Stan Bharti, the founder of Forbes & Manhattan took some time recently to speak with Metals News about their strategic plan and how they acquire investment targets.

Said Bharti, “I started Forbes and Manhattan about 15 years ago to take advantage of a resurgence in commodities, partially driven by China’s demand, and partially by a decade of low metal prices. I realized that the best returns on commodities are found in junior mining stocks, the proverbial twenty cents to two dollars. Combine a good asset with strong technical managers, capital market expertise and access, and proper company administration and governance and you have the ingredients for success.

Unfortunately that is not where the biggest bull market in stocks is right now. It is currently in technology. Even with the current focus on technology, Bharti believes there are still many lucrative options in commodities, but they are in the juniors where massive overselling has brought valuations to all time lows.

Bharti also believes the best returns are in emerging markets. He said, North America, as well as Australia has been fairly valued with respect to mining valuations in recent years. Fortunately for us the overselling has created fantastic opportunities to acquire companies with great projects that have become financially unviable in this current climate. We are picking up great projects such as Arena Minerals Inc. (TSX:AN), focusing on copper exploration in Chile, and Kombat Copper Inc. ( TSX:KBT) in Namibia.

With

this approach, Bharti has been successful, unlike many other junior mining

companies that are on the market. He

said, “When you look at listed companies, half of the junior companies will go

nowhere. We make money when stocks go

up.” We are mine-building focused from

day one, not focused on the build a resource /geology game. Stocks go up when you de-risk projects from

resource to engineering to environmental permitting through mine construction

and operation. That method is what has made him successful. He said, “The way you do that is you get a

world class asset and give the technical team all the support they need –

finance people, accountants, people who understand capital markets. If you don’t know how to promote the deal you

won’t go anywhere. We distinguish

ourselves by taking a junior company and we surround them with that expertise. We surround them with powerful legal teams,

investment bankers, analysts and financial teams.” This gives smaller mining companies access to

the expertise that a large company takes for granted.

Bharti

has proved that his approach works. He

said, “Since 2002, we have done an analysis on all of our mining deals and we

have a 60% IRR. We find good projects

and work them for three to four years.”

Avion Gold is an excellent example of how Forbes & Manhattan has

turned a project around. Founded in 2008

in Mali with the acquisition of a past producing mine for $20million, we put in

our own technical teams, re-activated the mine, increased the resource five

fold and doubled the capacity of the mill. We ultimately sold the Company for

$400 million dollars in 2012.” This is relatively common for the way that

Bharti does business. Said Bharti, “The

goal for us is to buy a company for $5 million dollars and sell it for $500

million dollars. That is the model.”

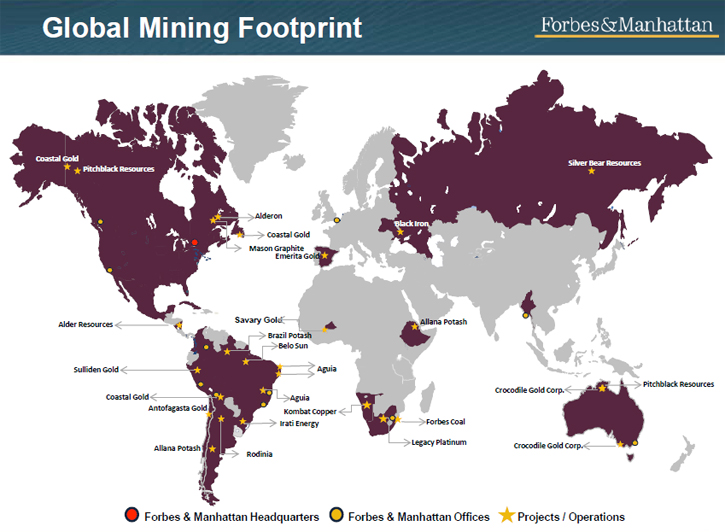

Forbes & Manhattan doesn’t limit themselves to one particular area

in the resource sector. Said Bharti, “We

work in base metals, precious metals, uranium, coal, un-conventional oil, and agricultural

inputs such as potash.” They also don’t

limit themselves geographically. Bharti

said, “We work in Africa, South America, and we are big in Brazil. We have a wide range of projects in over 25

countries.”

Bharti

has taken time to think through the bearish market and has questioned the

relationship of stock prices and metals prices.

He said, “Over the last year, it has been tough. There is a malaise in the resource

sector. For the first time, I’m seeing

the metals prices are strong, but the stocks are down 50-90%. These are good

metals prices – we are in a good market.”

He believes that there is a fundamental reason that stock prices have

been hard hit, one that has to do with the investments made by companies and

investors. He said, “Why are the stocks

not performing? The stocks are not

performing because a lot of the majors overpaid for assets. Because they paid

cash for the assets, they really have to produce in order to get a return. The assets have not delivered.”Also in the

hot market investors financed marginal projects and they have run into issues

either in construction or operation. Now investors are selling off all projects

without regard for quality.

With

that perspective, Bharti believes there are excellent values in the market

immediately. He said, “Right now, there

are excellent deals in the market. Our

strategy is to do acquisitions. We want

to put money into a company. We have

identified a new company called Deep Value Capital and we are putting $100 million

dollars together to invest in seven companies and install teams to get them

moving forward in the next three to five years, the same model we used for our

two best gold companies, Sulliden Gold Corp Ltd (TSX: SUE) and Belo Sun Mining

Corp (TSX: BSX). Both companies have

recently received their Environmental permits and are moving into a

construction phase. If you like more

speculative options we have a company called Silver Bear Resources Inc. (TSX:

T.SBR in Russia. The grade is close to

600 grams per ton at cash cost under $10 an ounce. Black Iron Inc. (TSX:BKI)

(FRANKFURT:BIN)in Ukraine has an outstanding project with a completed

feasibility, high quality infrastructure including rail, power and an

exceptional management team and a strategic local partner in Metinvest.

The opportunities are phenomenal.”

www.forbesmanhattan.com

65 Queen

Street West

Suite 805, P.O. Box 71

Toronto, Ontario, Canada

M5H 2M5

Tel: +1

(416) 861-1685

Fax: +1 (416) 861-8165

info@forbesmanhattan.com