Lakeland Resources (TSXv: LK) has a significant Portfolio of Uranium Exploration Properties in the Athabasca Basin

|

By Allen Alper.

on 1/29/2014

Jon Armes, the President and CEO of Lakeland Resources (TSXv: LK)

Jon Armes, the President and CEO of Lakeland Resources (TSXv: LK), took time to share with potential investors and the team from Metals News the latest information on their uranium exploration activities in the Athabasca basin while visiting the Cambridge House Investment Conference in Vancouver.

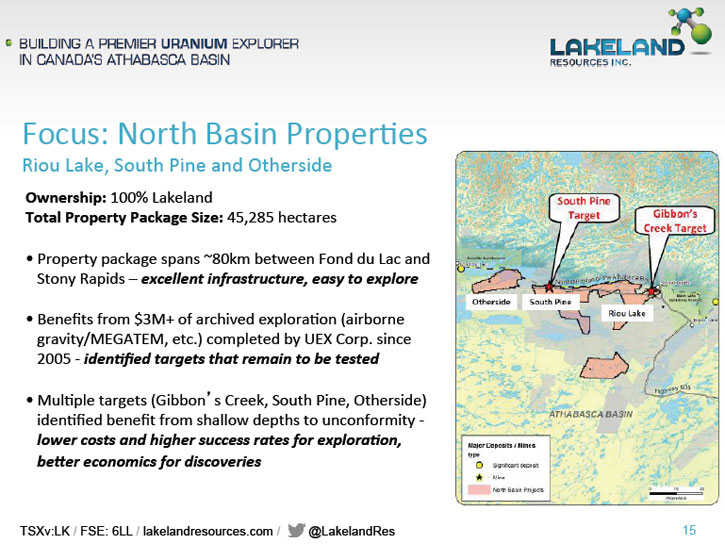

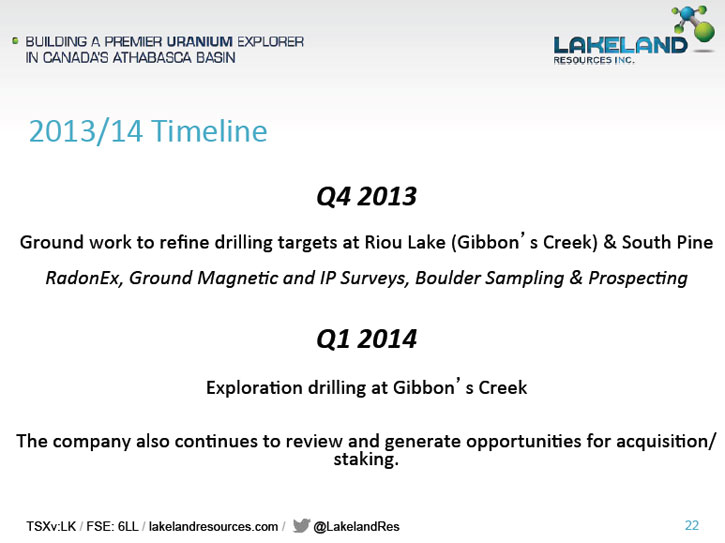

Lakeland Resources currently has thirteen projects in the Athabasca Basin that they are working on exploring for uranium resources. Said Armes, “We focused on our Gibbon’s Creek property as our first project. We did some surveys and line cutting added to our soil geo-chem and elevated the project to a drill ready project.” Moving their projects to a drill ready status is the goal for the company.

The results at Gibbon’s Creek have now resulted in a deal for a joint venture. Said Armes, “We have structured a deal with a company for $6.5 million dollars in the ground and $1.5 million in cash over a four year period. We are carried 30% and to a 43-101 resource with a royalty.” The company that has joined Lakeland is Declan Resources. Armes said, “In addition to the Gibbon’s Creek project, we have twelve other projects that will move to drill ready status in a short amount of time.” This ability to move projects to drill ready has attracted interest from companies interested in joint ventures, something Armes and his team welcomes. He said, “We have already been approached by other companies that are looking for opportunities.”

Given the quick movement in developing joint ventures, Armes believes the biggest challenge they face is one in the markets. He said, “Our biggest challenges will be to maintain our tight share structure. We only have ~40 million shares in the market fully diluted. We need to create awareness and get market attention.” Armes believes that this attention will come as they progress on the Gibbon’s Creek project, “We have to make the discovery first and Declan is in charge of that drill program.” Even without a firm discovery, Armes believes that there is good reason to be optimistic that uranium will be found there. He said, “Certainly, with some of the base data we have collected on the data, we believe there can be success there. In the meantime we will work on moving our other projects to a drill ready status.”

Part of Armes’ optimism comes from scientific results finding radon on the property. Said Armes, “From what I have been able to ascertain, radon is a good way to evaluate drill targets. It is a very good tool to utilize. The readings on other properties have been 1-2 and we have been getting over 9. How significant this will become, we will find out.” He believes that a patient explorer understands that the first holes rarely show the entire picture of the potential for a project over the long term. Armes said, “The McArthur River project needed a lot of holes before it became significant. You don’t typically find out a lot from the first few holes.”

Currently, the company is planning on beginning a drilling program to get more information on what is available at Gibbon’s Creek. Said Armes, “Our initial program will fall in the 20-30 hole range with Declan.”

Why should investors take a close look at Lakeland Resources? Armes believes there are several great reasons for additional evaluation. He said, “We have three key drivers that I have been emphasizing. We have a great team. Our team, as we assemble that, will provide expertise for the future. Our portfolio is another factor as we are situated at the edge of the basin and benefit from historical data. Our share structure with, on a fully diluted basis, only 40 million shares in the market.”

Armes believes that Lakeland Resources offers benefits over other companies working in the industry. He said, “As compared to several of our peers active in the basin, we are undervalued. We provide a great amount of leverage because of that.” Part of their advantage is due to the market movement on uranium. Said Armes, “Tom Drolet is suggesting that we will see uranium move to the upside in 2014, and even more so in 2015, because of all the reactors that have to be built. Typically, you need five years of uranium to start up a reactor.” This price move may be supportive for companies working in the sector in the near future. Armes said, “We see a supply demand crunch that might drive the price to $50 this year and maybe up to $70 or $80 in 2015. Companies could be up tenfold. We would expect an upside with an uptick of the spot price in uranium.”

The amount of stock on the market is surprisingly small. Said Armes, “Currently we have ~40 million shares free trading. Insiders, Zimtu Capital and friends and family control about 40% of the shares. Many of our shareholders have a long term vision. With uranium, you are looking at a 12-24 month horizon. We would like to own more shares and I will buy more when they come available. I have 3% in the company. The team that we have gives me the confidence that we will be successful in the Athabasca Basin. We will continue to build our team. Declan Resources will continue to drill this year. We will continue to identify opportunities and then there is a possibility to meet with peers on the market cap.”

http://www.lakelandresources.com/

Roger Leschuk

Corporate

Communications

Lakeland Resources Inc.

Ph: 604.681.1568

TF: 1.877.377.6222

Email: roger@lakelandresources.com

|

|