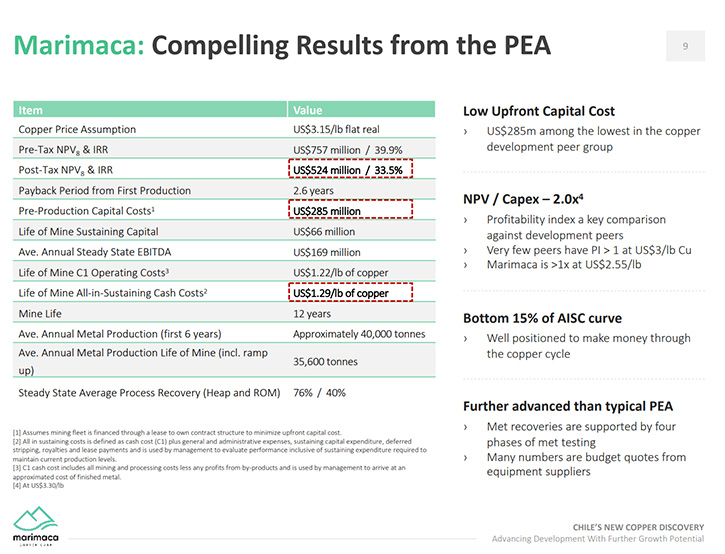

We delivered the PEA for the Marimaca project, in the middle of last year. It really showed what we had always thought this project would have, which was quite low capital cost of production. We're talking $285 million dollars of preproduction capital cost to build a project that will produce about 40,000 tons of copper for a minimum life of mine of about 12 years. It's a meaningful project, probably not quite at the scale that we want it to be yet and that's where the exploration comes in.

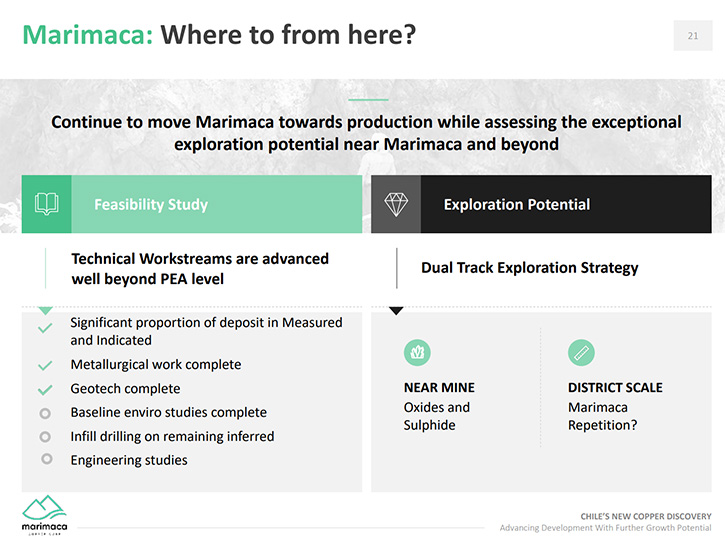

We are a long way in advance of the PEA. We've now completed four phases of metallurgical testing that were quite comprehensive and we're into our fifth phase of metallurgical testing, which really will deliver a huge amount of geo-metallurgical robustness in terms of our understanding of this deposit and we're quite a long way down the engineering front.

It's a fantastic project, with a relatively short development timeline to get into production and we're pushing hard on that. In parallel with that, we're drilling out on site looking for repetitions of Marimaca, but also the current drilling is looking for extensions at depth below the Marimaca oxide deposit.

Allen Alper, Jr.:

Could you tell us a little bit more about your deposit?

Hayden Locke:

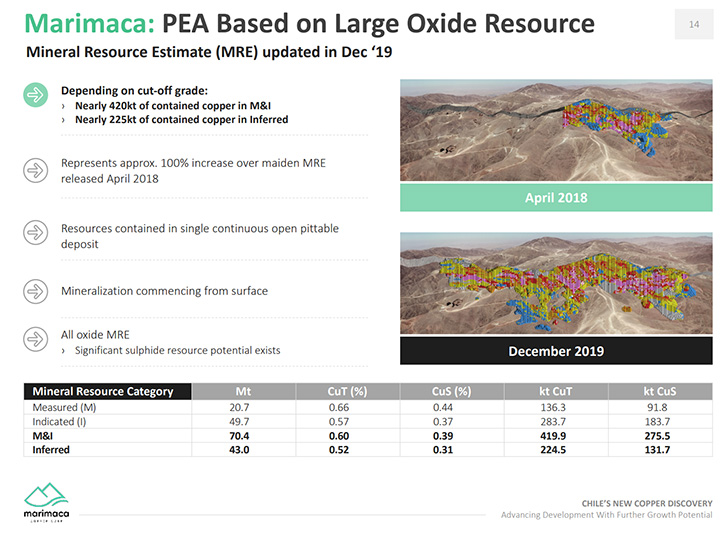

It's an all-oxide deposit from surface. It's somewhere between a Manto and an ICG. We don't have any gold byproduct to speak of. In terms of its geometry, it's a flat line, almost tabular orebody, ranging in thickness between 150 and 350 meters thick, virtually no pre-stripping to get into the deposit. The dominant minerals, in the early years of the mine life, are green oxide, so that's chrysocolla and some taconite, which are common minerals in this part of Chile, not so common outside of Chile.

In the latter years of the mine life, we get into some more mixed mineralization that has those green oxides that we talk about, but then also some secondary sulfides. It is a mixed orebody. There's some complexity on that front, which is why we've had such a high focus on our metallurgical testing programs, because that's an obvious area of risk, which at this stage is not closed off. We will continue to drill on the peripheries of the Marimaca project. Depending on cutoff grade, it's somewhere between 700,000 and 750,000 tons of contained copper, so not small by any stretch of the imagination, but in my mind, not yet past that magical million tons of contained copper mark. We see plenty of potential, with ongoing exploration work, to push us up towards those numbers in the future.

Allen Alper, Jr.:

What are your plans for 2021 and 2022?

Hayden Locke:

The start of 2021 is mostly focused on the exciting exploration potential that we have, both at depth at Marimaca looking for sulfide extensions, but also in the several targets that we've identified around Marimaca, which we believe are potential Marimaca style deposits. For the first six months of this year, it's going to be high focus on exploration. That's not to say that we're not continuing to move the Marimaca oxide project through the various technically risky milestones and towards feasibility study. It just means that we are spending money and resources and trying to find additional funds just to compliment the project that we already have.

In the second half of the year, depending on the exploration success, of course, we will start to have more of a high focus on driving the feasibility study forward for the Marimaca project, with the aim of delivering it sometime in the first half of 2022. That includes all of the engineering of the work that goes into the feasibility study, but also completing that Phase 5 metallurgical test work program, which is underway right now.

We will have some infill drilling to do to bring the 30% of the resource, which is in the inferred category, up to the measured and indicated category, so that it can support the calculation at the end of the feasibility study. Then there are the various permitting and environmental work strands that go in parallel, with moving towards being shovel ready sometime in 2022. There's a fairly strong focus on moving Marimaca towards being shovel ready and getting ourselves in a position where we can actually finance and then commence construction of this project. Our objective for the next 12 to 18 months is about ticking off all those technical, very risky milestones as we move towards becoming a developer and eventually a producer of copper.

Allen Alper, Jr.:

Your plan is to go into production yourself?

Hayden Locke:

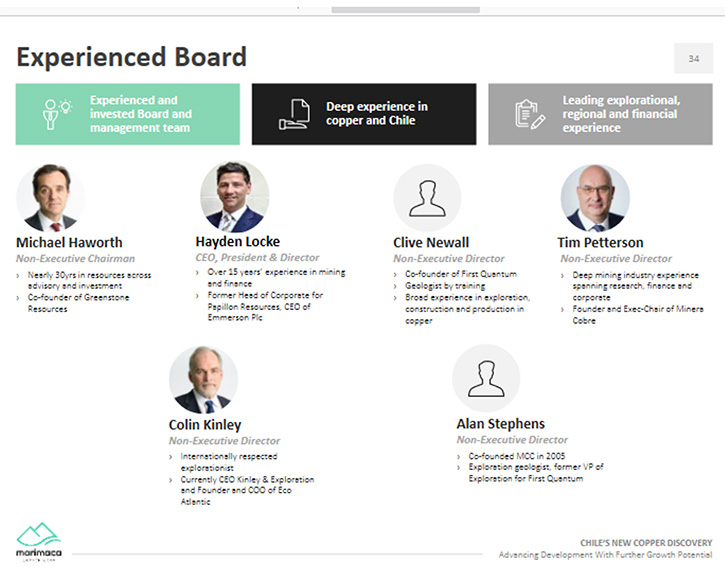

That's the intention. We see the opportunity of this project. One of our new Directors, Clive Newall, said that the Marimaca project reminded him of the asset that I had when I first started First Quantum. A small, but very high-quality asset that allowed them to create a business that eventually became one of the most successful senior copper producers in the world. Now, I'm not for a second saying that I think we can achieve what they've achieved there, but I think we would love to take Marimaca into production and use it as a base to build a copper business.

We're also pragmatic. We realize that there are very few new copper projects globally. There are very few actionable copper projects globally. And of course, as a result of that, Marimaca has a scarcity premium and is being recognized as one of the best undeveloped copper projects globally. I'm sure there would be a high degree of interest in the project from corporate sources. The shareholders will make the decision, whether or not we continue to go into production or if we look to some sort of corporate action in between now and then. As a Management Team, our focus is 100% on getting into production.

Allen Alper, Jr.:

Can you tell our readers/investors more about the strategic importance of copper and the main uses of copper right now?

Hayden Locke:

Copper is front page news currently. I saw some commentary from Mr. Friedland saying it was the new oil. The changing economy, the decarbonization of the economy and the electrification of the economy, of which electric vehicles is one small part, is really driving a higher degree of interest in copper. There are very few substitutes for copper, one being aluminum. But aluminum has a much higher carbon footprint per ton of aluminum output as a result of the refining and smelting process that goes on there.

It is going to be an incredibly important commodity for the transmission of electricity, in a decarbonizing economy, where we're using more renewables to drive equipment, mobility and more. I think the really big gap is the copper supply story. They just have a very few new copper discoveries made in the last decade that can step up to meet that oncoming wave of demand over the next 10, 15, 20 years.

You either must have a significant step up in prices to allow marginal projects to come into production, or you need to get out there and make new discoveries. We're in an extremely fortunate position, where we've made both a new discovery, but also a discovery that doesn't require higher copper prices to be brought into production. We're on the fast track to becoming one of the next copper producers in the global copper universe.

Allen Alper, Jr.:

Can you tell our readers/investors more about yourself, your Team and their experience working in Chile?

Hayden Locke:

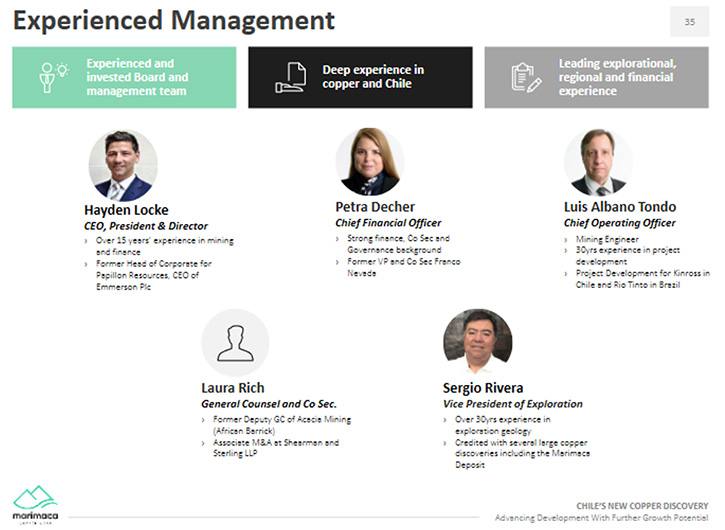

We have a fantastic Team on the ground in Chile. On the exploration side, the Team is led by Sergio Rivera, who's an incredibly experienced geologist. He has somewhere north of 35 years of experience, working in the Chilean copper sector. Before Marimaca he was at Codelco and was one of the Directors of Exploration. He's made multiple discoveries and discoveries in Chile, of which Marimaca is the most recent. He is an incredibly experienced and well-respected geologist, leading our exploration team. He has several geologists working with him that have been working with him for years. It really is a well-oiled machine, on the exploration side, identifying new targets for us to follow up on.

On the development side, the Team is led by Luis Tondo, who is based in Santiago. Luis is an incredibly experienced mine developer. He's built several mines and has operated Chilean copper mines, an incredibly experienced operator and builder of these sorts of projects. Those are the two technical aspects.

My background is far more on the corporate and strategic side and capital raising. I worked for a development-stage gold company called Papillon Resources, which found Fekola Gold project in Mali, in West Africa, which was bought by B2Gold. Since then, I've been working on development stage mining projects, mostly in Africa, but some in the European Union. Now with Marimaca, in a more capital raising role, we have a good, complementary mix of skills in the Senior Management Team, complemented by a very strong Board, which is led by Mike Haworth, who is a principal at Greenstone, our largest shareholder. Then the other Directors are very prominent and many of our shareholders will know them.

Allen Alper, Jr.:

How do you find mining in Chile as an environment for Marimaca?

Hayden Locke:

Chile is recognized as a Tier 1 jurisdiction for mining. It's an incredibly well developed and sophisticated mining industry and an important part of our economy. I liken it to Australia in terms of its importance. The copper industry is very large and a significant employer. There's variability within Chile. Operating in some areas can be better than operating in others. We're extremely fortunate that we're in the Antofagasta Region of Chile, which is the largest region for mining in Chile. A lot of the biggest copper mines are in that part of the world.

We have several additional benefits that come from our location. We're in a very sparsely populated part of Chile. We have no indigenous or local stakeholders that we would be impacting. We still focus on being a good corporate citizen and ensure that we are developing our mine in a sustainable way. From our perspective, Chile is an amazing place to operate, and we've had an incredibly good experience. It is a very well developed and sophisticated mining industry in Chile.

Allen Alper, Jr.:

Tell us a little bit about the infrastructure in the area.

Hayden Locke:

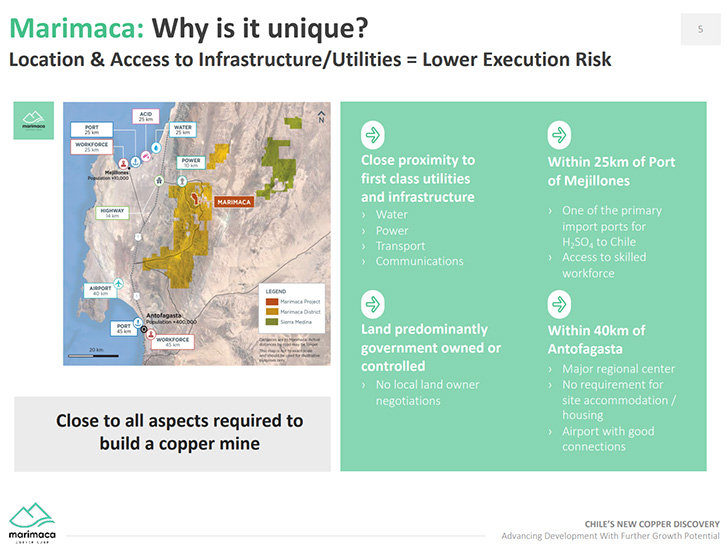

This is a key part of our story. My experience, having worked in Africa where infrastructure ranges from lacking to nonexistent, it's a nice position to be in where you have literally every piece of infrastructure that you would require to build a large-scale mining project. Infrastructure is one of the big stories for Marimaca. Access to infrastructure is one of the key benefits that we have as a Company. We are talking about all the roads and power and water and assets coming in through Mejillones, including a large, highly skilled workforce.

All of that is literally on the doorstep of this project. And it's one of the biggest advantages we have in terms of execution risk, but also permitting risk. It's almost second to none, in terms of its access to infrastructure, in terms of a copper project, in this part of the world. It is one of the key drivers of this project, one of the key advantages we have, and we intend to make the best use of it and make sure it delivers a significant result for us as a Company.

Allen Alper, Jr.:

You mentioned permitting, how does that all figure in?

Hayden Locke:

As with every jurisdiction in the world, permitting is a very key focus for us, as a Management Team. As of right now, the payments are on the critical path for the development of this project. We are spending a lot of time and effort now, focusing on developing the permitting timeline. The work streams that need to go into that, making sure that we're engaging with all our stakeholders, in the right way, to ensure we minimize any risk of delay. I don't think there's a very large risk of us not being committed, the biggest risk there is delay and that really comes down to good planning.

We're spending a lot of time right now planning ahead, as to when we need to start lodging these applications. Luis is experienced in these sorts of areas, so we have a strategy that we hope will allow us to fast track, at least some of the permitting. But really, it kicks off once we're into the feasibility study phase. We've actually done quite a lot of the environmental baseline work already, so we're in a pretty good position to start that permitting workstream. Towards the end of this year, we hope we'll be fully committed sometime in 2022, around the time that we're delivering the feasibility study for this project.

Allen Alper, Jr.:

Could you tell me or tell our readers and investors about your capital structure?

Hayden Locke:

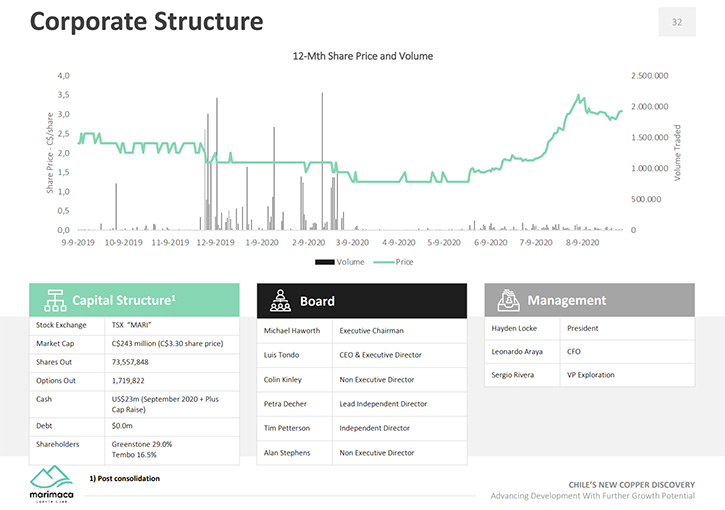

At the moment, we have in terms of shares on issue 87 million or thereabouts, on a fully diluted basis, including warrants and options to the Management Team, somewhere around 100 million shares on issue, with no debt on the balance sheet. As of today, we have somewhere around the $40 million US mark, in terms of cash on the balance sheet. We are very well funded to deliver on all of these milestones that I'm talking about. As of right now, we will be able to deliver all the exploration work, the feasibility study and permitting for this project to take us to where we're shovel ready, ready to finance this project and take that next step to becoming a copper producer.

Allen Alper, Jr.:

Could you tell us who your main shareholders are?

Hayden Locke:

We have two major shareholders, Greenstone and Tembo, two private equity funds based out of out of London in the UK. Very supportive, long-term shareholders, both with significant capacity to invest more money in this story, which they have done in the last couple of raises. Then backed up by those groups, we also have several large-scale institutions that are below the disclosable threshold, so I'm sure we'd prefer to have their privacy remain private. We also have large, high- net-worth and ultra-high-net-worth investors, who control a significant block of this Company.

They are well known mining investors in the Canadian and European markets. Again, a lot of experience with these sorts of projects and have been following the Marimaca story for a long time. We have an incredibly tight share structure, very tight ownership, not many shares trading. It is very difficult for people to buy in. We're gradually expanding the amount of investments we have on our register, with capital raises, but also with new investors buying in.

Allen Alper, Jr.:

How about Management and the Board, what is your investment?

Hayden Locke:

In terms of my personal investment, I now am invested in about 100,000 shares. Luis has 10 or 15,000 shares. Certainly, Sergio has quite a few shares. The Management Team is continuing to buy, expanding our own share position. We obviously have a lot of exposure to the success of this Company through the long-term incentive structures. I'm an ongoing buyer of this story at the moment, especially with the backdrop that we have in copper.

Allen Alper, Jr.:

Can you tell our readers/investors the primary reasons they should invest in Marimaca Copper?

Hayden Locke:Marimaca is a unique copper development story. It does incredibly well in the copper universe. Driven primarily by very low upfront capital cost and capital intensity and very competitive, with all-in-sustaining cash costs. Which, means that the return on invested capital for our project, relative to the vast majority of copper peers, is absolutely outstanding. As of today, our valuation is more than the value of the Marimaca project alone. We don't even need to have exploration success to underpin the current valuation. Arguably, we're still undervalued, relative to the quality of the Marimaca project that we have. As a result, it's one of those rescued risk profiles, where you're getting all this amazing exploration potential, which we're currently testing for free. With the comfort that your investment will be underpinned by a top-quality project in Marimaca that will almost certainly deliver excess returns to the shareholders over the short, medium and even long term.

Allen Alper, Jr.:

Is there anything else you'd like to add?

Hayden Locke:

No, I think that's fantastic, thanks for the opportunity to be interviewed by Metals News.

Allen Alper, Jr.:

We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://marimaca.com/

Hayden Locke, President & CEO

jgutierrez@marimaca.com

+56 2 2431 7608

|

|