Interview with David D'Onofrio, CEO, and Shawn Ryan, Chief Technical Advisor, White Gold Corp. (TSX.V: WGO, OTC – Nasdaq Intl: WHGOF, FRA: 29W): Largest Land Position in Yukon’s Prolific White Gold District with Multiple Recent Discoveries and Exciting Exploration Pipeline

|

By Allen Alper Jr., President, Metals News Inc.

on 4/9/2019

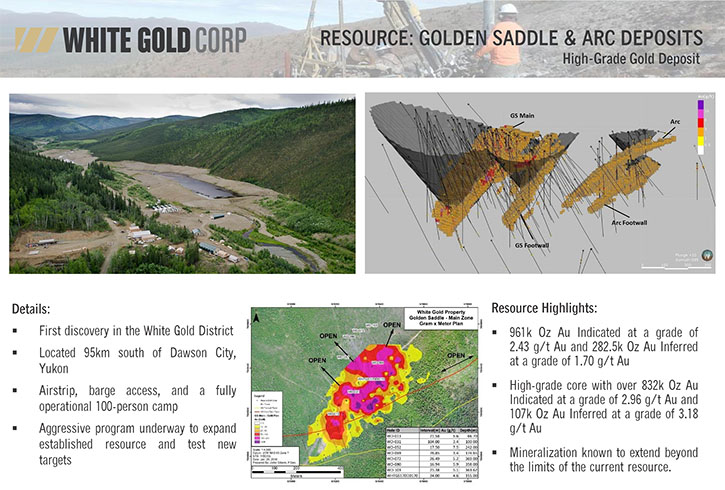

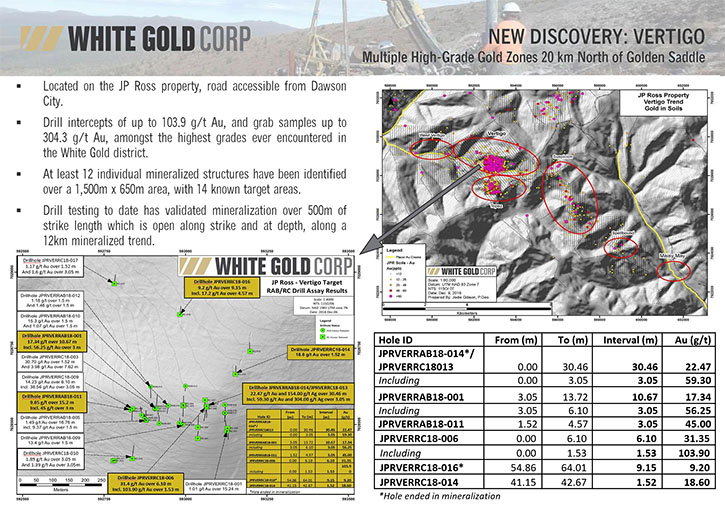

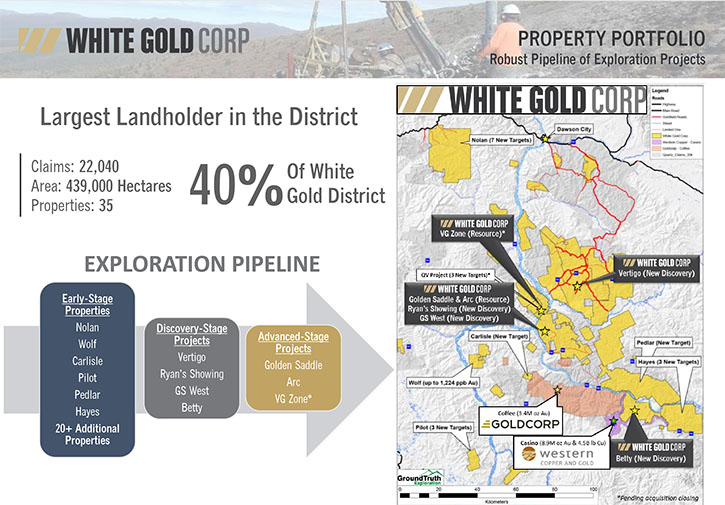

White Gold Corp. (TSX.V: WGO, OTC – Nasdaq Intl: WHGOF, FRA: 29W) owns a portfolio of 22,040 quartz claims across 35 properties, covering over 439,000 hectares, representing over 40% of the Yukon’s White Gold District. White Gold is one of the most active exploration companies in Canada, which last year led to 4 new gold discoveries, including the Vertigo, which intersected 22.47 g/t gold over 30.46m from surface. Their flagship White Gold property has a mineral resource of 960,970 oz Indicated at 2.43 g/t gold and 282,490 oz Inferred at 1.70 g/t gold. At PDAC 2019, we learned from White Gold’s David D'Onofrio, CEO, and Shawn Ryan, Chief Technical Advisor, that in 2019, they are focused on diamond drilling to expand their Vertigo discovery, grow their Golden Saddle deposit, increase their recently acquired 230,000 oz VG resource, as well as identify and test multiple high priority regional targets.

Shawn Ryan, Chief Technical Advisor, and David D'Onofrio, CEO, White Gold Corp at PDAC 2019

Allen Alper Jr: This is Allen Alper Jr., President of Metals News, here at PDAC 2019, interviewing Shawn and David of White Gold Corp. Please tell Metals News and our readers/investors a bit about your background, David, and then we'll talk more about White Gold Corp.

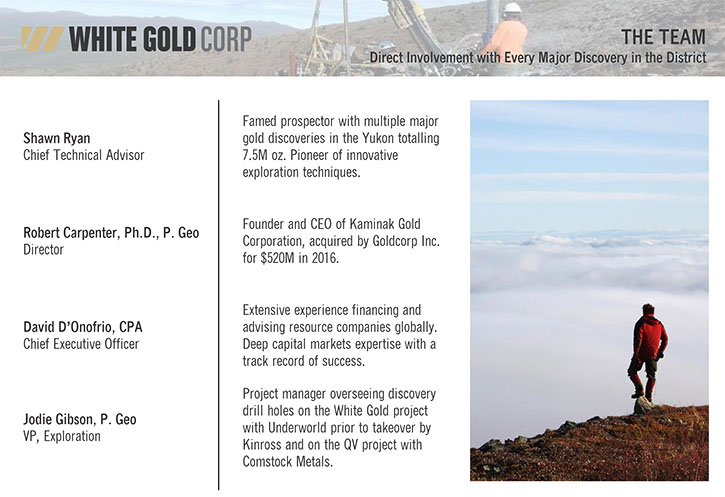

David D’Onofrio: I'm with the Power One group, a merchant bank based in Toronto, heavily focused on the resource sector. We've known Shawn Ryan for quite a long time. We've always been major fans of the Yukon, and a couple of years ago Shawn came to us with an extremely unique and impressive opportunity. Shawn's been credited with a lot in Yukon, including two major discoveries, over 7.5 million ounces of gold, and at one point had in his possession over 40% of the White Gold District, where White Gold Corp’s land package is currently located. The district where he has been working for years.

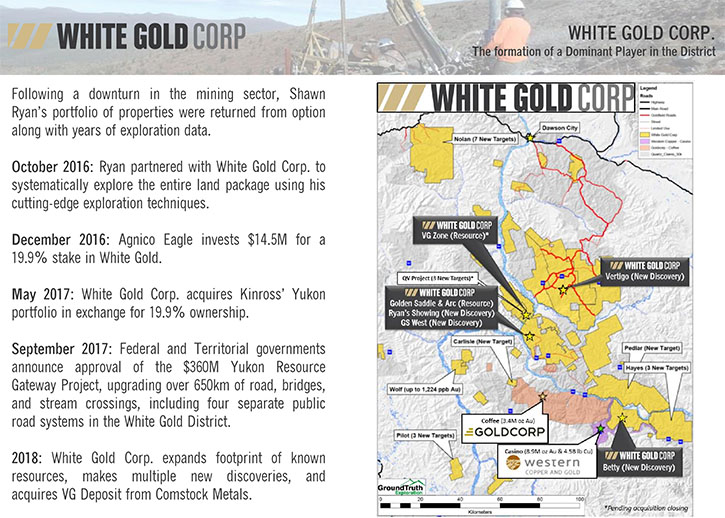

David D’Onofrio: Shawn had initially optioned these White Gold district properties off to several different juniors in the late 2000s; properties which had several significant successes. Underworld Resources had a big gold discovery and was taken over by Kinross. Kaminak had a big gold discovery and was taken over by Goldcorp for $520 million. These were all originally Shawn's properties. The other properties were equally as prospective, however the junior companies that they had been optioned to didn't have the capital to continue their exploration programs.

David D’Onofrio: With the junior exploration market going south in 2012, 2013, 2014, Shawn got all those properties back, but with the bonus of all the exploration work already completed and a tremendous amount of data that came with that. Shawn spent the next couple of years reviewing the data, improving his techniques, and packaging the properties together. He had a new vision and a new business plan he put together, and brought it to us at Power One. Shawn can share what happened next.

Allen Alper Jr: Great, Shawn, tell us more about it.

Shawn Ryan: At this point we had taken back a significant number of properties, but with just a single project, the probability of success can be low. There can be one, two or even three great deposits in a package of projects, but if you spread all the projects over 10 companies, you may have 9 losers. I said instead why don't we make just one super power, load the deck of just one company, then all those winning projects have to be in there. So that was one move.

The next move was to come up with an exploration strategy to methodically work all the projects efficiently and cost-effectively, exploring the entire land package systematically and with a regional view of the district. So that became our strategy that we shopped around to the majors, and they loved it. Our plan was to execute a very low cost effective exploration method, as we had all these great projects to cover, and needed to ensure value for every dollar spent. A key part of the strategy was utilizing the proprietary Drones-To-DrillsTM exploration technique of Ground Truth Exploration, our main exploration contractor.

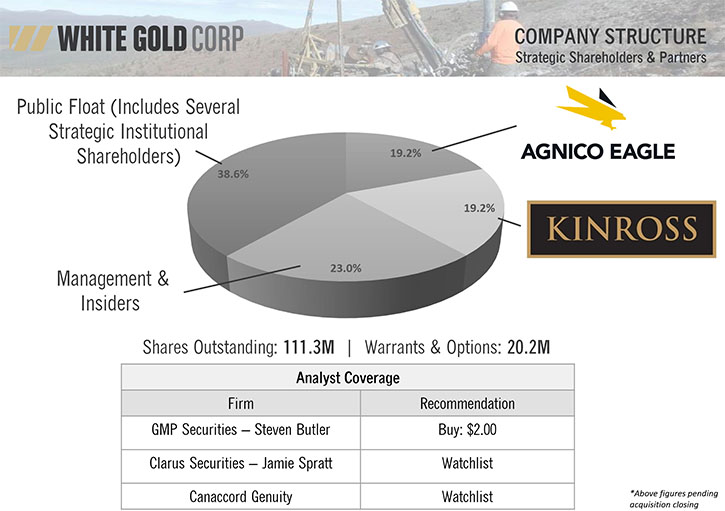

Right away Agnico Eagle came in as a partner for 19.9% of White Gold for about $14.5 million; that closed in the fall of 2016. Then in the spring of 2017, we approached Kinross to buy back the original White Gold property and the Golden Saddle & Arc discovery that they were sitting on. They came onboard and became our partners for their own 19.9% stake. With that transaction we acquired the White Gold property and the Golden Saddle & Arc, which we brought from discovery stage to its current 960k oz Indicated and 282k oz Inferred gold resource. Additionally, as part of the deal we acquired another prospective property called the J.P. Ross, which holds our most exciting discovery of 2018, the Vertigo. We’ll give more detail on Vertigo in a moment.

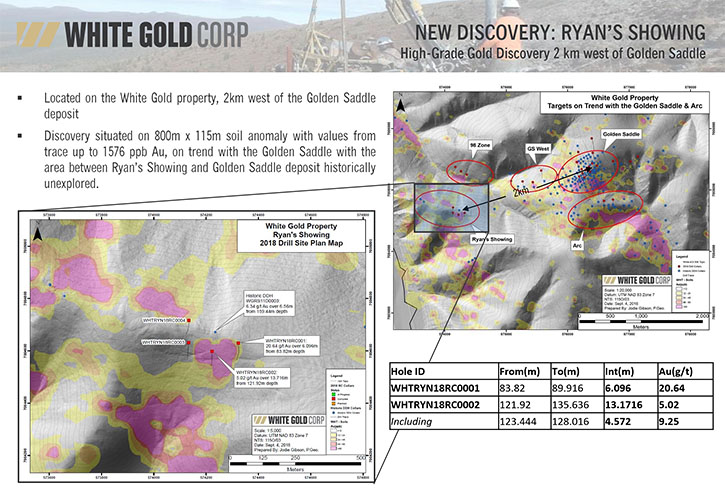

David D’Onofrio: Kinross was particularly interested in vending these properties back to us for an equity stake because we had compiled a team that was directly involved with every major discovery in the district. We had Shawn as a director, Chief Technical Advisor and partner. We hired Jodie Gibson, one of the head geologists for Underworld Resources, which was eventually was acquired by Kinross. And we brought on Rob Carpenter as a director, the founder and CEO of Kaminak, that Goldcorp bought for $520 million. Kinross looked at us and said, “You guys have all the experts for the district on your team. We're a big company. We've got a lot of other things to do. Why don't you guys take this ball and run with it and see what you can discover." And that's what brought us into the beginning of 2018’s exploration season, likely our best season to date with a tremendous amount of success on a number of different fronts. Some of our highlights of 2018 include, acquiring the QV property with its 230,000 oz gold resource from Comstock Metals. We also produced 4 high-grade discoveries with some excellent drilling results, including Vertigo with 22.47 g/t gold over 30.46m, Ryan’s Surprise with 20.64 g/t gold over 6.09m, GS West with 2.97 g/t gold over 10.0m, and Betty with 1.08 g/t gold over 50.29m. A very strong season to be sure.

Allen Alper Jr: It sounds like 2018 was very successful for White Gold. Tell us more about what to expect in the upcoming 2019 season.

Shawn Ryan: In the upcoming 2019 exploration season we will have more diamond drill holes around the Golden Saddle deposit itself, and the two new adjacent discoveries, GS West and Ryan’s Surprise, each sitting 750 meters and 1500 meters out respectively from Golden Saddle, to find more of the same style of Golden Saddle’s mineralization, at over 3 g/t. Additionally we will be continuing our aggressive regional program, diamond drilling our recently acquired QV property with its 230,000 oz VG gold resource, and of course we will be diamond drilling our new high-grade Vertigo discovery on the J.P. Ross, my original property from Kinross.

Shawn Ryan: What we identified on the Vertigo in our 2018 season was super high-grade material, with multiple structures. For me as a prospector, this Vertigo is one of the most exciting things I've ever found, and I think this upcoming 2019 season is going to really uncover what we have discovered here. Best of all its only 2 km from a road, so exploration and future development will be road accessible. In the Klondike we've never found the source of all this placer gold, and I believe this is the missing link that we’ve been looking for. The Klondike Goldfields has produced up to 13 to 20 million oz of placer gold, but there has never been any visual sign of the hard rock source producing all this gold; until today. The Vertigo represents a hard rock source of super high-grade material, sitting just above a producing creek. We can track the mineralization from the hilltop, right into the creek bottom where they are mining placer gold on Moosehorn Creek. These veins on Vertigo are super high grade, and they are only three to five meters, so they hide really well. So once we started tapping into those, this thing has the legs to grow very big, very quick, and the tonnage is there.

Shawn Ryan: So in 2019 we're going to be hitting Vertigo hard with a good budget. Exploration on the White Gold property, is more like industrial-grade drilling, you're just plugging away, building the ounces. But with Vertigo its really going to take our portfolio to the next level.

To top it all off we still have our discovery on the Betty property, which actually was everybody's favorite project originally. The property is adjacent and along trend to Gold Corp’s Coffee Project. Last season we only just scratched the surface on Betty, and we still hit 50 meters of over 1 g/t material. So it’s an enviable position to be in, this season we are going to move the White Gold property along, expand the VG resource, drill Vertigo to bring it to the next level, and then still have excellent targets like Betty to further explore.

Allen Alper Jr: So, what type of an exploration budget do you have this season?

David D’Onofrio: Our fully funded 2019 exploration budget is $13 million and like Shawn says, we have several focuses. One, is to keep adding ounces to our Golden Saddle deposit; we had two new discoveries this year on the White Gold property, just along strike with Golden Saddle, being the GS West and Ryan’s Surprise, and we believe there is a lot of shallow ounces there. Second, we will be increasing our 230k oz VG resource on the QV property, which we recently acquired from Comstock Metals. Third, we have this world class, high-grade discovery, the Vertigo to follow up on. And lastly, we have our new discovery adjacent and along trend with Goldcorp’s Coffee project, the Betty, in addition to our multiple other early stage projects that are in our exploration pipeline. Each with their own strong prospects for new discoveries. It’s going to be an extraordinarily exciting season, with a lot to look forward to.

Shawn Ryan: Our business plan works, that is what differentiates us from the other thousand juniors out there. Usually juniors are lucky to have one or two, maybe three projects. Currently we have 35 projects. Our game plan is not to concentrate resources around one target. Our strategy is to go in to a property, explore quickly and cost effectively, and most importantly, move on if there is no low-hanging fruit. And it has really paid off with perseverance with 2018’s discoveries.

Allen Alper Jr: Sounds very exciting.

Shawn Ryan: To me, it's like the market doesn't know really what's coming, so this is going to be fun. I'm pretty sure it's going to be a big career maker here with everyone that's involved, that's why I tell all the young geologists to take a lot of pictures. History is going to be made here, it’s happening as we speak.

Allen Alper Jr: Very exciting! Tell us a bit about your share structure.

David D’Onofrio: Currently, Kinross and Agnico each owns about 19.9% of the Company respectively. Management and insiders, another 30 or 35% of the Company. So it's fairly tightly held. The balance is a few key resource-type institutions and then the retail public. I think we've done a good job getting more retail eyeballs on the story, and people have really responded well to it, and liquidity has been building up. So it's really come together quite nicely on the structure perspective.

Allen Alper Jr: So how do you go out and do all this exploration without diluting your shares?

David D’Onofrio: I'm from the capital market side of the business, so I'm very sensitive to dilution. We're shareholders first. Shawn doesn't take a salary. He's in it for the shares and his royalty, so is incentivized to generate discoveries. We were very fortunate that after our big discovery last fall, Vertigo, we were able to raise money at a strong share price, and as a bought deal. That shows the confidence the Street has in our company, and now we are fully funded for this year.

Allen Alper Jr: Okay, that sounds very exciting. What are the main reasons investors should be looking at White Gold Corp?

David D’Onofrio: I think there are several strong reasons for investors to be interested in our story. We are located in a mining and exploration friendly jurisdiction, Yukon. We have the support of 2 majors, Kinross and Agnico Eagle. We own over 40% of the prolific White Gold District, and we have a team who has been responsible for every major discovery in that district. In regards to our portfolio, we have an existing resource, the Golden Saddle & Arc, sitting close to 1.25 million oz, and by the end of this season will have grown from there. We recently bought another property, the QV from Comstock Metals with its 230,000 oz VG resource, which has seen very limited drilling to date. We will be putting diamond drill holes on the VG resource this season, which we believe will quickly increase its size. We have just tapped into a brand new super high-grade discovery, the Vertigo, that's going to get hit for the first time this year with diamond drilling. The potential is there and could be several million ounces, we will find out as we drill. Additionally we have our regional exploration program on our extensive land package with multiple high priority targets, including the Betty discovery, all further displaying our dense exploration pipeline. So a massive year ahead.

Shawn Ryan: White Gold is kind of like owning 40 percent of the Timmins camp, and we have two majors that are backing us up. Would you let a claim drop in the Timmins camp today? No, you want to own all the ground you can. With this business model we are not the ones to bring the projects into production. We're designed to find the value in the ground, then take that asset and get it in the hands of a major to develop it into a mine.

Our vision for White Gold Corp. is to continue to generate discoveries, and vend them to majors to develop, for the next 20 to 30 years. Another important point, is with our land package, we have over 40% of the district, but in fact over 80% of the gold soil anomalies; all thanks to our proprietary 350,000 soil sampling database. This means we aren’t just blindly looking for needles in the haystack, but know where in the haystacks to start looking. It’s a great position to be in.

The Yukon is really unique, in that we are finding new discoveries right at surface using just soil sampling as a tool of choice, compared to say the Timmins camp (my home town), where they have to look for gold deposit over 1,000 feet below surface.

David D’Onofrio: Ha ha. Welcome to the Yukon.

Allen Alper Jr: Very, very exciting.

Shawn Ryan: We're getting underway here shortly, and I think there're going to be a lot of exciting things happening this year. So stayed tuned.

David D’Onofrio: I think people are going to be shocked at how quickly this moves along now. Like with these narrow structures last year. Now I'm the hunter. We're going to use new geophysical techniques. This is going to be a fun summer!

Allen Alper Jr: Okay. Excellent. More to come.

Shawn Ryan: Thank you so much for a great interview!

Allen Alper Jr: Thank you. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://whitegoldcorp.ca/

David D’Onofrio

Chief Executive Officer

White Gold Corp.

(416) 643-3880

ddonofrio@whitegoldcorp.ca

|

|