| Ross Beaty, the founder of Alterra Power Corp (TSX: AXY), spoke with Metals News at the recently held Renewable Energy & Mining Conference in Toronto. He said, “I’m a geologist based in Vancouver. I’ve been involved in the resource industry my whole career. I’ve built and sold a lot of companies including Pan American Silver and Alterra Power, both of which I was the founder and now the Chairman of the Board.” |

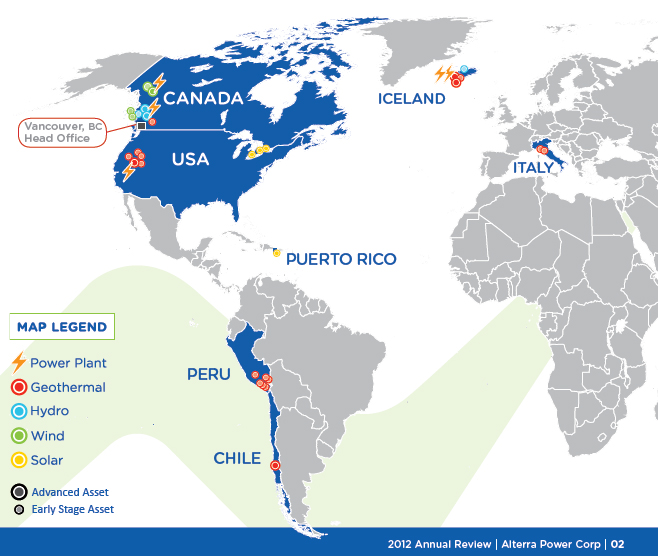

Alterra Power is a different type of enterprise from Pan American Silver. Beaty said, “Alterra Power is a clean power company in geothermal, hydropower, wind and solar energy.” The company, with holdings in several different countries, is solely focused on renewable energy sources. Said Beaty, “Alterra is a Vancouver based public company. We produce clean power in British Colombia, Iceland and Nevada.”

Their

holdings produce different types of energy in different markets. Said Beaty, “Specifically, we have two hydroelectric

plants in BC and the largest wind farm in BC.

In Iceland, we operate a geothermal

power company that produces 175 megawatts.

In Nevada, we own a company that produces 10 megawatts. In total we produce over 600 megawatts and we

own 315 megawatts.”

The goal in developing the company is to create

renewable energy for the long term.

Beaty said, “We have a sustainable model that will keep us around for

many decades to come.” Guided by their management, Alterra Power has quickly become

a noted name in renewable energy. Beaty

said, “Alterra Power is a public company.

I’m a large shareholder myself.

We have a strong board.” Alterra Power sells to two different types of

buyers – utilities and private buyers.

Beaty said, “We sell primarily to utilities. In Iceland, we sell the power ourselves. We also sell to an aluminum smelter which

uses our power for their operations.”

Beaty

doesn’t see any of these power sources as being the solution for every

circumstance. In fact, he quickly cites

the positive and negative aspects of both.

Said Beaty, “Every one of those renewable energy options has advantages

and disadvantages. Geothermal is base load

and can run at a very low operating cost.

It can be risky because it can be hard to find a place where you can

sustain an operation, and it has high construction costs. It works in certain places, but it is a

limited application. For hydroelectric,

we use run of the river power.” The

company has recently moved into the solar market as well. Beaty said, “We have just acquired an

interest in a solar power business with GE and we hope to expand that

soon. It can now be grid competitive in

many parts of the world. It is

intermittent. You have to deal with

that.”

Despite the challenges of the market, Beaty

believes that clean energy is the way to move forward. He said, “I started a renewable energy

company because I think of it as the future.

Oil, gas and coal have a limited future.

Plus you pollute the atmosphere.

There are all sorts of issues with fossil fuels. Renewal energy goes

forever and is clean, but it is expensive and you have to invest a lot up

front. Long term, renewable energy is

the only way.”

Beaty

believes that the mining sector is beginning to understand the positive aspects

of renewable energy. He said, “It is

very interesting today that we are at a conference which is called the Renewable

Energy & Mining Conference in Toronto.

Ten years ago renewable energy was an experiment. The revelation is that renewable energy does

bring down costs. Anywhere that there is

diesel or grid power you can easily find renewable energy solutions that are

cost competitive. It is being embraced.” With the acceptance of clean energy, Beaty

sees more and more companies taking advantage of the technology. He said, “The amount of energy that is being

used today is a lot more than five to ten years ago. We do have a headwind today in the decrease

in natural gas prices. It is very hard

to compete with low gas prices. That

will be a relatively short term thing. Medium term, gas prices will go up which will

make renewables more interesting.”

Alterra Power is in an enviable position for the

future. Said Beaty, “Alterra Power has

an enterprise value of $450 million dollars with a market cap of $150 million

dollars. We have a very low price

compared to our asset value. The market

is not recognizing us for the specific price of our assets or enterprise

projects. We are seeking to change that

with better communication in the near future.”

Beaty and his team believe that with more information in the market,

potential shareholders will see the possibilities for profit. He said, “Over time, we think the market will

value us more correctly. We are the

right kind of company to invest in.”

Why should

investors evaluate Alterra Power? Said

Beaty, “We are a clean energy company with a long term, diversified base of

producing power assets and a strong development pipeline. We offer a good value

proposition. We are trading at a

fraction of our value. We have a huge

pipeline of wind and geothermal assets that will be developed over the next few

years and we aren’t getting any value for our management team. We have a strong finance and development team.

This human resource asset has been completely discounted.”

Alterra

Power, with a diversified portfolio of geothermal, hydroelectric, solar and

wind power assets, is in position to create value for shareholders in the

future.