Giga Metals Corp. (TSX.V: GIGA, OTC: HNCKF, FSE: BRR2): Nickel and Cobalt for the Battery Industry; Interview with Mark Jarvis, President and CEO

|

By Allen Alper Jr., President, Metals News Inc.

on 3/20/2019

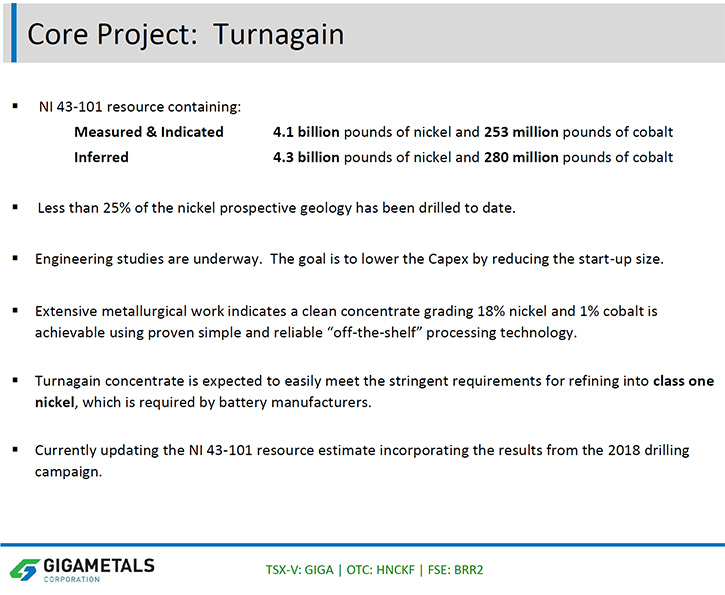

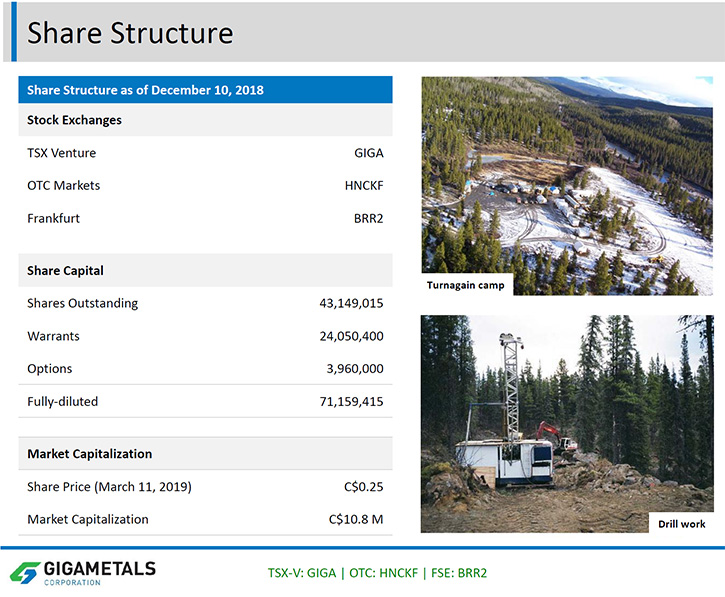

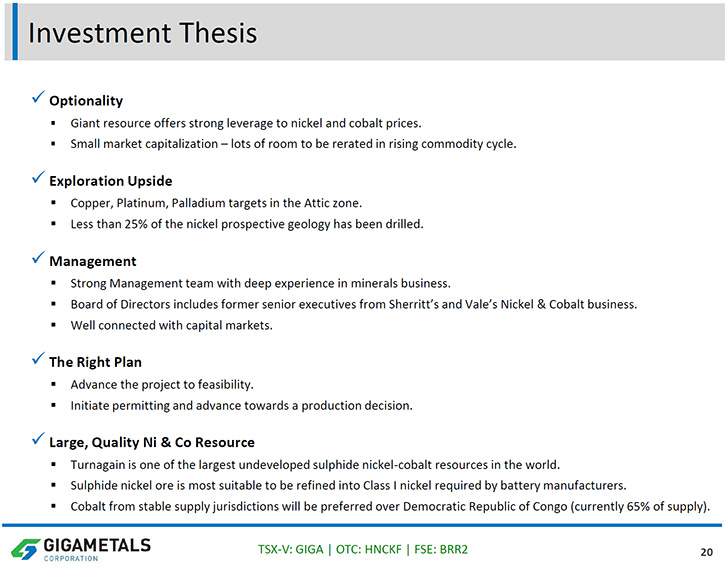

At PDAC 2019, we learned from Mark Jarvis, President and CEO of Giga Metals Corp. (TSX.V: GIGA, OTC: HNCKF, FSE: BRR2), that they are currently advancing their world class Turnagain nickel-cobalt project to the pre-feasibility study stage. Giga Metals recently sold a 2% NSR on future cobalt and nickel production at the Turnagain Project to Cobalt 27 Capital Corp. (TSX.V – KBLT) for US$1 million in cash and 1,125,000 shares of KBLT. Near term plans include a new resource model and getting their capex down. According to Mr. Jarvis, Giga Metals will be producing a high-grade, class one nickel concentrate for the battery industry, with a significant cobalt by-product credit.

Giga Metals Corp.

Allen Alper Jr: This is Allen Alper Jr., President of Metals News, here at PDAC 2019, interviewing Mark Jarvis, who's the President and CEO of Giga Metals Corporation. Mark, could you tell Metals News and our readers/investors a bit about your background? Then about Giga Metals.

Mark Jarvis: My background is from the financial side of the business. I used to be a stock broker many years ago and I financed exploration companies, oil and gas and mining. I crossed the street to join the board of a little oil and gas company called Ultra Petroleum, which ultimately proved up three trillion cubic feet of gas reserves and then I retired. I came back into the business in 2004 because I saw this project (Giga Metals) and I just fell in love with it. During the last commodity cycle we raised a lot of money and drilled a lot of holes. We have a giant resource defined by 204 drill holes. Last summer we drilled another 36 infill drill holes into this resource so now, 240 drill holes.

Mark Jarvis: That resource drilling we did gives us the confidence in the resource to advance to pre-feasibility and then feasibility. We don't have any more inferred resources, where we want to mine, it's all measure plus indicated.

Allen Alper Jr: Excellent! Very exciting!

Mark Jarvis: Yeah, so there's nothing stopping us.

Allen Alper Jr: Tell us a bit more. What is the measured and indicated?

Mark Jarvis: We'll be coming up with something new, but as of now, just in rough terms measured and indicated is 900 million tons and then plus inferred it's about 900 million- another 900 million tons as well. It's low-grade sulfide, nickel and cobalt with some PGs as well. But, the strip ratio's very low and the metallurgy is easy. This is a young deposit, 185 million years old, so we don't have a lot of the kind of alteration products that can screw up your metallurgy.

Allen Alper Jr: Excellent!

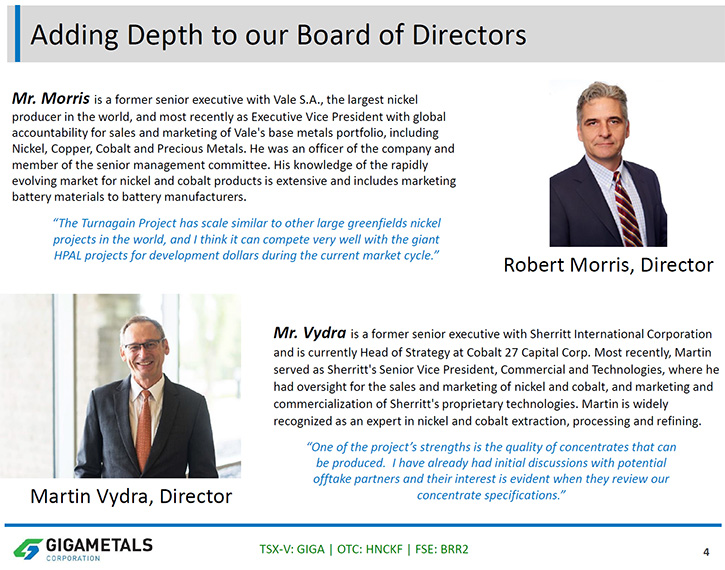

Mark Jarvis: We get excellent recoveries for a deposit of this type and the key is we can make a beautiful, clean, concentrate that's readily marketable. We have two recent additions to our board that joined because of the concentrate we can produce and they understand the value of it. One is Martin Vydra, an engineer, who spent 31 years at Sherritt International Corporation. He's done due diligence on every undeveloped large greenfield nickel project in the world. He likes our project and he joined our Board. He's no longer with Sherritt International Corporation. He left about a year ago. Towards the end of his career at Sherritt International, he sold nickel and cobalt products to the end users so he knows them all very well.

Mark Jarvis: The second addition to our Board, Bob Morris, just retired in December from Vale, the largest nickel producer in the world. He was in charge of worldwide sales of Vale's base metals portfolio, roughly seven billion a year in turnover. Prior to that, he was in charge of worldwide sales. He lived in Tokyo for five years and was in charge of base metals sales to Asia. So he knows all of those end-users very well. When he saw the specs sheet for the concentrates we can make-

Allen Alper Jr: He was all in.

Mark Jarvis: Yeah, He said I want in.

Allen Alper Jr: Great. That's very exciting. So what are your next steps?

Mark Jarvis: Well, we're just redoing the resource model. Then, based on that, we're redoing our engineering. We're trying to design a smaller startup than we did before. We're trying to get our capex down to between five hundred million to seven hundred million dollars. That's the intent, so the new resource model will be the basis for that. We want to mine more selectively and put higher grade, higher recovery material through the mill. After the resource model, we'll have some very focused metallurgical test work to do. Then we're going to do desktop modeling of various startup sizes to find the optimal startup size for us, a combination of capex and opex. When we determine the optimal size, we're going to advance that to pre-feasibility.

Allen Alper Jr: How flexible is that after you get started on the more selective product? Would you be able to expand?

Mark Jarvis: Oh, absolutely. We have so much resource here. Once we get it off the ground we're going to be here for many, many decades. If we can figure out a small startup, with a limited capital risk and get that off the ground, get it spitting out cashflow, conditions should be right to increase our production and then increase it again. There's enough resource here that we can keep doing that.

Allen Alper Jr: At that point, you're waiting for the market to get better, more profitability?

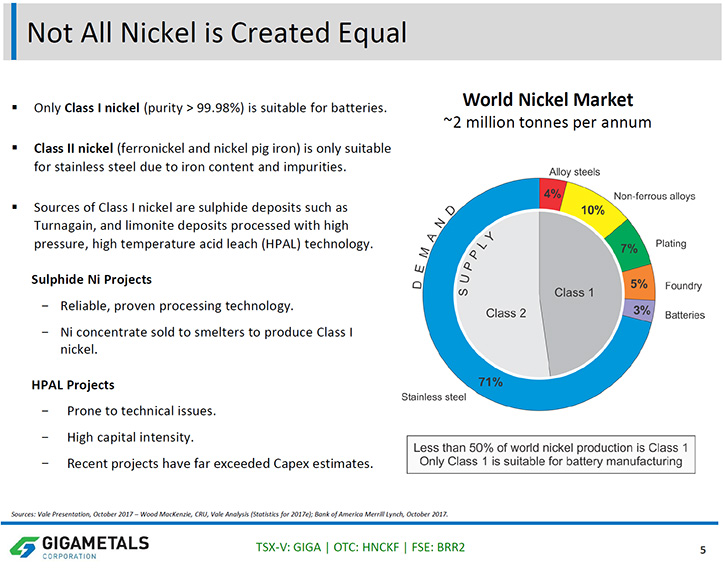

Mark Jarvis: Yeah, we see that coming. I see the inventory steadily getting drawn down on nickel, particularly for class one nickel that's suitable for batteries. Things will get interesting when the inventories get down to less than two weeks supply.

Allen Alper Jr: So you will be producing class one nickel?

Mark Jarvis: Absolutely. This sulfide deposit is very amenable to upgrading to class one nickel and to nickel sulfates (battery salts). We have a consistently, 18 to one nickel to cobalt ratio, so we have a significant cobalt byproduct credit.

Allen Alper Jr: Cobalt's very important to the electrical industry as well.

Mark Jarvis: Absolutely. You need nickel and cobalt.

Allen Alper Jr: Tell us what you think are the biggest challenges right now and what you need to do to address those?

Mark Jarvis: Well, the biggest challenge right now is that the equity markets for junior minors are terrible. The financing window has closed for now. This always changes but right now it's not good. We're fortunate in that we've bought about two years of capital so we can be picky about when we do financing. Not everybody's so lucky.

Allen Alper Jr: So that allows you to minimize dilution?

Mark Jarvis: Absolutely. And we're talking to people about possible strategic investors that would invest at the project level. When your stock's so cheap, it's a horrible thing to dilute. I don't mind diluting when we're fairly priced but we're not fairly priced right now, but that'll change too.

Allen Alper Jr: Yes. That all sounds like good things are coming. So tell us a little bit more about investment. You talked about your share structure but give us an idea of who your main investors are?

Mark Jarvis: Well I'm the largest single shareholder, with about 8.5% and there's another investor who has about 8.5% as well. He's followed this for ten or 12 years and he bought every private placement on the way up and every private placement on the way down. Just like I did. We have a couple of opinion leaders, who are shareholders, Mike Beck and Anthony Milewski, who have accumulated quite a bit of stock. Pala Investments is in. In fact, they have a Pala employee on our board. So we're well connected with the financial markets. That gives us the flexibility to look at all sorts of alternate financing methods.

Allen Alper Jr: What would you say are the main reasons investors should be very interested in Giga Metals?

Mark Jarvis: You know, that's such a good question. The way I would put it is this, “Why should an investor buy the stock today?” The answer is because they can and it's cheap. When things heat up in this market, stocks start moving very quickly. So for a patient investor, you can accumulate a meaningful position in our stock, buying it slowly, and then if you have a one to three year time horizon, you're going to do very well, I believe, because I believe the price of nickel is going to do very well and we're very leveraged to the price of nickel. I don't know what's going to happen in the short term, nobody does. But in the medium term, I'm quite confident that there is money to be made here.

Allen Alper Jr: Is there anything else you'd like to add?

Mark Jarvis: Just to thank you for interviewing Gigametals for Metals News, Al.

Allen Alper Jr: Thank you. To sum it up, you have a low-grade deposit that can make a high-grade concentrate suitable for the battery industry.

Mark Jarvis: Absolutely.

Allen Alper Jr: You have a great management team, a great location in a mining friendly area and now's the right time to buy.

Mark Jarvis: Absolutely.

Allen Alper Jr: We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.gigametals.com/

Giga Metals Corporation

Suite 203, 700 West Pender Street

Vancouver, BC

V6C 1G8, Canada

Email: info@gigametals.com

Phone: (604) 681-2300

|

|