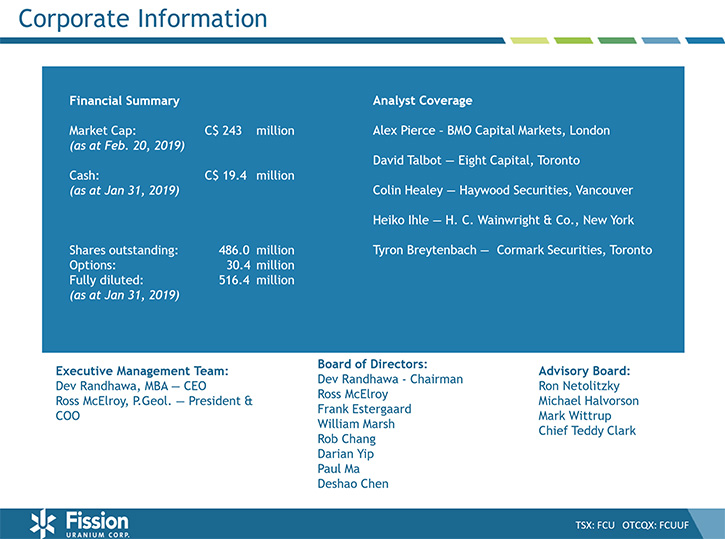

Fission Uranium Corp. (TSX: FCU, OTCQX: FCUUFÂ, FRANKFURT: 2FU): Interview with Dev Randhawa, Chairman and CEO and Ross McElroy, President and Chief Operating Officer

|

By Allen Alper Jr., President, Metals News Inc.

on 4/5/2019

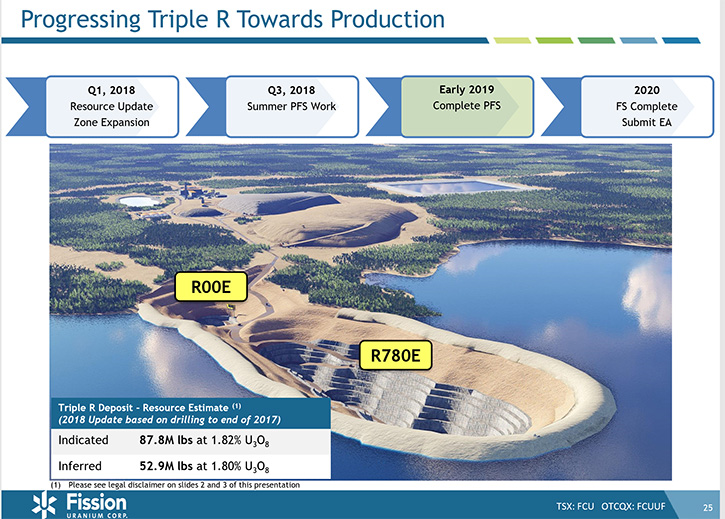

Fission Uranium Corp. (TSX: FCU, OTCQX: FCUUFÂ, FRANKFURT: 2FU) is focused on exploration and development of the Patterson Lake South (PLS) uranium property, located in Canada's Athabasca Basin, home to the world's richest uranium mines. The project is host to the Triple R deposit - the most significant high-grade shallow depth deposit in the region. At PDAC2019, we learned from Ross McElroy, who is President and COO, and Dev Randhawa, who is CEO and Chairman of Fission Uranium, that while 2018 saw the uranium supply going down, Fission has been working on their PFS that is expected to be ready in early Q2 2019, after which the company will go on to a bankable feasibility study. According to Mr. Randhawa, Fission Uranium is a well-funded company without debt, that boasts a highly decorated management team. There's a uranium deficit, and eventually as surplus gets eaten up, uranium prices have to go up.

Fission Uranium Corp

Allen Alper Jr.: This is Allen Alper Jr., President of Metals News, here at PDAC 2019, interviewing Dev Randhawa and Ross McElroy. Dev is the Chairman and CEO and Ross is the President and Chief Operating Officer.

Dev, would you like to tell us at Metals News and our readers/investors a bit about yourself and your background?

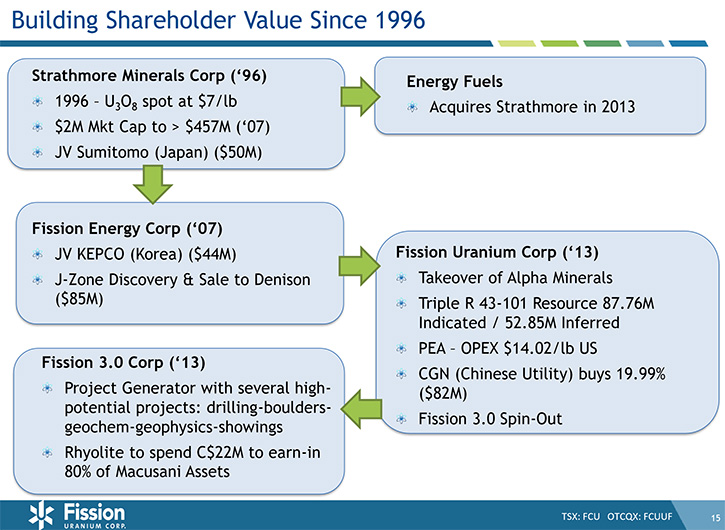

Dev Randhawa: Well thank you. I think I'm the longest serving CEO of the Uranium Industry. We started back in '95, so this is 23 years. You know I'm a contrarian by nature and I think good investors are contrarian by nature. They don't follow and uranium is just that. There is no love affair with uranium, like people have with gold.

So my background was MBA, financier. And my job was to find good technical people, which we did. Finance it, which we've done. We've been very fortunate. We've started with a group of projects. I think we're the only exploration Company in Uranium, that has actually had dividends given out. If you own original Strathmore, look in your account. There are four different Uranium companies. What we've been good at is identifying opportunities, bringing Asian money, Sumitomo Japan, Korean Electric Power Company from there, and the Chinese. We've been able to bring in these partners to help us develop these assets. We get an idea, we put our money into it, develop it to a certain point so that we get a big group in and we generally sell it. So we've been very fortunate to be seriously successful in this, because we have a good technical team and really good financial support.

Allen Alper Jr.: Ross, would you like to tell us a bit about your background?

Ross McElroy: Certainly. As a Geologist. I started my career in the Uranium business right out of school. I was hired by Cameco so I was into the Athabasca Basin since the mid 1980's. I was fortunate enough to be on the team that discovered McArthur River, the world's biggest high-grade Uranium deposit, that's still a producing asset, although temporarily shut down because of the Uranium sector itself, but a beautiful deposit. I was involved with another discovery, with the French group Orano (previously Areva), over in the western side of the basin, called Shea Creek. I came into the junior sector and partnered with Dev Randhawa, back about 12 years ago, bringing my expertise in Uranium hunting in the Athabasca Basin to Fission. Fission had some early stage grassroots projects and wanted to advance them. I came in and we built a strong technical team. We went to work on our then Waterbury project and made a discovery there, which we were able to grow into a pretty nice deposit. It was right next door to Hathor Exploration, who had made the Roughrider deposit discovery and was the focus of a bidding war back in the day.

We sold our deposit to Denison Mines. Then we went to work on a new discovery that we had at the time, in 2012, which was the Triple R deposit on our western side of the basin. We're a very innovative team. I learned early on in my career, working with groups like Cameco, and Orano , that discoveries are often made when you step out into the frontiers, where other people had not been looking. So we were exploring on the western side of the basin, but even hunting for uranium outside of the basin. We were breaking convention, in a number of ways, when we stepped out there. I learned that you have to take those blinders off, when you go looking for these things, so that you can try a few new ideas and make a discovery. Since the discovery at PLS we've been able to open up a brand new uranium district.

Allen Alper Jr.: Excellent, excellent! So tell me, what have you done in 2018 and what are your plans going forward?

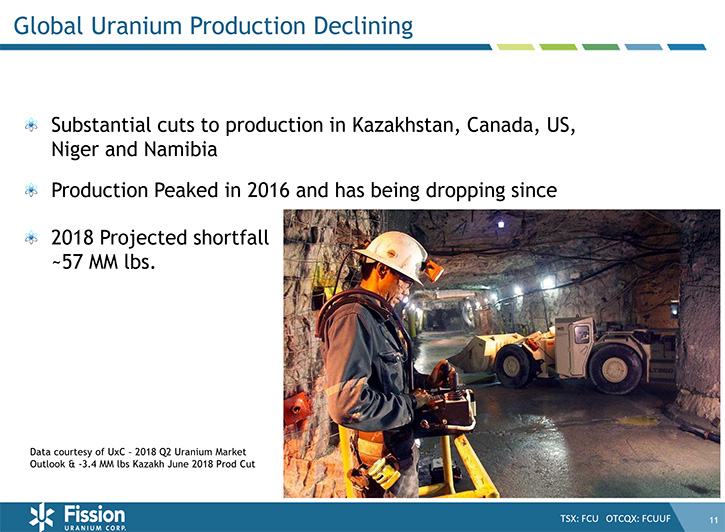

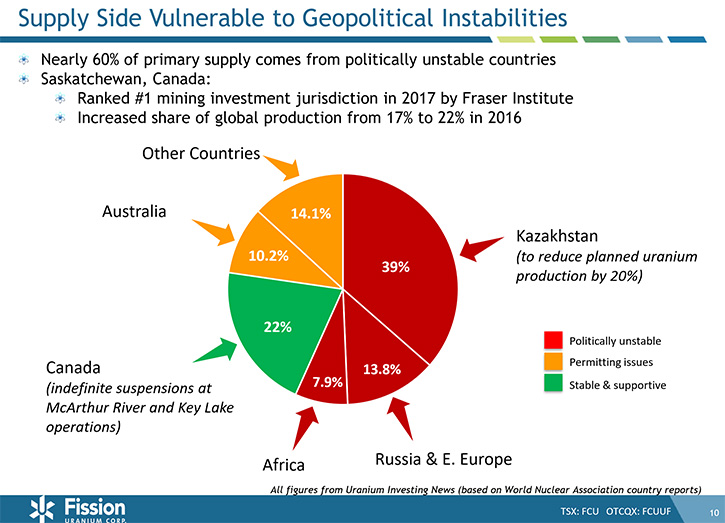

Dev Randhawa: Well our plans are really related to the overall market. We have not seen a very positive move. We saw a good uranium move from $21 to $29 dollars a pound. We had too much supply and demand was not there and the prices dropped. Then the supply dropped because Kazatomprom cut back 12% roughly, depending on who you talk to and for sure McArthur was shut down and that took about fifteen million pounds away, so we needed to see less supply in the market and that's what we've seen. So last year was pretty good in that sense. However, the US groups wanted subsidies. So they put this petition forward called 232, which has stalled the price move because people don't know who to buy uranium from.

So overall it was a good year. We had the right moves by the 60% of the market, 40% Kazatomprom, 20% Cameco. They did the right things, which was bring down supply. So I think this year will be better once the 232 petition before the US government gets out of the way.

People don't mind bad news, they love good news. What they don't like is uncertainty, like anything. And that's what Petition 232 has now introduced uncertainty into that equation. So, we've been careful not to blow our money on drilling when nobody cares. Instead we've been spending our money for our pre-feasibility, which should be out here in the next month or two, and then our feasibility study. So we're working towards production basically. We're owned 20% by the Chinese government through a SOE called CGN and that's really where we're focusing our time and effort.

Ross McElroy: Pre-feasibility should be out shortly and the program's underway right now to be able to get all the information required that we need to go forward on our feasibility. We have a geo-technical drilling geared towards mine design and the wall stabilization for the open pit, tailings management facility, that's the kind of work that's ongoing there.

We have plenty of exploration upside yet on the project, there's no question. So, when the market's turned and the conditions are right, we can come at this from multiple perspectives.

Allen Alper Jr.: I actually was sitting in on some different sessions here. One session was saying, "What is the next ten time opportunity?" They thought it was uranium, what do you think?

Dev Randhawa: Well tremendous. I think the average world mine won't make any money until $50/ $70 dollars. Even if half costs are $40/ $50 you still need $70 because there's a risk of rate of return and you have to pay back. So from my perspective, I think that the opportunity's there. Rick Rule, I think is the smartest guy out there, he comes from junior stocks. He says, "I'd rather invest in something with a question of when it ever happens, versus if it ever happens." We know it's going to happen. You can't have demand at 190, production 135; there's a deficit and eventually that surplus is eaten up. And that's what we're seeing. So there's no doubt in our mind uranium prices have to go up, or you have less power.

And it remains the only green energy that's base-load green energy, meaning that, you can turn it up and down as you need it. You can't do that with sun, you can't do that with the wind, so I think the future is great. The question is, is it three weeks, is it a year? I don't know that, but we're well-funded and ready for it. To me it's a question of when, not if uranium price has to go up, because China is added four more licenses. You've got 450 reactors, fifty being built, another 150 being planned as we speak, another proposed. So we're going to need double amount of uranium in a few years. But the utilities have not been quick to contract so that's why the price is where it is. When they start to contract, you remember last time uranium went from $7 to $140.

Allen Alper Jr.: Yes.

Dev Randhawa: Now it's at $30. I'm not seeing it going to $140 but I do see it going to $70 or $80, otherwise we can't open a mine. And so, when the two big guys are saying, "We can't make money." That's why, I think, uranium prices have to move out.

Allen Alper Jr.: Very well thought out! So tell us a little bit about your share structure.

Dev Randhawa: We're owned at 10% by Sprott, 10% by JP Morgan, 20% by the Chinese SOE CGN, so it's in those hands, about 40% of the stock. There's mostly a good retail base in the States, thanks to some good support there. So we're hoping that we can turn that around soon, make them some money.

Allen Alper Jr.: So tell us a little bit about management investment, do you guys have skin in the game?

Dev Randhawa: This is why we're just retail investors. We paid for every share. We weren't given a bunch of shares we founded at one cent,. We wrote checks. My average cost is $.50/$.60 cents. And I got three million shares, so I have money in the game, he has money in the game.

Ross McElroy: I think that's important. That's what you want to see in a Management team. You want to see the Management committed to the Company's results and shares. What makes investors’ money, makes us, money.

Dev Randhawa: Our salaries are very reasonable. We look at some of our competitors, especially US groups. Some guys are making a million and a half dollars a year, and $1.7. We're making much less than that. Yet, we are putting money in the ground and find economy, if we have to. Because I built this out of my basement, with the idea that the money we get needs to go into the ground, not into an expensive lifestyle.

Allen Alper Jr.: Absolutely. That is so very, very correct! How do you avoid dilution?

Dev Randhawa: Well, we didn't spend a lot of money the last few years because we knew we were not going to get aggressive until uranium prices go over $40. We have a bear market and you don't spend money in a bear market. I only spend money on moving the projects along towards production. But you don't go out and spend a lot of exploration money.

We've cut our Board from ten to eight people, we stopped paying them cash, more in shares. We've cut our marketing budget, so we've done a lot to make sure we save our money so we're not raising money at the bottom of a market. The last money we got was $.85 cents a share and the stock's $.50. So we are going to wait. We've purposely been saving our money so we can raise money at a higher price, so we're not diluting.

Allen Alper Jr.: Excellent. So what do you think are the main reasons someone should be looking at Fission Uranium for investment.

Dev Randhawa: I think that if you believe that we need more energy and we need more clean energy, you have to own some uranium stocks. There are only so many of them; Cameco, Yellowcake. But really, you need to have one stock that can shoot up double or triple and that's the potential we have. We're well-funded, we're the most awarded Management Team in mining, period. Forget uranium. He won the PDAC Award. I won Deal-Maker Award. We won Northern-mining People of the Year Award. Because we did some pretty special things in a very tough market. So, we're well-awarded, with third-party recognition of our skill set and the project.

Ross McElroy: And this deposit has characteristics that others don't have. The main thing is that it's not only large and high-grade but it's near surface. That gives us flexibility in mining, how we do it, and lower costs. So you have management with a track record, you have the asset in the ground, the ability to move it forward and here we are.

Allen Alper Jr.: And good jurisdiction.

Ross McElroy: The best jurisdiction.

Allen Alper Jr.: So. Good management, good location, good asset.

Dev Randhawa: Cashed out management.

Ross McElroy: What's not to like?

Allen Alper Jr.: Right, exactly. Is there anything else you guys would like to add?

Dev Randhawa: No that's good, thank you for interviewing Fission Uranium for Metals News.

Allen Alper Jr.: Thank you very much for sharing your Company’s strategy and success with us at Metals News and our readers/investors. I am very impressed! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.fissionuranium.com/

Email: ir@fissionuranium.com

Telephone: 1-250-868-8140

Toll Free: 1-877-868-8140

|

|