Rare Element Resources Completes Positive Prefeasibility Study on Bear Lodge Rare Earth Project in Wyoming

|

By Allen Alper Jr.

on 9/30/2014

Randall Scott, the President and CEO of Rare Element Resources (TSX: RES), spent some time with Metals News recently discussing the progress that the company has made at Bear Lodge and the results of the prefeasibility study. He said, “We have been working very diligently over the last year and a half to get to the point where we could put out this prefeasibility study. During that period of time, we achieved a number of milestones.”

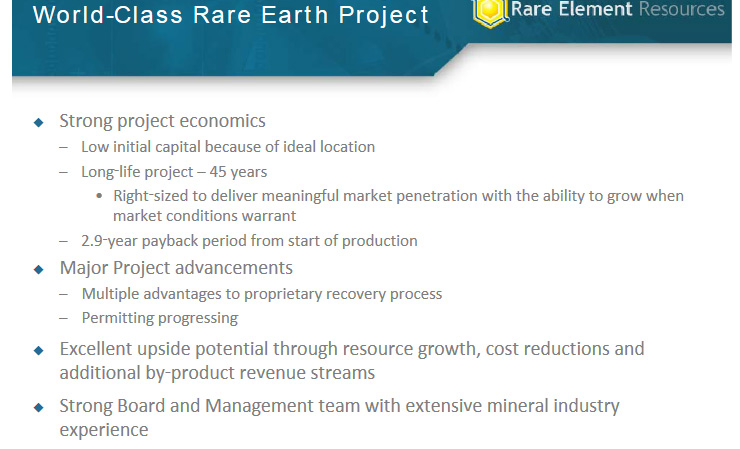

By completing the research necessary to publish the prefeasibility study, the company was able to generate more specific information about Bear Lodge. Said Scott, “The resource was expanded quite significantly. We also did additional metallurgy and multiple pilot plant studies to confirm the proprietary technology for the recovery of the rare earth elements.” Additionally, the company has made progress on the permitting needed to take the project to the next stage. Scott said, “A lot of good work has been done on the permitting side of things, and it has progressed nicely for us over the last year. So, when you take all this and pull it together in the prefeasibility study, we were able to come up with some pretty impressive economics. We were also able to identify attributes of the project that we think differentiate us from many of our peers and provide us with both options and upside for the project.”

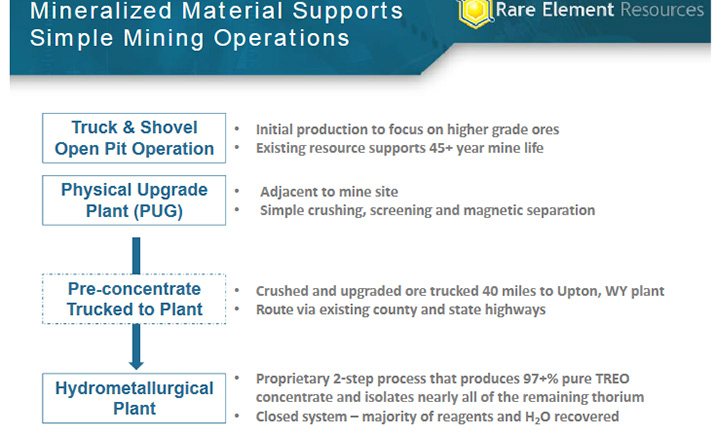

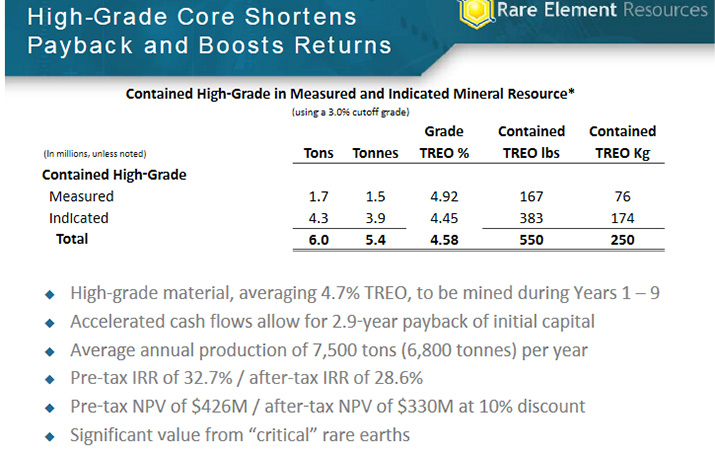

Scott believes that there are particulars regarding the Bear Lodge Project that give Rare Element Resources a unique opportunity in the rare earth sector. He said, “There are two major factors that will contribute to our success and help differentiate us from an economic perspective. The first is the geographical location of our project in Northeastern Wyoming. It is a geopolitically secure area and one where we have good support in the local community. Tremendous resource-oriented infrastructure already exists in that part of the country, which will allow us to build a lower cost project. Also, we don’t have to build the biggest project in the world in order to get meaningful amounts of production or cover large infrastructure costs.” Even though the initial project may be smaller, the company is anticipating rare earth concentrates coming from a high-grade zone within their mineral resource that will support higher production levels in the early years. Said Scott, “The second part of that equation is that we have further delineated a high-grade zone within our 45-year project resource. A mine plan has been designed to allow us to recover that high-grade zone for not just one or two years, but for a period of nine years. The combination of higher grade mineralization and lower infrastructure costs resulted in projected initial capital costs of $290 million. Equally important, we will have a short payback period of only 2.9 years, due to the economics of processing the high-grade materials. For a project these days, that is pretty darn good.”

With a relatively low capital cost, Scott is optimistic about the project’s future. He said, “From a market perspective, we are going to produce an average of 7,500 tons a year over the life of the project. We are trying to enter the market in a meaningful way and will then let the market tell us how it would like us to grow in the future. In support of that, we have built in the capability to expand the project when market conditions warrant.”

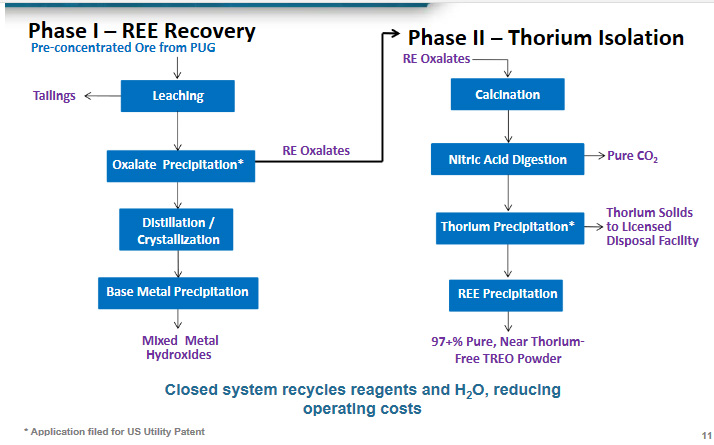

Improving the project has included patent development. Scott said, “As I mentioned, we filed a couple of patents on technology and really, the story for us now is that we are able to produce a bulk concentrate that is 97%, or better, purity. The concentrate is almost thorium-free with very few deleterious materials in it. We are also looking at moving up the value chain and separating out the individual rare earths ourselves. We believe it will be a major advantage for us.” With the permitting moving forward, Scott believes they will be able to bring product to market in the intermediate term. He said, “The permitting side of things has progressed nicely for us. We have been collecting baseline data on this project for four years now. When we started the environmental permitting process, we had a lot of reports that had already been finished that we shared with the Forest Service. The plan of operations was deemed ready to move on last year. We have an EIS (Environmental Impact Statement) project manager and a contractor, and they completed public scoping in April. If everything stays on the Forest Service’s publicly stated schedule, we expect to have the draft environmental impact study by early 2015 and the final record of decision by the end of 2015. We are doing everything we can do to move the process forward on our end. Once we are in production, the high tech industry will have an alternative to China for the supply of rare earths.”

Scott said, “It comes as no surprise that the biggest challenge is pricing. Rare earth prices right now are pretty low. We think there will be demand growth in the next two to three years. We also think there are several factors that support them bouncing up from the bottom in the near term. As a results of our pilot plant testing, we have been able to produce a significant amount of the 97% pure product, which we have distributed to potential customers. We are getting positive feedback from those potential customers, and we are focused on keeping those relationships advancing so that we can create a strategic alliance or offtake agreement that will support us financing the project.” Despite the challenges with pricing, Scott believes that investors should consider his company. He said, “We are one of only a couple projects that are moving forward in a tough industry environment. Over the last few years, we have substantially de-risked the project. We have great economics and have lots of upside to continue to be advanced. And, we are continuing to progress toward production, hopefully in late 2016, subject of course to timely permitting, financing and board approval.”

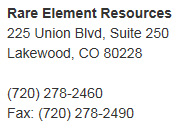

For more information:

http://www.rareelementresources.com

|

|