This week both Gold and gold stocks (GDX) surpassed the upper end of our rebound targets at $1850 and $38.

However, precious metals gaining in real terms and showing relative strength against other markets was more meaningful.

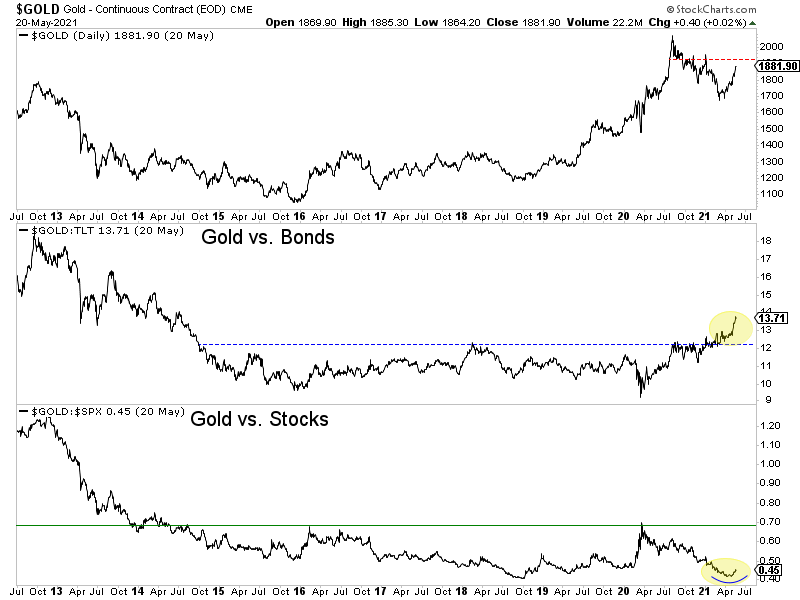

Gold traded as high as $1891 on the week but, relative to Bonds confirmed a major breakout to a 6-year high. In addition, Gold against the stock market has a chance to emerge from a major low.

Gold, Gold vs. Bonds, Gold vs. Stocks

Gold, Gold vs. Bonds, Gold vs. StocksThe gold stocks are showing even more relative strength.

GDX traded as high as $40 this week and is likely to retest its high before Gold does.

As you can see, the GDX to Gold ratio is not far from testing 8-year resistance. Thus, a breakout would have massive implications for precious metals.

Meanwhile, GDX against the stock market hit nearly a 5-month high yesterday.

GDX, GDX vs. Gold, GDX vs. Stocks

GDX, GDX vs. Gold, GDX vs. StocksWith that said, precious metals have hit resistance.

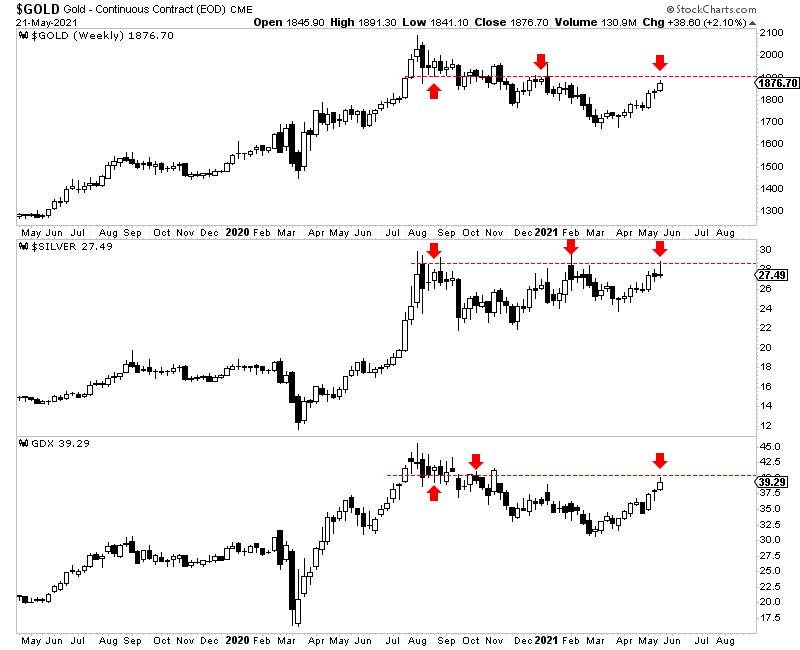

Gold has weekly and monthly resistance at $1900 while Silver, which has been leading, has weekly and monthly resistance at $28.50. It closed the week below $28.00.

The weekly candle charts are shown below.

Gold, Silver, GDX (Weekly)

Gold, Silver, GDX (Weekly)Next Friday is the monthly close. We’ll see if Gold and Silver can break $1900 and $28.50.

My guess is no. Not yet.

However, Gold and GDX rebounding past important resistance and building relative strength against other markets is a good sign.

So is Silver testing resistance (August 2020 highs), again. The more times a level is tested, the more likely it is to give way.

I expect more consolidation and correction, but recent action argues we need to be prepared for that big breakout sooner than we expected.

That means holding our positions, getting ready to pounce on weakness, and looking for companies we missed.

I’ve positioned myself in companies with the best combination of upside potential and fundamental quality. These are companies you can buy and hold for a few years that have the potential to be 5,7 and 10 baggers should Gold break past $2,100/oz.

In our premium service, we continue to identify and accumulate those quality juniors with considerable upside potential over the next 24 months. To learn the stocks we own and intend to buy with at least 3x to 5x potential and more, consider learning more about our premium service.

The post Gold & Gold Stocks Gaining in Real Terms appeared first on The Daily Gold.