Caledonia Mining, (TSX: CAL, AIM: CMCL), Ready to Expand Gold Production at Blanket Gold Mine

|

By Allen Alper Jr.

on 11/8/2015

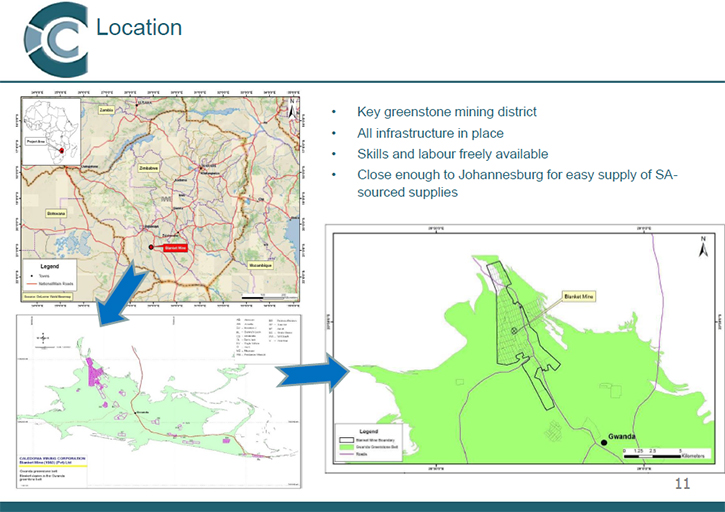

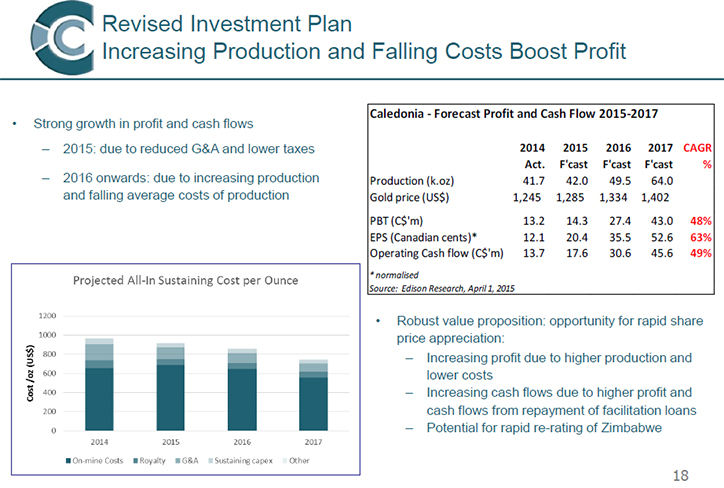

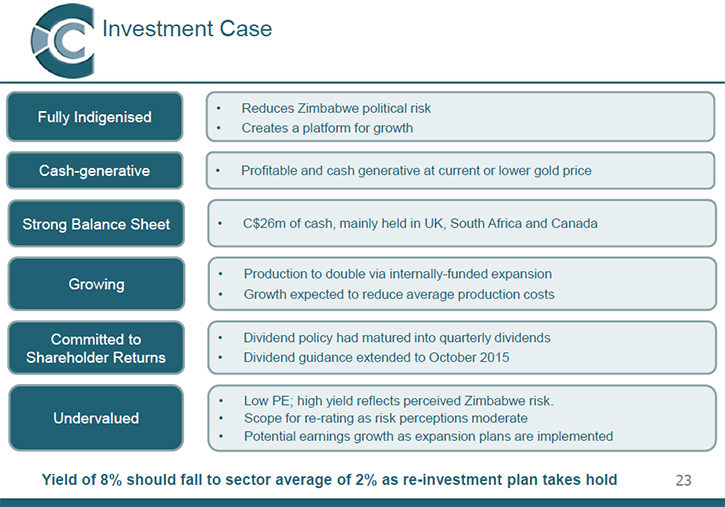

Mark Learmonth, CFO of Caledonia Mining, took a few moments to update Metals News on the progress that the Company is making at the Blanket gold mine in Zimbabwe, which, he says, “produced about 42,000 ounces of gold in 2014 and this year it will do about the same, another 42,000 ounces. Then the plan is to increase production to 80,000 ounces in the next five or six years.”

The Company aims to achieve this through accessing deeper orebodies, “It is an underground mine with about 750 meters of depth from the surface. One of the things that Caledonia will be doing in the next few years is to take the mine deeper. We will be taking it to about 1000 meters below the surface by sinking a new shaft and deepening the current shaft” which, Mr Learmonth states, will also improve their overall production costs.

The Caledonia team is pleased with the current state of the mine and the direction that they are taking to lower costs. Learmonth said, “The mine is currently somewhat low cost to operate. The current on-mine cost is below $700 per ounce and the All-in sustaining cost is approximately $1000 dollars an ounce yet we have actually operated at a significantly lower cost in earlier years. As production increases, we expect to decrease the All-in sustaining cost to below $750 dollars an ounce. That should happen by 2018.”

How does Learmonth expect to reduce the overall costs of production? He said, “It’s simple: decreasing costs is a volume game and seventy per cent of our costs are fixed. When you increase the amount of ounces that are produced the costs come down. We have seen that and we are very confident that our costs will inevitably go down as we intend to double production over the next six years.”

The Company has planned to decrease the costs by about 25 per cent in the next few years. Learmonth said, “When we talk about the all-in sustaining costs coming down below 750 dollars an ounce by 2018, we are not taking into account the cost efficiencies that will arise from our investment program. Sinking the central shaft below 1000 metres will fundamentally change the way we do business: our efficiency will improve because the miners will have shorter underground travel times, increasing their productive day by two hours; better ventilation will mean that the mandatory re-entry period after each blast will be cut from four hours to two hours, meaning we will actually have more time underground. Putting in a new shaft will be quicker and more efficient; we will also close down a less efficient shaft, and all of this will further enhance our cost reduction. Frankly, we are very confident that we can get our costs down from $1000 to $750 even without the new shaft. Either way, reducing our costs by 25 per cent will act as a catalyst for Caledonia’s increasing cash flow as the Company’s margins begin to look very healthy indeed.”

Importantly, Caledonia’s senior management are also invested in the company. The reason for their belief in the Company’s future performance is simple, “Caledonia is very undervalued. Our share price is about US$0.60 a share, of which over half is made up of the Company’s cash holding. As earnings increase, we can achieve a higher rating. That makes it a tremendous opportunity. We also pay a quarterly dividend at one-and-a-half cents per share which is rare for a junior gold miner. That equates to a high yield of 7.5 per cent. Hopefully, as people get more comfortable with the delivery on our investment programs and realize we don’t need to raise money to build the mine, the share price should start to reflect our inherent value.”

Caledonia Mining is in good shape financially and the management team sees modest improvements in the gold price in the future. Learmonth said, “We take a very conservative approach to running the business. We have quite a bit of cash and we do that deliberately to protect ourselves from any shock with the gold price. We get the sense that the gold price has corrected and we see strong support at the current level, and we would expect it to move ahead modestly over the next few years. Of course, the market is often volatile, especially with the current tensions in the global geo-political environment affecting the price.However, we hope that the worst has passed. We hope for the best and have planned for the worst.”

Summary: Caledonia Mining Corporation is working to increase production and decrease their operating costs at the Blanket gold mine located in Zimbabwe by adding a new shaft and continuing to upgrade equipment.

http://www.caledoniamining.com/

Caledonia Mining Corporation South Africa

4th Floor, No.1 Quadrum

Office Park

Constantia Boulevard,

Floracliffe

South Africa

info@caledoniamining.com

|

|