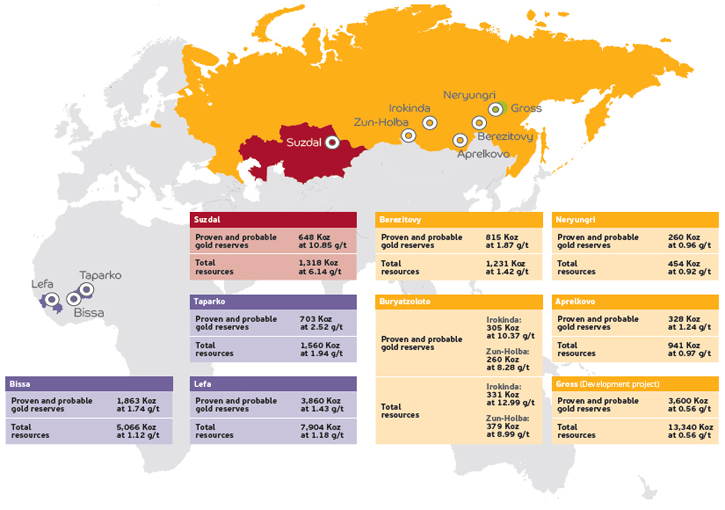

Nordgold (LSE: NORD), with 9 gold mines in several emerging markets, has spent 2013 working on increasing their production and efficiency to combat challenging global gold markets.

Nordgold

(LSE: NORD), is a gold producer that specializes in emerging markets. With 9 operating mines currently located in

Russia, Kazakhstan, Guinea, and Burkina Faso, the company has spent 2013 focused

on increasing the efficiency of its production and administration processes

across its portfolio as well as delivering the launch of the Bissa project, its

second mine in Burkina Faso. Nikolai

Zelenski, CEO of the company, took a few minutes to speak to Metals News about

the progress that Nordgold has made during the last year.

Said

Zelenski, of the complicated business atmosphere in the resources sector, said

“I think Nordgold’s challenge is similar to that of everyone else in the

sector.” The largest issue for gold producers is that the gold price has

dropped 28% since the start of 2013.

In order

to continue to be profitable, Zelenski and his team have been working to

increase operational efficiency. He

said, “We have been working throughout the year in order to improve the

efficiency and performance of our business.

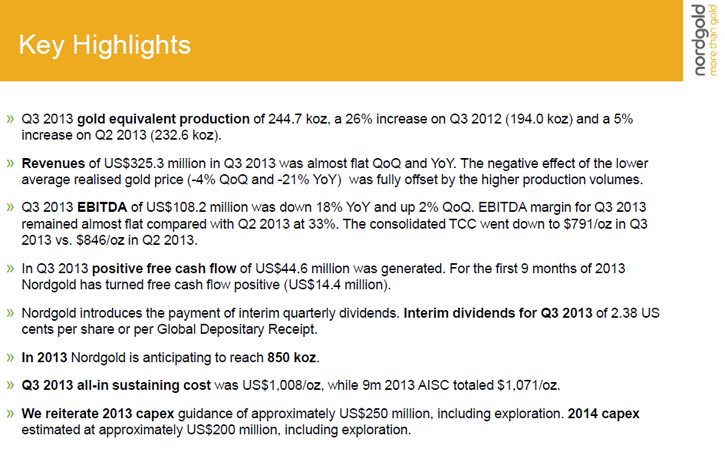

We have made significant progress. In third quarter our all-in

sustaining cost per ounce of production was $1008 dollars.”

Nordgold’s

efficiency programs deal with entire area of value creation in gold, starting

from geology where the company continues to grow their reserve/resource

profile, mining and metallurgy, as well as a constant vigilance on

administrative expenses. Added Zelenski, “In the company, we are looking at

reducing dilution and improving the utilization of equipment, as well as

improving recovery rates, growing plant and fleet productivity and we want to

reduce some of the consumption of energy for the mines.” These changes are what have brought the cost

per ounce of gold production down.

Zelenski

believes that a forensic approach to cost management is very important in a low

cost environment. He said, “In this kind of market you can never be

relaxed. We will continue to work on

improving efficiency.”

In addition to

bringing their cost per ounce down, the company is also looking to build a best

in class management team. Said Zelenski,

“Nordgold has bolstered its management team with the recent arrival amongst

others of Louw Smith as Chief Operating Officer, who joined from Alacer Gold

and Martin White as Technical Director who joined from Aureus Mining Inc.”

While

Nordogld remains focused on driving value from its existing growth pipeline, it

remains open to opportunities in emerging markets. Said Zelenski, “We have a new mine launched

in January 2013 that is working really well – Bissa in Burkina Faso. It was built within 15 months with a capital

expenditure of $250 million dollars – on time and on budget. It will deliver an

excellent return on invested capital and it is already significantly exceeding

our initial production estimates. We intend to repeat Bissa’s success”.

Zelenski said that

there are particular characteristics the company looks for before going after

an acquisition. He said, “We are looking

at junior companies for small-scale acquisitions. The typical project will have two million

ounces with a grade of above two grams and a simple structure to process

ores. We are looking at areas that have

infrastructure that is reasonably developed. This is the criteria we use when

identifying projects.” The company tends

to focus on emerging markets rather than traditional markets. Although Zelenski and his team see the value

in working in areas such as North America, that is not their chosen niche. Said Zelenski, “We will look at a wide range

of areas. We believe that jurisdictions

such as US, Canada, Australia, and South

Africa are the areas where the local miners have competitive advantage and this

why we are not actively looking at those countries.” Nordgold is looking to more underexplored

regions for opportunities to find gold.

Said Zelenski, “We are looking at emerging markets, especially at the

countries where we already operate, such as Russia, Kazakhstan and across West

Africa. We are quite flexible and we are

look at the quality of the deposit.

Certainly, we also look at countries where there is a properly managed

resource industry.” Zelenski and his

team are not interested in political areas that aren’t open and sympathetic to

mining. He said, “We avoid countries

that aren’t friendly to mining.”

Nordgold’s focus on driving down costs, building

a very strong management team, an excellent pipeline of projects and developing

new mines, as well as making careful acquisitions, means that shareholders will

likely benefit. Said Zelenski, “The

dividend yield for 9 months of the year has been at 4.1% and if we pay dividend

for the fourth quarter the yield will be certainly higher. We pay dividends on

a quarterly basis. Our Board of Directors will meet in February and determine

what dividend will be paid for the fourth quarter of the year.” After the company decides on the dividend,

they will continue looking for new opportunities.

The

company does have some debt to pay down.

Said Zelenski, “Our current debt is slightly above $700 million

dollars. The debt level is something

with which we’d be very comfortable in a normal market, but in this market, we

need to decrease it. Our mines are very

well invested and are generating free cash flows. We don’t have any projects in the

construction phase that need capital. As

a result we have quite a bit of flexibility around using the cash that our

operations generate to pay dividends and reduce debt. Market volatility is

something we have to deal with. The

further down the road, the more difficult the challenges become. But we are

very fortunate to have added very strong professionals with the right

experience and attitudes in developing mines in different parts of the

world. We believe that they will improve

the performance of the company next year.”

Why

should investors take a look at Nordgold in this challenging market with

falling gold prices? Zelenski said, “I

think there are a lot of reasons to be interested in Nordgold right now. We are a dynamic gold producer. We have been in gold since 2007 and we have

continued to increase our production in 2013. Nordgold is anticipating reaching

850 koz of gold in 2013 compared to 717 koz in 2012. We have been resilient to

the gold price: well invested assets and low AISC allow us to generate free

cash flow. We have had a lot of success improving our resources. We also have

an excellent pipeline of projects and new mines. We have a simple strategy and

good dividend yield. And the overall low multiples that we currently have must

attract investors”.

http://www.nordgold.com/

Nord Gold N.V.

Luna

Arena, Herikerbergweg 238, 1101 CM Amsterdam Zuidoost,

The Netherlands

T +31

20 406 4480

F +31 20 406 4555

Investor relations

Valentina Bogomolova, IR Manager

M +7 916 474 59 96

T +7 495 644 44 73 ext.6711

va.bogomolova@nordgold.com